Low close Doji

How to trade doji candle, gravestone doji, dragonfly doji, doji candlestick, long legged doji, doji pattern, doji candlestick pattern, doji candle

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers ]

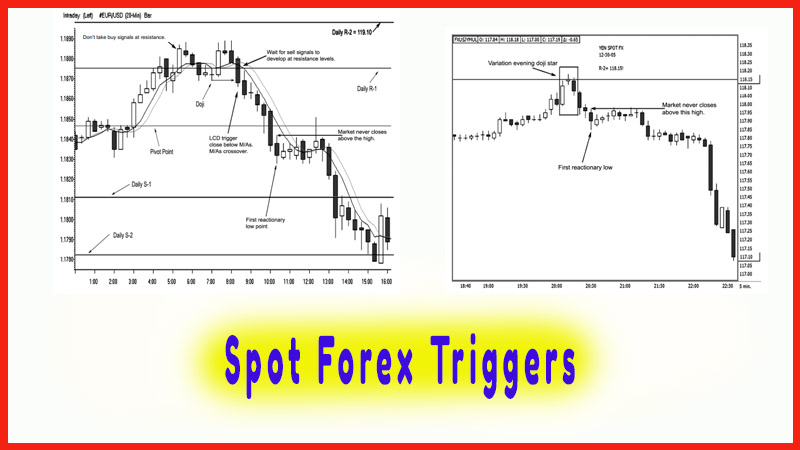

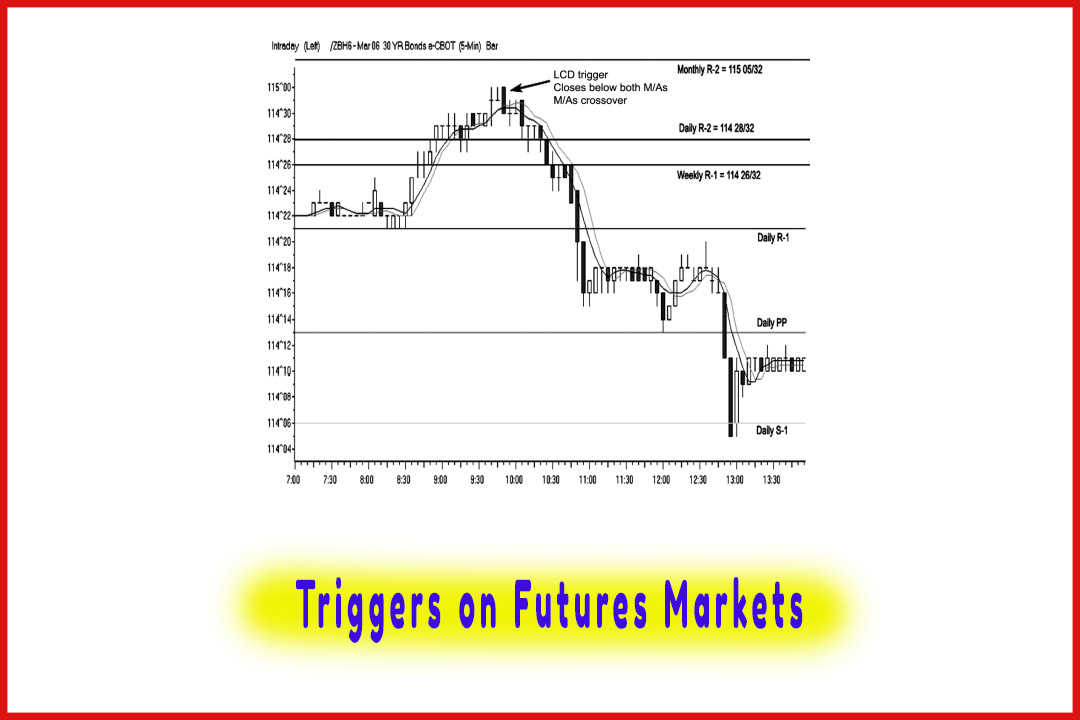

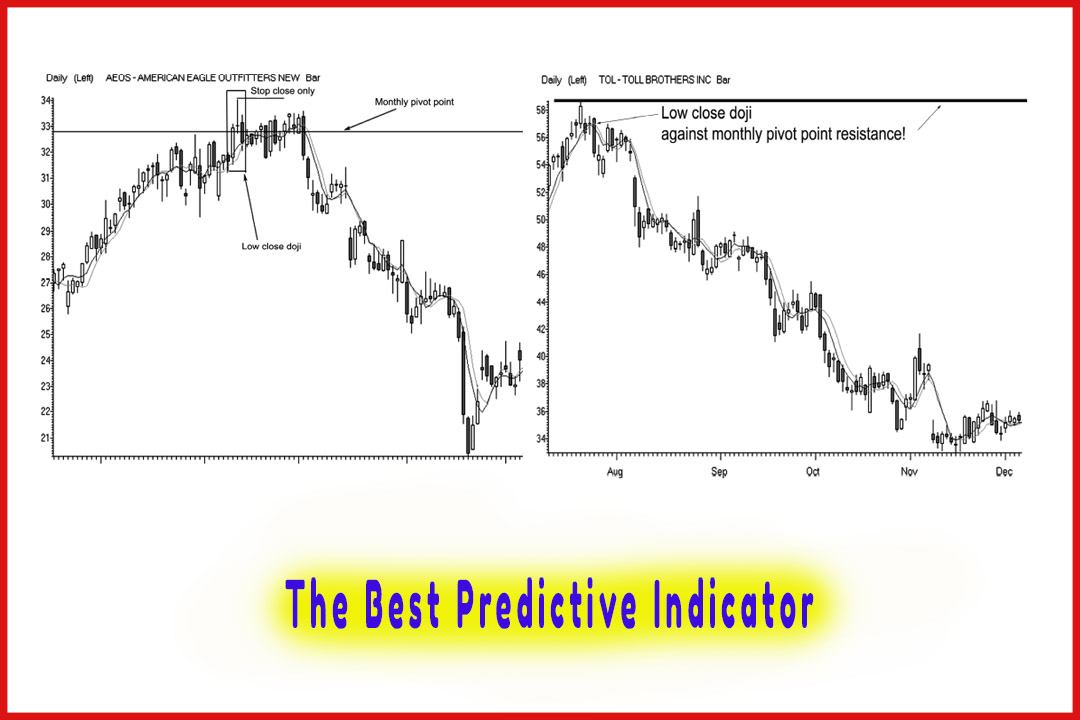

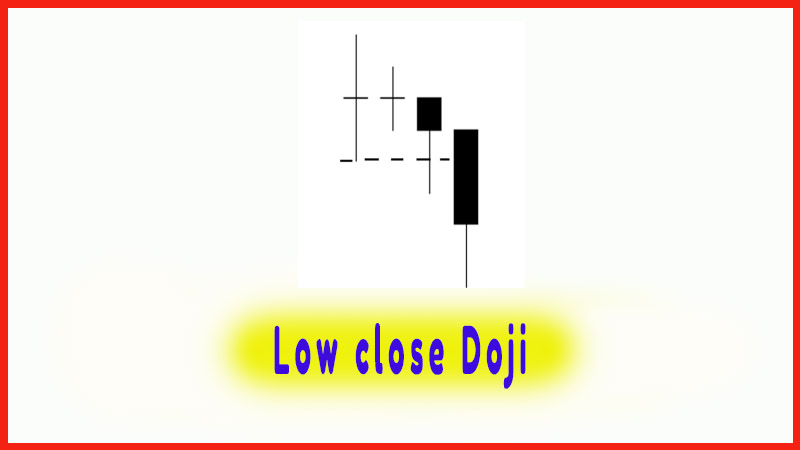

The next trading signal is the opposite of the high close doji. It is a setup developed on the premise that once the market has rallied and established a high, when a doji forms, it is indicating there is indecision; and once we establish a lower closing low below the doji’s low

LOW CLOSE DOJI

The next

trading signal is the opposite of the high close doji. It is a setup developed

on the premise that once the market has rallied and established a high, when a

doji forms, it is indicating there is indecision; and once we establish a lower

closing low below the doji’s low, as shown in Figure 8.16, which establishes

that there is a loss in bullish momentum, we can initiate a short position.

Characteristics

When the

market is in an extended trend to the upside and the market is overbought, a

doji appears, indicating indecision and weakness of buyers to maintain the

upward trend. Pay particular attention if the candle preceding the doji is a

tall white candle, which would be a two-candle pattern called a bearish harami

doji cross. Watch for increased volume, as this also confirms a blow-off-top

formation.

Trading Rules

When a doji appears, you should:

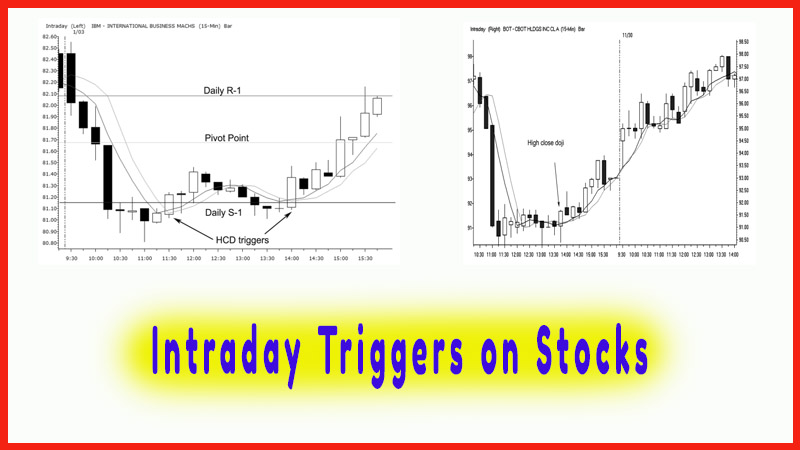

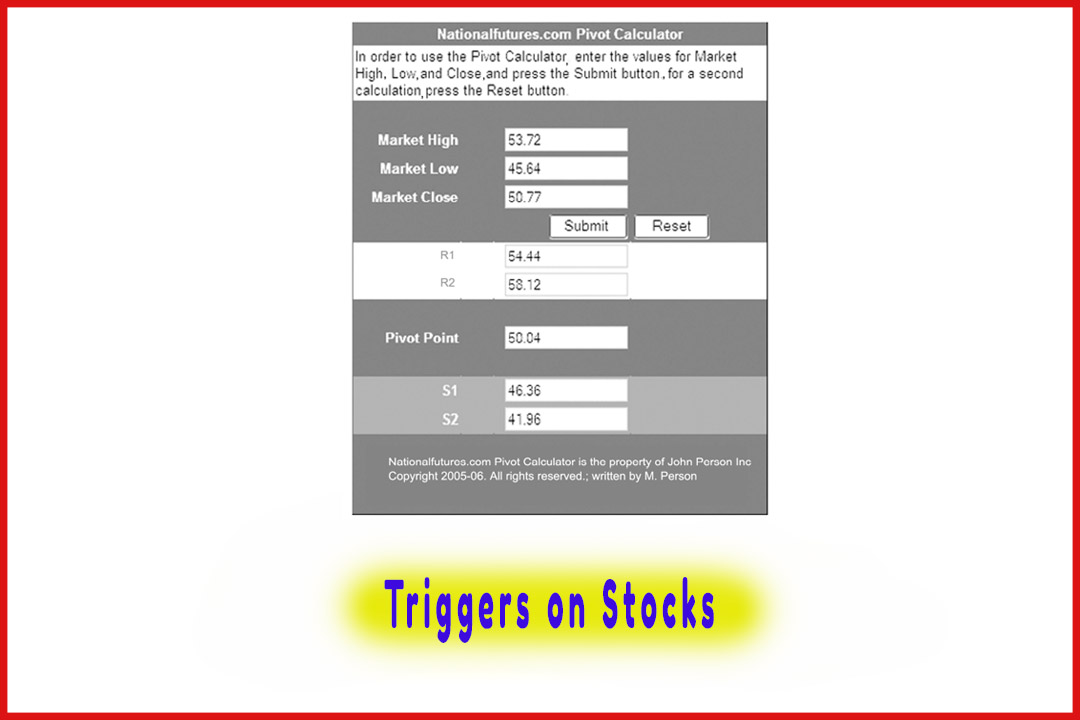

- Sell on the close or the next time period’s open once a new closing low is made from the previous time period’s doji’s low, especially when the market is against a key pivot point resistance target number.

- Place stops above the highest high point of the initial doji candle. Stops should be initially placed as a stop-close-only, meaning you do not exit the trade unless the market closes back above the doji’s high.

- Buy or exit on the open of the first candle after the previous candle makes a higher closing high than the previous candle.

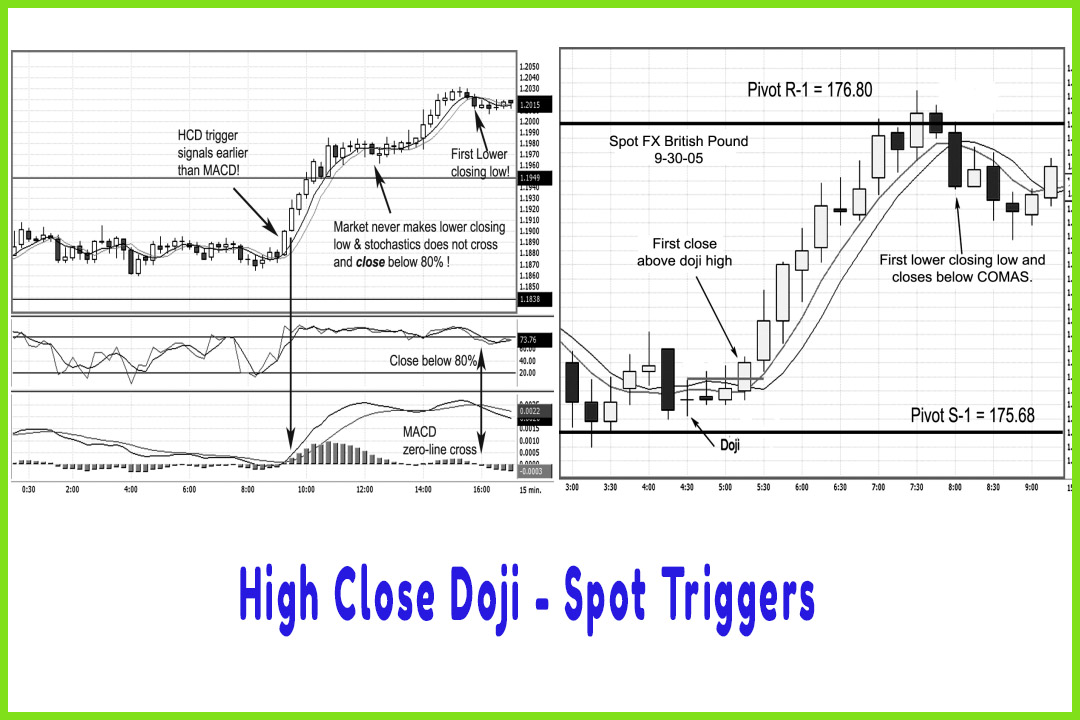

You can

use a filter confirming the signal, such as a bearish divergence stochastic or

MACD pattern.

Here is a

secondary guideline for the exit and risk management strategy. Get out of half

of your positions on the first shift in momentum, which in a low close doji

(LCD) trade would be after the initial trigger. The market moves in your favor;

and at times we see a consolidation period, similar to a bear flag formation.

Covering your shorts and booking profits on half of your positions will keep

you in a profitable position for the remainder of the trade. You initially

placed a stop-close-only; but for an intraday time period, this would have been

a mental stop-close-only because most order platforms do not have that feature

for day trading. As the market has moved in your favor, you can place a hard stop

above the doji high. There will be times when you have to make a judgment on

whether the risk is too excessive by the distance of the proposed entry and the

stop-close-only. Therefore, you may want to scale out of two-thirds of a

position at the first sign you see the trend lose momentum.

The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to trade doji candle, gravestone doji, dragonfly doji, doji candlestick, long legged doji, doji pattern, doji candlestick pattern, doji candle - Low close Doji