Bullish Engulfing Pattern

Bullish engulfing, Engulfing candle, Engulfing pattern, Engulfing candlestick, Bullish engulfing pattern

Course: [ Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns ]

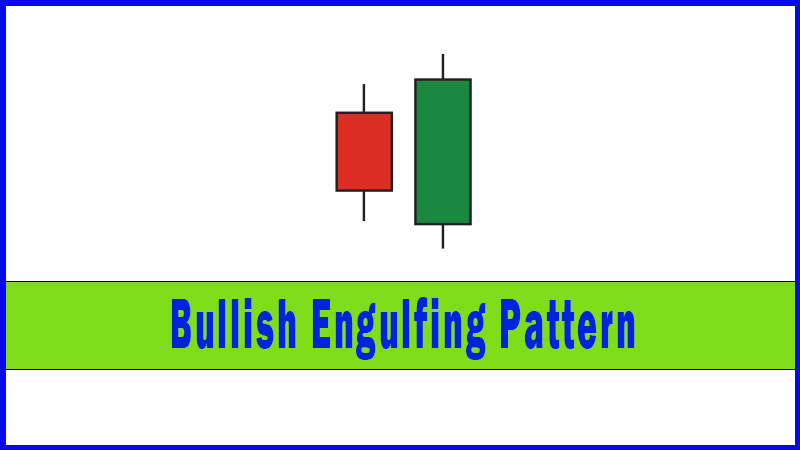

The Bullish Engulfing Pattern suggests that a market has found support, and depicts two sessions where the bears dominate the first day but the bulls come back to life in some style in the second session.

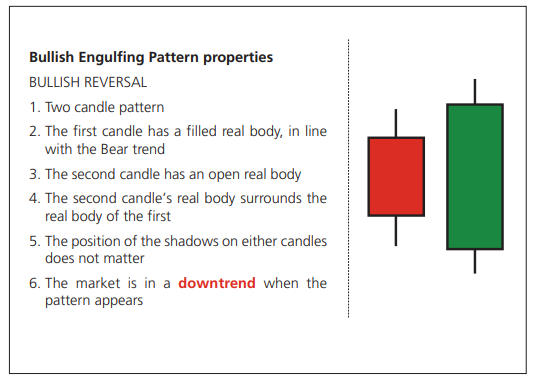

Bullish Engulfing Pattern Properties

The

opposite of a Bearish Engulfing Pattern is, as you might guess, a Bullish

Engulfing Pattern. It is similarly powerful, and the set of rules is the same

but in reverse.

The Bullish

Engulfing Pattern suggests that a market has found support, and depicts two

sessions where the bears dominate the first day but the bulls come back to life

in some style in the second session.

It’s the

same sort of price action as can be seen during a Hammer candlestick, except it

happens over two sessions.

Once again,

all you have to do is think about the price action that goes into the separate

candlesticks, and immediately you can see why it’s a potential reversal. The

second candle is akin to the second half of a Hammer session; the bulls

suddenly wake up, and come storming back to the party. The market has to close

strongly as well for it to engulf the first candle’s real body. All of this

bullishness comes after a weak open on the second day, so it’s quite a revival

that’s been achieved.

Figure 4-4: ICE Brent Crude Oil futures (all sessions, active unadjusted continuation); daily candlestick chart; 21 November 2007 - 11 February 2008, showing Bullish Engulfing Patterns on 5/6 December 2007, 23/24 January 2008, and 6/7 February 2008

This chart

shows three Bullish Engulfing Patterns after pullbacks in Brent Crude at the

end of 2007 and the beginning of 2008. If you look at a much longer-term chart

for this one you’ll see that the market was up near (what was then) all time

highs having rallied strongly in the previous couple of years. The preceding

chart merely shows some short term pullbacks near the top of this bigger

picture move.

Important note

We were in

a long-term uptrend, there’s no doubt about that. In fact the trend was so

strong that there would be many people out there looking for a buying

opportunity, either because they’ve missed making money on the previous up-leg,

or because they’ve covered longs and are now looking to get long once more on

any weakness.

On these

three occasions the market pulled back to a short-term Fibonacci retracement

level, then the Bullish Engulfing Patterns appeared.

Bullish Engulfing Pattern summary

The Bullish

Engulfing Pattern is two candles; the first a filled candle in a downtrend. The

change occurs on the second candle when the bulls have a great day after a bad

start, and they manage to post a close on day two above the open on day one.

This is

generally a strong reversal pattern, and one I’d recommend keeping an eye out

for.

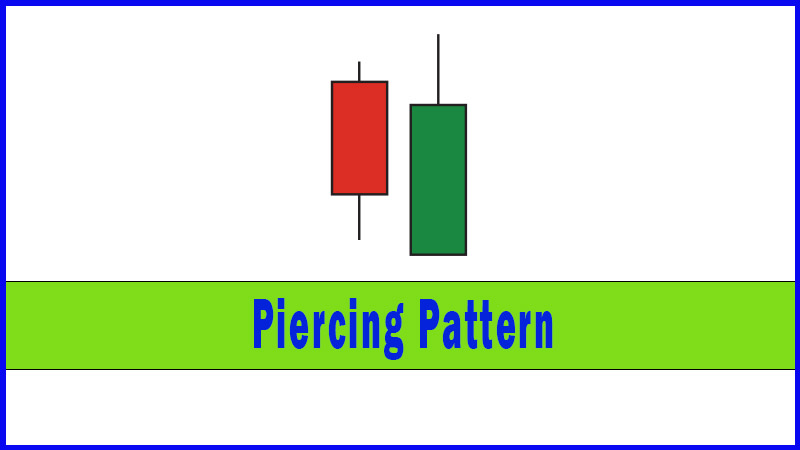

The next

pair of patterns we’re going to look at is Dark Cloud Cover and the Piercing

Pattern.

Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : Bullish engulfing, Engulfing candle, Engulfing pattern, Engulfing candlestick, Bullish engulfing pattern - Bullish Engulfing Pattern