Bearish Star Pattern

Doji star bearish, Evening doji star, bearish shooting star pattern, bearish doji star candlestick pattern, types of bearish candlestick patterns

Course: [ Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns ]

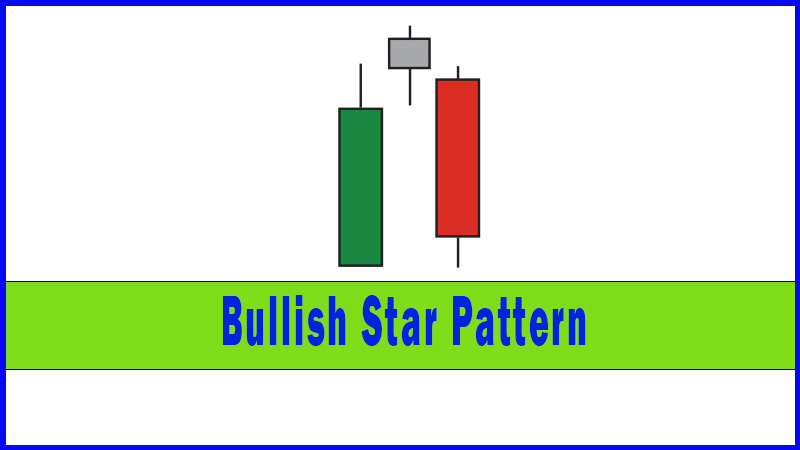

You can also get Stars in bear markets, warning that a down-leg may be cooling off or even reversing, so now we’ll look at the Bullish Star.

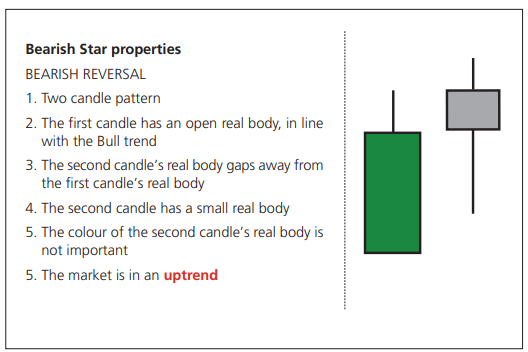

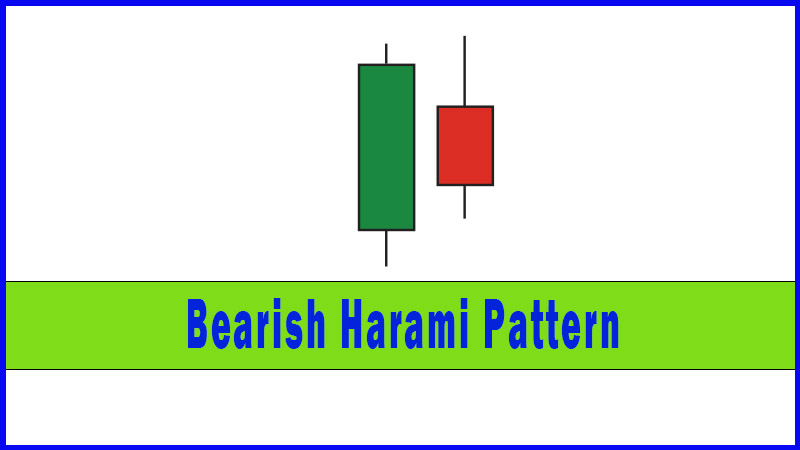

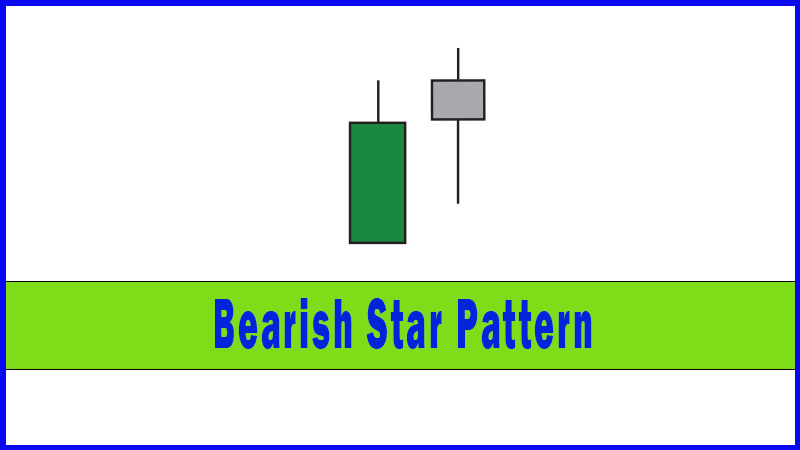

Bearish Star properties

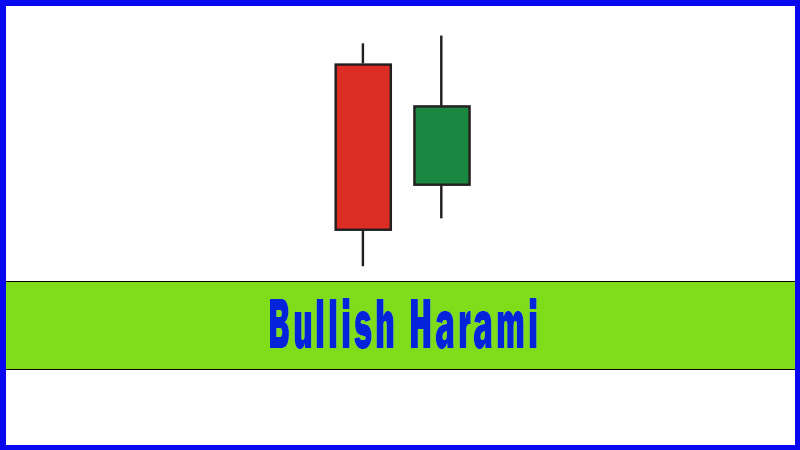

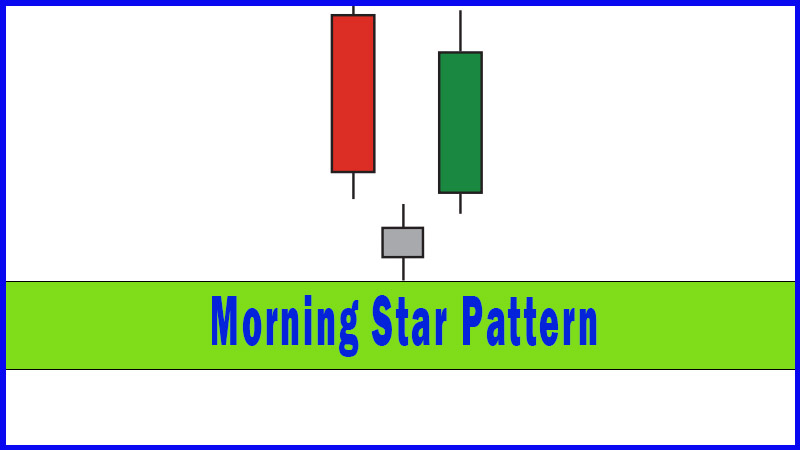

You could

class the Star as a one candle pattern, but I have always been happier to call

it a two candle pattern, and ask that a Star-like candle is posted after a

strong up day. A Star is a small bodied candle that gaps away from a large

bodied candle before it. The real body of the second candle doesn’t have to be

above the first candle’s high, but this makes it more potent.

The point

is that the second candlestick is small of real body, in other words it was a

day where the bulls didn’t beat the bears. It was a pretty even balance between

the two, and all of that after such a promising start.

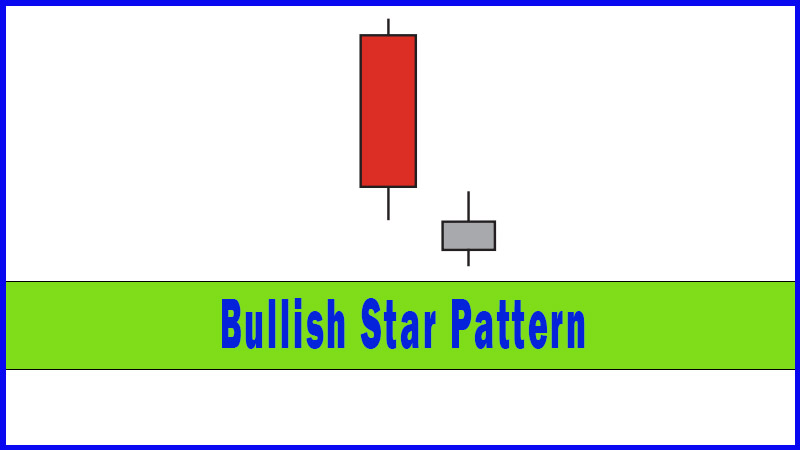

That’s

the key point behind the Star formation. The open on the second day was higher,

so the bulls had a chance to show their stuff, but they didn’t. We ended up

having a damp squib of a session. It’s almost the same sort of psychology as a

Harami, except this time there was an added bit of bullishness first up in that

there was early promise on day 2. This early promise didn’t translate into

another solid day. The bears did as well as the bulls, and no one won. Have

things changed? Has the balance evened out? Did the bulls mess up what started

out as a really promising session for them? Quite possibly the answer to all of

these questions is “Yes!”

Most

technicians recognize that round numbers can make important psychological

barriers, and therefore form support or resistance levels. I believe that most

find this a bit difficult to grasp, because these round number levels are

surely the sort of thing that only private investors and less sophisticated

investors would be looking at, whereas surely the smart money shouldn’t care

about such frivolities? But be assured, these levels do count for some reason,

so shouldn’t be ignored.

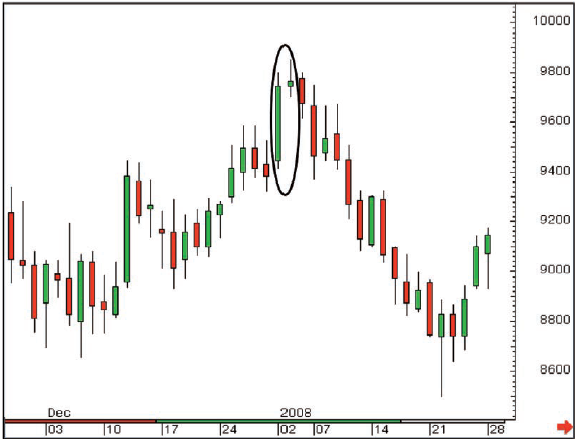

Anyway I

digress. After the day that oil (in the US at least) hit $100 the whole world

was talking about how much higher it could go, but anyone trading Brent who

looked at the daily candlestick chart on that day should have at least

scratched his or her cranium. This is what I wrote the next day:

‘As

you can see from the chart this mixed session left us with a small bodied

candlestick. This should be used as a warning sign of the bull run waning. ’

In the

next section (Evening Star) I’ll come back to this, as there’s a bit more to

say.

Bearish Star summary

A Bearish

Star is a small bodied candle seen above a large open bodied candle in a rising

market. The small body on the second day shows that despite a promising start

the bulls lost temporary control. We should now be on alert in case this loss

of control becomes a more sustained deal from the bears, i.e, a reversal.

You can

also get Stars in bear markets, warning that a down-leg may be cooling off or

even reversing, so now we’ll look at the Bullish Star.

On the

first trading day of 2008, NYMEX Light Sweet Crude hit $100. The London-based

Brent Crude Oil contract didn’t quite make this mark, trading up to 98.50 on a

day that ended with a small bodied candle that gapped away from the big green

candle before it, or in other words, a Star.

As you

can see the market sold off a bit the next day (which actually engulfed the

previous day), but it took a few more days before things really got going for

the bears and within a few weeks the market had pulled back to 85.00, where a

bounce was seen after a Hammer day.

Figure 4-11: ICE Brent Crude Oil

futures (all sessions, unadjusted continuation chart); daily candlestick chart;

28 November 2007 - 28 January 2008

Now

here’s something that I’ve always said about Star days.

What are

the headlines in the press the next day? “Oil hits new all time highs” and “Oil

nudging $100” are the sorts of thing that we would have seen after this day,

all trumpeting from the rooftops that the market is at levels never before

seen, and surely $200 is the next stop!

Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : Doji star bearish, Evening doji star, bearish shooting star pattern, bearish doji star candlestick pattern, types of bearish candlestick patterns - Bearish Star Pattern