Trendline Violation Technique

trendline trading, Trendline Breakout, Trendline Breakout and Retes, Best trading strategyt

Course: [ Best Trading Entry Techniques : Trade Entry Techniques ]

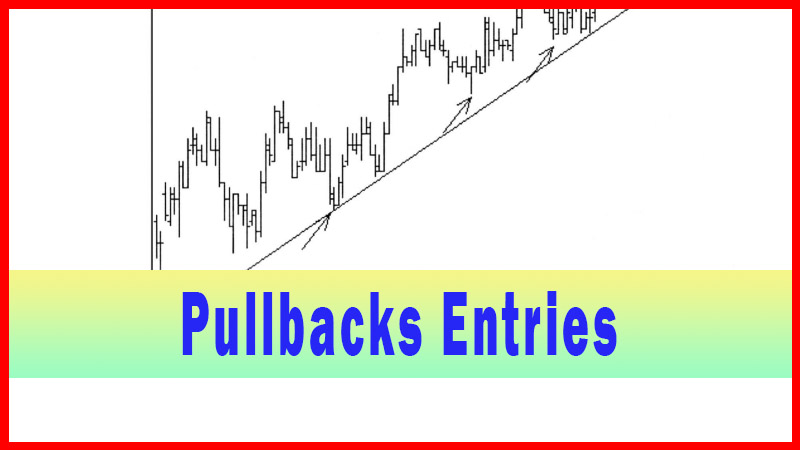

The trendline violation technique when an issue is oscillating along an axis as it heads into a potential trade area. This type of price action is very difficult to use with moving averages, since you may get multiple false signals. In general, this oscillating price action can be difficult to trade.

Trendline Violations

The next technique I will present I call the trendline violation

technique, and for obvious reasons. The trigger into the trade will

be when a trendline is violated by the price action. But violation of what

trendline? And when do I like to use the technique?

I am really partial to the trendline violation

technique when an issue is oscillating along an axis as it heads into a

potential trade area. This type of price action is very difficult to use with

moving averages, since you may get multiple false signals. In general, this

oscillating price action can be difficult to trade.

If you still want to trade an issue that is

demonstrating this type of price action, perhaps because the traded timeframe

setup is particularly nice, this can be a good technique to use for entry.

Understand, though, what the expression ‘difficult to trade’ means. The

bottom line is, it really means your stop will have to be wider and/or you’ll

hit fewer trades. And perhaps make less when you hit one.

That all translates to making less, on

average, per trade. That, then, alters the reward/risk ratio. Just because you

can trade something doesn’t mean it fits into your game plan. Sometimes it

does, but what I want to point out is, sometimes it doesn’t. Fully assess

trades that are more ‘difficult’.

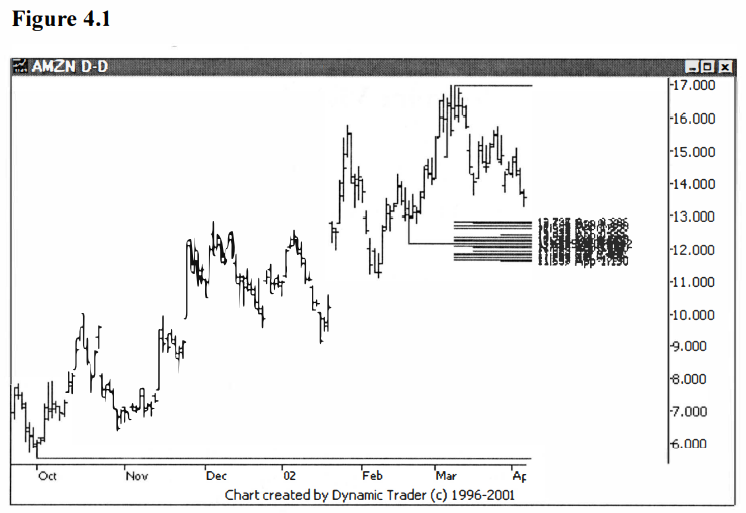

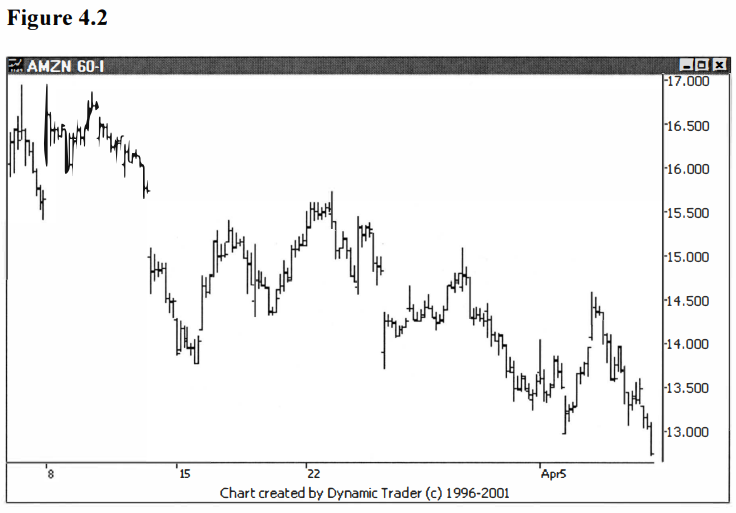

Let’s look at AMZN, which, in this example, is

headed for a potential trade area on a daily chart. The potential trade area is

a huge Fibonacci support zone, based on the groupings technique. Keep in mind,

the entry techniques presented here are not specific to the Fibonacci groupings

techniques only, I just use them for examples because they are one of my main

ways of trading. See figure 4.1.

The assumption on this trade is that the

uptrend will reassert itself, reversing off of the area of one of the three

Fibonacci groupings. At this point an entry technique is sought, and that would

be on the lower timeframe. In this example we’ll look at the 60-minute chart.

For the sake of clarity, I will not include

all the Fibonacci groupings on the 60-minute chart. We can note that the first

grouping will be reached as soon as the price drops below $12.80. Once that has

happened, i.e., the potential trade area has been ‘penetrated’, any valid

trigger that I have decided on would be accepted. Let’s look at AMZN on a

60-minute as it approaches the potential trade area. See figure 4.2.

AMZN has now traded into the potential trade

zone here, with the low on the last bar being $12.71. At this point I would now

be looking for my trigger, whatever trigger I have pre-chosen, to initiate me

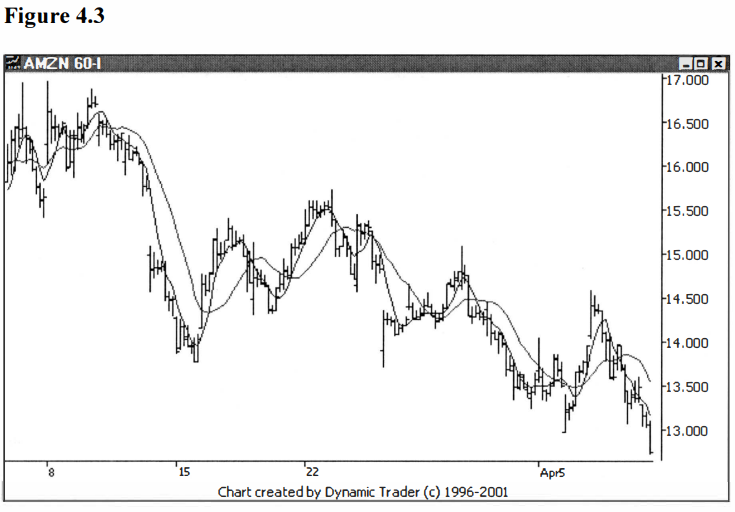

into a trade. For comparative purposes, let’s add in the 5 and 15-period simple

moving averages to the chart, and see what observations we might make. See

figure 4.3.

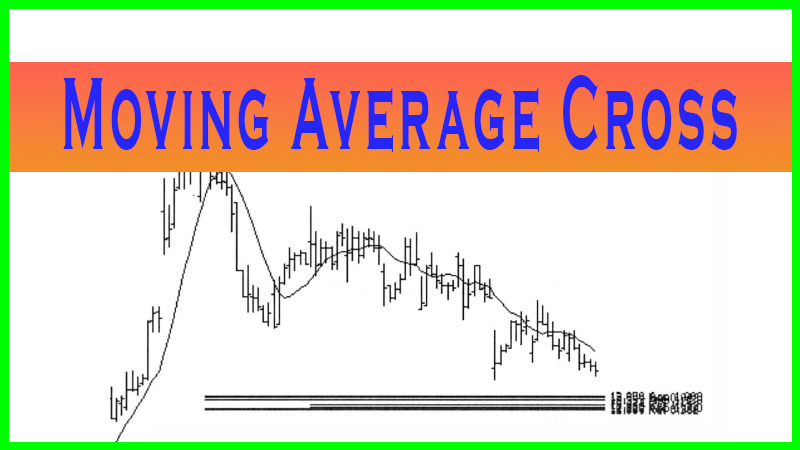

Notice how AMZN is oscillating up and down in

fairly broad swings as it trends down to the potential trade area. This doesn’t

preclude the use of a moving average crossover trigger, but it does make me

less inclined to use it. In my experience, I have seen more false starts when

you see action like this.

Admittedly, though, when I look at figure 4.3.

I have to say that it is fairly orderly. Hence, based on what information I

have up to this point, this is an example where I almost feel it is a coin toss

between using the moving average cross trigger and ‘paying up’ for more

confirmation and waiting for a trendline violation. Let’s add a trendline in

and reassess. See figure 4.4.

I drew the trendline from the first two points

where you can see contact between the price and the line. It’s amazing how the

third point of contact was such a sharp reversal, right at the contact point. I

would hazard a guess that a few people were watching that trendline. The fourth

point of contact slightly exceeded the trendline, with no closes above the

line. It then sharply reversed once again and set a new low, this time right at

the top of the groupings. Let’s move ahead another four bars and see what’s

happening. See figure 4.5.

The price has dropped a little bit further,

but it is a very smooth, orderly decline since the reversal off the trendline.

I particularly like using the trendline at this point because it has been such

a great guideline thus far. Many traders are likely watching it, and a

violation will surely initiate action on the part of some of these observers.

The downside? Everyone is watching a trendline

that is guiding trade so well. That may make it difficult to use when the entry

time comes. A moving average crossover trigger would likely come first, and one

might opt to use that as an entry to anticipate the trendline violation.

One possible option is to use the moving average

crossover trigger, and if the trendline isn’t then taken out as

expected, close the trade. At that point the trade would likely be a small

profit or a scratch. Let’s move another five bars ahead. See figure 4.6.

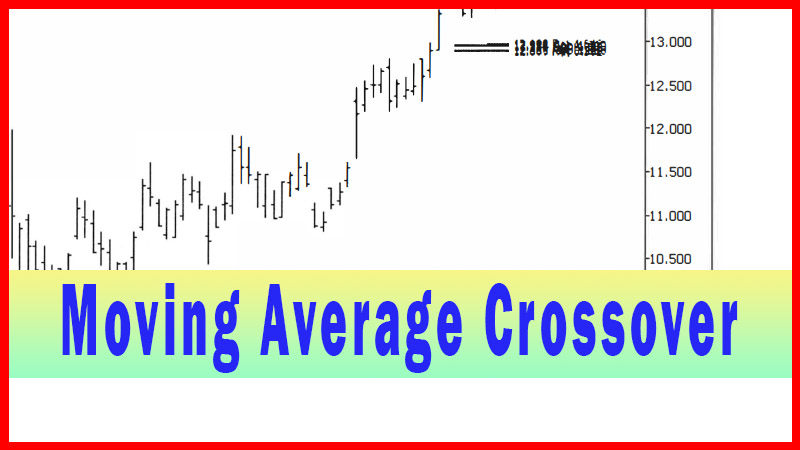

AMZN has come off the top of the groupings

very strongly, and we now have a moving average crossover trigger. Keep in

mind, we are examining the trendline violation technique in this chapter, but I

want to watch the moving average crossover trigger at the same time, for the

additional educational value this should provide.

As you look at this chart, you can clearly see

we have a battle going on between the very short-term uptrend that has begun

from the reversal off of the top of the groupings (and pointed out to us by the

moving average crossover trigger to the upside), and the downtrend, as clearly

defined by the down trendline. Why would I play a trade like this, then?

Recall that my traded timeframe is the daily

chart, and I have formed my potential trade area based on that daily chart. The

downtrend that is guided by the trendline is on my entry chart, and that is a

lower timeframe 60- minute chart. I expect the daily chart will prevail, and

the uptrend will reassert itself.

I find that in almost all the trades I look

at, there is always a battle between two (or more) timeframes, and I am forced

to play one against the other. As I have outlined in some of my other works, I

call this ‘the trader’s dilemma’. Unless I am specifically trading against the

larger timeframe trend, I just about always bet on the larger trend. In this

case, we would be betting on the larger timeframe trend by going long at this

point. Let’s note that the closing bar price after the moving average crossover

here is $13.53. Now let’s move ahead another six bars. See figure 4.7.

AMZN is now right at the trendline. It’s done

or die time, when the buyers and sellers will be making critical decisions. My

expectation, based on my experience, is that the most common scenario is for

the issue to pullback, hence pulling in some shorts who expect the trendline to

hold, and then once it’s dropped a little bit, the real buyers will step up and

take all the rest of what the shorts have to sell, and it will then tum up.

Once the trendline is then taken out the shorts will cover and off it will go.

I can hear a lot of readers right now saying ‘Well, we know what

is going to happen on the next few charts now, since he already knows the

outcome, or he wouldn’t have just set us all up for that scenario.’ Actually,

no. I do know what the outcome was already, since this is past history, we are

reviewing, but I put that comment in just as I would have thought about it as

this unfolded in real time. And as you’ll see, that scenario isn’t how it

played out. Let’s first move just one more bar ahead. See figure 4.8.

AMZN has continued up and violated the

trendline with a firm close above the trendline. Whether you chose a price

cross above the trendline or a close above the trendline (or anything else you

may have decided on ahead of time), the trade would now be initiated at this

point.

For our example, let’s note the trigger bar’s

closing price, which is $14.05. This is a full fifty-two cents above the

closing price for the moving average crossover trigger bar. If you waited for

this trigger, you paid up a lot more. I would consider this if I felt I got

something for that extra money I paid, and in this case what I would feel I got

was a greater likelihood this trade is going to work out as I planned it.

Let’s move ahead one bar and see how the

market is reacting to this ‘breakout’ above the trendline. Note that AMZN has been going nearly

straight up for $1.57. I prefer not to hit an area of strong support or

resistance that I hope to break with the issue possibly running out of

steam. I’d prefer to see a few rests stops before it hits the critical area.

Also note that, as I mentioned before, it’s

common for an issue to pullback near or shortly after a moving average

crossover with the type of period lengths we have been looking at. On the

timeframe we are looking at, the 60-minute, we didn’t get any notable pullback

after the crossover. This may mean we are out of steam and the slight trendline

violation won’t hold, or that this thing is strong and we, as they say, ‘are gone’.

See figure 4.9.

AMZN exceeded the ‘breakout’ bar by one

cent, but otherwise essentially printed an inside bar. This is a period of

indecision, and all we can do is wait and see how it plays out. Our stops would

already be set and we would do nothing but let the trade play out.

I just like to assess what I see to help

evaluate trade behavior and see if I can learn anything useful that I may use

in my future game plan. My reason for such detail here is to help you see what

my thought process is and how I come to make the decisions I do, based on ‘experience’.

I’m trying to share some of my experience, simulating how I get some of that

experience. Let’s go forward and see how this is playing out. See figure

4.10.

Well, AMZN went up a bit after the ‘inside’ bar,

and now has pulled back below entry, right to the trendline. This is all normal

behavior and may be the rest before the launch I frequently see. Regardless of

the stop you chose, it would likely be well below this tiny pullback, and not

threatened at all at this point. Again, we are just trying to glean educational

information out of the price behavior at this point, and all we can do is let

the trade, itself, develop, as we stick to our pre-determined game plan. Let’s

move forward and see how the players are going to react to this small dip. See

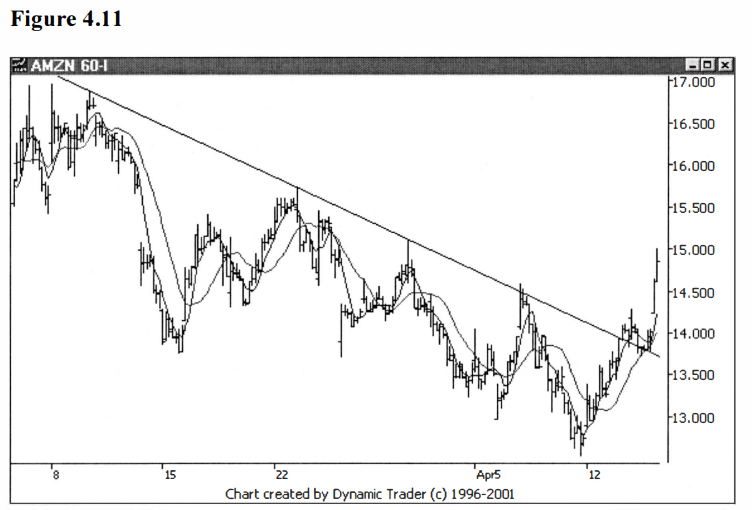

figure 4.11.

They decided to take the small dip, and AMZN

is now clearly broken out above the trendline. The slight pullback was a quick ‘test’ that was

bought, and the trade is now working out quite well so far. But remember, the

traded timeframe is the daily chart, so I’m not going to try and micromanage

the trade on this lower timeframe 60-minute chart. First, let’s see how the

trade played out longer-term, on the 60-minute chart. Since the chart had to be

compressed quite a bit to show all the data, we’ll follow that up with the

daily chart, to show it in its proper perspective. See figures 4.12 and

4.13.

AMZN rested for a while after the trendline

break, but hardly pulled back at all. If your game plan allowed you to be

patient i.e., it had no type of fairly short-term time stop, you would have

been able to capitalize on quite a strong up-move. This up-move was very

consistent with the type of moves already seen on the daily chart, and should

have come as no surprise in the context of your overall plan.

In looking back at this example, it is fairly

clear that this was a trade where you couldn’t clearly see what the best choice

was for an entry plan. By this, I don’t mean that you couldn’t see any good

choices, but that one choice didn’t jump out as clearly superior over the rest,

at least in my experience. This is quite commonly the case.

Since you have no idea what the future holds,

you won’t ever know until after the fact what the best choice would have been.

This is something one has to get used to as a trader. You play the

probabilities, and that includes the choice of entry techniques. You must

decide, using your experience, what the probabilities tell you about a given

setup, and then make your best decision. After that you can only let it play

out according to your plan.

You then incorporate that additional

experience into the mix, and try to assess the probabilities better the next

time around. I have never found there to be one clear-cut ‘right’ answer, at

least not before the fact. I choose my entry techniques, and all other aspects

of my plan, as best I can, by assessing the likely outcomes of the scenario at

hand.

With all that said, I want to present one more

example, this one where I think the trendline violation is clearly superior to

the moving average crossover technique. The problem is, any time this technique

is clearly superior, you may not want to take the trade. Let me explain.

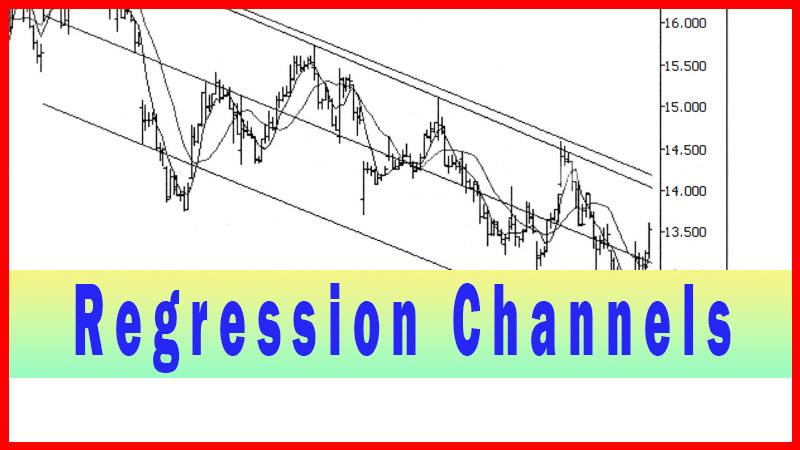

The times when you may want to avoid the

moving averages, whether it be moving average cross or moving average

crossover, is when the market is ‘choppy’. When the issue is trending, let’s say, but

jumping all herky-jerky above and below a moving average or regression line as

it trends. It is still trending, but not in a smooth, orderly fashion. In

general, when I notice this, I just stay clear of

the issue.

Sometimes, though, I find a potential trade

area that looks just great on the traded timeframe, but it is choppy on the

lower timeframe. The moving average techniques just get whipsawed, so I opt to

pay up and go for the more confirmation technique of the trendline violation.

Not necessarily because I want more confirmation, but because this may be the

least restrictive technique that I can use for the issue, the way it’s

behaving.

You have to look at the way the issue behaves

and try and match up a technique that will work. If you have more than one that

looks good, then, as I mentioned, I use the least restrictive technique, the

one that gets me in the soonest, paying the least ‘premium’. And when won’t the

trendline technique be useful? Well, for example, how about if you can’t draw a

nice trendline?

Many times, an issue won’t grant you the nice

points necessary for a trendline. Or what if you can draw a trendline (or

multiple trendlines), but the issue doesn’t seem to respect them to any great

degree? Well, then I wouldn’t use this technique. The nice thing about these

techniques is that you can see, before you reach a potential trade area, how

the issue is acting with respect to a broad choice of the different techniques.

To summarize, I find the trendline violation

technique as the best choice when the issue is choppy but a trendline can be

drawn, and the trendline looks to guide the trade. This happens here and there,

because it may be the only obvious guide the trade has, and hence many starts

to watch it. Gaps and irregular trade are brutal on moving average

calculations, but have very little effect on a trendline.

When you have an issue that is gapping all

over the place and chopping as it trends into the potential trade area, look to

the trendline technique as a possible entry technique. Keep in mind, though, I

think it should be the rare exception when an issue that behaves like this

should be traded at all.

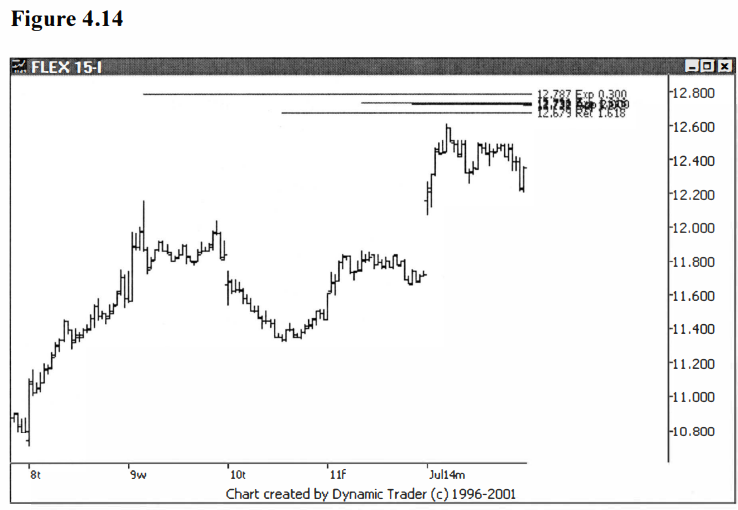

Let’s look at the example, now, where I think

the trendline violation technique would clearly be the choice. FLEX trades in a

very choppy manor, with large gaps being pretty much the norm. The company is

actually headquartered in Singapore, but it trades on the NASDAQ. It trades

somewhat like an ADR in the way it gaps nearly daily, sometimes with quite

large gaps.

I noticed a pattern develop on the 15-minute

chart, and the 60-minute and daily charts gave me the context I needed to

confirm the potential viability of my potential trade area. The trade was

actually a reversal trade and not a trend continuation trade (which is my most

common type of trade), and hence I was looking for a technique with a pretty

fair amount of confirmation. I wanted to be a fair amount away from the

potential trade zone, in exchange for what I would expect to be a greater

likelihood of the trade working out. Let’s first look FLEX on the traded

timeframe, the 15- minute, as it is approaching the potential trade area. See

figure 4.14.

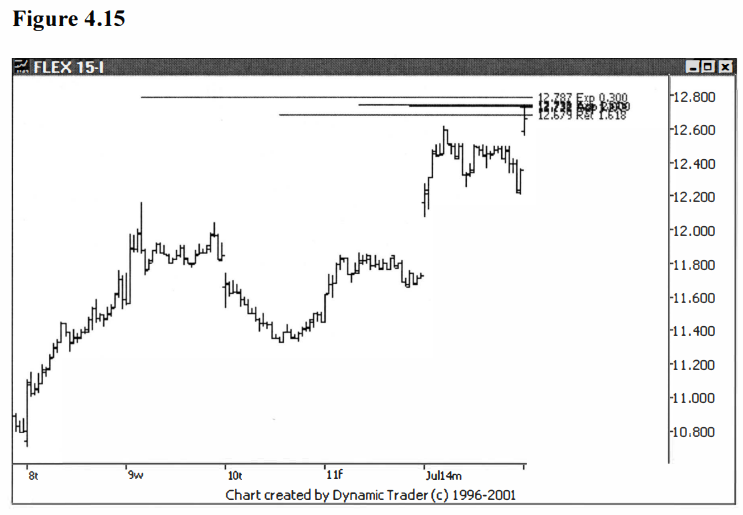

FLEX approached the potential trade area and

backed away, ending the day in the middle of the day’s range. Let’s move

forward to the next bar, which will be the opening bar for the next day. See

figure 4.15.

As is so common with FLEX, it gapped open, and

right into the potential trade area. Once this area is penetrated, I drop down

to my lower timeframe and look for my trigger. I will show the 5/15 simple

moving averages on the charts so we can examine that trigger as we look at the trendline violation

trigger. First, let’s look at the 5-min chart the day before the gap

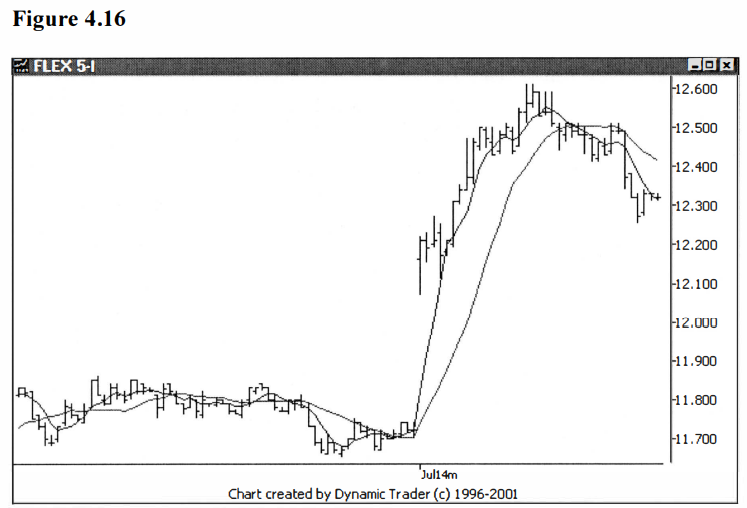

up into the potential trade area. See figure 4.16.

FLEX appears to be behaving fairly orderly

with respect to the 5-minute moving averages. The biggest problem is with all

the gaps, which can really skew the moving average calculations. Let’s move

forward on the 5-minute chart, jumping ahead to the end of the next day. See

figure 4.17.

Well, now we have some data we can discuss at

length. The open on July 15 was the gap up move we saw, into the potential

trade area. At was at that point that I stated I would be willing to take my

trigger and initiate a trade. If you were inclined to use the moving average

crossover technique, you would have a trigger very soon after the open.

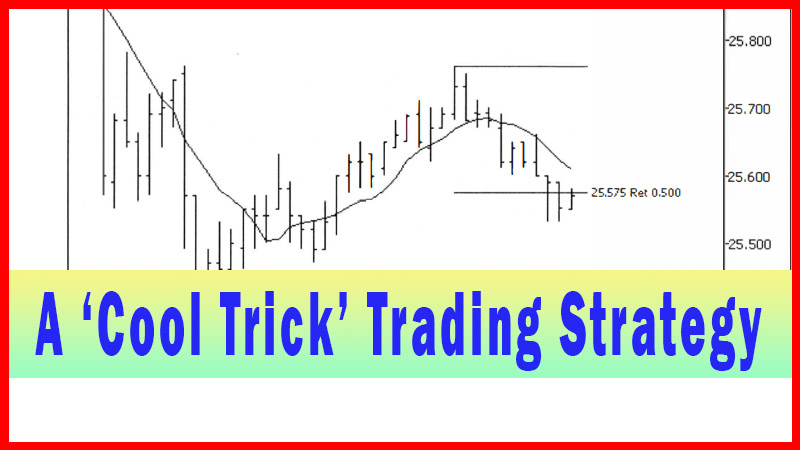

But notice how skewed the moving averages are

by that gap open. You have a crossover, but it is clear that at that point the

longer period moving average, the 15-period, still hasn’t overcome that gap

yet. That indicates that the crossover is not a ‘smooth data’ cross, if

you will. Take note, though, the most interesting thing to me is the multiple crossovers and re-crossovers as the day

wears on.

Granted, you could be triggered into this

trade by the moving average crossover and be just sitting tight, waiting for

your game plan to play out. But I would not be confident that any of these

crossovers mean anything. Now you can guess that I picked a trade that is going

to work out so I can demonstrate the trendline violation entry, and that is a correct

assumption.

Given that, it’s apparent that the moving

average crossover entry is going to work out okay.

That may all be true, but this is just one

example, and one with a predetermined outcome. When I evaluate a trade after

the fact, one of the things I like to look at is how the issue behaved in the

areas that I considered technically significant. That’s how I judge the action

in the issue, that is, how well it appears to react to areas where I expect

reactions. Sure, the moving average crossover may work here, but it appears

like it would just be luck, not technical factors. Let’s look at more data on

the 5-minute chart, to see where the trendline is in all this, and what it is I

am looking at for my trigger. See figure 4.18.

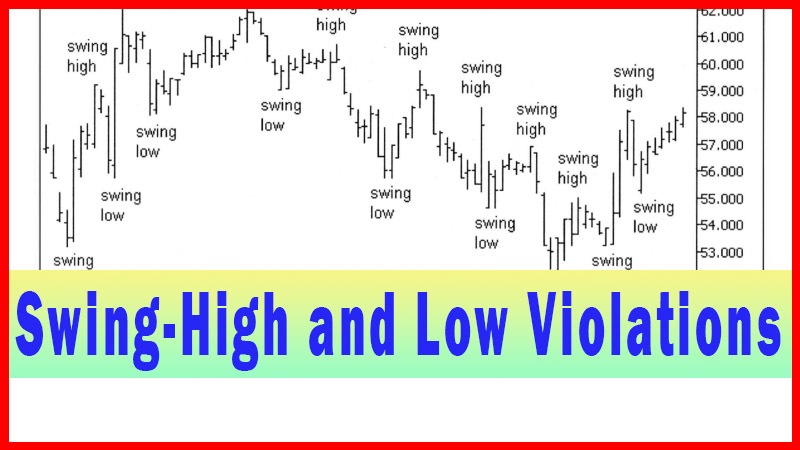

Now that adds the needed perspective. You can

clearly see that FLEX has mostly traded sideways for two full days, and is

approaching the uptrend line. This line is pretty obvious to most traders, and

hence I would expect it is being watched closely. Note, too, that this

trendline has just the two points needed for its construction. It hasn’t been

tested at all. If buyers are going to come in, this is an area I would expect

them to really buy the stock.

If the potential trade area is not to be a

reversal point and FLEX is going to set a new high for the move, this is where

I expect the move up to start. This is what I mean by choosing a trigger

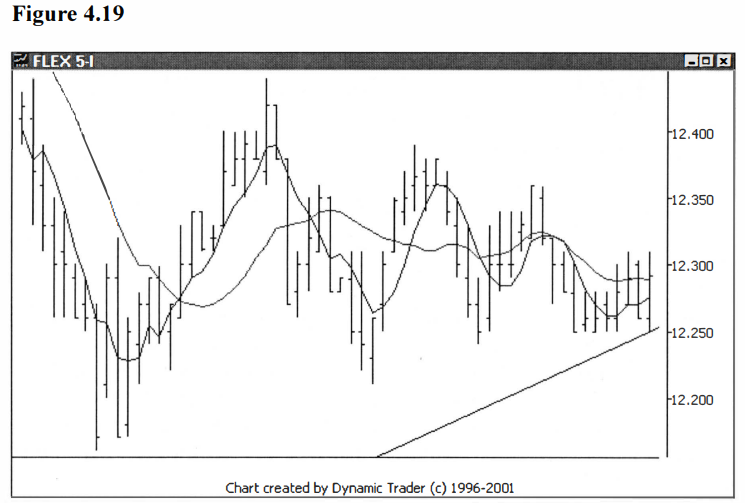

technique and area that has some technical significance. Let’s zoom in on this

area as FLEX touches the trendline for the first time. See figure 4.19.

Although this is well after the first moving

average crossover following penetrating the potential trade area, just look at

those repeating crossovers! I would just have no faith in using crossover

triggers with this issue, on this timeframe. Let’s jump two bars ahead and

assess the situation. See figure 4.20.

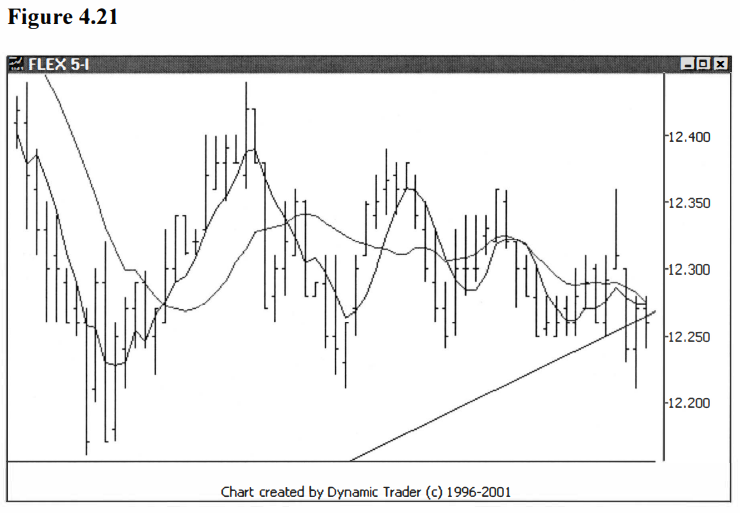

Wow, look at the price action. You have a big jump up off of the trendline, a quick reversal back down, and a close below the trendline. The trade would now be triggered using the trendline violation technique. But is this really a significant event that just happened, or is happening? When I look at the sideways action on this chart without focusing on the trendline, I would think that nothing has really happened that is of any significance. Let’s move one bar ahead. See figure 4.21.

Not much has happened yet. We have an inside

bar with a close lower than the open, and below the trendline. A period of indecision,

which, as you know by now, is common as an important technical area is

approached. I’ve found that most trades that work out ‘play around’ the

technical breakout area before launching. Let’s keep advancing and see how this

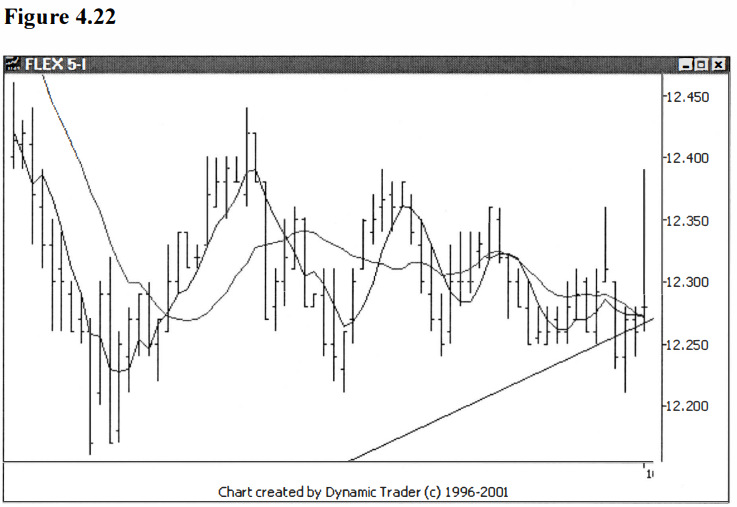

one goes. See figure 4.22.

Wow, again. This is one choppy trading stock.

A huge up bar that traded way above the trendline. (This bar is also the

opening bar for the next trading day.) But notice that the bar is a doji

bar that closed on the low end of the bar, and couldn’t hold its gains.

This wouldn’t stop me out since my stop would

be up above (likely just above all the congestion on this chart, or perhaps

above the potential trading area, if I was very confident in the pattern), but

it sure would make my heart jump for a minute. Let’s keep going and move ahead

another bar. See figure 4.23.

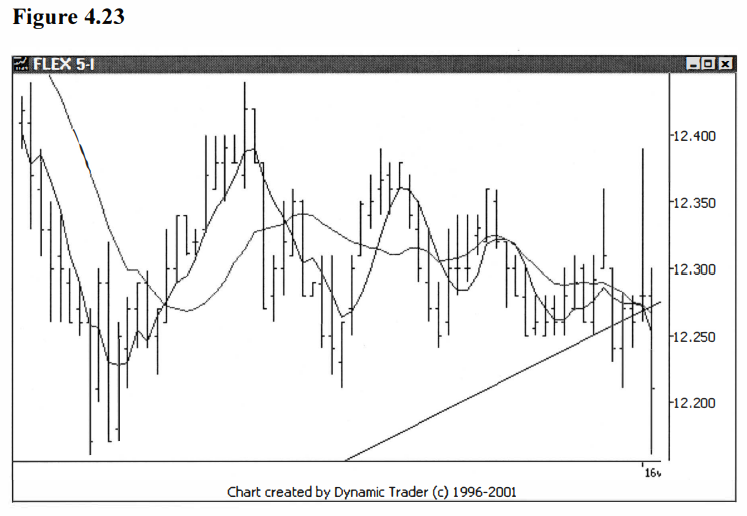

Now that’s more like it. We have a quick

reversal back down, trading to the low of the entire congestion area. Any move

below this low should ‘kick it off’. Let’s move two bars ahead and see what

happens. See figure 4.24.

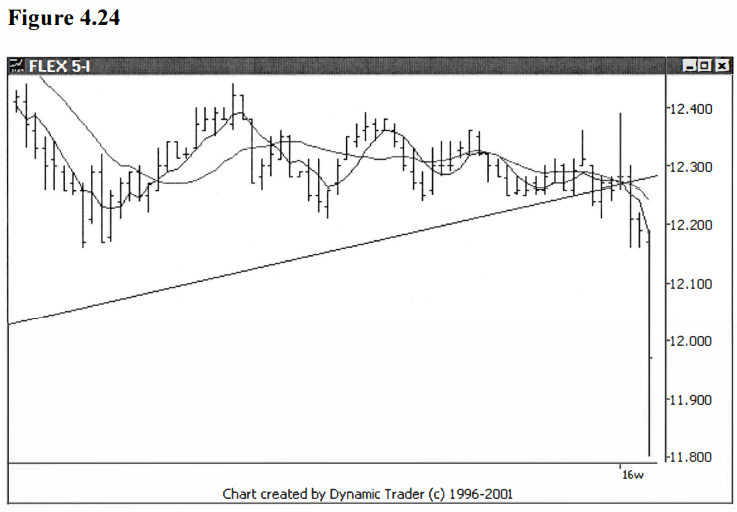

There it is. An inside bar and then the

sellers crush it. Notice how the breakdown in the stock coincides with the

breakdown through this trendline? If buyers had decided to come in at the

trendline, which is a likely place for them to do just that, the moving average

trigger would have been a stop out, but the trendline violation would not have

triggered. That’s the tradeoff. The moving average trigger would have you in

earlier, but it will give you more false starts.

When I see an issue that chops and gaps all

around the moving averages but I still see a trade I like, I lean towards an

entry like this one. On this trade, I liked the potential trade area because it

was not only an Elliot wave pattern, but also another trading pattern I use,

right on top of the same area, with outstanding Fibonacci convergences. Let’s

take one look at how this played out on the traded timeframe, the 15-minute

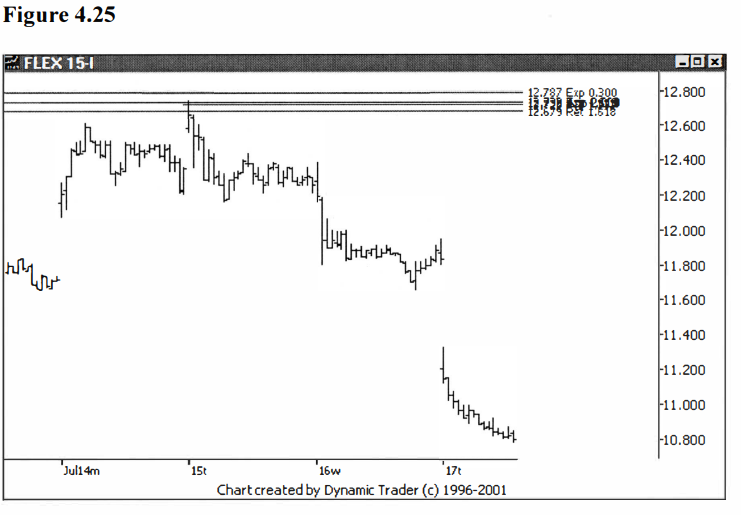

chart. See figure 4.25.

This trade went on to yield plenty of profit

potential after the trigger. It’s amazing to me how a stock that trades as

choppy as FLEX still frequently follows technical patterns so well.

The trendline technique can be a very useful

technique to have in one’s arsenal, but experiment with it and decide if and

when it may help your trading. It’s a technique that I apply when conditions

call for it, but that is not the majority of the time. I consider it a more ‘specialized’ technique.

Best Trading Entry Techniques : Trade Entry Techniques : Tag: Trade Entry Techniques, Forex : trendline trading, Trendline Breakout, Trendline Breakout and Retes, Best trading strategyt - Trendline Violation Technique