The Jack Hammer

hammer pattern, Best trading Pattern, Jack Hammer

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers ]

The jack hammer, however, develops in the middle to the end of the trading session. Usually immediately following the hammer is a bullish candle, or a marabuzo, a tall green positive (+) assigned candle.

THE JACK HAMMER

In

my experience, the one candle pattern that is associated or synonymous more

than any other with the word capitulation is the hammer as Figure 8.30 shows.

In Chapter 7, we identified the frequency or the percentage of times over a

course of the year on a 15-minute time interval when the hammer candle pattern

formed at or near the low of a given day. The jack hammer, however, develops in

the middle to the end of the trading session. Usually immediately following the

hammer is a bullish candle, or a marabuzo, a tall green positive (+) assigned

candle.

What

specifically describes the jackhammer? The jackhammer pattern is a hammer

candle, but it occurs in the middle to the end of a trading session. I call it

“the search and destroy” stop-loss order pattern. The general market

characteristics of this pattern starts off with the market establishing a low,

then consolidates or trades sideways for a bit, and then without warning sells

off abruptly. It is generally that particular sell-off that creates a hammer

pattern. Therefore, anyone who had intraday stops too close, under what is

considered the primary low for the day, got “bagged and tagged.” In other

words, stop-loss orders were elected, and longs were jacked out of their

positions and money—as in hit over the head with a billy club and “jacked”

(robbed).

Trading Rules Defined

The

jackhammer formation is an extremely powerful intraday reversal formation that

requires immediate action to enter a long position. The sequence of events that

occur for this pattern is:

- The hammer formed is a secondary low with the close at or near the primary low’s low.

- It does not matter whether the real body is formed with a higher close than open or positive assigned value; however, it is generally a more solid signal when the close is above the open.

- This action generally completes a bullish convergence in the stochastics or MACD oscillator.

- Buy on the close of the hammer or the next time periods’ open; initial risk is a regular stop below the hammer’s low.

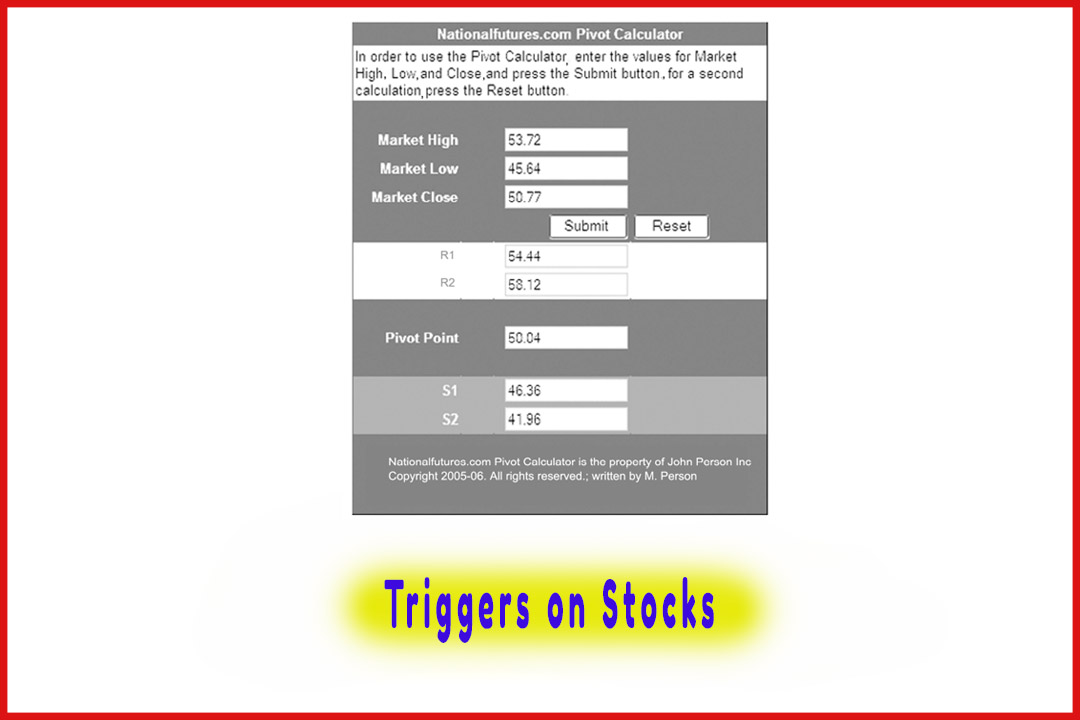

- Give additional importance if this pattern develops near pivot point support targets, especially if there is a confluence of pivot support targets from different time frames.

- Stock traders should watch for an increase or a volume spike, which indicates an exhaustion bottom is confirmed.

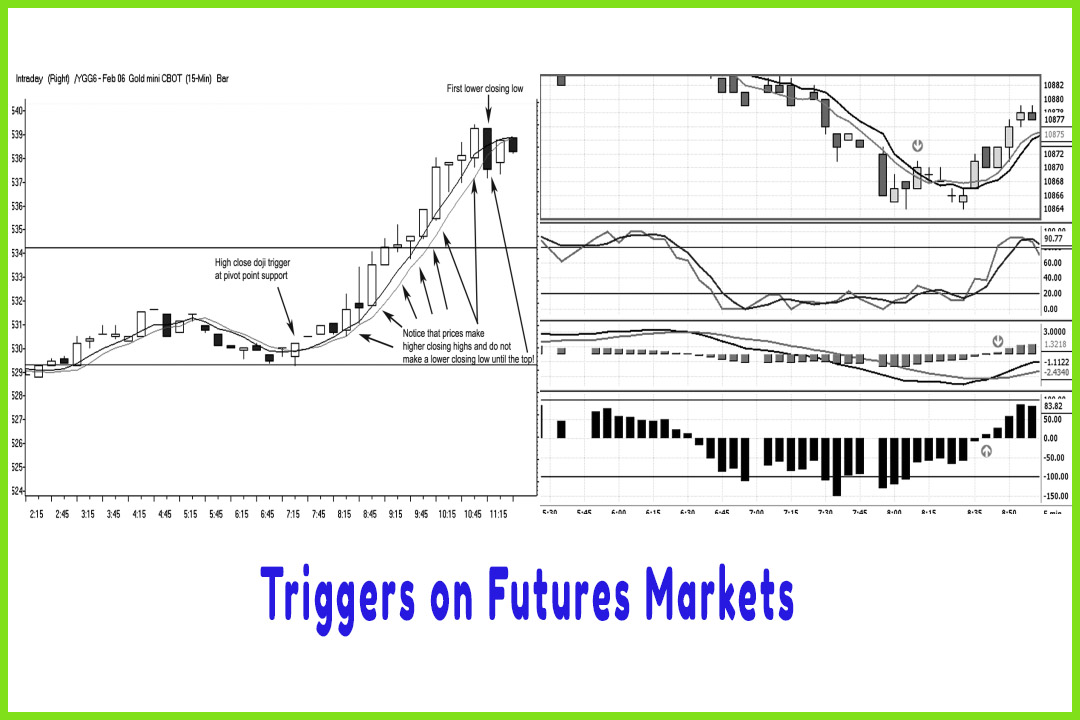

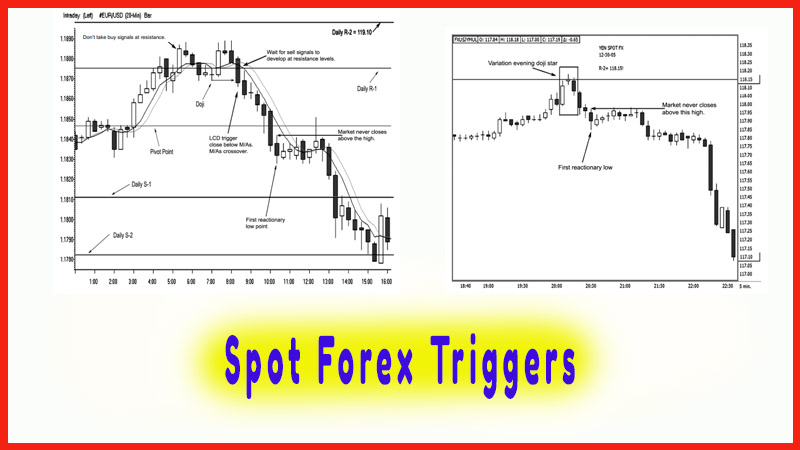

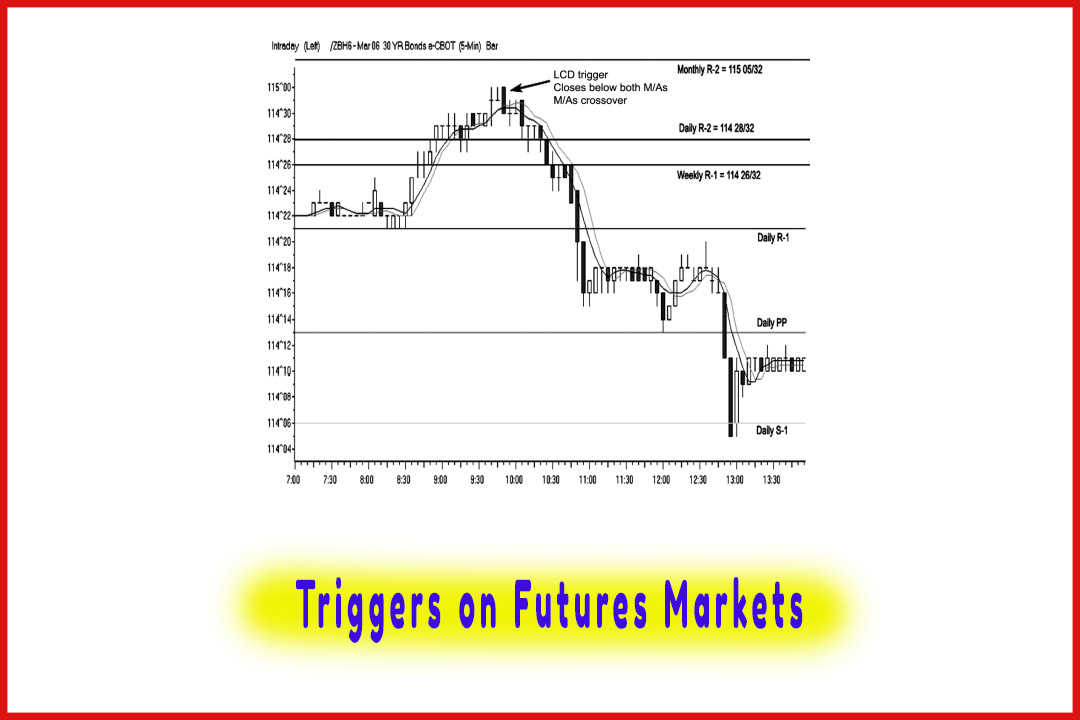

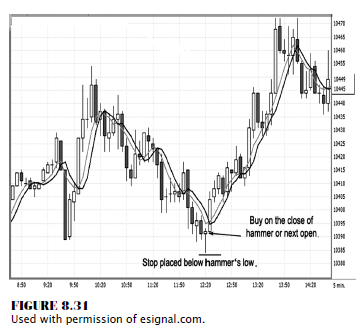

Figure

8.31 shows a 5-minute chart on the CBOT mini-Dow. Notice that the “midsession”

is defined by the middle of the day. The first intraday low has been

established, nearly three hours pass by, and the market makes a nosedive as

prices hit a new low for the trading session. In this example, the hammer

closes back within the primary low’s range. The trigger to go long is on the

hammer’s close or on the open once the hammer formation is confirmed.

Generally, the jackhammer is followed by a

blast-off secondary candle as prices surge ahead. What we also have happen is

that the market crosses above both moving average values, thus signalling

confirmation that this is a valid buy signal. The trigger to buy was at 10393;

as you can see, the market ran straight to 10473 before giving an LCD trigger

to exit at 10443 for a 50-point Dow move, or $250 per contract.

So far in

this book, I have given you several patterns that work well for great day

trading vehicles, such as the stock index futures contracts. The electronic

markets offer retail traders a competitive advantage because they can use a

home computer with a DSL or a broadband connection to integrate charting

software packages and equal access to markets. The stock index futures

contract, such as the mini-Dow contract, has what technical and fundamental

traders need: News-driven events and other technical trading market

participants both provide volatility and liquidity. Many of the chart examples

contained in these pages are a great representation of an average day’s trading

patterns. That’s not to say the other stock index markets, such as the

e-mini-S&P and the Russell, perform differently; they interact extremely

well with each other. In fact, at times I may have a trigger in the mini-Dow

and take the trade in the S&P, and vice versa. Most times, when the Dow

gives me a trigger, that is the market I will trade in. Consider that the

e-mini-S&P have an influence from the tech sector. Dow at times may or may

not have a similar dollar value move as the S&P. Both markets are great day

trading vehicles, as is the Russell. The Dow more times than not has more

distinct trading signals; for that reason, I have il-lustrated these setups

with using the Dow.

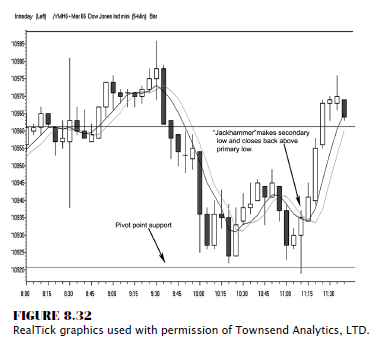

As

another example of spotting a jackhammer pattern, look at Figure 8.32, which is

another 5-minute chart in the Dow. Here you see the secondary low bounce right

off a pivot point support; and as the white or positive assigned values show,

the candles’ closes are above the opens and what is indicated immediately after

the hammer forms. Notice the immediate reaction of the market as the sequence

of higher highs, higher lows, and higher closing highs occurs. You can also see

confirmation of the buy signal with the moving averages crossing over and with

the second candle after the hammer is formed—it closes above both moving

average values. This is the confirmation that should give you the confidence to

maintain a long position. The stop is initially placed below the hammer’s low.

This should not be a stop-close-only as this setup should see an immediate positive

reaction. The trigger to go long here was at 10935; the first sign that the

bullish drive lost momentum was the lower closing low at 10965, which resulted

in a quick 30-point gain.

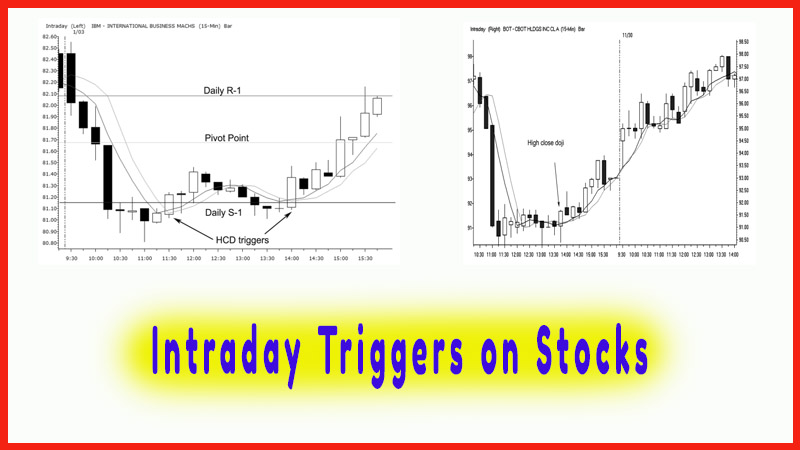

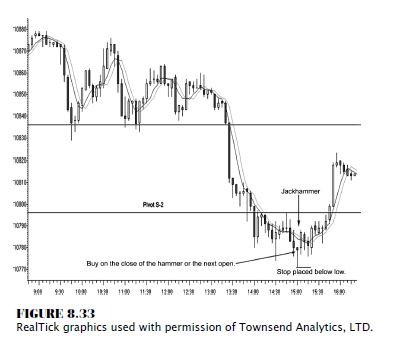

There are

times when we see this pattern late in the trading session. But keep in mind

that the CBOT Dow contract trades continuously until 4 p.m. (CT), whereas the

e-mini-S&P closes at 3:15 p.m. (CT) and reopens at 3:30 p.m. (CT).

This

offers day traders more time to play those short squeeze plays that tend to

occur toward the end of the day. More important, I covered why I do not look to

sell at support levels. These short squeeze plays occur as those who may have

sold at higher levels look to cover and take profits, as we see at certain times

when the secondary low was rejected, which is what the hammer represents.

Prices tend to move sharply higher in a very short period of time, signifying a

rejection of lower prices. It is that price action that shows buyers attracted

to the market, and bears start buying back or covering their shorts.

Therefore,

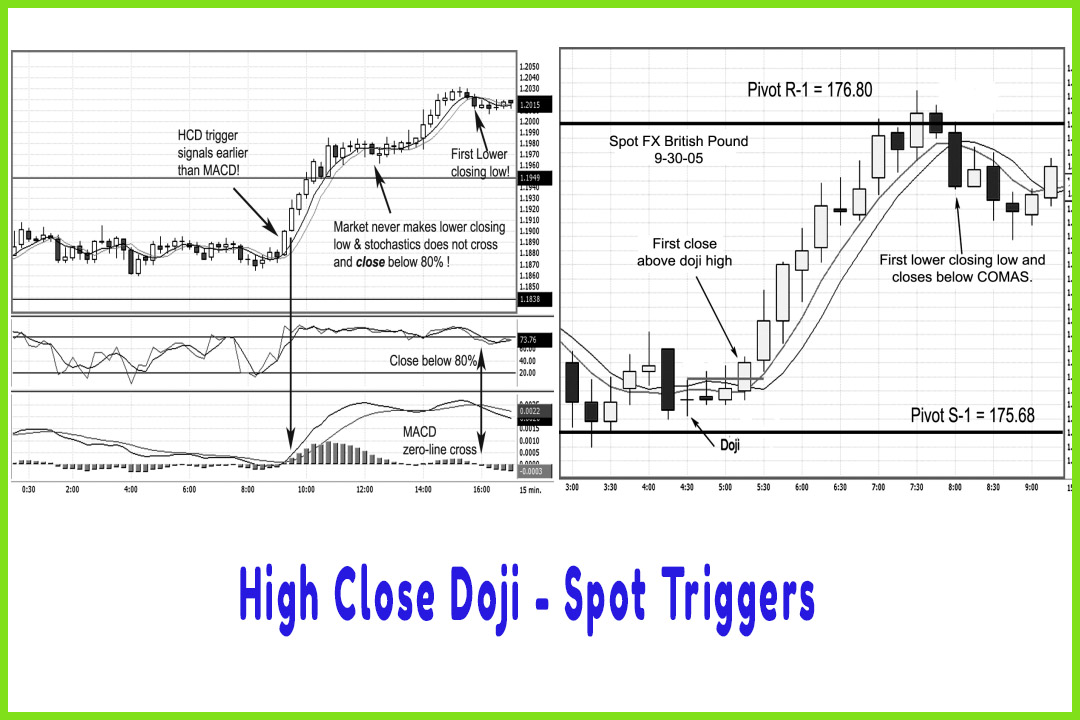

when you are looking for a pattern such as the high close doji or the

jackhammer in this situation, it is a more fruitful venture. One great example

is in Figure 8.33, where the jackhammer forms near the end of the session. The

trigger to go long was at 10784, which we see as almost an immediate reaction

for prices to move sharply higher to nearly 10830. This was another quick 40-point-plus

gain, or $200 per contract. Again, this does not sound like big money; but when

you consider that the day trading margin is $500 at most online brokerage

firms, that is a healthy percentage gain.

Trading Tips

- If the stop level is too great a distance, lower or reduce your contract size.

- Place hard stop below the low of the hammer candle.

- Scale out of positions when the market gives you a windfall profit, and move stops on balance of position above your entry price.

The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers : Tag: Candlestick Pattern Trading, Forex, Pivot Point : hammer pattern, Best trading Pattern, Jack Hammer - The Jack Hammer