Swing Point Entries Trading Strategy

Swing trading, Double top, double bottom, pivot point Trading, Fibonacci Pullback Trading

Course: [ Best Trading Entry Techniques : Trade Entry Techniques ]

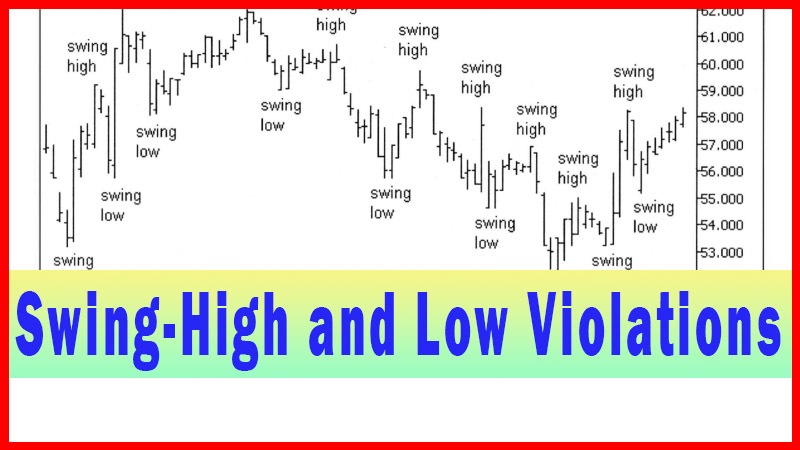

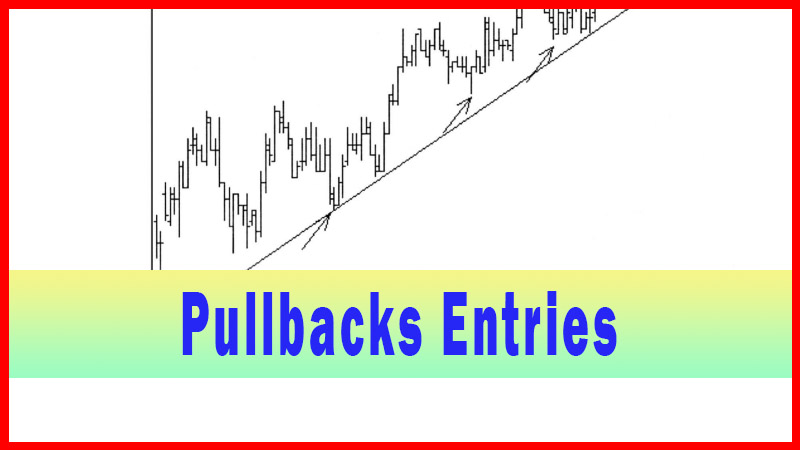

Swing points occurred after the reversal point in the potential trade area. What if there was no tradable swing-point after the reversal? Could a swing- point that occurred before the reversal be used? And what about using a swing-point that forms between a double bottom or a double top.

Additional Swing-Point Entries

In Chapter 6 the technique of swing-point

violation entries was covered. All of the examples in that chapter had one

thing in common, though. All the swing points occurred after the reversal point

in the potential trade area. What if there was no tradable swing-point after

the reversal? Could a swing- point that occurred before the reversal be used?

And what about using a swing-point that forms between a double bottom or a

double top?

I have seen a fair amount of work discussing

the relative merits of swing- points before and after a reversal pivot point.

Some authors say that a swing- point before a larger scale pivot is more

important and more useful. Then others say a swing-point after the pivot is the

one that carries the most weight for trading purposes. What about a swing-point

when the reversal pivot point actually has two points to it, i.e., a double

bottom or a double top?

In doing extensive experimentation with

respect to my own trading, I discovered that it didn’t seem to matter all that

much which of the three swing-point variations I used for my trading. What did

matter was that the swing-point was formed with a certain proportion and had a

certain character. I covered that proportion and character in extensive detail

in chapters 6 and 7, and it applies just the same for swing-points that occur

before the reversal pivot and for swings that form as part of a double bottom

or double top.

Keep in mind, when I use the terms ‘double top’ and

‘double bottom’ here, I don’t

necessarily mean in the classical sense. In fact, if the swing-point is to have

the characteristics I have mentioned, it would be precluded from the classical

definition of ‘double top’ or ‘double bottom’,

simply because the two points would be way too close to each other. The term

will be used here just for the convenience, and it shouldn’t be confused with

the much more spread-out classical version of the term.

One thing I have noticed is that I find a lot

more trades with the swing point after the pivot (reversal) point than before

the pivot. Although there are plenty of these swings to be found before the

pivot and a fair amount of the double top and double bottom types, I still see

a lot more after the pivot as a percentage of the total opportunities. In

general, then, if I want to use the swing-point techniques I focus on swings

after the pivot, and keep an eye out if something nice shapes up before the

pivot, or ‘around the pivot’, in the case

of the ‘double’ formations. This will allow me to utilize these pre-pivot

swings if they occur, and if they don’t, I simply look for another entry

technique.

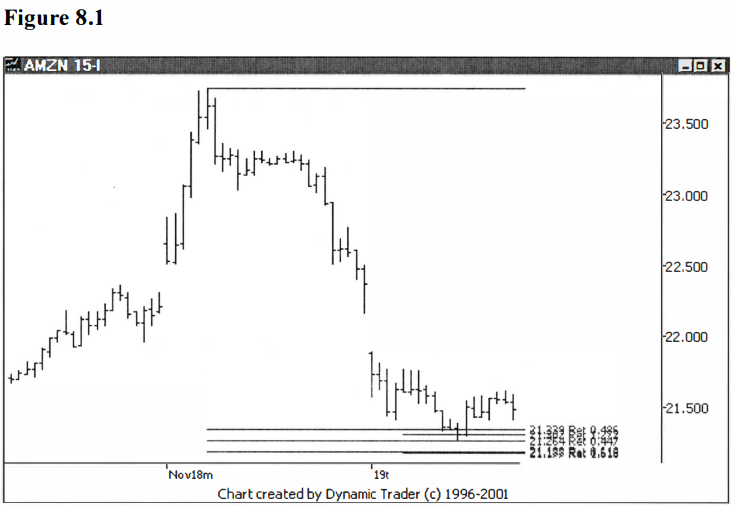

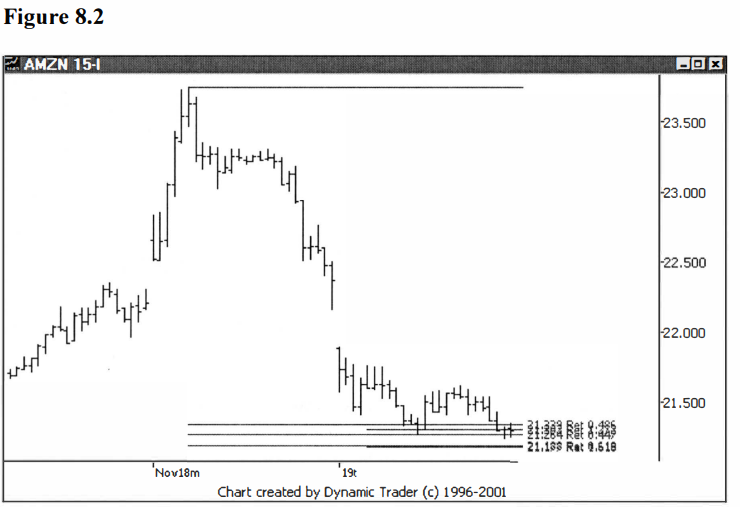

Let’s start out with an example in AMZN. There

is a potential trade area on the 60-minute chart. I’ve dialed down to the

15-minute to look for an entry. AMZN has penetrated the upper end of the

potential trade area and is starting to pull back. See figure 8.1.

At this point I would be willing to take a

trigger because AMZN has penetrated the potential trade area. As this chart

lays out right now, though, I have a few options, or at least potential

options. If AMZN starts to go up right from here, and if I like the swing-high

that has just formed (the pullback so far has penetrated

a 50% retracement), I can use a trade above that high as a trigger. I

could also use the swing-high that formed just before AMZN dropped into the

potential trade area, again if I liked that swing- point. What I want to do is

form possible scenarios, and whether or not I would consider the triggers, so

if they happen, I’ll know how to react. Let’s move ahead on the chart and

reassess. See figure 8.2.

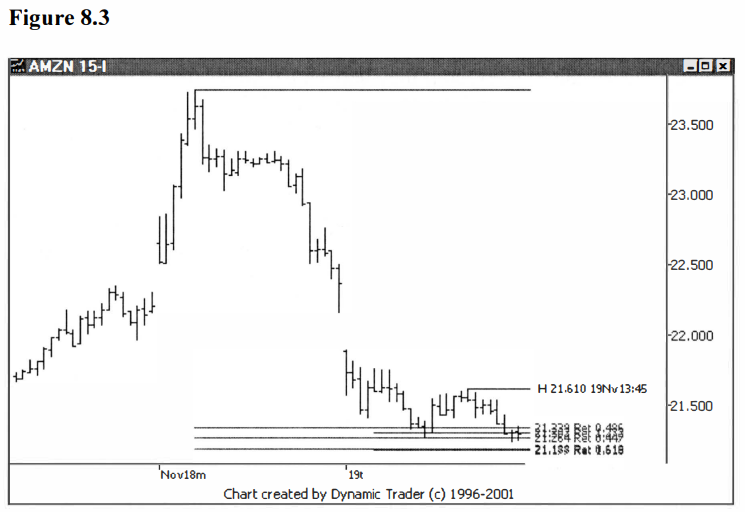

AMZN didn’t go up from that last point; instead,

it went down and set a nominal new low for the move. This sets up a potential

‘double bottom’ and defines a swing-high point that I would consider acceptable

for a trigger. This goes on the assumption that AMZN doesn’t do anything I

don’t like before the trigger is hit, and that AMZN starts toward the trigger

fairly soon.

It’s hard to describe what price action would

invalidate the trade for me; I just know it when I see it. The best thing I can

say is that I’d really prefer for the price to just do what I expect, and that

is to tum somewhere in here and go up in an orderly manner. Anything that

deviates too far from that and I’ll reconsider taking the trigger. I’ll label

the trigger on the chart with a horizontal line. See figure 8.3.

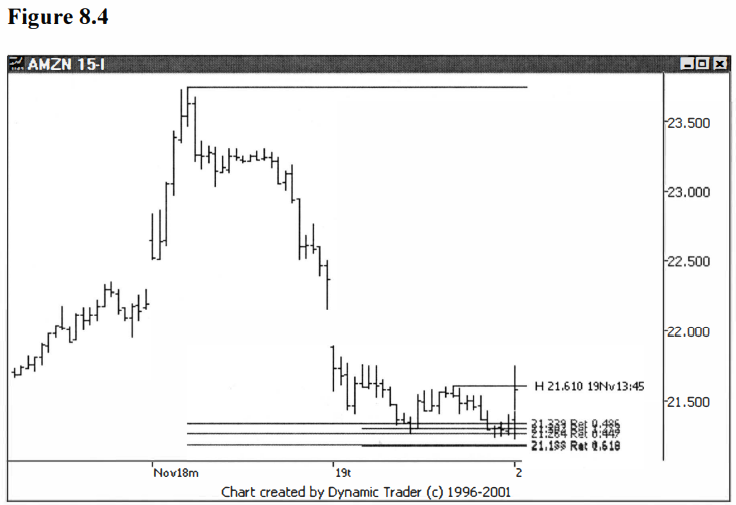

There’s nothing to do now but watch and wait,

and see how AMZN reacts to this area. The trigger is set, and unless some new

price action comes in that invalidates the current trigger, I’m in watch mode.

Let’s move ahead a few bars and see what happens. See figure 8.4.

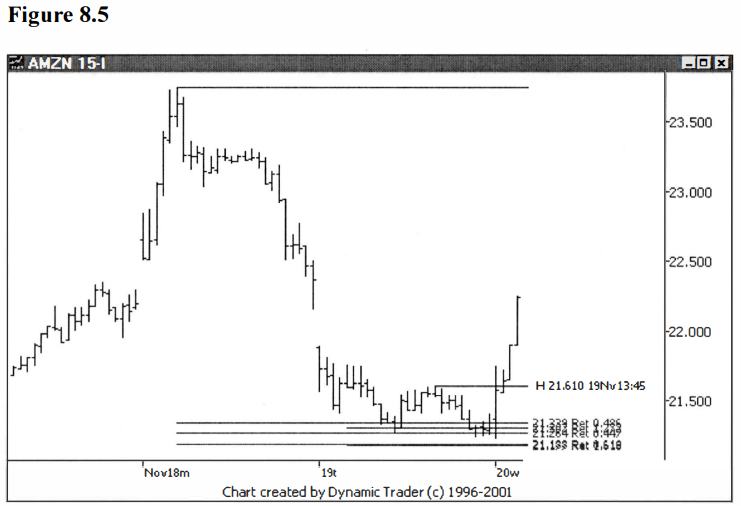

That’s it. As can be seen on the chart, the

trade has triggered, and it has done so on the first bar of a new day’s trading

action. Let’s move ahead a bit and see how AMZN is acting. See figure 8.5.

There was a small pause in the area of the

break (which we now know is not uncommon), but then AMZN started up strong.

Unless you thought that tiny rest was enough of a pullback to try and use for

entry (it certainly doesn’t meet the criteria I

have presented thus far), you had no swing-point or pullback opportunity

at all once AMZN started up. Let’s move farther ahead and analyze how AMZN is

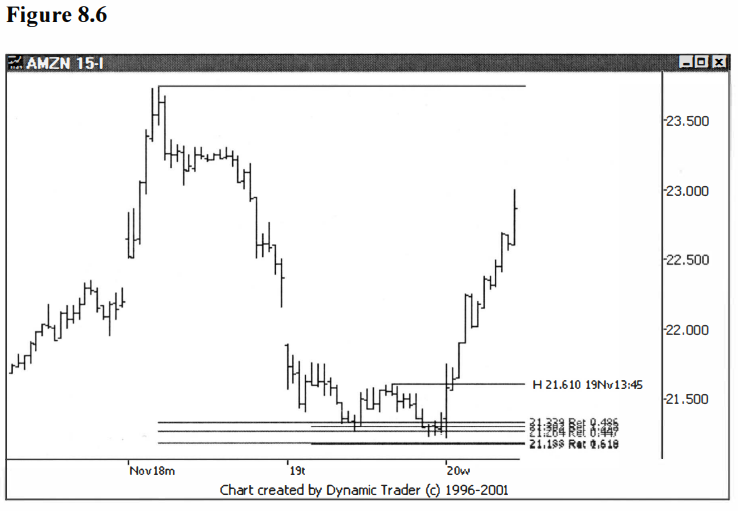

behaving. See figure 8.6.

AMZN is just rocketing up. There was one

additional, small pullback on the way up, but it would not be the type I would

use for entering a trade. If the highlighted swing-point was not used for

entry, that was the last chance for this technique, as I’ve outlined it. This

is one of the reasons I utilize this technique when given an opportunity. I’d

hate to be left on the sidelines in a potentially great trade, waiting for a

post-pivot swing-point that never comes. Let’s advance a bit more and make

another assessment. See figure 8.7.

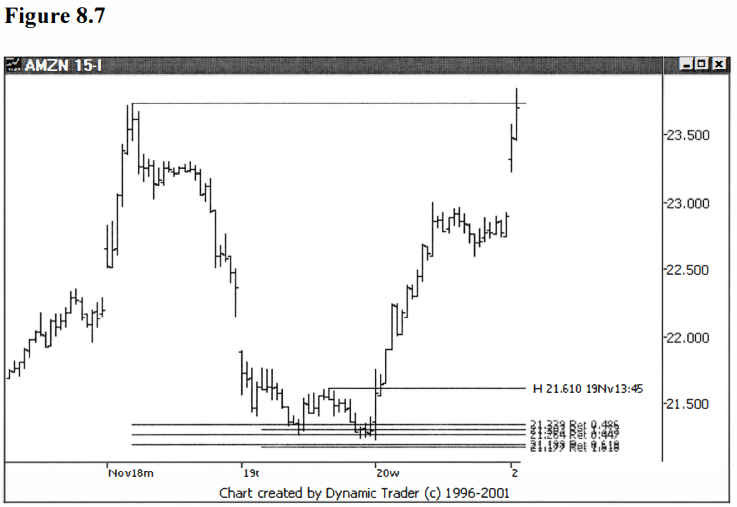

AMZN had a congestion/rest period and then

just started up again, and on a big gap (this might

be considered a ‘continuation’ gap). Although there may be a potential

trade entry in this area, it is so far above the potential trade area that it

would be an entirely different trade at that point. Any trade entry based on

the potential trade area has either long since been executed, or long since

abandoned. My point for showing this additional data is to demonstrate how

sometimes, if an opportunity is presented and passed over, no more

opportunities may be presented.

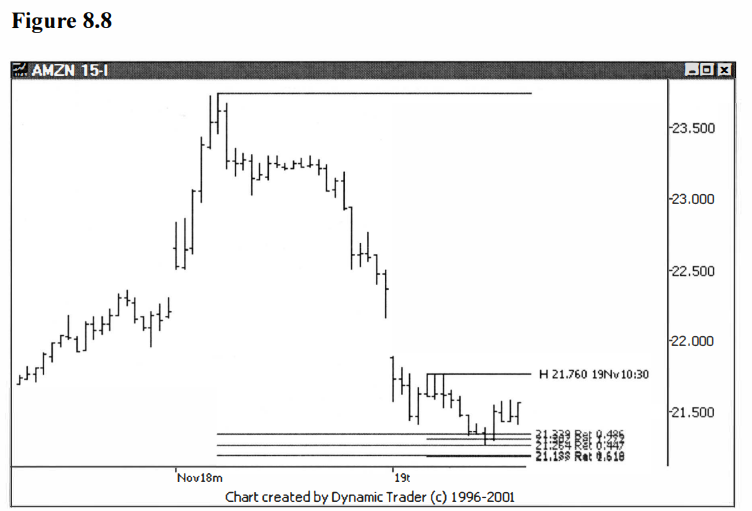

Now some of you might be thinking that there

was another potential swing- point entry that I haven’t mentioned, and you’d be

correct. What about the swing-high point that stood out fairly well, before

AMZN penetrated the potential trade area? I’ll highlight that potential

swing-high trigger with a horizontal line, and back up the chart on AMZN to the

point where it was just bouncing for the first time off the potential trade

area. See figure 8.8.

This is a great observation, noting this

swing-high as a potential trigger. The character of the swing, and its

placement with respect to the potential trade area, make it acceptable for me.

At this point on the chart, an assessment has to be made. The question is, if

AMZN goes straight up from here and takes out that trigger, would that meet

your own personal criteria for a trigger? For me, the answer is yes. I

definitely would have this line on my chart, and I would be ready for that

scenario to play out.

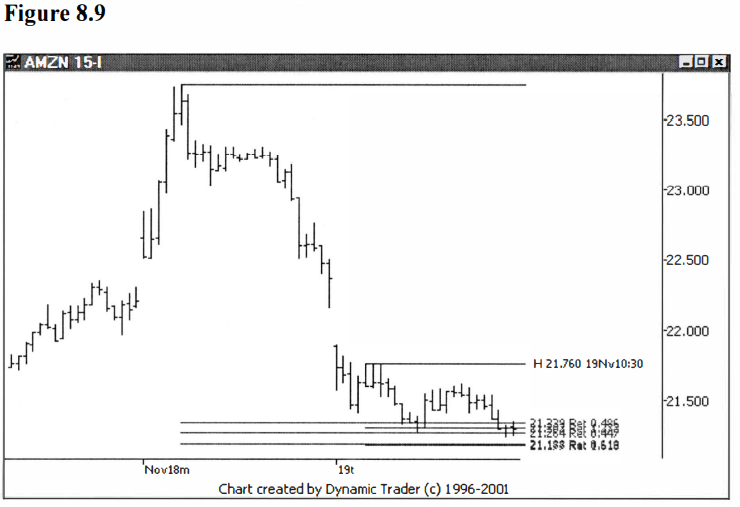

I didn’t present this at first because I don’t

want to present multiple possibilities when I first introduce a concept, it may

get too confusing. Once I feel the reader is likely to have the basic idea, I

then feel it makes sense to present multiple choices and opportunities at the

same time. One has to walk before one can run. Let’s see how this potential

trigger would play out. We’ll move ahead on the chart and reassess. See

figure 8.9.

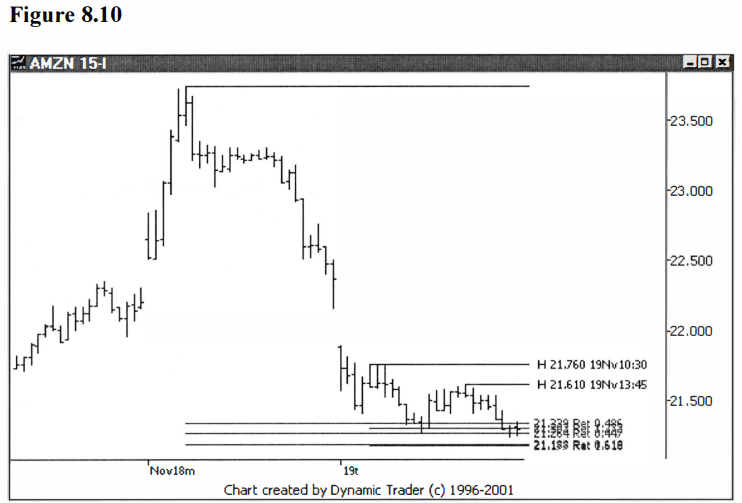

As soon as I see AMZN in this position, I

would immediately abandon the highlighted trigger in favor of the lower

potential trigger. This puts us in the position we were in, in Figure 8.2. This

is the point where I added in the horizontal trigger line on this new

swing-high point. I’ll add it back in, retaining the current horizontal trigger

line for comparative purposes. See figure 8.10.

Now, using the same assumptions as before, I

would focus on the lower price trigger, having this newer trigger supersede the

higher price trigger. As a potential trade evolves, I make constant assessments

and changes in my plan. When I see a potentially

better trigger come up, I frequently ‘upgrade’ to that trigger. It’s

an ongoing, evolving process.

Let’s move on to another example. I want to

point out, though, that I chose the last example with AMZN because it had less

than ideal price action. I will choose the next two examples trying hard for

them not to be too ‘well- chosen’. I’ll select them both to be a bit choppy,

with the pullbacks not being the most perfect, textbook pullbacks. The last

example in this chapter, with CAT, will be slightly illiquid in the chosen

timeframe. I’ve done this on purpose, to reflect what a less than ‘perfect’

behaving trade may look like. I’ve attempted to do this throughout my works,

but I’ve particularly focused on this with the examples in this chapter.

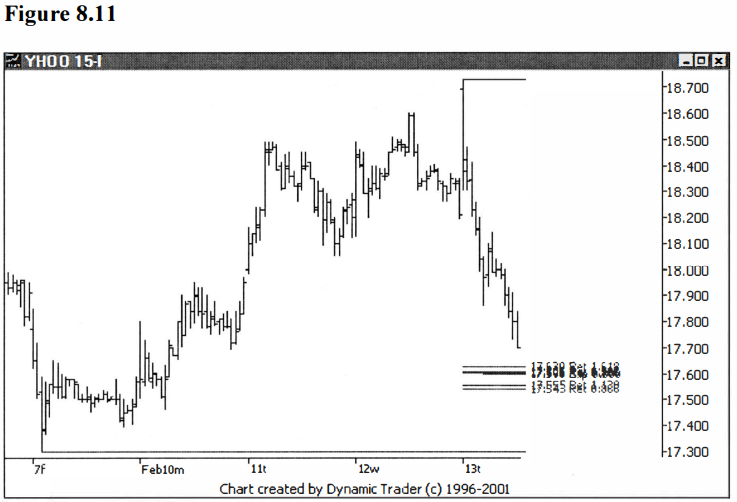

There is a potential trade area on the

60-minute chart on YHOO. I’ve dropped down to the 15-minute chart to look for

an entry trigger. I’ll add a lot of data onto the 15-minute chart to give you

some perspective for the potential trade area as YHOO approaches it, but

generally I’d spread the data out a lot more and only focus on the price action

on the trigger chart as it comes into the area. See figure 8.11.

Let’s move ahead one more bar and see what

happens. See figure 8.12.

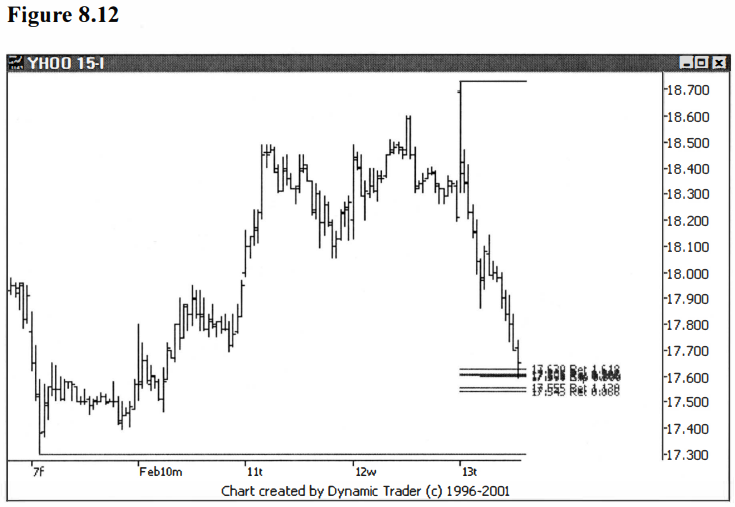

YHOO has penetrated the potential trade area,

and I would now be willing to take an entry trigger. I will watch as the

potential trade unfolds and make assessments as time goes on, trying to decide

on a trigger. Let’s add two more bars and see if I can decide on a trigger. See

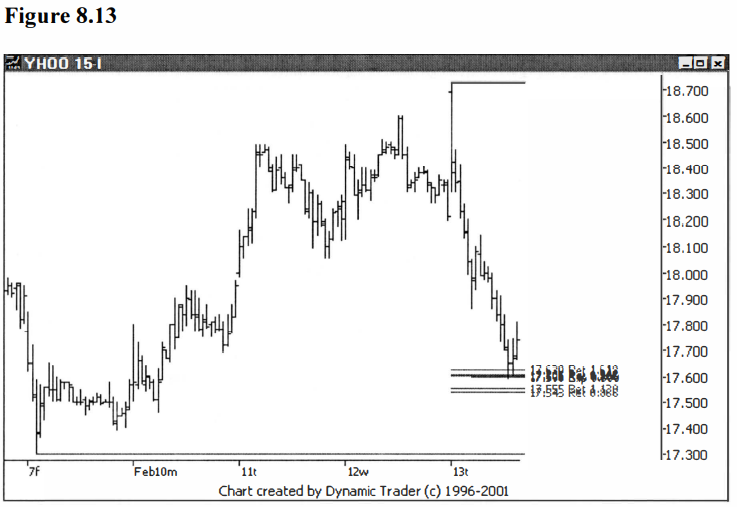

figure 8.13.

YHOO has bounced off the potential trade area,

and I’m thinking that if it just rockets straight up from here, I’ll miss the

trade. That’s a downside to triggers that key off of swing-points. If you don’t

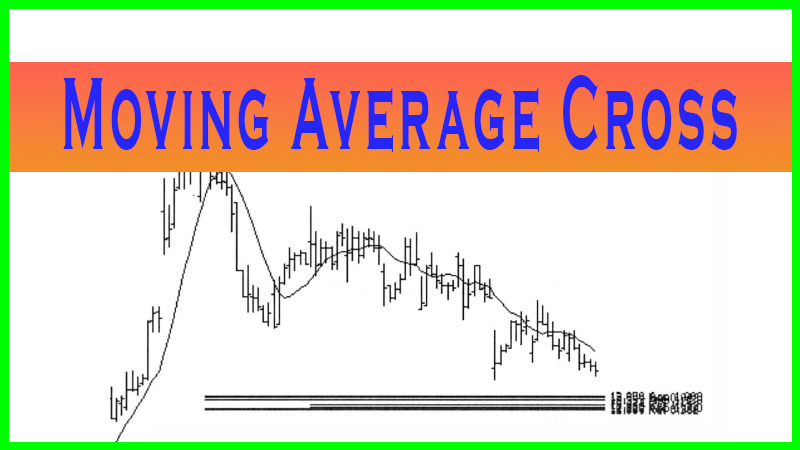

get any swing points, you don’t get any triggers. If YHOO just went straight up

from here, would other triggers, like moving average crossovers or trendline

violations, work?

Yes, these triggers could be utilized in this

case, since they don’t require any swing-points to be triggered. But perhaps

you’ve decided you want a trigger that is based on a swing-point violation for

this trade. Then all you can do is wait for the trigger to set up, and if it

doesn’t, you have to let the trade go by. I’ll add two more bars and see what

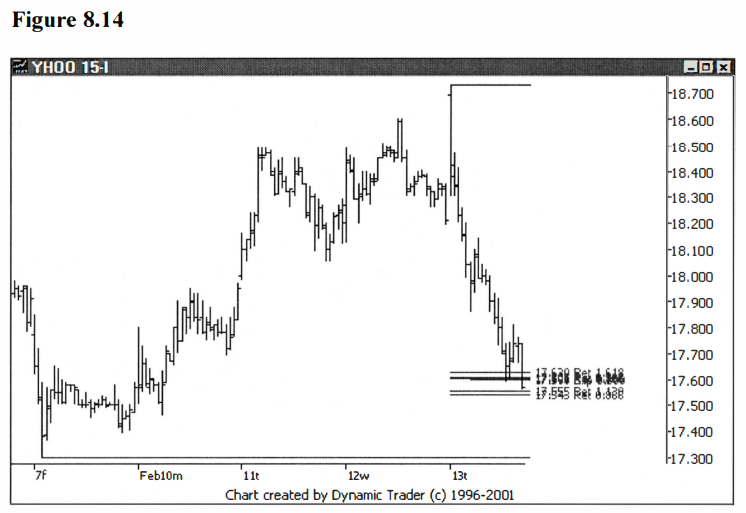

YHOO is showing us. See figure 8.14.

Now that’s a quick change. YHOO decides to set

a nominal new low for the move, and test the lower part of the groupings (my

potential trade area). Not only that, it sets up a possible swing-high point

that I might use for a trigger. I want to see how YHOO behaves as the potential

trade unfolds. If YHOO does what I want, then this swing-high point will make

an excellent trigger for me. And what do I want? It should be clear by now. I

want YHOO to reverse in here and start up, in a nice and orderly manner. This

will be a subjective evaluation, and I do it based on my experience. Let’s go

forward another bar and see what happens. See figure 8.15.

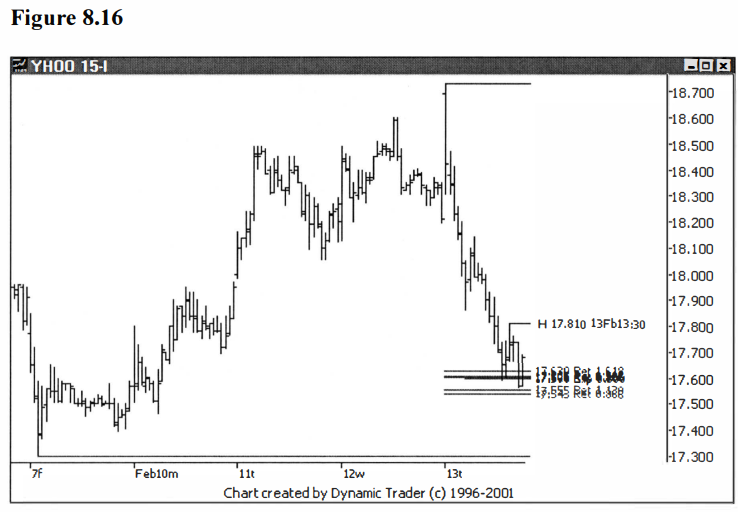

YHOO is reversing off the second move into the

potential trade area, and I like the price action so far. I would now consider

the swing-high point for a trigger, assuming YHOO keeps heading up in an

acceptable manner. I’ll add in my horizontal trigger line at this point. See

figure 8.16.

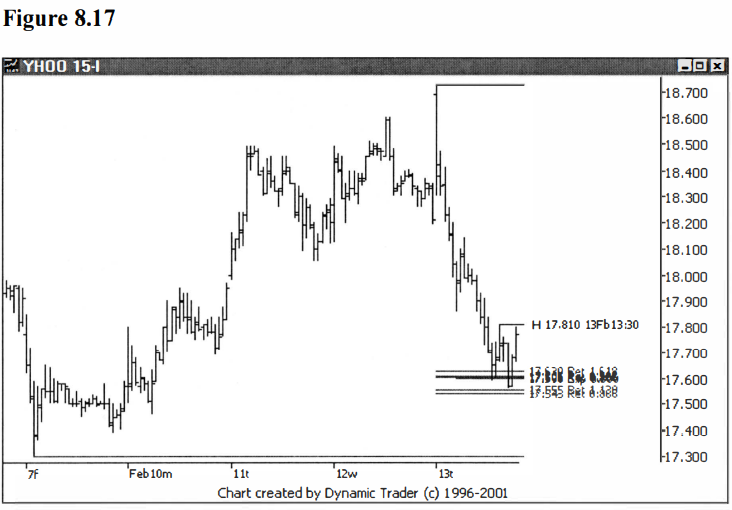

There is nothing to do at this point but watch

as the potential trade unfolds, and assess the situation as necessary. I’ll add

one more bar in and reevaluate. See figure 8.17.

YHOO is acting very well here, heading for the

trigger. I would be very confident at this point that I have done a good job in

choosing my trigger. I would expect that if YHOO is going to respect the

potential trade area, it will overcome this trigger fairly soon. Let’s add

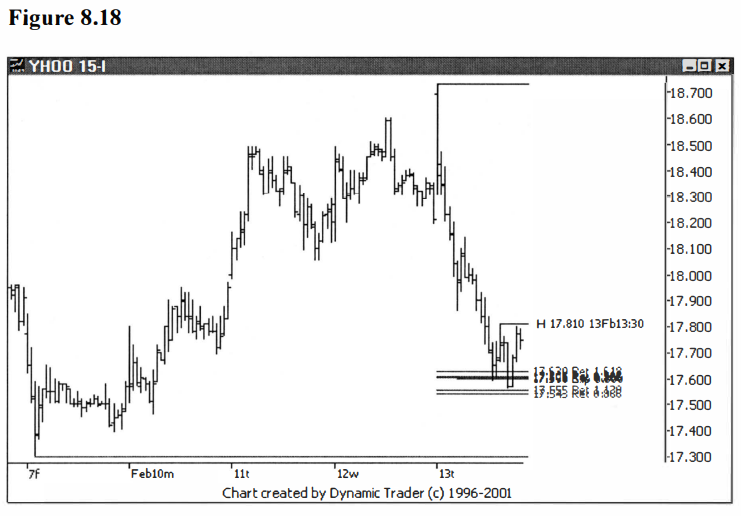

another bar and see if YHOO triggers. See figure 8.18.

YHOO paints an inside bar, but still hasn’t

triggered. If YHOO trades back down into the potential trade area, I would

likely want to reconsider my trigger. I might be thinking that YHOO is

congesting and trading sideways in the potential trade area, and that is

something I don’t like to see. My experience, in most cases, has been that if I

have chosen my potential trade area well, and the area is going to ‘play out’

and give me a good trade, something should happen pretty quickly, and usually

decisively. I’ll add one more bar and we’ll evaluate the situation. See

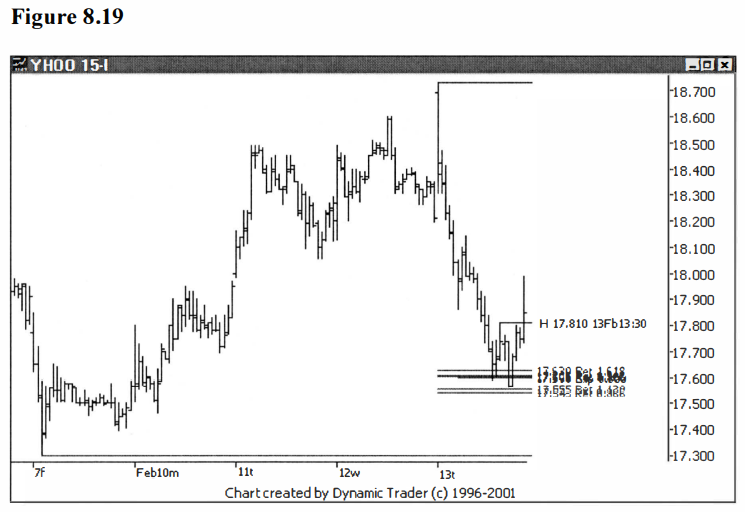

figure 8.19.

Well, I didn’t have to make any further

assessments or make any other decisions, since YHOO triggered on the next bar.

From what I see on the chart, I think the choice for a trigger was pretty good.

Let’s see how this played out. See figure 8.20.

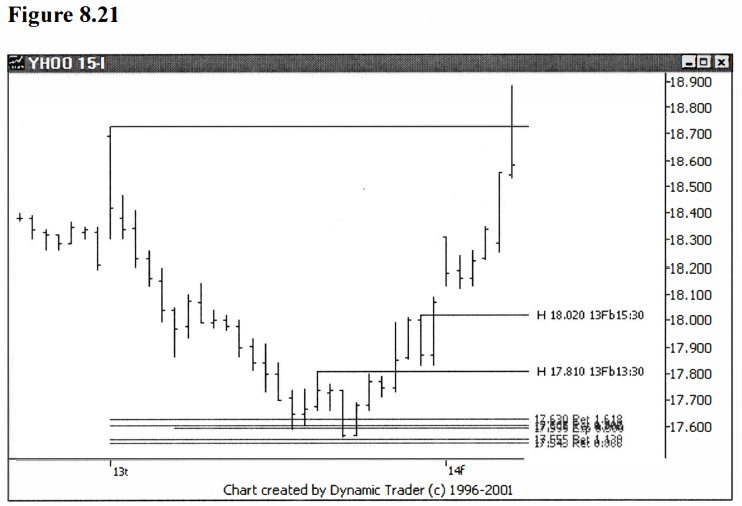

YHOO pretty much just blasted off this area.

There was some ‘congestion’, or a

pause of sorts that is barely visible on this chart, right after the trigger

point. There aren’t any good swing-points for entry from my perspective,

though, once the trigger was hit. Let’s do a close up of the price action after

the trigger. I’ll do a horizontal line trigger on that ‘rest area’ after the

trigger, so we can do an assessment on that spot as a potential trigger. See

figure 8.21.

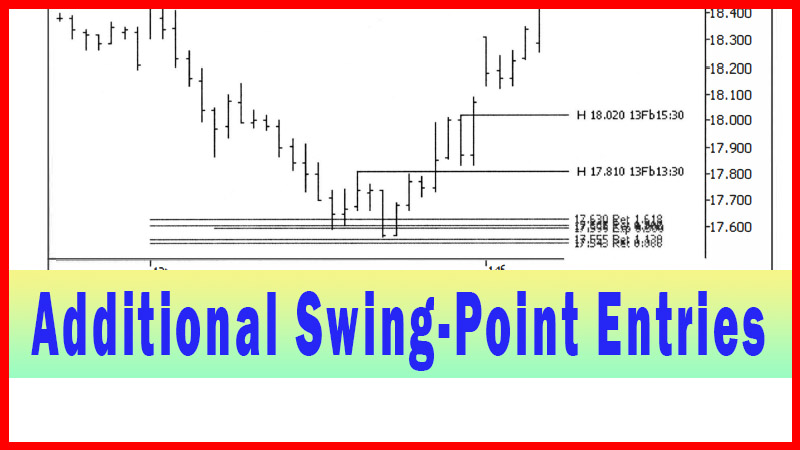

Although the second trigger line up at $18.02

could have been used as a trigger, the swing-point sure didn’t meet my

criteria. If you were to look at the next swing-point up from there, you’d be

way too far up for me to take the trade as it relates to the potential trade

area. This is another example of the highlighted swing-point as the last chance

for using that technique. Again, this is why I watch for these opportunities as

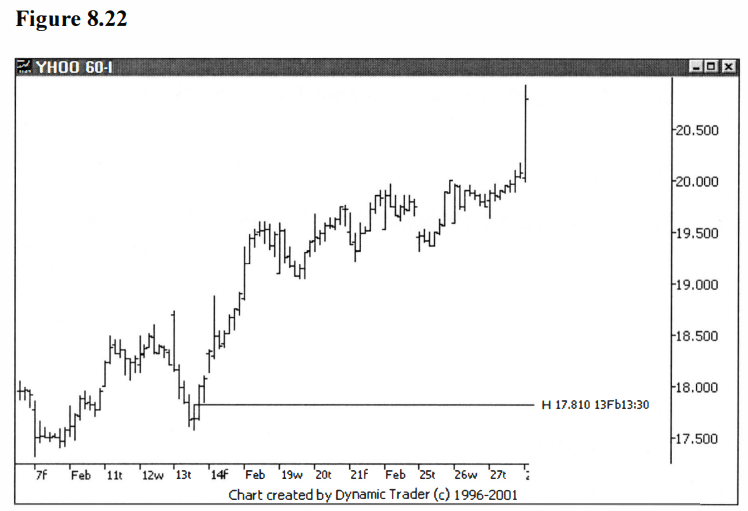

they unfold. I’ll show one more chart of YHOO, this time the traded timeframe,

which was the 60- minute chart, to show the larger perspective. I’ll put the

trigger line on the chart so it is easy to see where the potential trade

started. See figure 8.22.

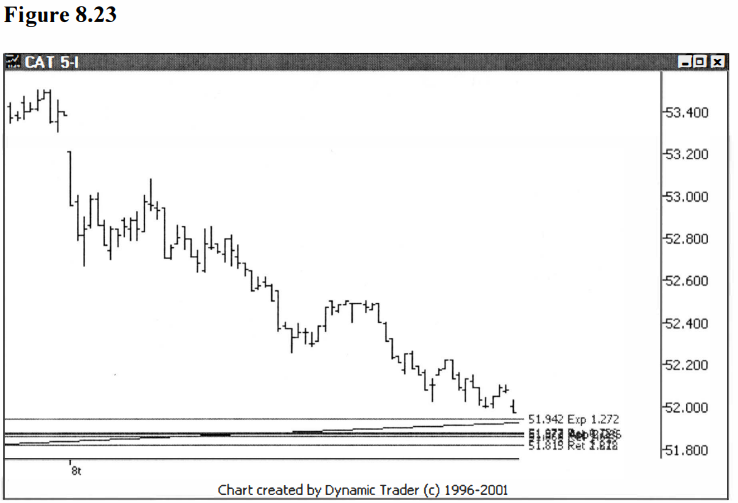

I’ll present one final example with CAT. There

is a potential trade area on the I5-minute chart. This area also corresponds

with a trendline, which is quite prominent on the 60-minute chart. Let’s start

with the 5-minute, trigger timeframe, as CAT heads towards the potential trade

area. See figure 8.23.

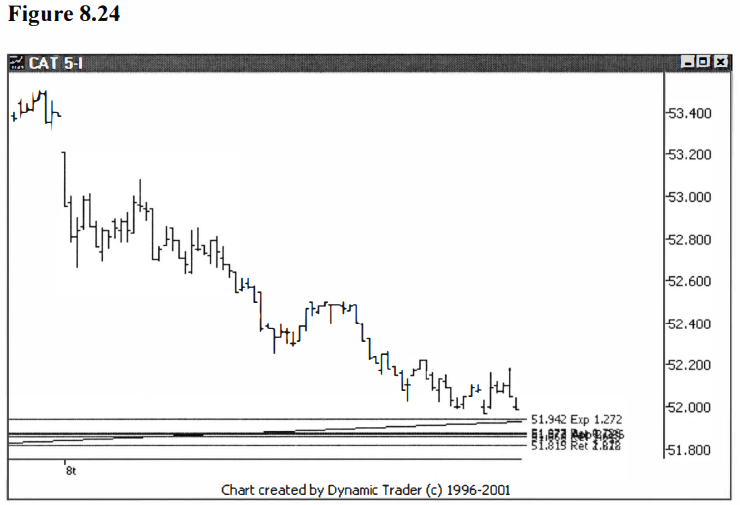

Let’s move forward in time and assess the

situation. See figure 8.24.

CAT didn’t penetrate the potential trade area

as expected, but instead bounced up a bit. It has then started to roll back

over and head towards the area. In doing so, though, it has created a fairly

nice swing-high. The swing- high doesn’t have that picture perfect look to it,

it has more of a slightly illiquid trading look to it, but it is potentially

more than adequate for trigger purposes. I’ll add one more bar to the chart. See

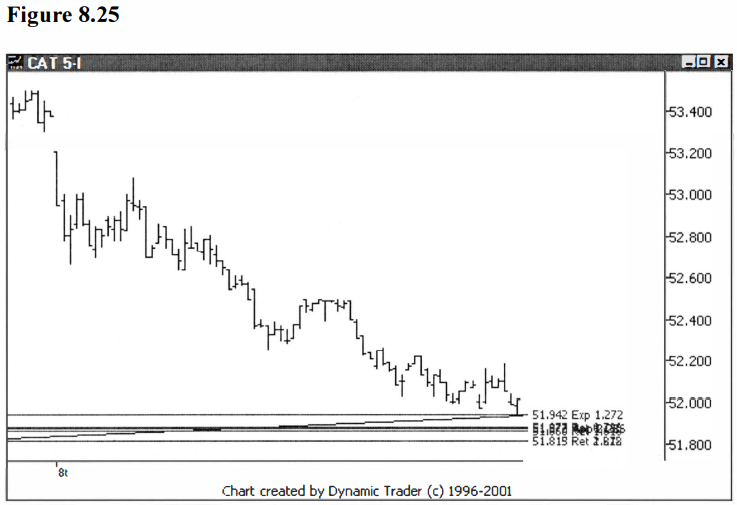

figure 8.25.

CAT has now bounced off the top of the

potential trade area and the trendline. I would actually prefer that it trades

through the top area just a bit, but I would now accept a trigger. I would

consider the swing-high I mentioned as an acceptable trigger. I’ll label the

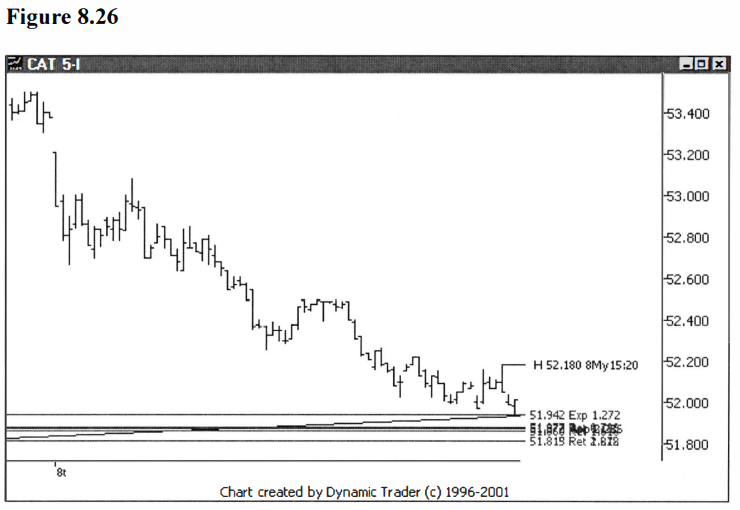

swing-high with a horizontal trigger line. See figure 8.26.

Now I just wait and see how CAT behaves and if

the trade is triggered. I qualify this, as usual, by mentioning that any price

action that I don’t like will have me ‘pulling’ the potential trigger. Let’s move ahead several

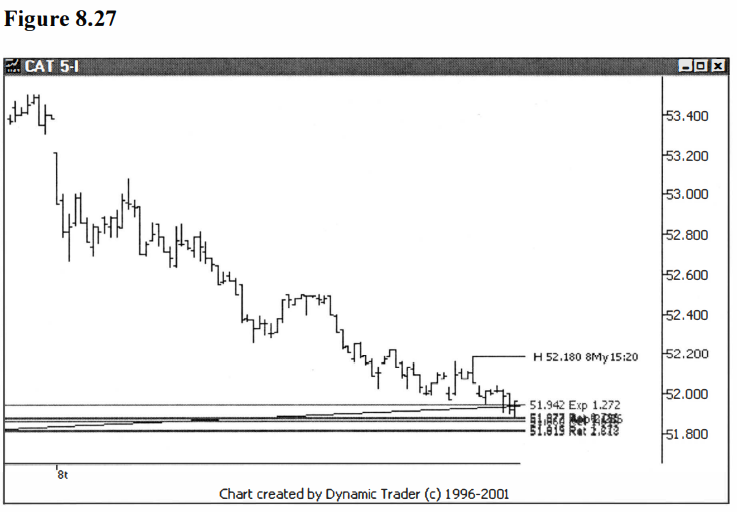

bars and reassess. See figure 8.27.

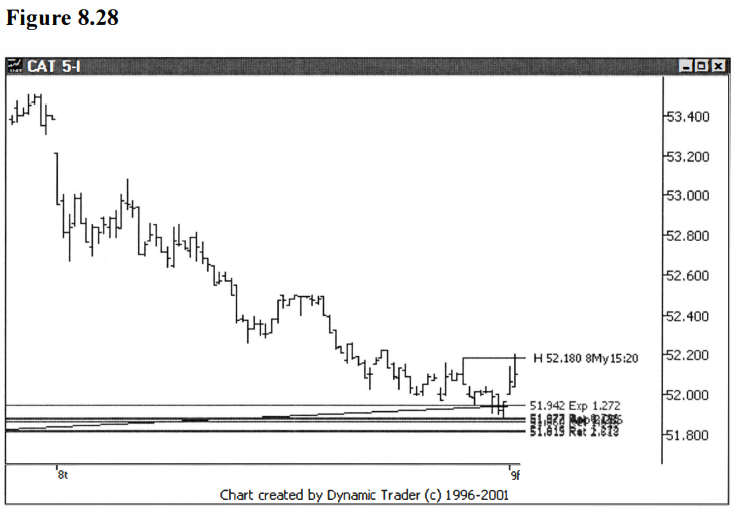

CAT has done what I had hoped it would do, and

that is to penetrate a little bit further into the potential trade area. If it

trades up from here and triggers, I would take the trigger. If CAT continues

down and trades below the potential trade area, I would cancel the trigger and

no longer consider the trade. Also, if CAT, for example, traded sideways in

here for any sustained period of time, I would also cancel the trigger. Let’s

move ahead a few bars and see what happens. See figure 8.28.

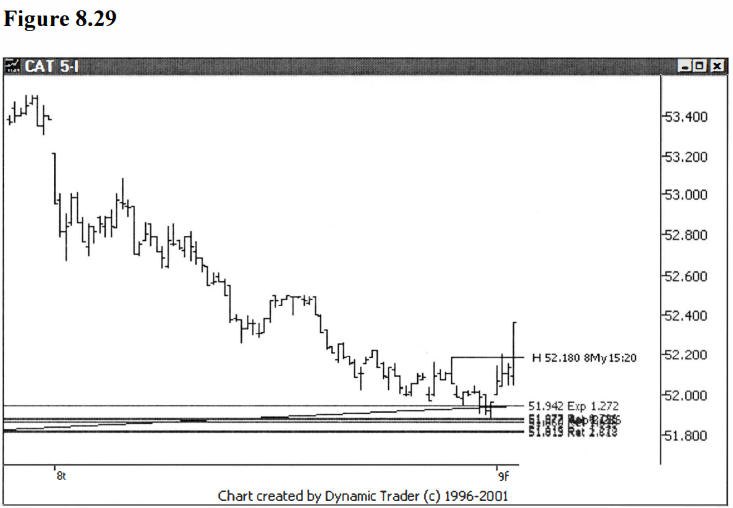

CAT has now triggered on a small gap up

shortly after the open of a new trading day. Let’s add two more bars in and see

how the trade is progressing. See figure 8.29.

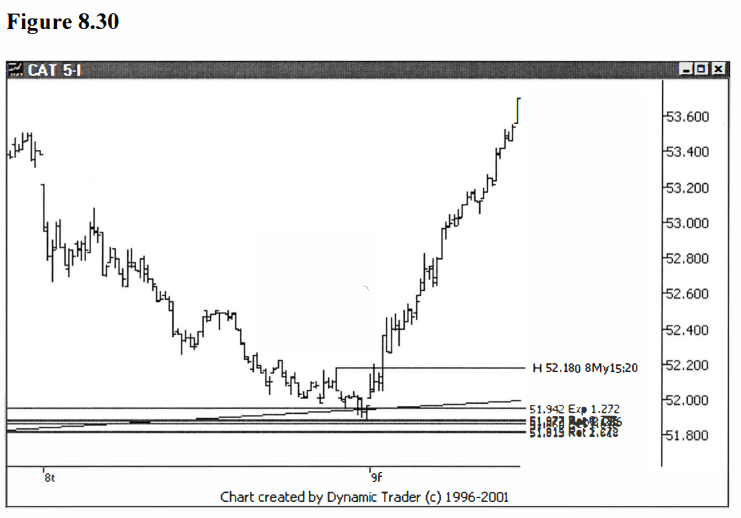

CAT is really going, as it takes out that swing-high

trigger. Let’s add a bit more data and see how this one played out. See

figure 8.30.

CAT really launched off this potential trade

area, and didn’t give much in the way of swing-points/pullbacks on the way up.

Although the quality of the swing-point used to trigger this trade wasn’t the

greatest, it was as good as I would expect, given the behavior of the issue up

to this point. For my trading, I felt the 15-minute traded timeframe was

adequately liquid for trading, but the trigger timeframe was getting close to

not having good enough behavior to trade.

Given that the 5-minute timeframe is not the

traded timeframe, I might be a bit more lenient in assessing the character of

the price behavior. Still, I need a minimum quality to the swing-points and

pullbacks in order for me to consider their use as potential triggers. What all

that boils down to is that although this swing-point trigger wasn’t the best I

have seen, it did turn out to be the best, and only, swing-point trigger that

met my criteria for this trade.

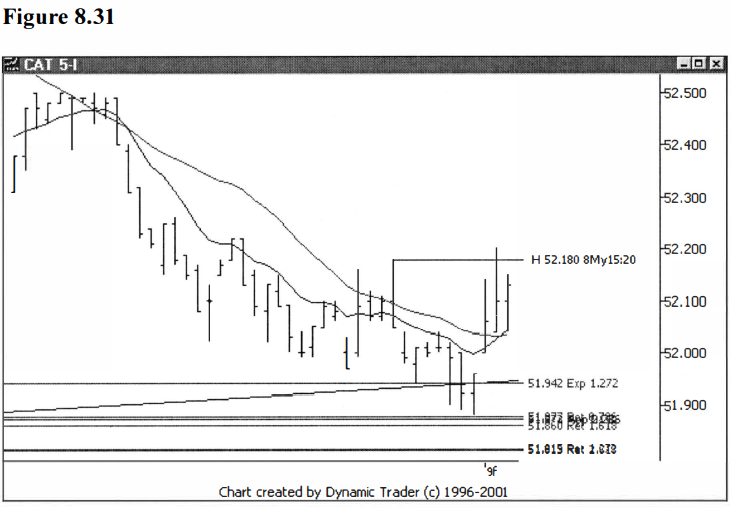

I’ll finish this example, and chapter, up by

zooming in on the potential trade area and trigger area and looking at two

other potential entry triggers at the same time as this swing-point entry

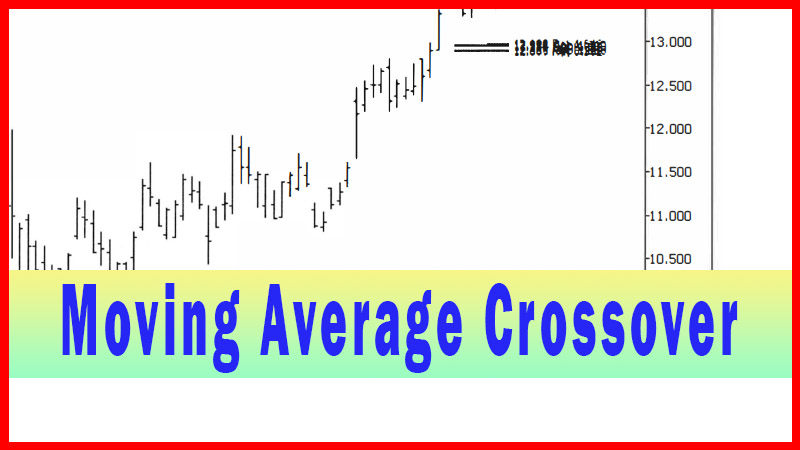

trigger, for comparison. First, I’ll add on the 10-period

exponential and 20-period simple moving averages. I’ll look at the

moving average crossover trigger. See figure 8.31.

Notice how the trade triggered one bar after

the swing-high trigger, and at a slightly lower price. All in all, though, the

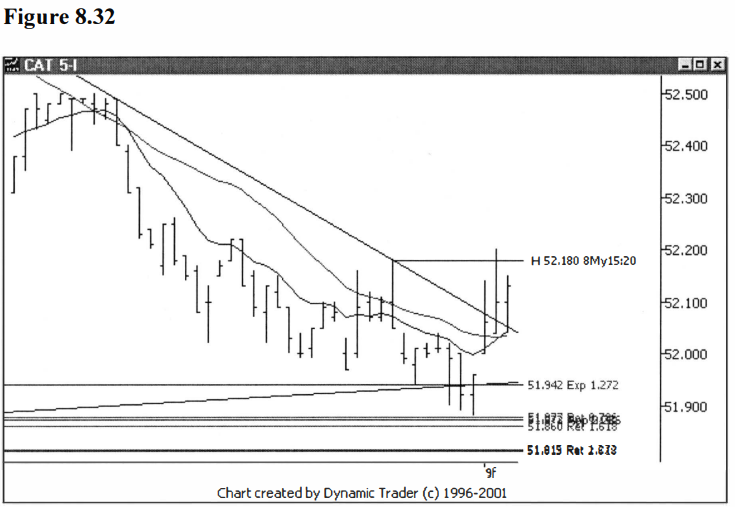

trade triggers at a very similar spot. Let’s throw in a trendline, for use in

the trendline violation technique, and see where that trigger. See figure

8.32.

The trendline trigger also produces a very

similar entry. If you waited until the first close above the trendline, your

trigger price would be lower than the swing-point entry, at least in theory.

It’s hard to estimate what an actual fill price might be, and, again,

discussion of the prices in this regard is only for comparative purposes. The

lesson is in how close these trigger prices all are to each other.

I hope it was clear in this chapter just how

similar the application of these techniques is to the presentation made in chapter

6. For all intents and purposes, I trade all three variations of the

swing-points pretty much the same. My main concern is the quality and character

of the swing-point and its pullback, and how it fits in the context of the

current price behavior. I’m not near as concerned with where the swing-point

occurs.

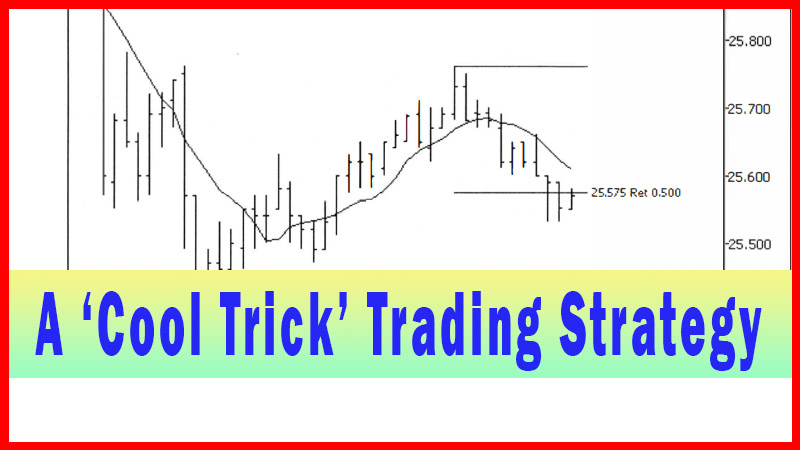

In the next chapter, I’ll introduce one of my

favorite variations on an entry technique that I presented in an earlier

chapter.

Best Trading Entry Techniques : Trade Entry Techniques : Tag: Trade Entry Techniques, Forex : Swing trading, Double top, double bottom, pivot point Trading, Fibonacci Pullback Trading - Swing Point Entries Trading Strategy