Cool Trick Trading Startegy

Moving Average Crossover, trendlines, Regression Channels, Swing low, Swing high, swing trade entry points

Course: [ Best Trading Entry Techniques : Trade Entry Techniques ]

The ‘middle’ timeframe is the traded timeframe, the longer timeframe is used for context, and the shorter timeframe is used to fine-tune an entry into the trade. What I will be presenting here amounts to dropping down yet one more timeframe, to fine- tune the entry even more. This is not a ‘trick’ whose use I take lightly, however.

A ‘Cool Trick’ Trading Strategy

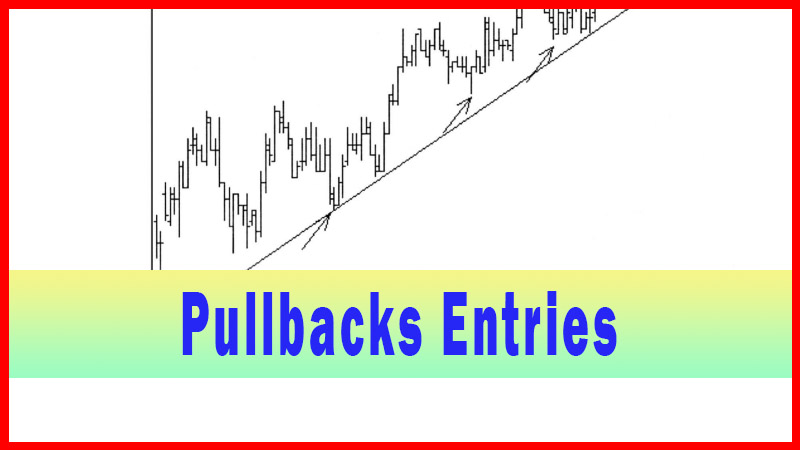

The ‘cool trick’ is a favorite variation of

mine that I apply on pullback entries. I am only presenting it here in the

context of the pullbacks, as described in chapter 7. I apply it to other

pullback situations, but for now I am presenting it only as I apply it to

pullback situations like those shown in chapter 7. As always, I encourage

experimentation with the techniques, and their use and application in any

situation that works for the individual trader.

One of my main methodologies, one I’m sure the

reader is by now quite familiar with, is the use of three timeframes. The ‘middle’ timeframe

is the traded timeframe, the longer timeframe is used for context, and

the shorter timeframe is used to fine-tune an entry into the trade. What I will

be presenting here amounts to dropping down yet one more timeframe, to fine-

tune the entry even more. This is not a ‘trick’ whose use I take lightly,

however.

What I mean by that is, I have to be careful

not to indiscriminately start going down to a lower timeframe than my entry

trigger timeframe. To do so may introduce a timeframe that is way too small

with respect to the traded timeframe to have any real meaning. The ‘sensitivity’ is simply far too great.

What I am doing with this technique is different, though. I am looking at the

entry chart like it is a trading problem in its own right, and looking to solve

that entry problem.

The entry problem on the entry chart, though,

is just the same as the original entry problem. Confused? You shouldn’t be. If

we have a traded timeframe chart and we drop down to a lower timeframe for

entry once we

have penetrated the potential trade area,

and we find that the entry chart has a potential trade area (the 50%

retracement), why not apply the very same technique again? That’s the premise

here, and for my trading it’s a valid premise.

I am only applying this technique to pullbacks

that are part of an acceptable swing-point formation, and only once the

pullback has penetrated the minimum 50% retracement. I generally don’t apply it

in other circumstances. I have exceptions, but only because I’ve experimented

extensively with the technique and found other ways to apply it. As with any

technique, whether it is one if my techniques or one from any other source,

each trader should experiment and decide if it will work for him or her, and

under what circumstances.

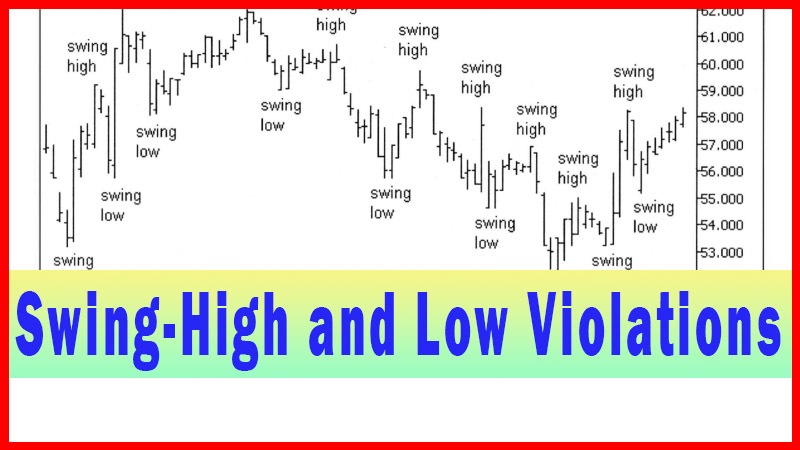

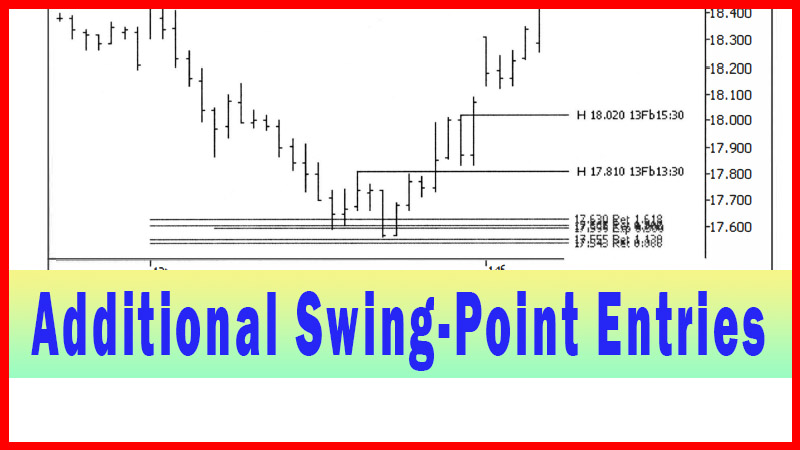

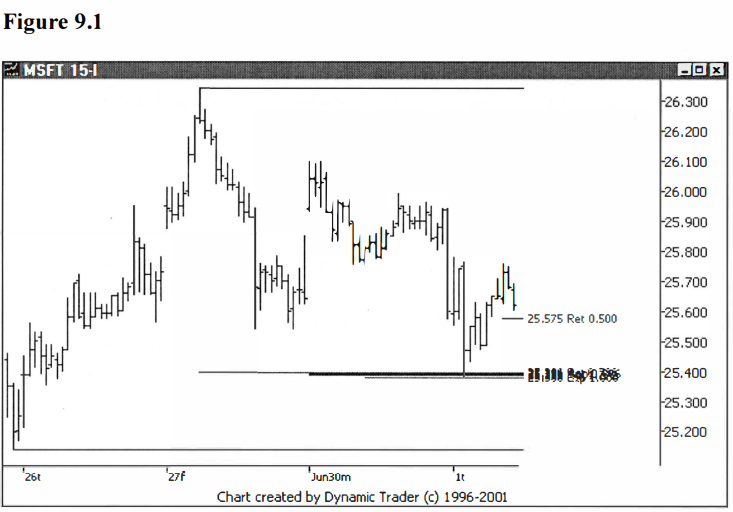

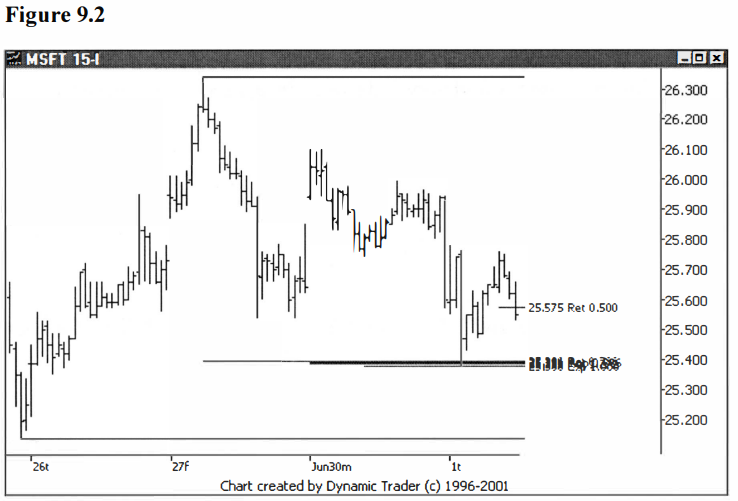

Let’s look at that MSFT example from chapter

7. The following chart is from figure 7.9. Recall that MSFT has penetrated the

potential trade area around $25.40 and reversed. MSFT then began to form a

swing-high point and pullback that met my criteria. The chart is the lower

(trigger) timeframe. The 50% minimum retracement I look for is labeled. See

figure 9.1.

MSFT hasn’t yet hit the 50% minimum

retracement, so let’s advance forward one more bar. See figure 9.2.

MSFT has now penetrated the 50% minimum

retracement area, and I can now consider a trigger. Here’s where I see the

similarity with the initial trade process. What if I presented this chart and

said I have a potential trade area at the 50% retracement. Now I want to dial

down to a lower timeframe and look for an entry. Likely, you would see that as

a valid plan.

The only difference I can see is that the 50%

retracement is just one number, not a grouping of numbers. Normally, I trade

areas I think have a preponderance of reasons for significance, at least as far

as my experience tells me. (They don’t necessarily have to be Fibonacci

groupings, just solid potential trading areas.) That’s why I am confident to

consider it as a potential trade area.

Remember the ‘Plan for a Trade’. It includes

an area to trade, an area you have decided you think gives you an edge, an area

you think something is likely to happen. This trade, redone as a standalone,

simply doesn’t have that. That’s why I say I don’t want to just apply the

technique at random, so to speak. I have found the technique works for me

because it is a refinement of a valid trade premise I have laid out.

As long as I apply it in this context, I think

it is useful to me. What I am trying to convey is, don’t just apply it whenever

you want to any situation you want. It then becomes out of context, and as I

have pointed out so many times, without context, I find very little value in

any technique, regardless of at what stage of the trading plan it is applied.

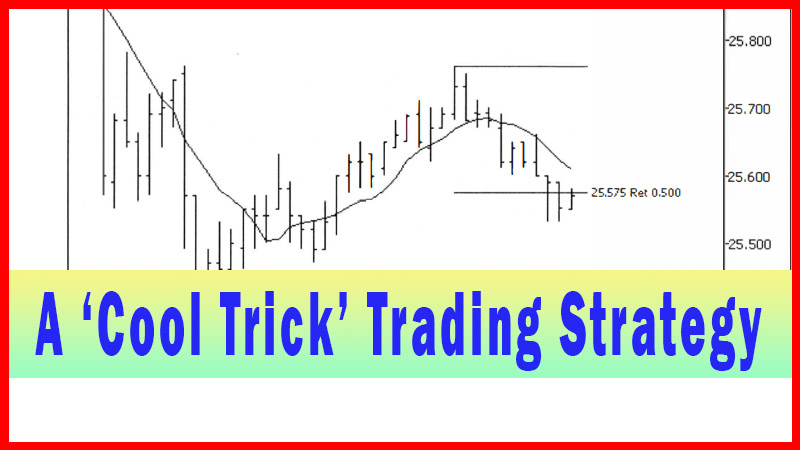

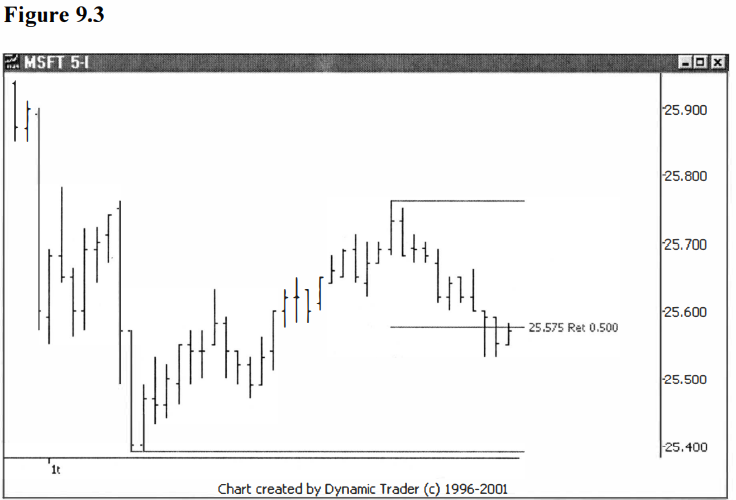

Let’s now drop down to an even lower

timeframe, this time the 5-minute chart, as MSFT penetrates the 50% retracement

area. See figure 9.3.

MSFT is in the area where I would consider a

trigger. Down on this 5- minute timeframe, I have more detail to examine. I

want to look at the pullback, and decide when I think that pullback may be

ending. I have a few preferred techniques I usually choose from to help me

decide. I can see that this pullback is very orderly and it appears that it would

lend itself very well to a trendline violation entry. Sound familiar? I am just

using techniques and concepts I already have to address this trading situation.

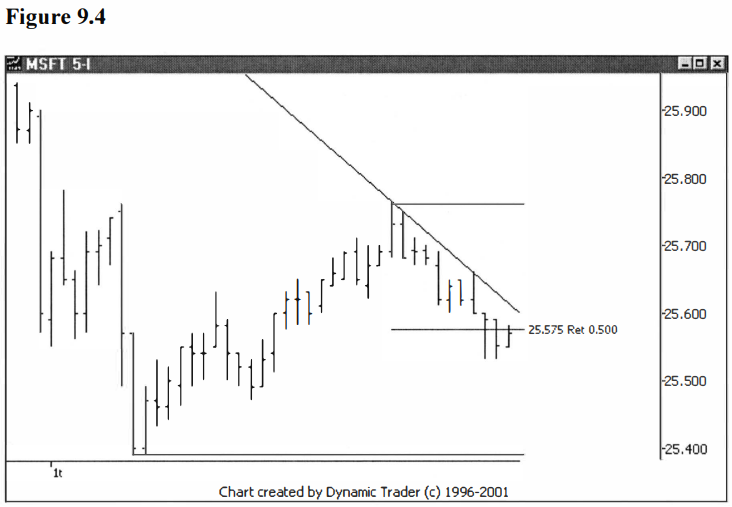

Let’s draw in a trendline and see what that shows us. See figure 9.4.

The trendline represents the price action very

well. Understand, when you use a trendline for such a small trend i.e., so few

price bars, it frequently will not have multiple contact points. That doesn’t

matter to me, since I’m only using the trendline to indicate to me that the

price direction has changed right at that instant. I’m not trying to determine

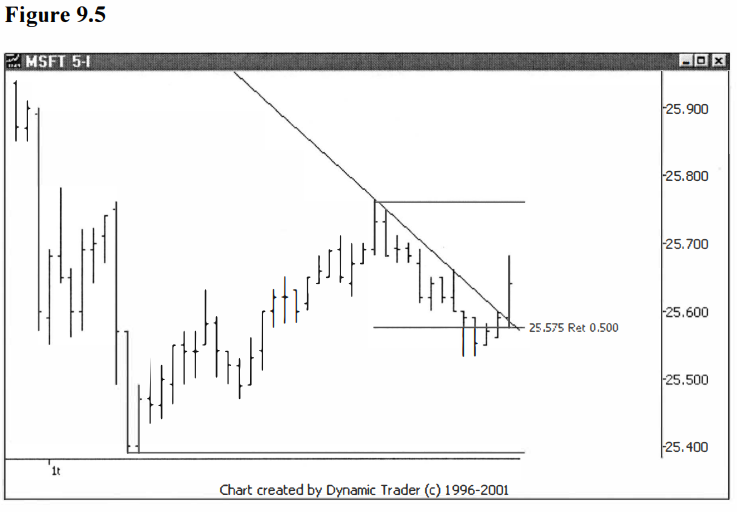

how solid of a trend I feel is in place, or anything else. Let’s move two bars

ahead and assess the situation. See figure 9.5.

The trade would be triggered at this point,

with a close above the trendline. Let’s note the closing trigger bar price for

comparative purposes, which is $25.64. If you’ll recall, the entry over the

high of the 15-minute bar was at $25.67, as shown in figure 7.11. This entry

was a slight bit lower, but in the same general area.

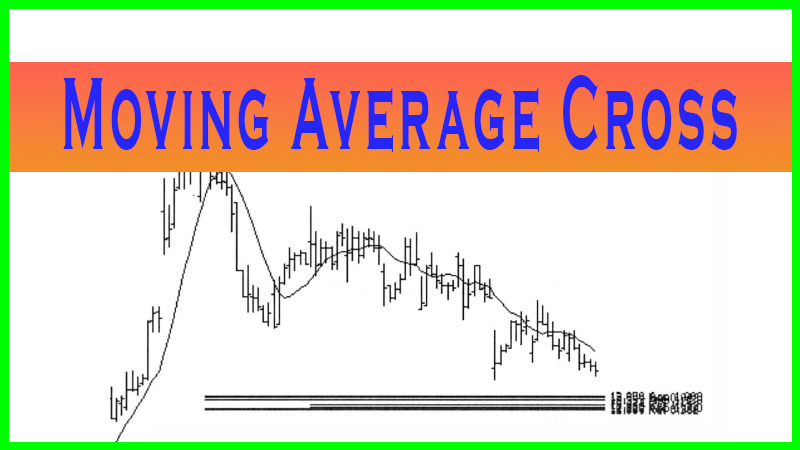

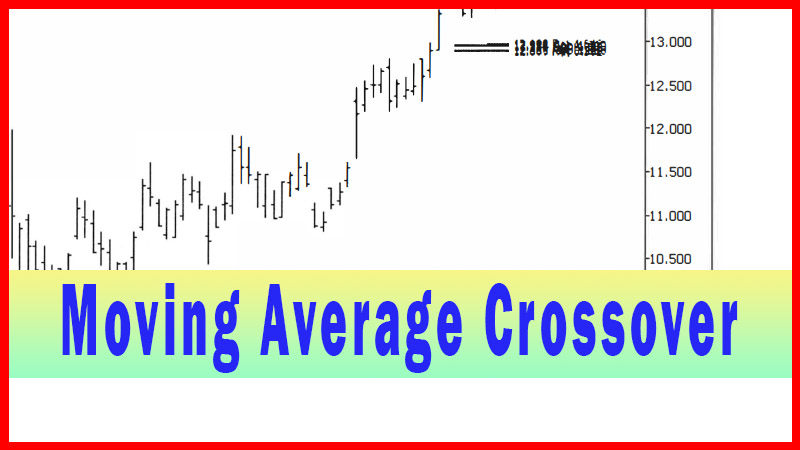

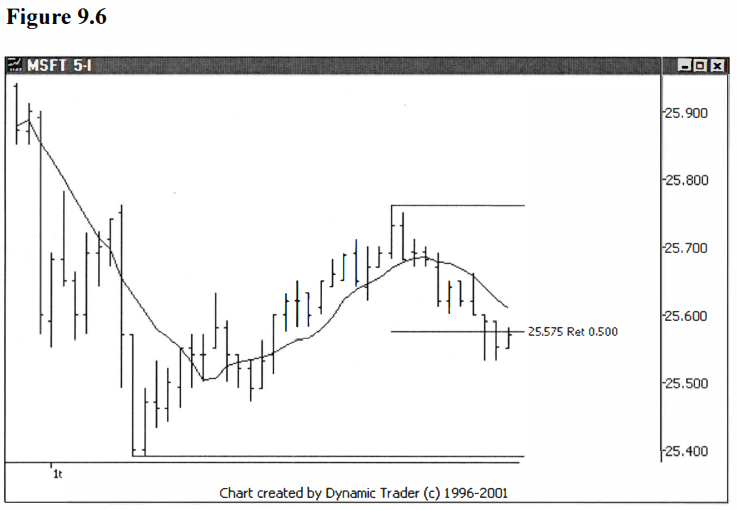

When I see such a nice, orderly pullback, I

also look at a moving average cross entry, as covered in chapter 2. I use a

fairly short period moving average, usually a 5-period or an 8-period, when I

do this ‘trick’. I will try a few variations and see which one looks like it

best represents the price action that I have available once the 50% retracement

area has been penetrated. In this case I went with an 8-period simple moving

average. Let’s look at the chart with this average added on. See figure 9.6.

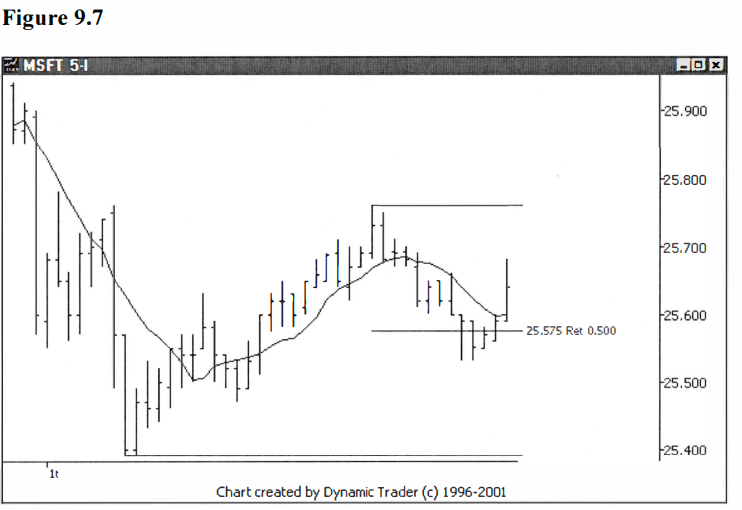

This looks very similar to what we just did

with the trendline. Let’s move two bars ahead, again, and do another

assessment. See figure 9.7.

The trade is again triggered at this same

point, and we’ll note the same price of $25.64 as the closing bar trigger price

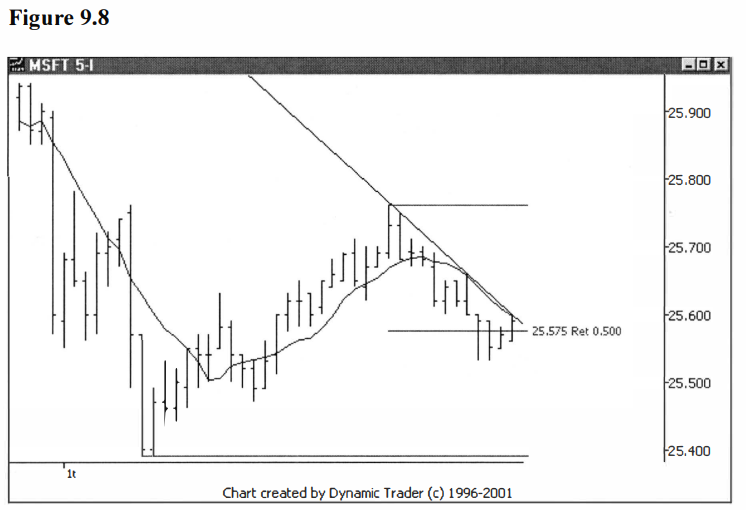

for this variation of the technique. To show just how similar the two

variations are, on the next chart I’ll show both the trendline and the 8-period

simple moving average together. See figure 9.8.

Now, to me, that’s amazing. The two just about

converge right at the breakout point. It just goes to show how these techniques

can frequently point you to very specific areas if you choose the parameters to

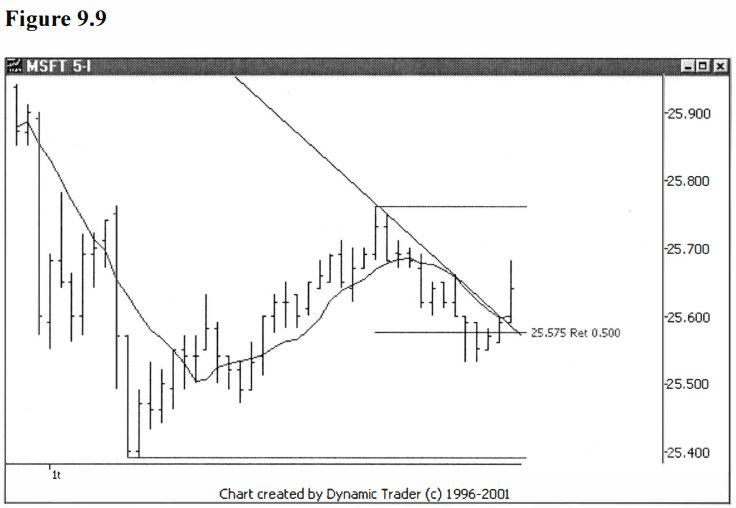

represent the price action well. Let’s move ahead one more bar, and look at the

trigger bar with both the triggers on the same chart. See figure 9.9.

Either technique variation would have been a

good choice within the guidelines of my trading plan. As we have seen, when the

technique is chosen well and applied correctly, the entry areas are, many

times, very similar to each other.

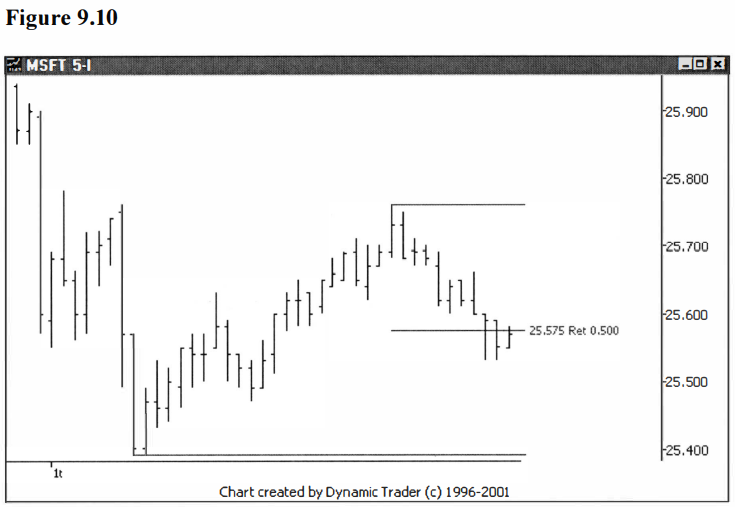

A third variation I really like is using the

bars to trigger me into the trade. This is really a fine-tuned variation on

taking out the bar high (low for shorts), just applied to the lower timeframe.

I prefer to use some judgment in this regard, and not just automatically take

the first signal from the first trade over any bar high once the 50%

retracement area is penetrated. I look at the other two entry variations we

just covered on the same chart, and I look at the last few bars. Let’s look at

the chart for now without anything else on it, as the decision point is

approaching. See figure 9.10.

How would I assess the bars here? Normally,

it’s common to use the high of an inside bar for a long trigger. It’s even

somewhat common to use the high of yet another successive inside bar as a

trigger. If I were in the ‘regular’ lower timeframe, I would likely use those

criteria for my trigger.

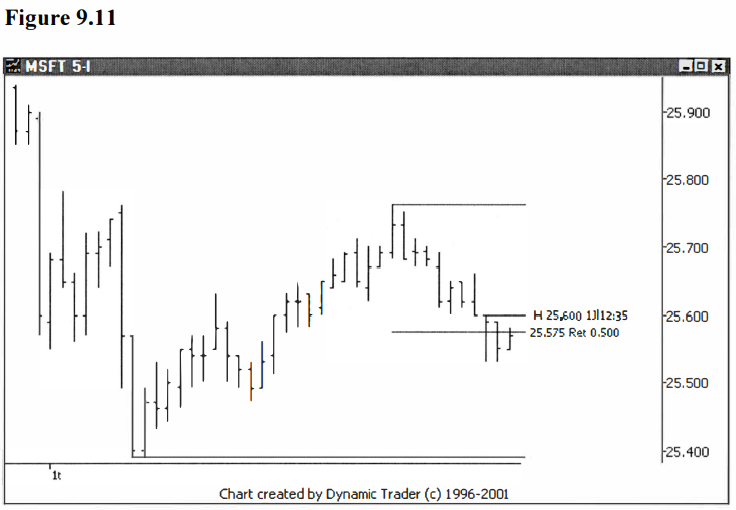

In this case, though, since I’m in an even

lower timeframe, which I consider more ‘sensitive’ that usual (with respect to my traded timeframe), I want to

be a little less quick to trigger. So, in this case, I would use the high of

the bar that set the low, which is just a bit higher than the inside bar that

followed it. Let’s see what that looks like by drawing in a horizontal trigger

line on the chart. See figure 9.11.

It is interesting to note that the 15-minute

chart bar trigger is actually the high of the bar just before the trigger bar

on this chart. You can see, then, that this choice of triggers would be at a

lower price. That is the reason behind doing all this extra work, to attempt to

get in at a better price with a smaller protective stop loss, and to not lose

all that advantage by greatly increasing the chance of a ‘false start’. Let’s move two bars ahead and

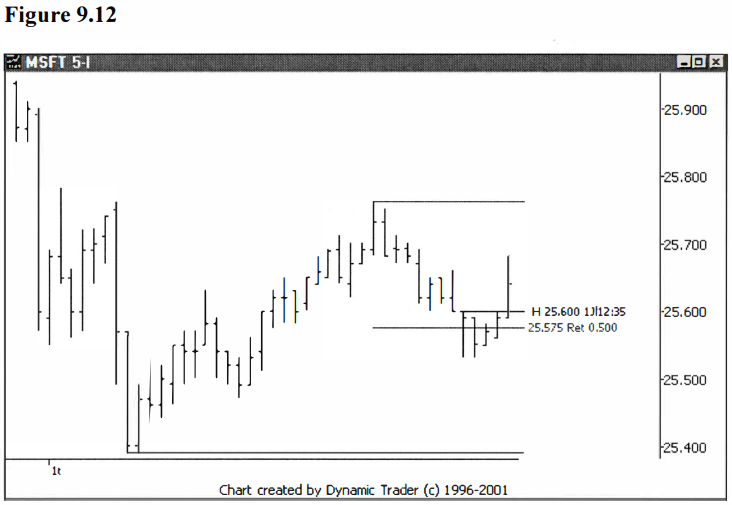

assess the situation. See figure 9.12.

Well, this is getting repetitive, isn’t it?

MSFT didn’t trigger on the next bar, as that bar traded to the same high as the

trigger bar, but not above it. It did trigger on the following bar after that,

though. But since the trigger is the first trade above that bar high at $25.60,

we’ll record the trigger price at $25.61. That’s not to say that anyone could

have gotten filled at that exact price, of course, but we need some prices for

general comparison. This price is better than the previous two variations at

$25.64.

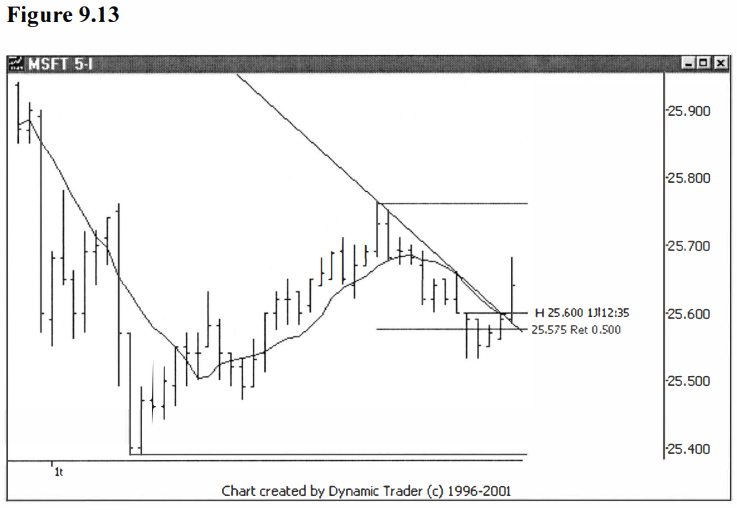

Let’s finish this example by adding one more

bar to the chart, and putting all three of the trigger variations on the chart

at the same time. See figure 9.13

In a case such as this one, I would certainly

note that the three techniques all converge on pretty much the exact same

point, right at $25.60 on the second from the last bar on this chart. Given

this, I would seriously consider a trigger on any trade above this point. This

is a great example of why I actually like to use multiple techniques at the

same time to guide my decision-making process. In a situation like this I would

be very unlikely to wait for the close on that last bar to initiate the trade.

This is a subjective call based on experience, and all I can do is pass on the

reasoning behind my potential decisions.

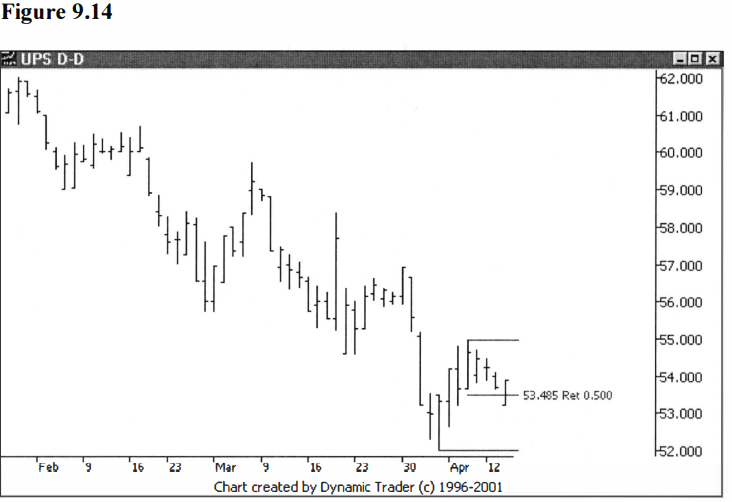

I’d like to present one more example on this

‘trick’. Let’s go back to the UPS example, which was triggered on the daily

timeframe. 1’d like to dial down to a lower still timeframe of 60-minutes and

go through the ‘trick’ on this one. Let’s go back to the daily trigger

timeframe chart of UPS and look again at the swing-point and pullback, as the

50% minimum retracement is penetrated. This chart was previously shown as

figure 7.14. See figure 9.14.

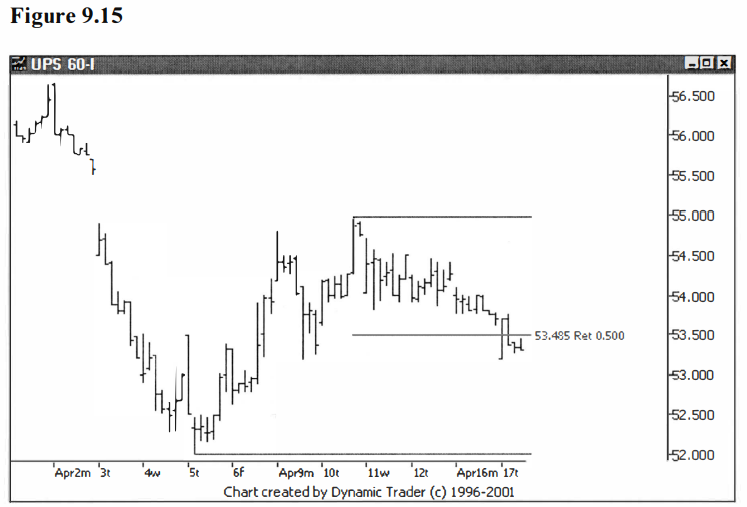

The ‘regular’ way to look for an entry would

be to utilize this chart and one of the previously described techniques.

Instead, we will attempt to use the ‘cool trick’, and go down to an even lower

timeframe; in this case I’ll choose the 60-minute. Let’s look at the same

pullback on UPS shown in figure 9.14, this time on the lower timeframe. See

figure 9.15.

At this point UPS has penetrated the 50%

retracement area and I have to make a decision on what trigger I might

consider. I like to put all three triggers that we have covered for this

‘trick’ on the chart at the same time and make a more ‘holistic’ decision, but

it’s up to the reader to decide if he or she wants to try them all at the same

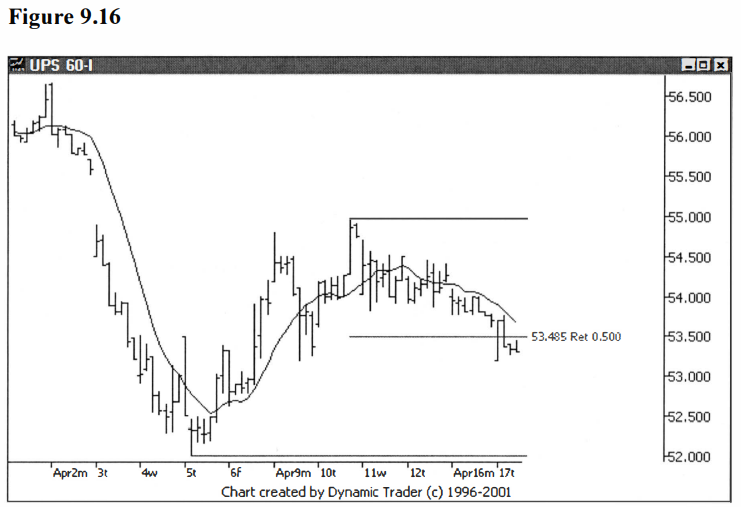

time, or to pick a particular one and just use that. First, I’ll add a simple

moving average to the chart. See figure 9.16.

In this case I opted to use a 10-period simple

moving average. I tried an 8- period, but felt the 10-period did just a

slightly better job at representing the price action. In reality, the

difference is extremely minor and likely of no trading significance at all. UPS

is not all that smooth or orderly as it trends into the trigger area, and that

will usually have me using a slightly longer period moving average. I suggest

you experiment with varying period lengths and see what works best for you and

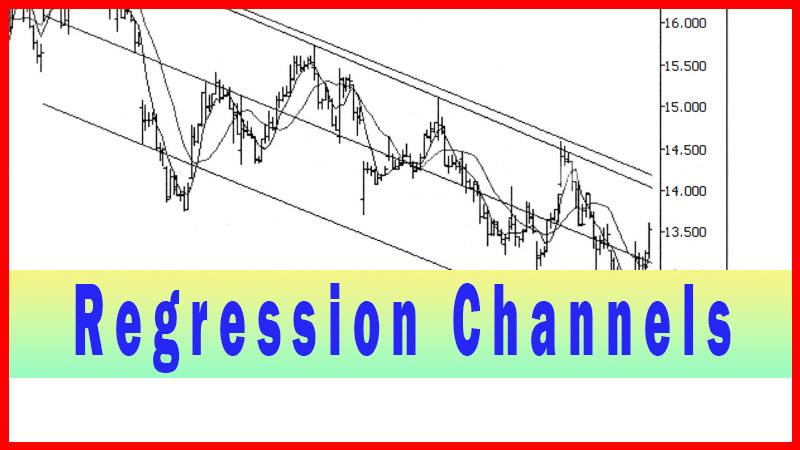

your particular trading plan. I’ll now add in a trendline and see what that

shows me. See figure 9.17.

The first thing I notice now that the

trendline is on the chart is that the trendline is tracking a bit above the

moving average. This might give me a later signal if I use the trendline. If I

am feeling a great deal of confidence in this setup, I might opt for the moving

average cross trigger, and if I’m not quite as confident I may opt for the

trendline violation.

This level of confidence is not something I

can quantify for the reader, it is a matter of my ‘gut feeling’, based on

having seen a vast quantity of similar setups over a long period of time. All

in all, I don’t feel the difference is very great between these triggers, and

all I’m trying to do is increase my perceived edge by just an additional

fraction, if I can.

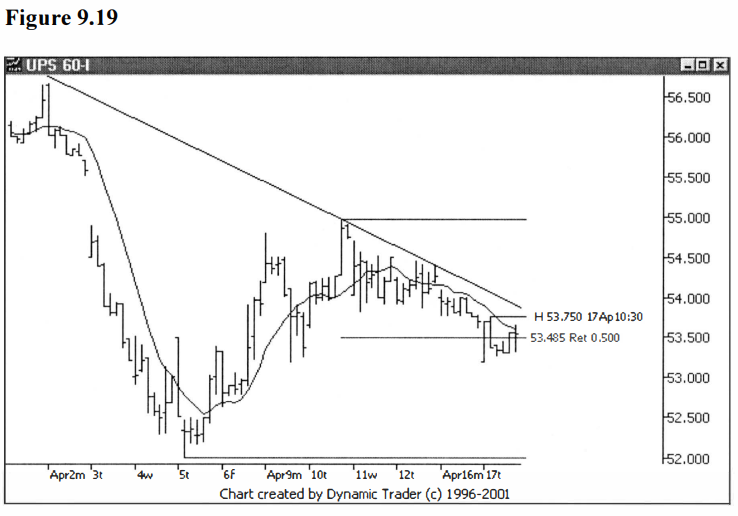

I’ll now add a bar high trigger to the chart.

See if you can guess which bar I am going to choose as my trigger bar. Look at

the bars as UPS heads into the trigger area and see if anything jumps out as

potentially more significant than anything else you might use. I see the bar I

want to use right off. I’ll add a horizontal trigger line to the high of that

bar. See figure 9.18.

When I choose a high of a bar trigger and

highlight it with my horizontal trigger line, I am doing that in the context of

the chart, as it exists when I do the labeling. If the chart changes before the

trigger is hit in such a way that I no longer like my choice, I will change it.

The bar trigger is based on the assumption that the trigger will be hit with no

unusual price action, and with a tum towards the trigger happening fairly soon.

I re-evaluate the choice with every additional bar that’s added to the chart.

Let’s move two bars ahead and assess the situation. See figure 9.19.

At this point UPS hasn’t triggered any of the

variations. The price has penetrated the moving average, but has still closed

below it. If you were opting to trigger on any price action above the moving

average, you would have been triggered at this point. Let’s add one more bar

and see if any triggers have been set off. See figure 9.20.

Wow, that’s pretty interesting. One bar has

triggered all three variations at the same time. The close of this trigger bar

is $53.87, and I’ll use that price for comparison for the moving average cross

trigger and for the trendline violation trigger. The trade above the high of

the bar trigger I’ll record as one cent over the bar’s high, so that one would

be $53.76. Recall back to the example using the daily bar high trigger, that

the trigger price using that method was $53.90.

In a similar way as we have seen in the other

examples, we see that some potential price improvement may be gained using the

‘trick’. It’s up to each individual trader to decide if this potential

improvement is worth the additional effort, or even if the technique will work

at all for his or her trading plan. Myself, I have found real benefits from

this technique.

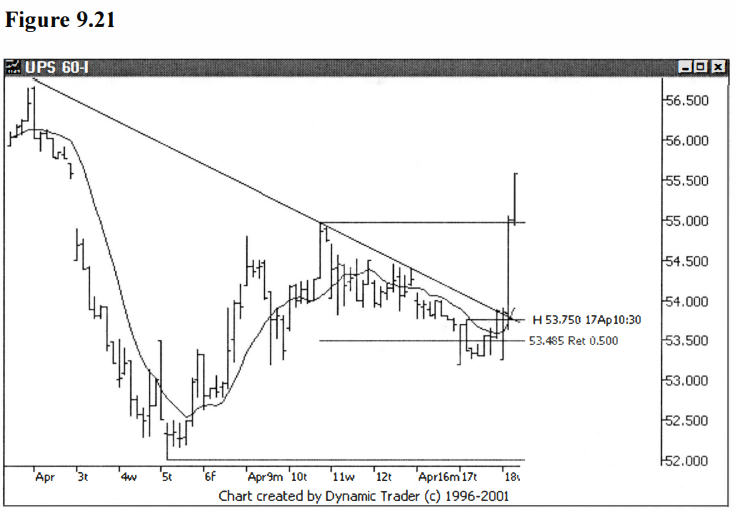

Let’s look at UPS right after this trigger, to

see if it appears as though this area was important, or if many traders seem to

have been watching this area. See figure 9.21.

It does appear that this area was of some

significance. Can I guarantee that this ‘explosion’ in price action had anything

to do with what I have outlined on the chart? Absolutely not. It may have had

nothing to do with the technical features I’ve outlined. All I can say is that

in my experience, I’ve come to conclude that I see these areas of activity most

often in areas that seem to have technical aspects that lead me to believe

something might happen in that area. It just seems like too great of a

coincidence to me.

Perhaps it’s a self-fulfilling prophecy, in

that if enough traders and fund managers all see the same thing and then

dog-pile in at roughly the same time, the move will occur for that very reason.

As a trader I’m not that concerned why a move happens. I’m concerned with

finding areas where I think a move might occur, and then trying to find a place

to get into a trade where I feel the reward to risk ratio gives me the

potential to profit over the long run. That’s what I’m trying to accomplish

with my methods.

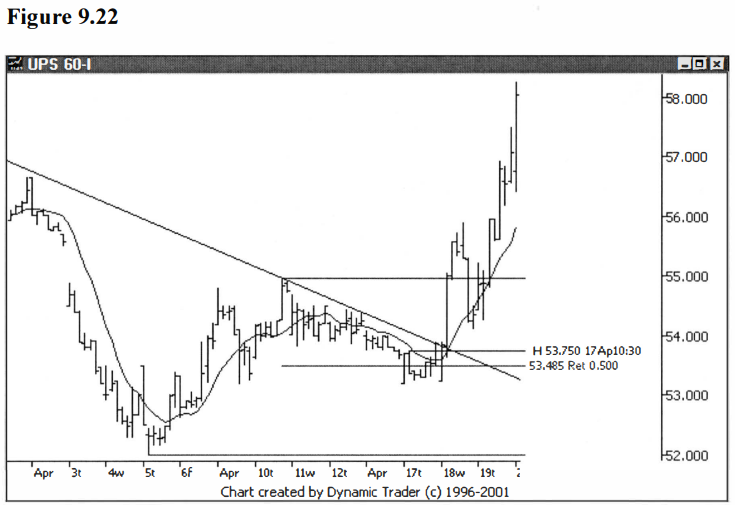

Let’s take one last look at UPS with a little

bit more data added after the trigger. See figure 9.22.

It turns out that the trigger area was quite

significant. UPS did a strong pullback almost to the trigger area after its

first thrust up. Perhaps a few readers are thinking that a pullback like that

would shake them out. Keep in mind, this is not only a lower trigger timeframe,

it’s a ‘twice-lower’ timeframe, a ‘trigger for the trigger’ timeframe. Remember

I said that as soon as I’m triggered, I switch back to my traded timeframe?

Best Trading Entry Techniques : Trade Entry Techniques : Tag: Trade Entry Techniques, Forex : Moving Average Crossover, trendlines, Regression Channels, Swing low, Swing high, swing trade entry points - Cool Trick Trading Startegy