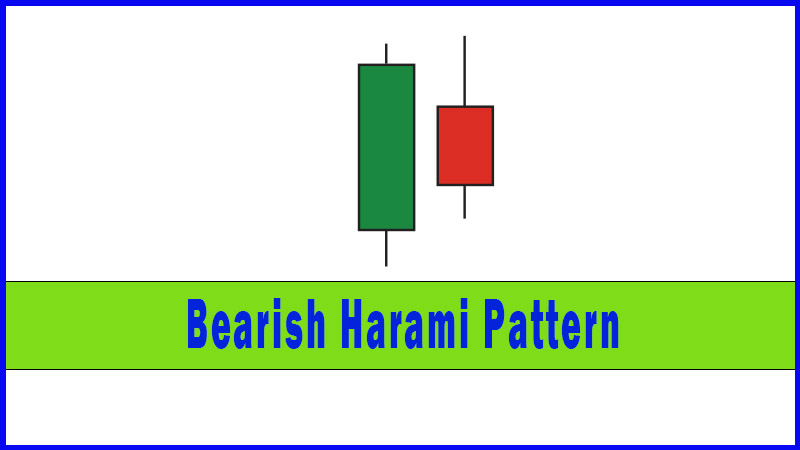

Bearish Harami

Bearish harami pattern, bearish harami candlestick pattern, bearish harami cross, bearish harami candle pattern

Course: [ Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns ]

The next line is going to be rather predictable, I fear. The opposite of a Bullish Harami is... can you guess? Yes indeed! Go to the top of the class! A Bearish Harami.

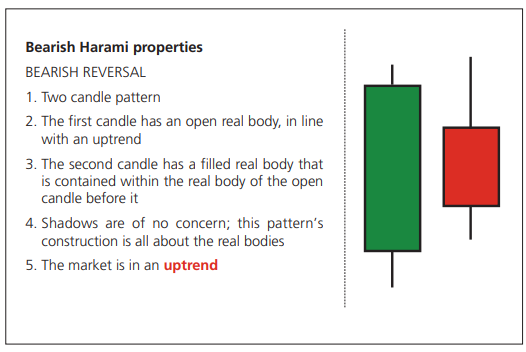

Bearish Harami properties

The next

line is going to be rather predictable, I fear. The opposite of a Bullish

Harami is... can you guess? Yes indeed! Go to the top of the class! A Bearish

Harami.

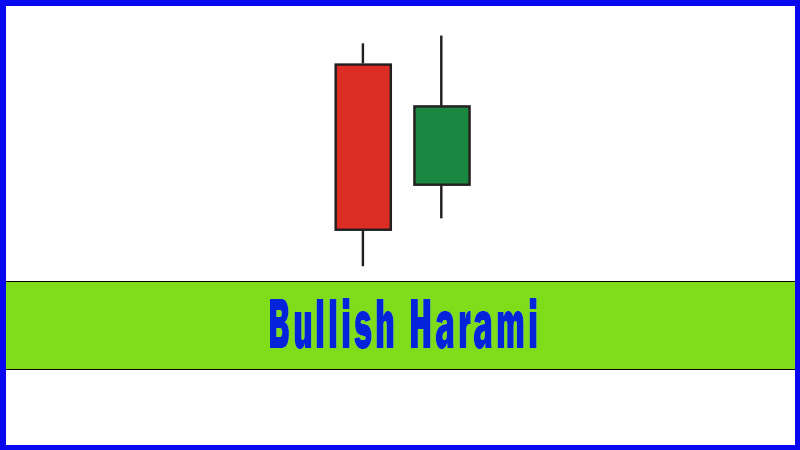

As you

can see from our box on the previous page, it has all of the rules of the

Bullish Harami but in reverse; this time a small red real body sits within the

green real body prior to it.

In other

words, day one was good for the bulls, and when you consider that we’re in an

uptrend this is no big shock to anyone. The weak open on the second day of our

pattern is the first sign that the market may be struggling at these levels.

The Bulls don’t react to this weak open on this particular day. Often weakness

in an uptrend is pounced upon as a buying opportunity by the bulls, if they’re

in a dominant mood. But that doesn’t happen on this occasion. Instead the

market does pretty much nothing, and ends the day within the real body of the

previous session.

We’re not

worried about the shadows on this pattern, remember, we’re only concerned with

the position and size of the second real body, which must be a “baby” contained

within the “mother” candle before it.

The

reason why this is classed as a reversal is because the second session is a

pathetic effort after all that’s gone before. Usually it’s accompanied by a

failure to make a new high as well, and generally we’d ask for a bit more

confirming price action subsequently before acting upon it.

If I were

forced to give pattern star ratings based on my personal experience across all

markets and time frames this one would score pretty lowly, although as I

mentioned earlier this is not a game I like to play.

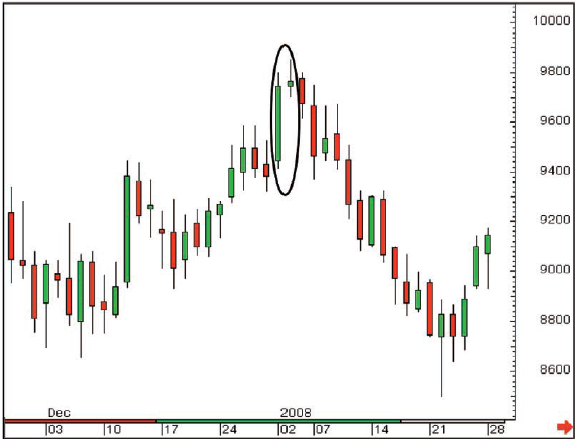

Figure 4-10: British Energy pic; daily

candlestick chart; 15 November 2007 - 29 January 2008, showing Bearish Harami

on 8/9 January 2008

If you

looked back at the previous price history of this stock you would instantly

have seen that £6.00 was a strong resistance level, so seeing a Harami when

approaching this level would have piqued interest at least.

This

wasn’t the top on this occasion, as there were some decent gains the next day,

when the market got through 600 to print 607, but on this day the gains were

sold into and the session ended back near the lows, posting a Shooting Star.

This was engulfed the next day with a big red candle. I’ve never quite decided

what the collective noun for candlestick reversals should or could be, but I’d

certainly be using it in this case. We have a gaggle of reversal patterns, a

sloth of bears, a cacophony of noise arguing in favour of further downside, and

the market duly obliged.

Spotting

the Harami pattern would have given you an early hint that something was amiss,

and with each day that another negative candlestick was posted our conviction

increased. Once 5.50 cracked just one week after our Harami the market dropped

another 85 pence in five days.

You were

ready for this sort of move, and the Harami meant you’d “geared up” earlier

than you might have done without it. So it wasn’t a definitive reversal signal,

but it still did a job for us.

The

psychology behind the Harami is that the market opened weaker on the second

day, immediately putting doubt into people’s minds. As is customary in a strong

uptrend, this weakness was not bought into. While it’s fair to say the bears

didn’t exactly weigh in and change the entire landscape, there’s still been a

subtle change in the balance of power, with no one dominating the second day.

Bearish Harami summary

The

Bearish Harami warns of a market topping out. It is constructed of two candles.

The second candle has a filled real body, usually quite small, contained within

the open real body before it.

It isn’t

one of my favourite patterns but can serve to set off a few alarm bells, which

can be useful particularly if you’re in a trade and wondering where or when to

take some profit.

Candlesticks don't have to be a "black and white" signal generating tool!

This is

something I often try to get across to people about candlesticks, especially

people who want to be completely definitive about this sort of thing. There

have been many studies done on technical analysis and candlesticks, and they

always “do the stats”. For example, you see a pattern and you buy it the next

day and you run it for n number of days. If you did this with Harami patterns

the results would probably be abysmal. If you did it with something supposedly

more potent like Shooting Stars the results would almost certainly still be

ordinary, if not disastrous.

The point

I’m trying to get across right now though is that they don’t have to be treated

in this way at all. You can simply use candlesticks to give you a better

understanding of the balance of power between bulls and bears at any particular

moment, and you can use candlestick reversal patterns to set off alarms that

maybe a move is running out of steam. At least then you’ll be ready for a turn

around.

It’s so

easy as a trader, and a chartist, to get married to a position, a trade or a

trend. If you’re making good money on something it’s so easy to get carried

away with the idea that it’s going to last forever. This simply isn’t going to

be the case, and you don’t want to maintain your long position all the way back

down. Maybe something like a Bearish Harami reversal can jog you out of

thinking that the market’s going to go up for ever and always, and can have you

getting ready to jump out of a position earlier than you normally would, before

you give too much back.

Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : Bearish harami pattern, bearish harami candlestick pattern, bearish harami cross, bearish harami candle pattern - Bearish Harami