Swing Low and Swing High Trading Method

Swing Trading Strategy, Swing Trade, Lower Timeframe trade, Moving average, Crossover Trading Strategy

Course: [ Best Trading Entry Techniques : Trade Entry Techniques ]

I have read do a fine job at coming up with extensive sets of rules to define what is and isn’t a swing point. I’ve also seen a few sources that refer to a simple set of rules, such as a swing-high simply has the bar to the left and right of it with lower high points (reverse for swing-lows).

Swing-High and Low Violations

One of my favorite techniques for entries is

violation of swing-highs and lows. This is a fairly commonly presented

technique, but hopefully the twist I will present, like most of my material,

will be different. In my experience, whenever I have seen entry via a

swing-high or low violation, it has been on the traded timeframe. I’m not

saying that no one has presented these violation techniques any other

timeframes, only that I haven’t seen it in the material I’ve covered.

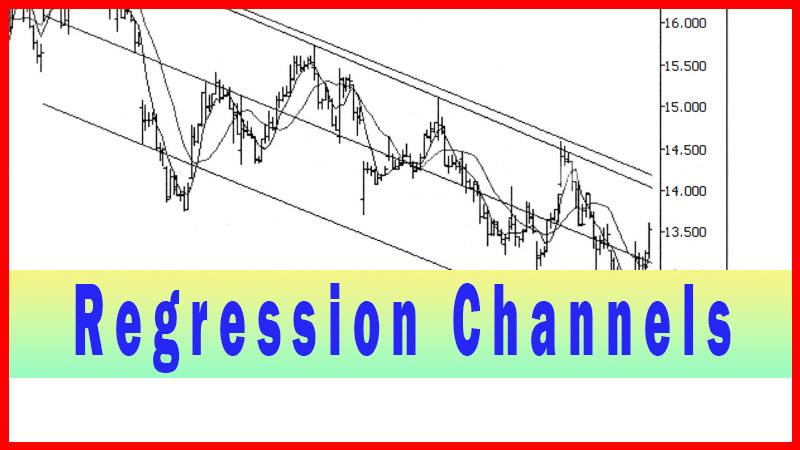

As the reader should now be familiar with, one

of my main tenets is to decide on your ‘potential

trade area’ on the traded

timeframe, and then to drop down to a lower timeframe to decide on, and

implement, the entry technique. I will continue in that vein in this chapter.

As I just mentioned, this is the main concept that I have not found when I read

the available works. I see a lot of mention about using these swing-high and

low violations, but always on the traded timeframe.

For me, that just doesn’t make sense, for the

same reason it doesn’t make sense with other entry techniques. You are not

taking advantage of a ‘fine- tuned’ entry by going down to a lower timeframe and

taking advantage of the price action in the potential trade area. And on top of

that, you will generally be a lot farther away from a logical protective stop

area if you make the entry decisions based on the traded timeframe. Hence, I

will present this technique, again, in the context of a lower timeframe from

the traded timeframe.

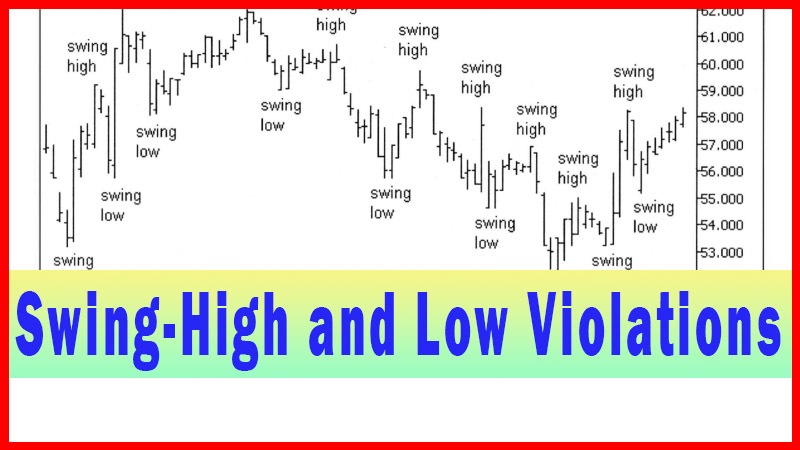

Let me first explain what I mean by a

swing-high or low, and a violation of that swing-high or low. When an issue trends,

it will commonly pullback a bit and then resume the trend. When it does this,

the swing it just formed will create two small turning points, termed swing

points. If the swing point is a high point, it is further term a swing-high,

and conversely, if the point is a low point, it is further termed a swing-low.

I will not get further into defining these

terms here. Many references I have read do a fine job at coming up with

extensive sets of rules to define what is and isn’t a swing point. I’ve also

seen a few sources that refer to a simple set of rules, such as a swing-high simply has the bar to

the left and right of it with lower high points (reverse for swing-lows).

From a practical standpoint, for my own trading, I don’t need to define a swing

point with a set of rules; I simply recognize one when I see it.

When I look at a pullback and attempt to

decide if it's a good swing to consider using in an entry plan, I mostly look

for proportion. I want the swing point to be a certain distance from what I

expect is the major turning point on the traded timeframe. But I also want the

size of the swing to be the right amount. And I want the time factor i.e., how

long before the swing started and how long the swing has lasted, to be in the

right balance.

I expect you are saying ‘I’m fine with all

that, just tell me what all those proportions and guidelines are, and I’ll be

ready to go.’ Unfortunately, you won’t like my answer to that, at least not at

first. My answer is, as I’ve said, I don’t have any rules for that. But the

good news is that I can eye a ‘good’ one in one second flat. And with practice,

you should be able to make a decision by eye, too.

To me, a good analogy would be deciding on

swinging at a baseball pitch. Sure, some are way out of the box and not even

worth discussing. What about the rest of the pitches, though, the ones that may

or may not be good ones? How do you explain and define what you will swing at? Generally,

a batter will tell you he just knows it when he sees it. And I can tell just by

looking which swing-points I will consider for use as an entry technique.

Let’s look at a few swing-points to start, and

then I’ll move on to trying to show what I do and don’t like about certain

swing-points. Once we have the idea of what a ‘good’ swing-point looks

like, I’ll present the entry technique I use, using the swing-point violation.

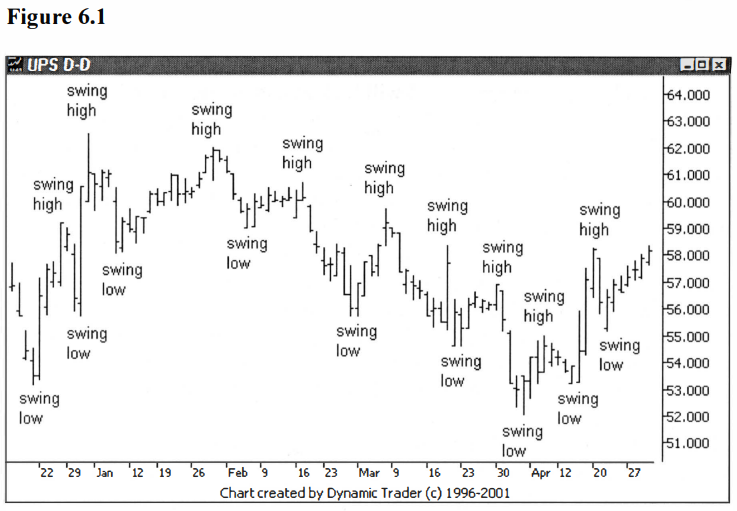

Take a look at UPS on a daily chart, with what I consider the important swing-highs

and lows labeled on the chart. See figure 6.1.

This labeling shows what I consider the

pertinent swing-highs and lows from a trading standpoint. Depending on the

definition used, there could be others. My goal here is to show not only what a

swing-high or low looks like, but to label only those that seem to fit the

timeframe of the chart we are looking at. To my eye, these points jump right

out.

Some of these swing-points may also have a

greater significance on a larger timeframe, pointing out larger timeframe

turning points, but for now we are only concerned with the swings as they

relate to this timeframe. Note how the swings are all very similar to each

other, with none really standing out from any of the others. UPS is trading

with quite a distinct rhythm on this chart, with all the swings being

candidates I would consider for use in potential trade entries. This is not the

norm, though.

Most of the time there will be a lot more

variance in the swings, with many not being of a proportion and character that

I would use for a potential trade entry. The most important thing to remember

is that I will apply this technique just like the others I have presented thus

far. I will find a potential trade area on the timeframe I plan to trade, and

then drop down to a lower timeframe to look for an entry technique.

It is on this lower timeframe that I will look

at and assess the swing-points that I see on the chart. I will be looking for a

swing-point right around the potential trade area that has the proportion and

character that I want. If other swing-points in other areas don’t have the

desired character, I’m not going to be that concerned. As long as the

swing-point that I will use for the actual trigger has what I want, I will

utilize it.

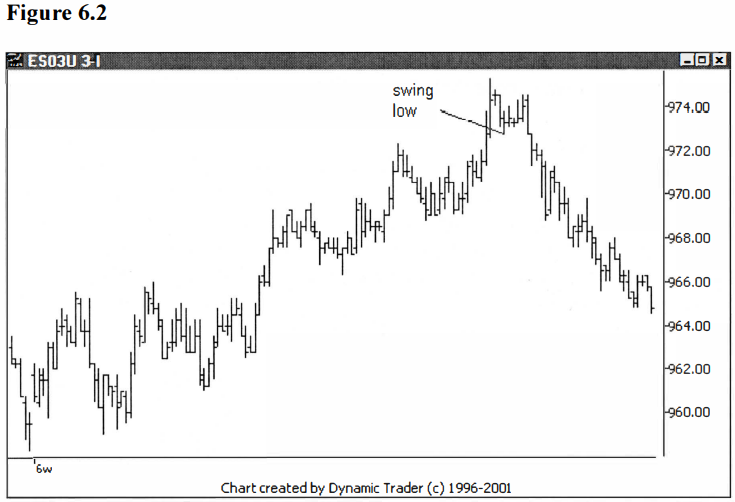

Let’s look at a swing-point on the S&P

e-mini 3-minute chart. The 3-minute chart is my lower timeframe chart in this

case, as I’ve spotted a potential trade area on the larger timeframe 13-minute

chart. I’m looking at the 975 area as a potential trade area for a short trade.

I’m watching to see if a tradable swing-point low forms after I penetrate the

potential trade area.

Since we haven’t yet gotten to the actual

technique, I’ll present the trade with the results on the chart, in one shot. I’ve

outlined the swing-low that I would have used for the trigger. See figure

6.2.

I like this swing-low because it began to form

shortly after the potential trade area was penetrated. It pulled back up

shortly after that, and began to reverse before it reached the previous peak.

This would be a so-called ‘failed test’ of the immediate high of the move. As you can see

from the chart, this was the last swing type move before the mini dropped right

off.

Keep this example in mind, as I will refer

back to it when I explain the actual technique itself, and compare the

technique to some of the ones we have covered so far. At this point, let’s look

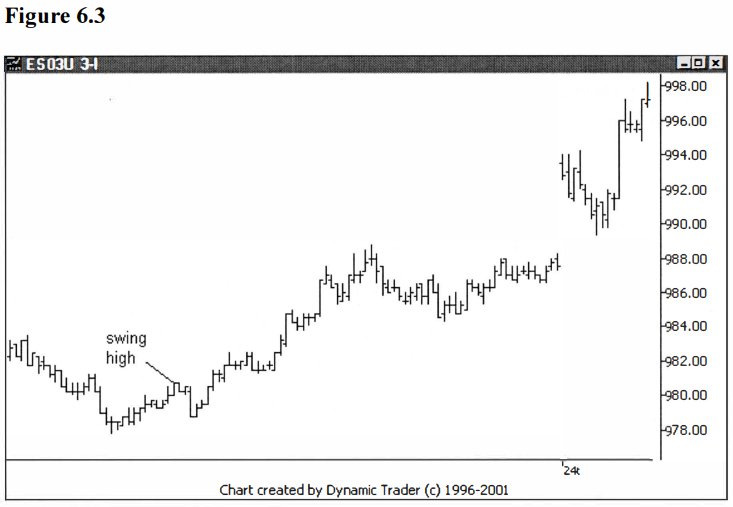

at another swing-point in the mini that I consider a tradable swing-point. I

was looking at a potential trade area at 978 on the 13-minute timeframe. I

dialed down to the 3-minute timeframe and was looking for a swing-high point

that could possibly be used for entry. I’ve labeled the chart with the

swing-high that formed right after the mini traded into the potential trade

area. See figure 6.3.

Notice that the proportion and setup of this

swing is very similar to the last example. The main notable difference is in

the time balance between the first impulse

of the uptrend that formed the swing-high, and the pullback to the swing-low.

In the last example it was fairly balanced time-wise, but in this example the

pullback is an approximate 25%-time retracement. Generally, I like the pullback

to be between a 50%o and 100%-time retracement, but if all the other aspects of

the pullback and the formation of the swing-point are acceptable, I wouldn’t

let a 25%-time retracement preclude my taking the trade.

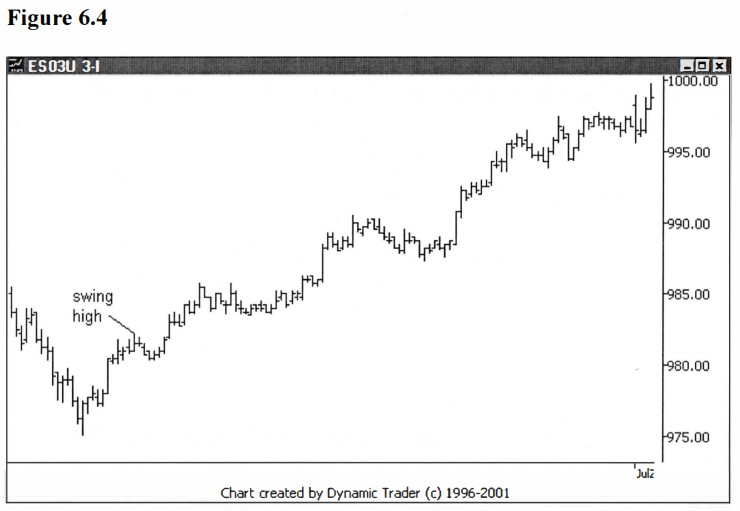

Let’s move on to an example of a swing-point

that I wouldn’t consider. That’s not to say that it couldn’t lead to a great

trade, as it very well might. But I choose my criteria for a reason. One of the

main things I look for when I’m choosing an acceptable swing-point is that it

is still fairly close to the potential trade area. This allows me to set a

protective stop fairly close to my entry point.

Although a trade using a swing-point that is

far away from the potential trade area could still use the area just below that

swing-point as the protective stop area, this is technically not as strong,

since this stop comes from the entry timeframe, not the traded timeframe.

Hence, I prefer to use a swing-point entry that is close to the potential trade

area and a more technically strong protective stop, usually just below the

potential trade area. Let’s look at another example in the mini, again showing

the 3-minute trigger chart. The potential trade area was around 975. See

figure 6.4.

Notice how far above the reversal point this

pullback starts. And notice how shallow the pullback is. Generally speaking, I

am looking for the pullback to start sooner and for the pullback (retracement)

to be at least 50%. This pullback is less than a .382.

And as I mentioned, you could still trade this

swing-high, but logical stop placement would be more difficult. As you can

clearly see, this turned out to be a smoking trade. But if I were looking to

enter using the swing-point technique, 1’d have been left out. Such is trading.

If you stick to your trading plan guidelines, you’ll sometimes miss great

trades.

It’s my opinion that if you try to come up

with a plan that makes sure you never miss any great trades, you’ll probably

not miss those great trades, but the trade-off will likely be an enormously

great deal of losing trades. If your game plan works, don’t fret over missed

trades, it’s part of the business.

I can hear some people saying ‘Hey, what about that smaller swing that formed between

the reversal point in the potential trade area and the swing- high you highlighted?’

In my opinion, that small swing-high would not meet my criteria for a tradable

swing-high. Not only did it not move far enough off the reversal point

(time-wise or point-wise), it didn’t pull back enough either. An acceptable

swing-point would have formed at a point between these two swing-points, and

pulled back at least 50%. It also would have shown a good time balance.

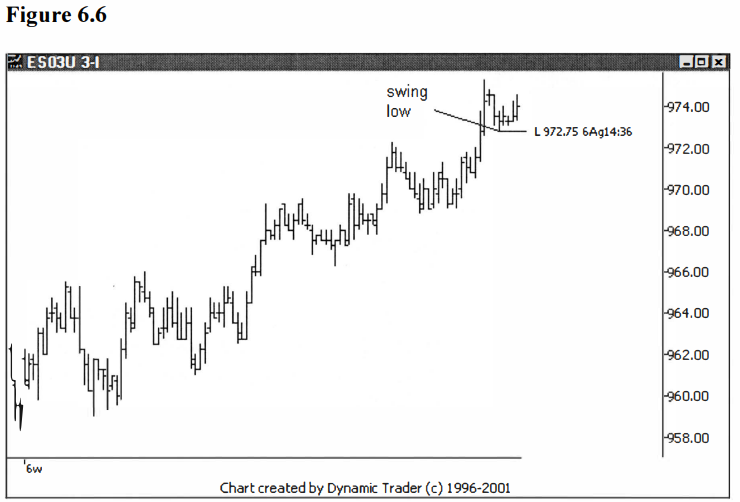

Let’s move on to the actual technique itself.

The trade will be triggered when the issue trades above the swing-high in an

uptrend or the issue trades below the swing-low in a downtrend. This will be a

lot easier to see if we just move on to a chart. Let’s go back to the first

example in this chapter, as shown in figure 6.2. I will back up the chart a bit

in time and show the trade as it unfolds. See figure 6.5.

The mini has traded into the potential trade

area and has formed an adequate swing-low for entry purposes. At this point the

next step is to draw in a horizontal line from the swing-low, going to the

right. Once this line is breached, the trade will be triggered.

As with the other techniques presented so far,

you will have the choice of triggering the trade when the price simply trades

through the trigger line, or waiting to trigger until you get a close after

crossing the trigger line. Unlike the previous techniques where I generally

wait for a close to trigger me into a trade, I usually trigger on this

technique with a simple price cross of the trigger line. Let’s look at the

chart with the trigger line drawn on the chart. See figure 6.6.

The trigger line is at 972.75. Any trade below

972.75 would trigger me into the trade. Since the tick value on the mini is

0.25 point, the trigger price for initiating a trade for me would be 972.50.

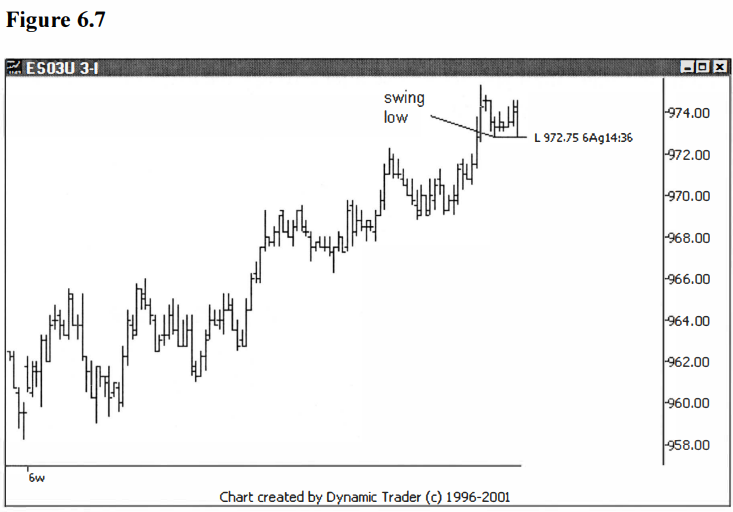

Let’s look at the chart, moved ahead one more bar. See figure 6.7.

The mini traded right down to the trigger

line, and although it is difficult to see on the chart because of the trigger

line, the last bar closed on the low, right at 972.75. One more tick down is

going to trigger the trade. Let’s move ahead one more bar on the chart. See

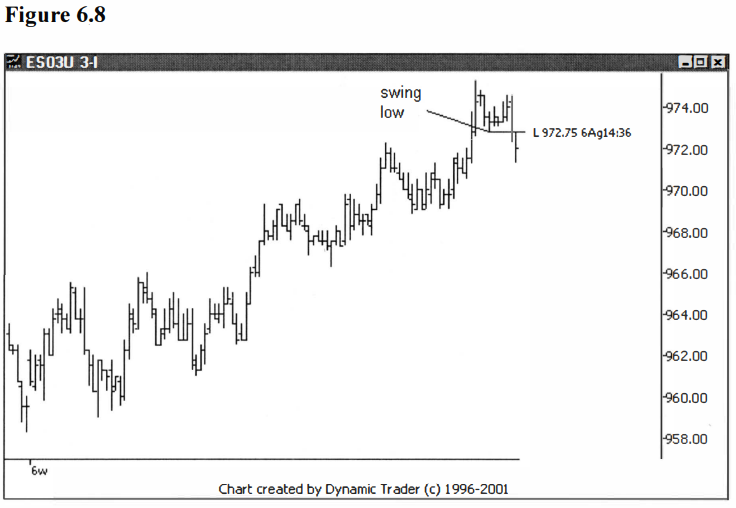

figure 6.8.

The trade is now triggered at this point,

whether you chose the simple price cross or the price close below the trigger

line. Let’s look, again, at how the mini behaved after the trigger. See

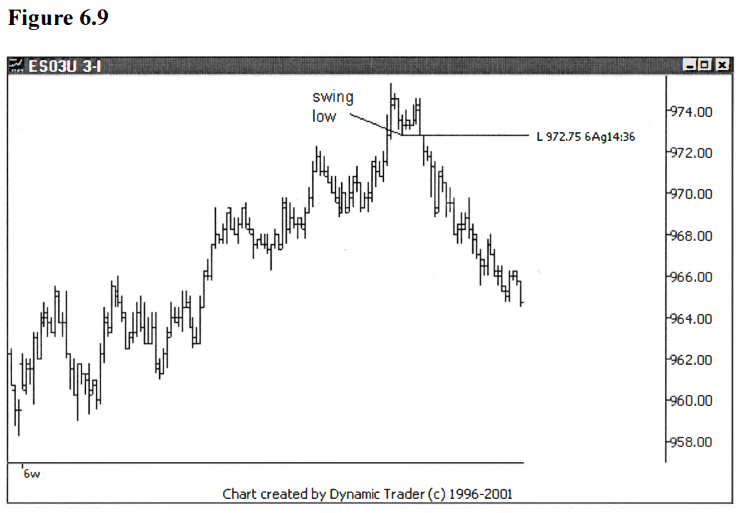

figure 6.9

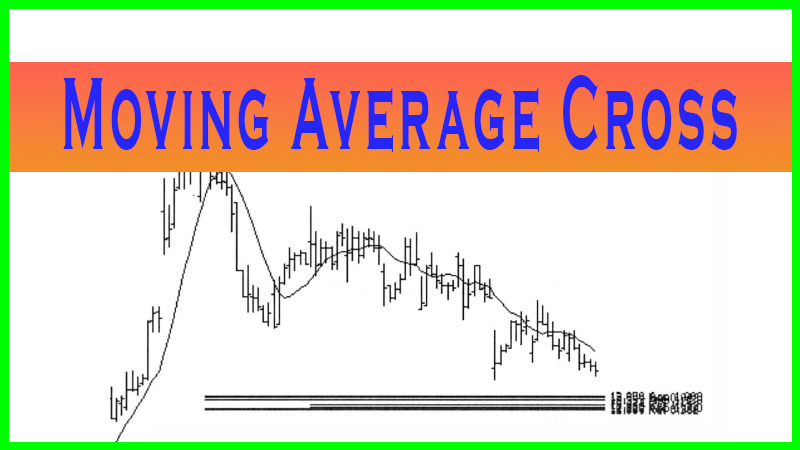

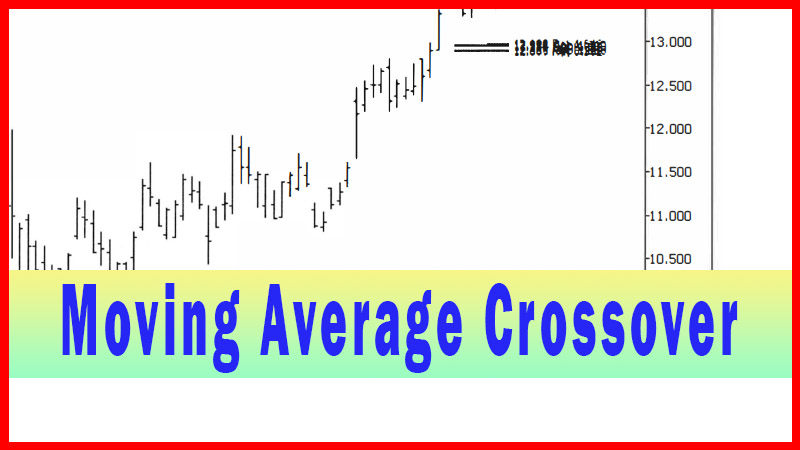

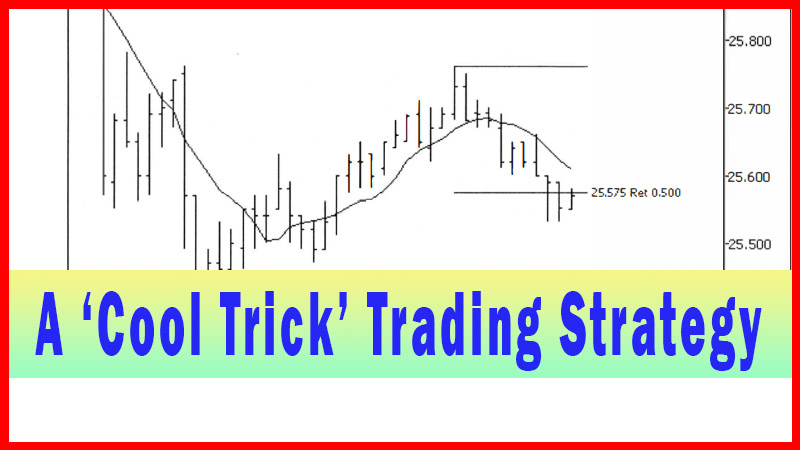

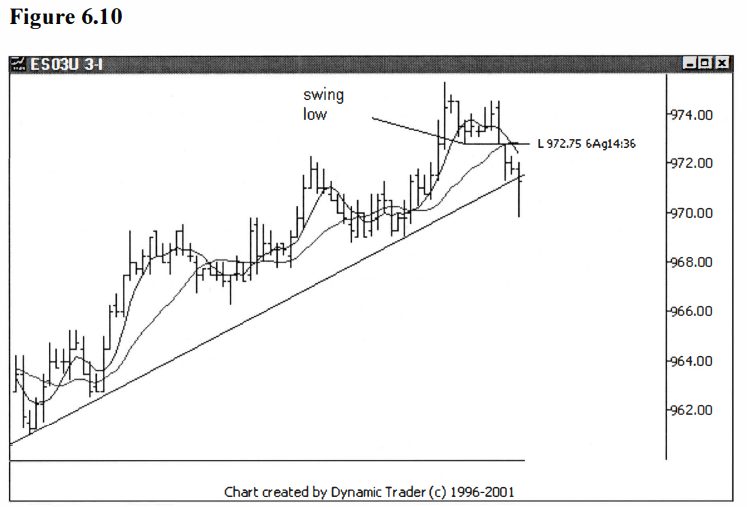

I want to make a quick comparison here with a

trendline trigger and a moving average crossover trigger. I’ll use my favorite

for the moving averages, the 5/15 simple moving

average combination. I’ll put both of these triggers on the chart

with the swing-low entry, for comparison. See figure 6.10.

Now that’s interesting. We are seeing just

about the same thing we’ve been seeing all along. I do believe a pattern is

emerging. All three entries are, indeed, very close. Usually, the 5/15 simple

moving average crossover will trigger first, and then the trendline. One might

expect that the swing-point technique would trigger after both of these

techniques because it is a higher confirmation technique, and one that

generally triggers later.

Sometimes this is the case, but sometimes it

is not. This is due to the fact that the there is some discretion to the choice

of swing-points that are considered for the trade. I prefer a swing that is

close to the potential trade zone, and hence will trigger fairly early in the

move. This means the swing- point entry may not come up and trigger that often,

but can give you a price that is better, the same, or not as good as the other

techniques. It’s not uncommon for me to have my chart set up like figure 6.10,

so I can observe multiple possible triggers at the same time.

So what are the different trigger prices for

the three techniques on chart 6.10? The first trade below the swing-low trigger

line would be at 972.50, and the first closing bar price below that

trigger line is 972.00. The following bar is the trigger bar for the moving

average crossover, and that bar closed at 971.75. The bar that follows after

that is the trigger bar for the trendline

violation technique, and that bar has a closing price of 971.25.

Now, again, I’m not stating that anyone could

or would get filled at those exact prices, but they allow for comparison. And

as you can see, the prices are all within 1.25 points of each other. I think it

is getting clearer that the variation between the techniques is minimal and

that any of them can be adequate for most circumstances. You can do some

fine-tuning to choose the best parameters and the best technique for an

individual trade situation, but don’t get carried away with the time invested

in making your choices, either.

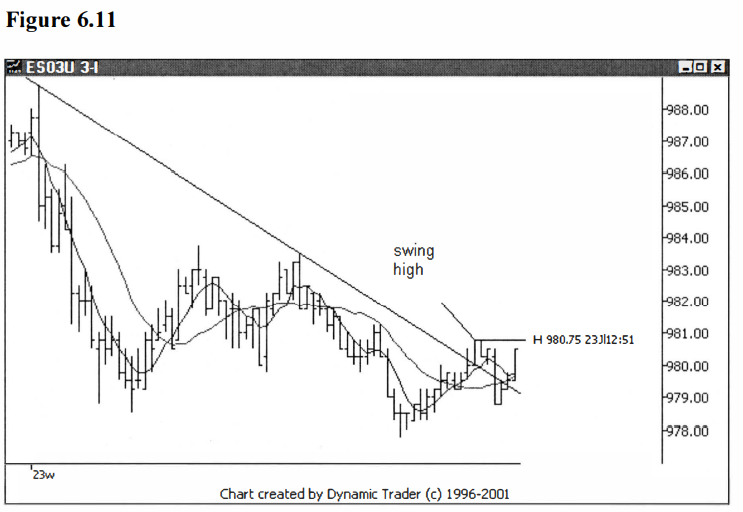

Let’s look at another example, the one from

figure 6.3. I will make this example short by putting all three of the triggers

we looked at in the last example on the chart in one shot here. See figure

6.11.

At this point both the moving average

crossover and trendline techniques have triggered, but the swing-high violation

has not. Let’s move one more bar ahead and see if the swing-high triggers. See

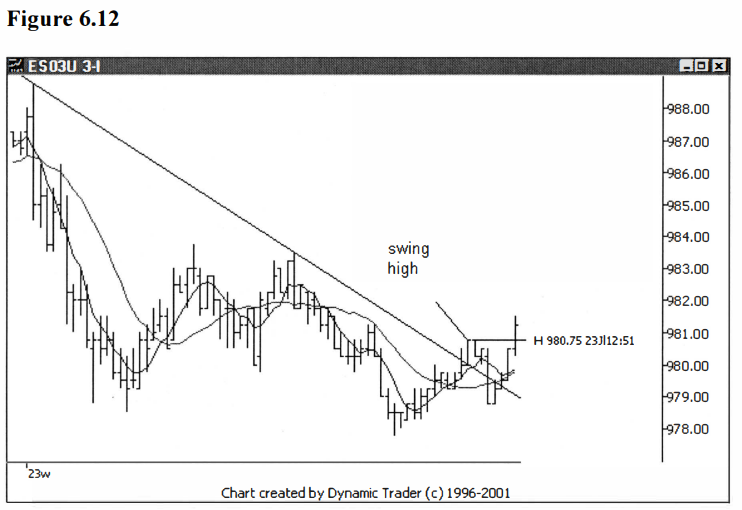

figure 6.12.

One more bar was all it took to trigger the

swing-high violation trade. On this trade the order of triggering was more what

one might expect, starting with the moving average crossover, then the

trendline violation, followed by the swing-high violation.

Again, for comparative purposes, the moving

average crossover trigger price is 979.50, the trendline violation trigger price

is 980.75, and the swing-high violation would be at 981.00. The price on the

first bar to close above the swing-high trigger line is 981.25. All in all,

these prices are very close, and the price is greater as the greater

confirmation technique is applied, as one might expect.

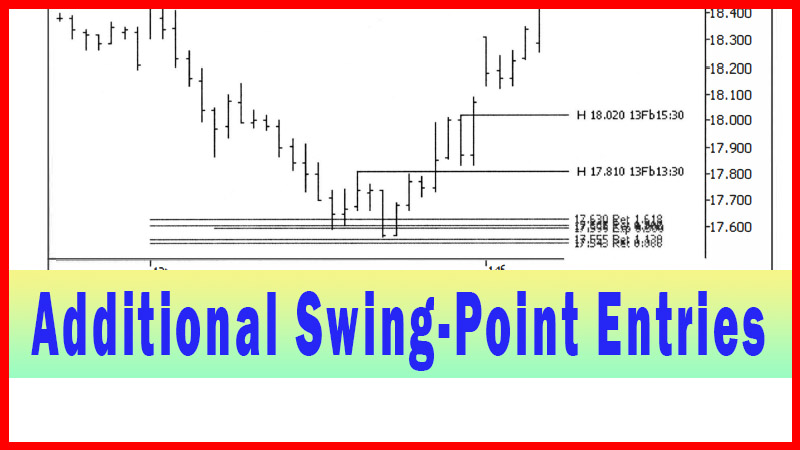

Before moving on to the next chapter and

technique, I want to point out one interesting observation I see on a regular

basis with respect to this technique. Let’s take another look at UPS, as shown

in figure 6.1. See figure 6.13.

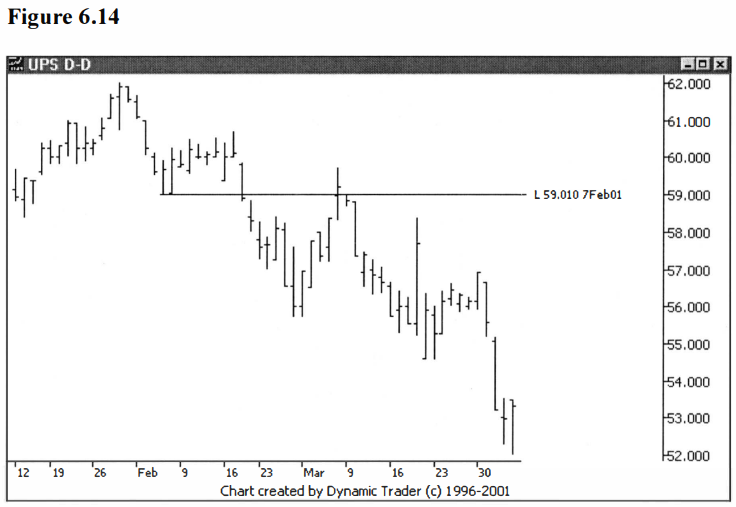

Here’s the same chart as figure 6.1, without

all the swing-point labels. I’m going to add a swing-low trigger line to the

low on February 7 and expand the chart out a bit. See figure 6.14.

The trade was triggered by violating the

swing-low trigger line, and UPS began to fall off nicely. But then it began to

rebound and went right back up to the trigger line, and even traded above it.

UPS reversed again in this area and resumed the downtrend. I have found it to

be very common for an issue to trade back up to, and even slightly through, the

trigger line. It doesn’t happen all the time, but it sure seems to happen

often.

This can scare a trader out of a good trade if

he or she stays on the trigger timeframe or revises the stop loss very quickly.

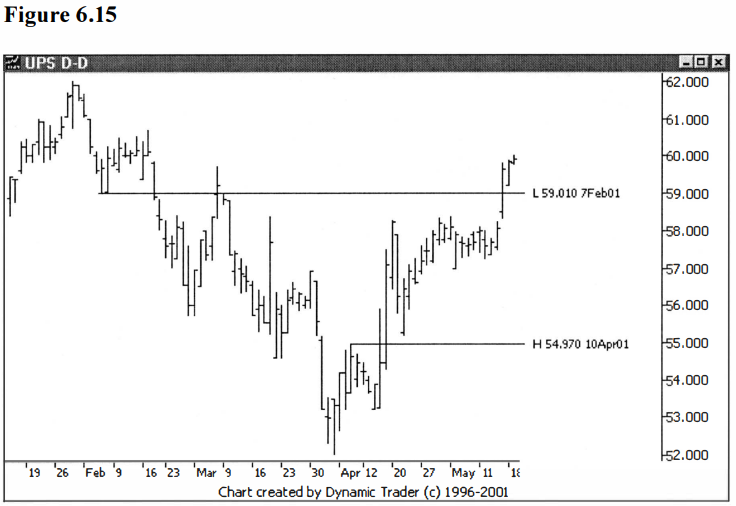

I just want to point this out so you can be on the lookout for it. Let’s look

at one more example on this same chart. I’ll leave the swing-low line on the

chart, and add a swing-high trigger that comes up just a little bit later on. See

figure 6.15.

Notice how UPS traded through the swing-high

trigger line and continued up $3.55 before pulling back. And when it pulled

back, it came back almost all the way to the trigger line. Again, it doesn’t

happen every time, but it happens often, so keep a watch out for it.

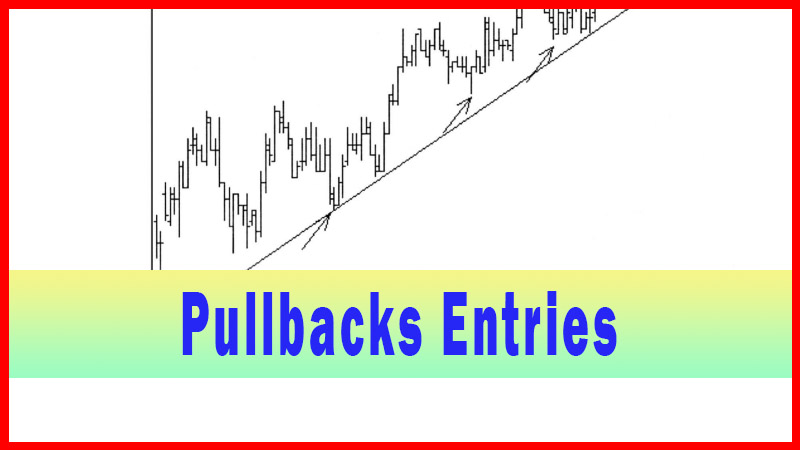

The next chapter is on the pullback technique,

and that doesn’t sound related at all to the current technique. But, in fact,

the way I use it, it is a variation on the swing-point technique. The pullback

technique is a way to anticipate the trigger on the swing-point entry

technique, in order to get a better price. The downside? You’re getting less

confirmation, so you’re more likely to get a false signal.

Best Trading Entry Techniques : Trade Entry Techniques : Tag: Trade Entry Techniques, Forex : Swing Trading Strategy, Swing Trade, Lower Timeframe trade, Moving average, Crossover Trading Strategy - Swing Low and Swing High Trading Method