Morning Star Pattern

morning star candlestick, morning star candle, morning star candlestick pattern, morning doji star, morning star candle pattern, morningstar pattern

Course: [ Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns ]

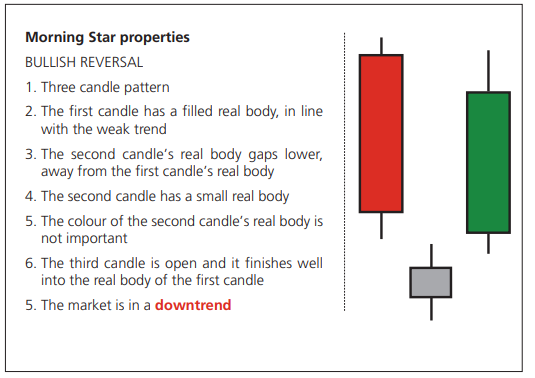

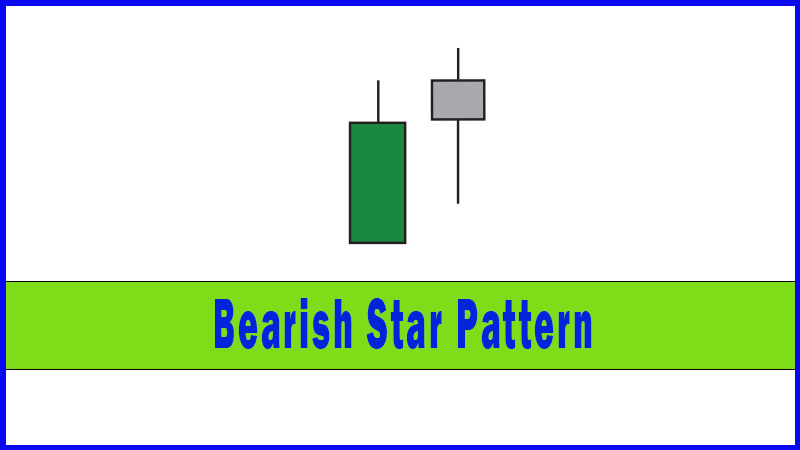

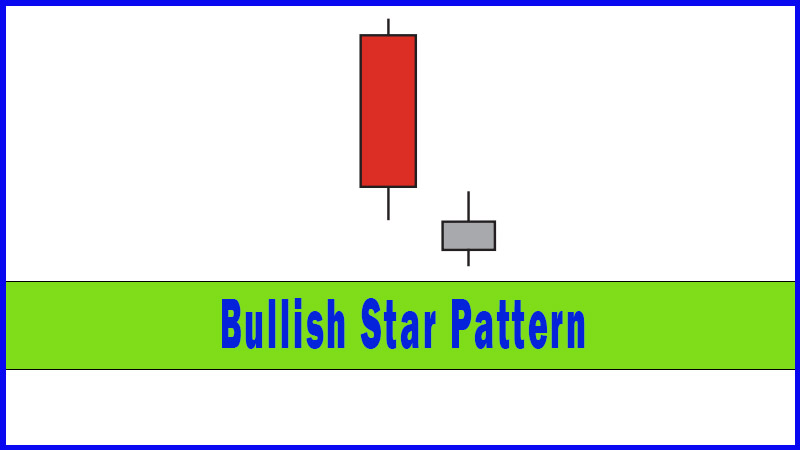

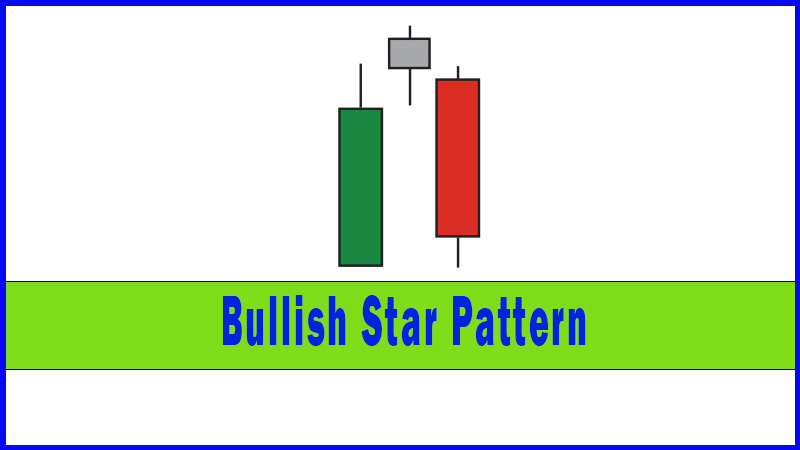

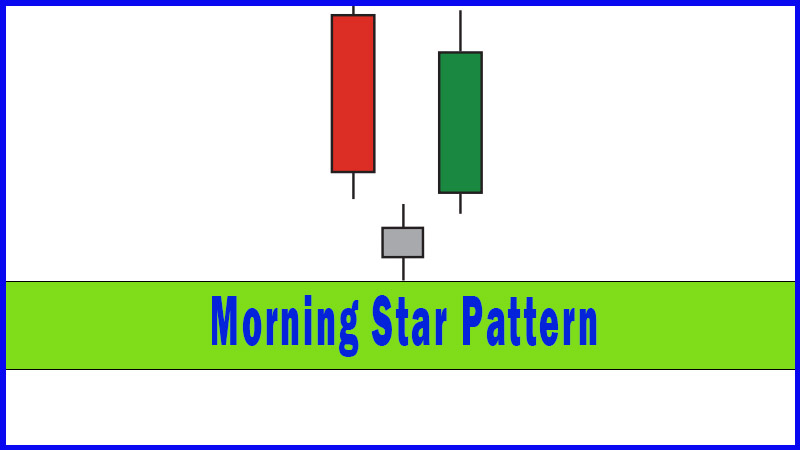

It’s a pretty simple step to go from a Bullish Star to a Morning Star: you just need a nice big open candle to make it a three candle pattern - the third day confirms the suspicions aroused when the market stopped travelling relentlessly lower the previous day (the middle day of the three).

Morning Star properties

It’s a

pretty simple step to go from a Bullish Star to a Morning Star: you just need a

nice big open candle to make it a three candle pattern - the third day confirms

the suspicions aroused when the market stopped travelling relentlessly lower

the previous day (the middle day of the three).

The

buyers are back in town, and day two was the definitive turning point. The

market has moved in a “V” shape over the three days. It’s all change.

As I said

with the Evening Star, this is a particularly potent pattern according to the

Japanese, and you can see why. There are lots of components that need to come

together, and ticking all the boxes requires a pretty serious turnaround in the

market’s fortunes.

Third day flexibility

I’ve

always subscribed to the view that the starting point of the third day is of

far less importance than where it ends, so I don’t worry about whether the

market gaps higher on the third session. Instead, only the condition of closing

well into the real body of the first day needs to be satisfied (that word

Marabuzo comes into play once more).

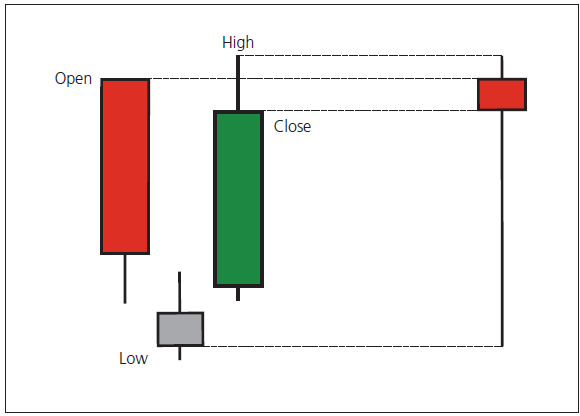

So Figure

4-16 below shows an ideal scenario Morning Star, and Figure 4-17 shows a

variation that we’d be happy to label as such.

Examples

Figure 4-16: Anglo American pic; weekly

candlestick chart; 28 August 2007 - 28 April 2008, showing Morning Star pattern

between 14 January and 1 February 2008

Figure 4-18: Three candles that make up

a Morning Star - when merged together they form a Hammer

Morning Star summary

The three

candles that form a Morning Star make a potent argument for the reversal of an

established downtrend. The first candle has a large filled real body just like

many of the other sessions that we’ve seen during the downtrend. Day two starts

off with further weakness but then nothing really happens. After this questions

should be asked as to the sustainability of the down-move. Day three answers

these questions. A big open candle tells us the bulls are back in town.

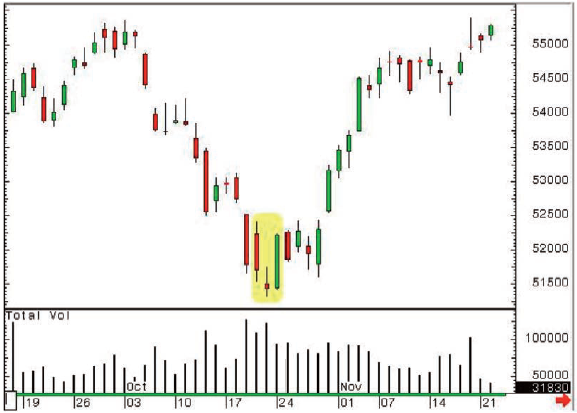

Figure 4-17: FTSE futures (unadjusted

continuation); daily candlestick chart; 16 Sep 2005 - 22 Nov 2005, showing

Morning Star variation on 20, 21 and 24 October 2005

Combining the Morning Star

Again we

would pose the question of what these three candles would become if you were to

condense them all together into one? Hopefully you can see how price action

that takes on a “V” shape can form a reversal pattern however long it takes, be

it one day or three days. The following illustration shows this clearly.

The importance of the Marabuzo line to most of these patterns

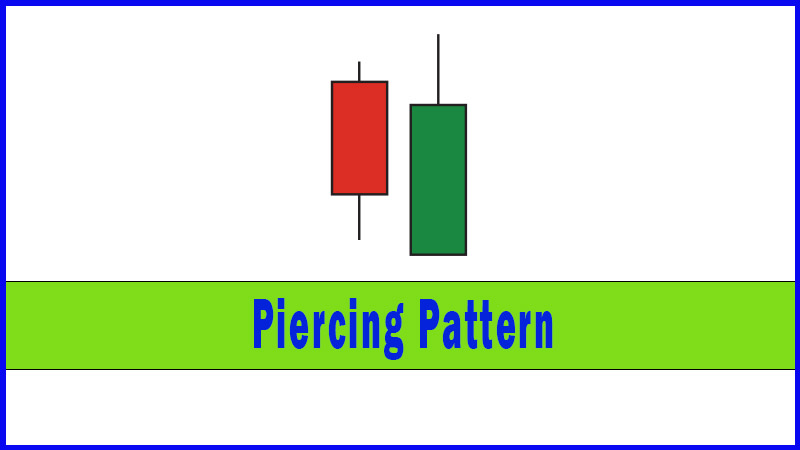

In

looking at the Dark Cloud Cover, Piercing Patterns, and Morning and Evening

Stars you have been introduced to the concept of the Marabuzo line, a level

that defines when prices are moving well into the real body of a preceding

candlestick. Prices need to break through this level to form these patterns,

and it needs to do so on a closing basis.

An

Evening Star isn’t an Evening Star if the third candlestick in the trio doesn’t

close below the Marabuzo line of the first. Similarly a Dark Cloud Cover

formation is only formed when weakness on the second session takes us below the

Marabuzo line of the green candle posted beforehand. Of course this weakness

also has to be maintained into the close, but the breaking of this level has to

occur first, and this very often sees these levels becoming a strong focus.

Marabuzo lines for reversal rejection and trend confirmation

Marabuzo

lines can also be excellent “lines in the sand” if you want to confirm a

reversal pattern, even if they’re not required in the set of rules. For

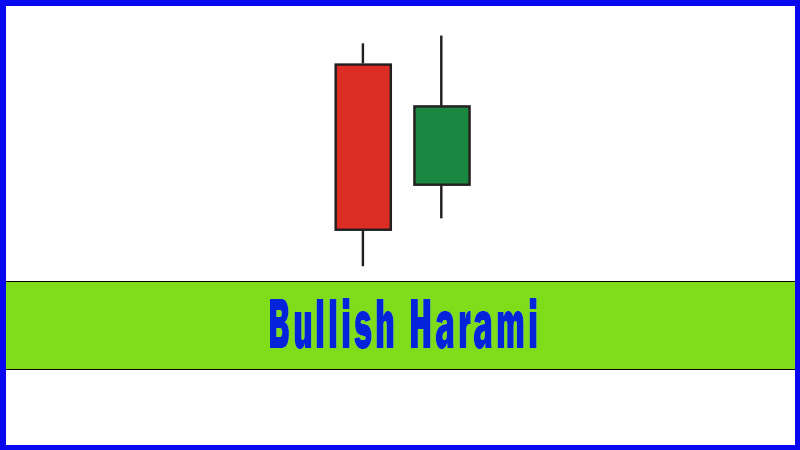

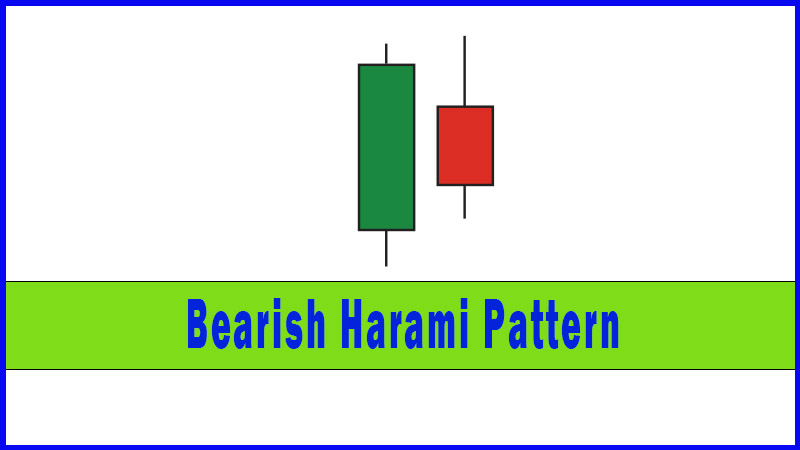

example, I said in the last chapter that Harami generally aren’t the strongest

of reversal patterns, and that a bit of extra confirmation is always good in

this situation. Have a look at the following chart:

Figure 4-19: ICE Brent Crude Oil

futures (all sessions, unadjusted continuation); daily candlestick chart; 4

September 2007 - 6 November 2007

Two

Bearish Harami patterns were posted in a row on 16 and 17 October, then again on

18 and 19 October. Only a few days earlier, on 15 October, a big green candle

with a Marabuzo line at 81.50 was posted. Looking back at my commentary after

these Harami patterns, we see that the reversal patterns were flagged, but I

asked that the market take out 81.50 before becoming too concerned that a

change of trend was taking place.

The power

of the Marabuzo line came into play again a week or so later. You can see a big

red candle was posted at point A (30 October 2007). This was one of the most bearish

days the oil markets had ever seen in absolute terms (at the time), but I went

into the next day sticking with a bull stance, because the market hadn’t broken

86.12, the Marabuzo line from the big open candle posted on 25 October 2007.

In fact I

said on the very next day that if 86.12 held, one should be using the weakness

as a buying opportunity. Needless to say I was very pleased to see the low of

the day coming in at 86.13, followed by a very swift rally that swept away any

of the worries created by the previous session.

So I’m

happy to put a Marabuzo line on any large bodied candlestick because I’ve noted

over the years that these can be extremely good support or resistance levels

over the next day or two - or sometimes for even longer.

Just for the sake of clarity, below is

a good example of Marabuzo lines proving to be a good reference to stay with

the bears in a down move.

Figure 4-20: LIFFE Long Gilt futures

(adjusted continuation); daily candlestick chart; 17 March 2008 - 23 May 2008

One thing

worth noting at this point is that these lines generally work best if they give

support in an uptrend or resistance in a downtrend. Let’s go through all of

these conditions for clarification purposes.

If the

market is in a solid uptrend you will see many strong days with large green

candles. After these big up days we are generally left looking at a big green

real body to which we can apply a Marabuzo line. Any weakness in the subsequent

days often finds support at these lines. Think about it; in an uptrending

market you should be looking for buying opportunities, or support levels where

the buyers are likely to step back in. I always suggest looking to trade in the

direction of the underlying trend, for example buying dips to support in rising

markets. Unless you have extremely deep pockets it’s far better to try and

position yourself in line with this. It’s much easier to walk out of a train

terminal during the rush hour than into the station, because you’re going along

with the tide of the crowd, and not trying to push against it.

If you’re

in a downtrend and looking for selling opportunities you could do worse than

short the market at the Marabuzo line of a big red candle, as the example on

the previous page shows clearly.

Psychology of Marabuzo lines

What’s

the psychology that makes Marabuzo lines so effective? I think there may be

something about halfway that makes people sit up and pay attention. I’ve never

run a marathon but I know a few people that have, and they all said that the 13

mile mark is an important one: knowing you’re halfway round gives you a boost.

I feel like that most Wednesday lunchtimes!

Once

prices get back above the Marabuzo line of a big red candle in a downtrending

market, the bulls feel like they’ve achieved something. This is a rarity at the

time, of course! The bears who defended this level, and possibly used it as a

selling opportunity, have been wrong-footed and need to buy back to stop out.

There may have been bears who weren’t going to worry about their short

positions unless some key resistances started being retaken. The Marabuzo line

would be one such key resistance, so its break may cause these shorts to start

covering.

Marabuzo lines summary

To sum

up, I think Marabuzo lines can be a great tool for answering those big

questions that are posed after large directional days.

Debt

markets often see a strong reaction to the US Employment report on the first

Friday of every month. The Monday after can often be a day of head-scratching

as people try to decide whether the big move seen on the Friday should be

followed by more of the same, or whether it was just a bit of over-reaction

(“surely markets don’t over-react?” he asked sarcastically).

Marabuzo

lines can often answer this question. Say the market saw a strong reaction to

the numbers and rallied from an open at 116.00 to a close of 118.00 on the

Bonds. The Marabuzo line will be at 117.00. We can say that all the time the

market remains above 117.00 we can feel comfortable with the idea that the

gains can be sustained and that the market is heading higher. However, if

prices fall back through 117.00 maybe Friday’s gains were overcooked, and in

the cold light of day the sellers have been presented with an opportunity.

I have found over the years that these lines can

provide extremely powerful and reliable levels of support or resistance,

particularly in strongly trending markets.

Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : morning star candlestick, morning star candle, morning star candlestick pattern, morning doji star, morning star candle pattern, morningstar pattern - Morning Star Pattern