Evening Star Pattern

evening star candlestick, evening star candle, evening star candlestick pattern, evening doji star, morning star and evening star pattern

Course: [ Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns ]

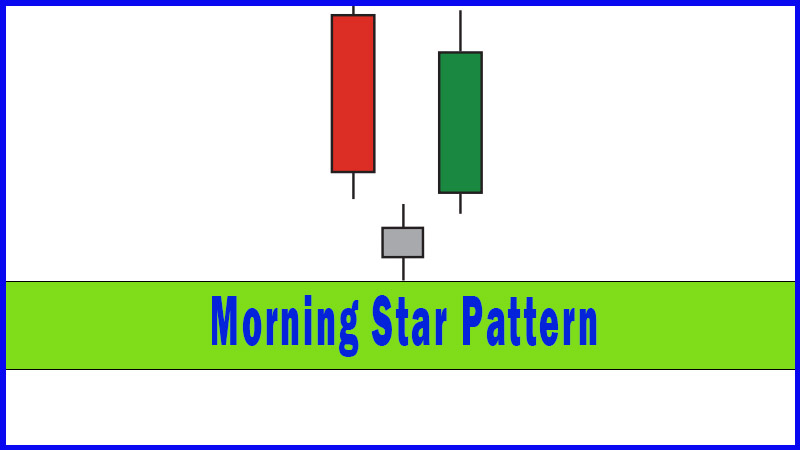

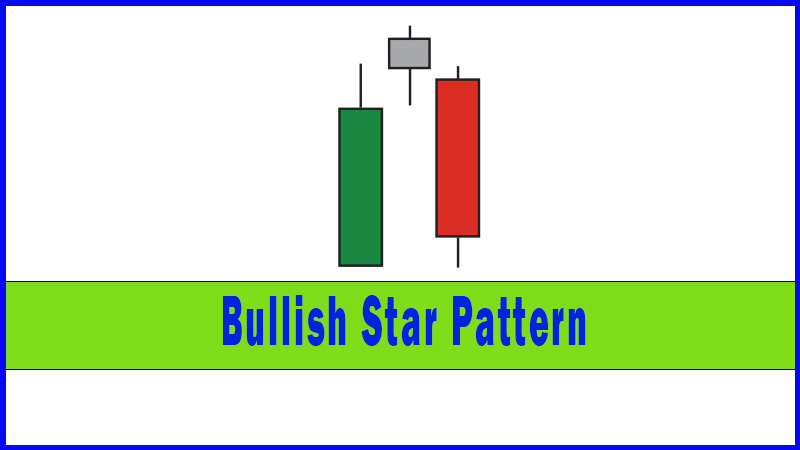

An Evening Star is a three candle pattern, but if you’ve just read the previous few pages, understanding it will be a very simple task, as all we’re doing is adding one more element to a Bearish Star - an immediate confirming candle.

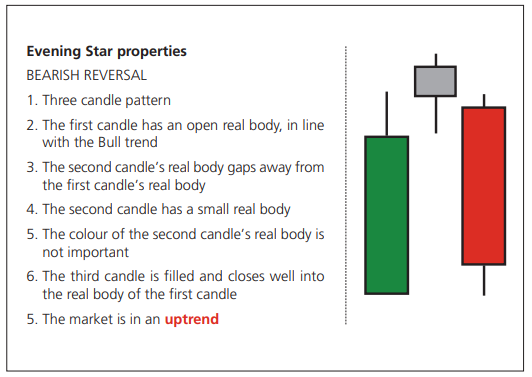

Evening Star Properties

An

Evening Star is a three candle pattern, but if you’ve just read the previous

few pages, understanding it will be a very simple task, as all we’re doing is

adding one more element to a Bearish Star - an immediate confirming candle.

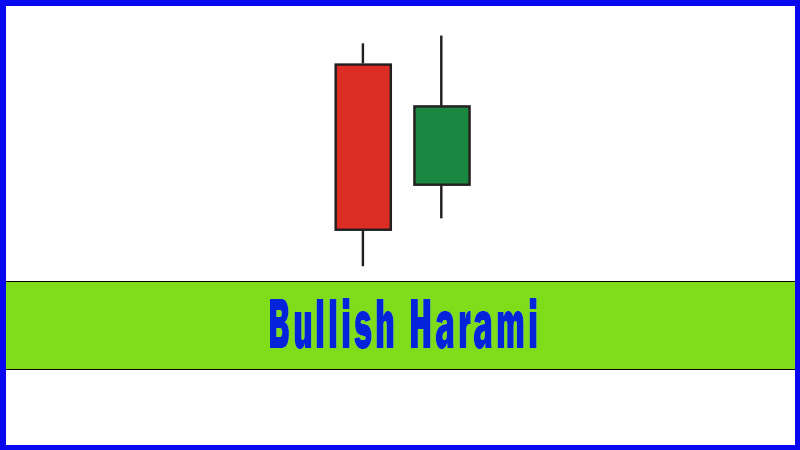

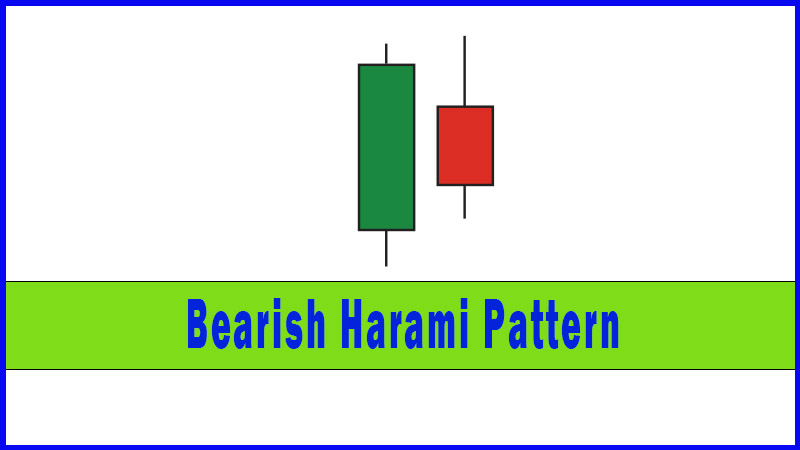

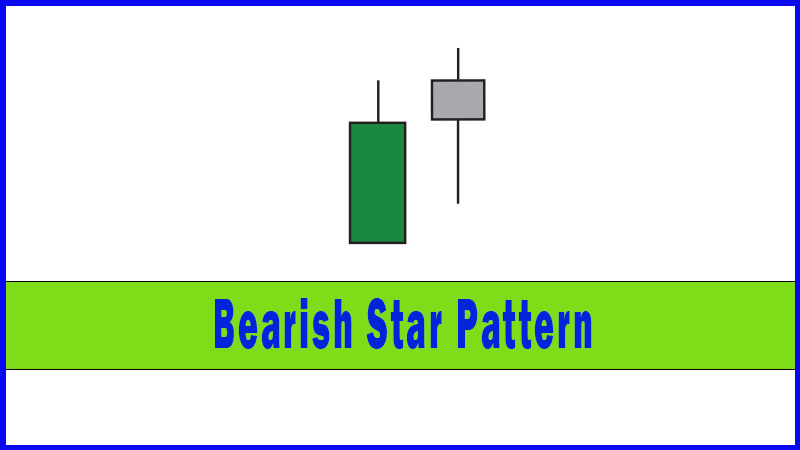

So there

are two candles that make up a Bearish Star - a green candle followed by a

small candle that gaps higher. After a really good start on day two nothing

really happened, and I was raising an eyebrow that the bulls didn’t keep things

going. Then the third day is a big red candle that confirms the suspicions

expressed after the small gap day. The third day sees the market close well

into the real body of the first candle of the three.

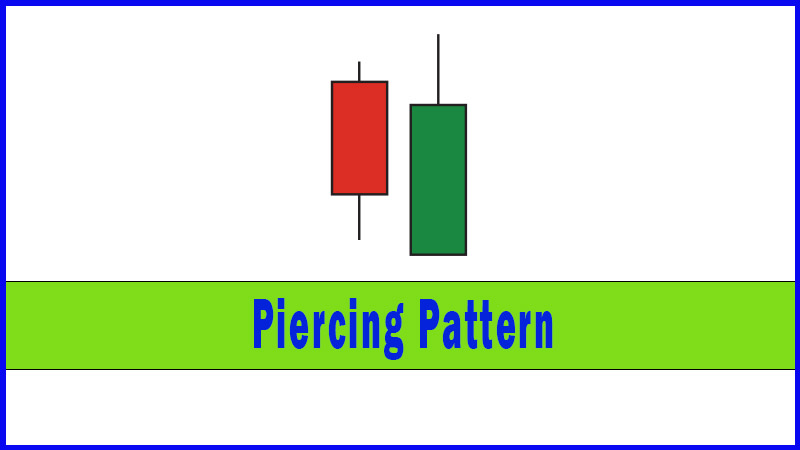

Once

again we see that phrase “well into” with regard to the closing value of the

third candlestick. Where have we seen this before? If you go back to the

section on Dark Cloud Cover you’ll see that for the formation to be completed

the second candle’s body has to see a close well into the real body of the

first’s. We solve this slight ambiguity by using the Marabuzo line of the first

candle, and the same applies here: we need to see a close on the third day

below the halfway point, or Marabuzo line, of the real body of the first candle

of the pattern.

The

Japanese particularly favour these patterns, and you can see why - there are

three key elements needed to make up the reversal:

1. Initial strength

2. A day of pure indecision despite the market making a new high

3. A session that backs up the indecisiveness of the previous session and confirms that prices had reached levels that were too high!

It is a

recurring theme when you study Japanese charting techniques that the number three

has almost mystical connotations. Maybe this is what makes Evening and Morning

Stars so potent, it’s because they show a reversal occurring over three

different candles. There are many other patterns in candlestick analysis with

“three” in their name: three upside gaps, three red soldiers, rising/falling

three methods, and three Buddha tops and bottoms (akin to the Western Head

& Shoulders pattern).

Examples

Figure 4-13: Astra Zeneca pic; daily

candlestick chart; 29 January 2007 - 8 May 2007, showing Evening Star on 19,

20, 23 April 2007

You can

see on the left hand side that the market had got to within a whisker of the

psychologically important £30 level on a couple of occasions, but then was

faced with some weakness. The market rallied again though, several times, and

in April saw a run higher that ended with an Evening Star. The day after the

Evening Star had been completed the market gapped lower, and sold off over 5%

in the next 8 sessions - instant gratification!

This

proves something else about these powerful reversal patterns. Even though this

pattern’s formation involved the market selling off just under 5% from the

high, there was still plenty of weakness immediately afterwards to make money

on the short side. It’s never too low to sell, nor - in a rising market - too

high to buy.

Abandoned babies

This illustrates an ideal world

scenario for an Evening Star pattern, with the middle candle sitting pretty on

its own above the rest of the chart. In fact there is a name for a small bodied

candle that sits on the chart after having gapped higher (or lower in a

downtrend, below the rest of the market). It’s called an Abandoned Baby.

This is

one of those patterns where as soon as you start to talk about it you start to

get those “I think he may be losing his marbles” looks.

Variation - no gap on the open of day three

The

cynics among you may argue at this point that we don’t live in an ideal world,

and even when I’m in my most optimistic of moods I have to concur! Nevertheless

as long as we stick to the basic principles, there are several combinations of

candles that can come together and still be classed as an Evening Star. The

following chart shows a variation that I would be happy to call an Evening

Star, even though the market didn’t gap lower on the third day. The important

message about the third session, surely, is where it finished? Even if the

market didn’t gap lower at the start of this session, surely the selling that

followed was enough to make you at least worry that things might be changing?

The psychology of the third session of an Evening Star is all about how far the

sellers took us back into the range of the first day, not where the first trade

of the day may have been.

Figure 4-14: Diageo pic; daily

candlestick chart; 9 May 2007 - 3 August 2007, showing variation on an Evening

Star posted on 15, 18 and 19 June

When candle patterns collide

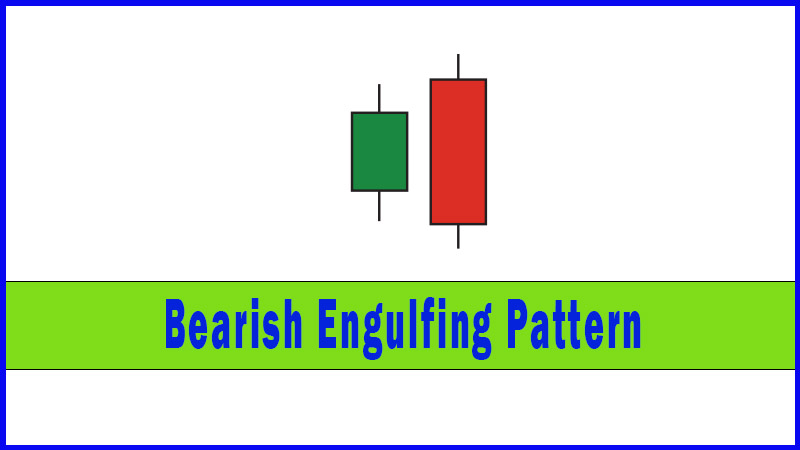

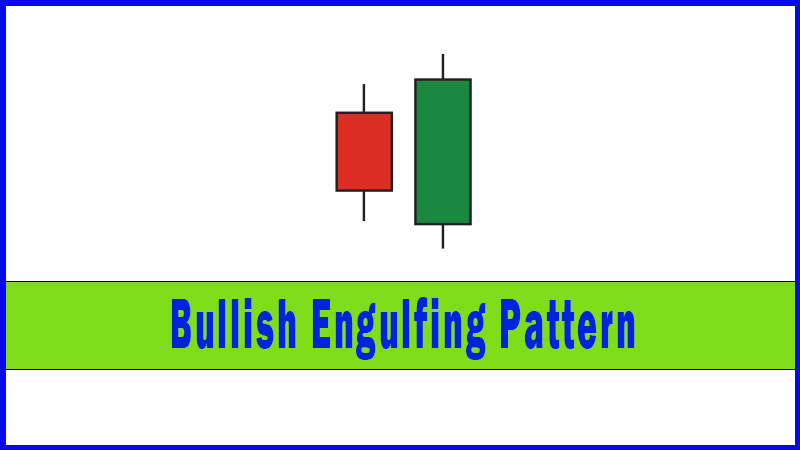

There’s

something else that can be said about the Diageo chart shown in Figure 4-14.

The second and third candles of the Evening Star also combine to form a

variation on a Bearish Engulfing Pattern. Although the real body of the first

candle (of the Engulfing Pattern, the middle candle of the Evening Star) wasn’t

open, the next candle certainly satisfied any criteria for being classed as

Engulfing. You may have noticed that I am sneaking into the text the idea of

adopting some flexibility into the reading of the charts and the patterns. This

is quite deliberate, although there are some observers (particularly the left

brain people) who would strongly disagree with this blurring of the lines.

To those

people I would ask the following question: in a real life situation would you

want to ignore a big sell-off day at a high like the one we can see in the

Diageo chart? This can be classed as an Evening Star, a Bearish Engulfing

Pattern, a Tweezer Top or a Bearish Belt Hold Line to name but a few!

Maybe

though, the point isn’t what we should call it, but what we would do about it

in a live situation, and whichever way you look at it, it wasn’t the best of

sessions for the bulls. It came right on a high, it was a big down day, and it

didn’t take long for the market to start to confirm it subsequently. If you

were long and you allowed the bearish candles to signal some lightening up of

your position, you would have been delighted. If you had sold the market short

after the formation of the pattern you would have only been showing a loss for

a short period of time during the subsequent session.

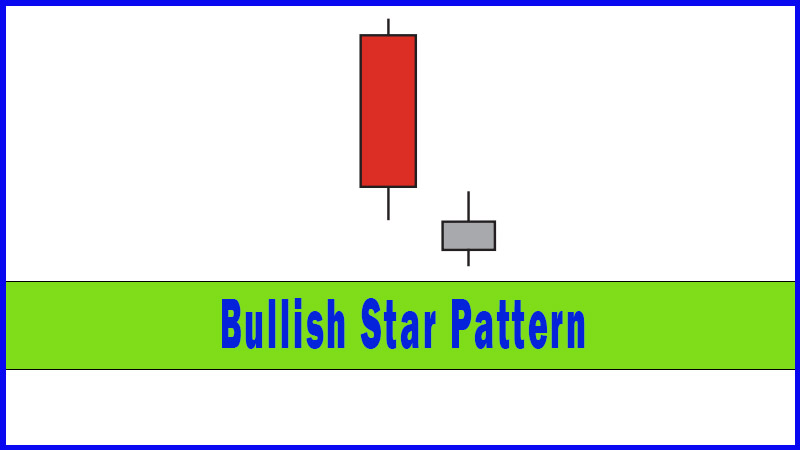

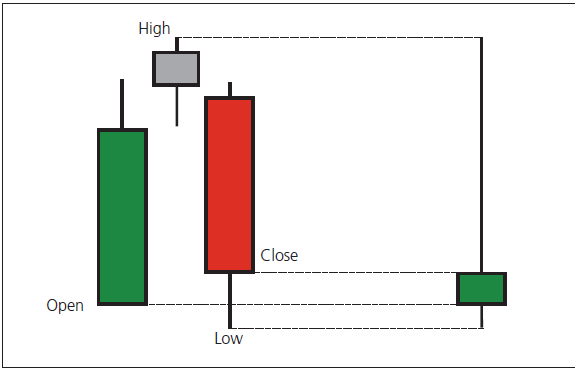

Merging candles

If you

are in a strong downtrend you will likely see a fair few big down days posted,

with large filled real bodies. If after one of these the market opens

significantly lower but then does nothing for the rest of the day, this lack of

reaction can be taken as a warning signal that the selling is stalling.

So we can

see that the Star patterns that work the best are the ones where there’s

confirmation subsequently, which sets the scene nicely for the next pair of

patterns: the Morning and Evening Stars.

Figure 4-15: Three candles that make up

an Evening Star, when merged together form a Shooting Star

Evening Star summary

An

Evening Star is a powerful reversal pattern seen in a rising market. It is

comprised of three candles. The first is a bullish day, the second is a Star

with indecision rife despite the early promise. This indecision turns into

outright bearishness on day three, which is why this is such a powerful

reversal, and so closely watched by the Japanese.

You may

have an idea where we’re going to go next on our trawl through the candlestick

patterns. What happens when a Bullish Star formation is backed up by a strong

day the next day? You’ve got it!

Uses of Candlestick Charts : Chapter 4. Multiple Reversal Patterns : Tag: Candlestick Pattern Trading, Forex : evening star candlestick, evening star candle, evening star candlestick pattern, evening doji star, morning star and evening star pattern - Evening Star Pattern