Multiple Reversal Patterns

Reversal Patterns, Multiple Patterns in Candlesticks

Course: [ Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns ]

The last chapter walked us through the commonly used single candlestick patterns, and hopefully by now you can look at any candlestick and be able to work out what sequence of events led to its formation as far as the combination of open, high, low and close is concerned.

Multiple Reversal Patterns

The last

chapter walked us through the commonly used single candlestick patterns, and

hopefully by now you can look at any candlestick and be able to work out what

sequence of events led to its formation as far as the combination of open,

high, low and close is concerned.

We will

now take things further by looking at combinations of candlesticks that make

patterns that are made up of more than one candlestick.

Once

again it’s all about the direction of travel that has to occur to form a

particular shape or colour of candlestick, and once again it should pretty much

make sense if you take this approach. Do you remember how a Shooting Star is

formed by an arc shaped direction of travel - gains then weakness? Well, most

of the bearish reversal patterns discussed in this chapter do exactly this,

except that the movement occurs over several candlesticks as opposed to just

one.

I have

deliberately made this chapter a little less structured than the material we’ve

already covered, as you should now be well versed in the idea that candles are

formed by a certain sequence of events, and that assumptions can be made from

that.

I have

retained the rules section and the summary for quick and easy reference.

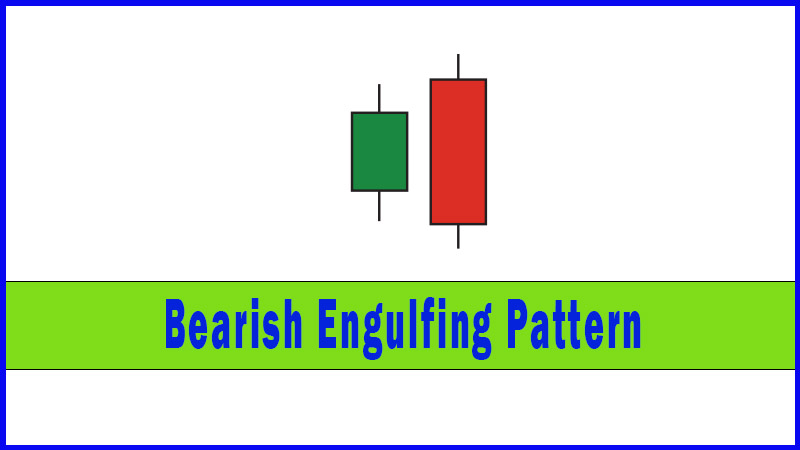

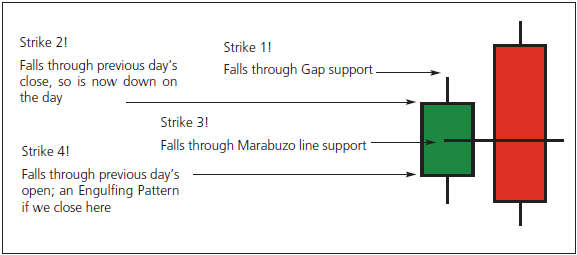

But

there’s more to it than that, because quite often a Bearish Engulfing Pattern

starts off with a dramatically stronger open, like that illustrated in Figure

4-1, and this means there are several big “lines in the sand” to the immediate

downside, which could and should act as support if the bulls are on their game.

Figure 4-1: The four stages of a

Bearish Engulfing Pattern

Let’s go

through this one stage at a time. On the second day, if the market opens above

the previous day’s high, there is a gap. The bulls often step in and buy

weakness to the gap, but on this occasion the market falls through the gap

support. Strike 1 to the beaten up bears.

There is

then some selling off through the previous day’s close. Strike 2. This, in

turn, is followed by a sell off through the Marabuzo line (see page 81) of the

green candle - Strike 3. This will further encourage the bears, who by now are

starting to realise they’re having a rare good day!

To post a

Bearish Engulfing Pattern though, you need to surround the real body of the

preceding candle, so the previous day’s open is another important line in the

sand. Strike 4! That’s a fair bit of work for the bears to get through in one

day, especially when you consider that we’re in an uptrend, and they haven’t

been achieving much lately. The final thing, of course, is that the market has

to close low as well (below the first day’s open) for it to qualify as an

Engulfing Pattern, so the selling has to be sustained into the close.

Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : Reversal Patterns, Multiple Patterns in Candlesticks - Multiple Reversal Patterns