The Best Predictive Indicator

Best signal predictive pattern, Best doji pattern, Best trading pattern

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers ]

The best predictive market analysis tool is the pivot point, especially when using the higher time periods, such as the monthly and weekly time frames. We did cover the power of confluence, which should never be ignored.

The Best Predictive Indicator

The best

predictive market analysis tool is the pivot point, especially when using the

higher time periods, such as the monthly and weekly time frames. We did cover

the power of confluence, which should never be ignored. Using the monthly time

frames, any investment vehicle like forex, futures, and stocks, especially

after a market starts to form a doji on a daily chart, is a sure sign that

there is a strong possibility that a price or trend change is about to occur.

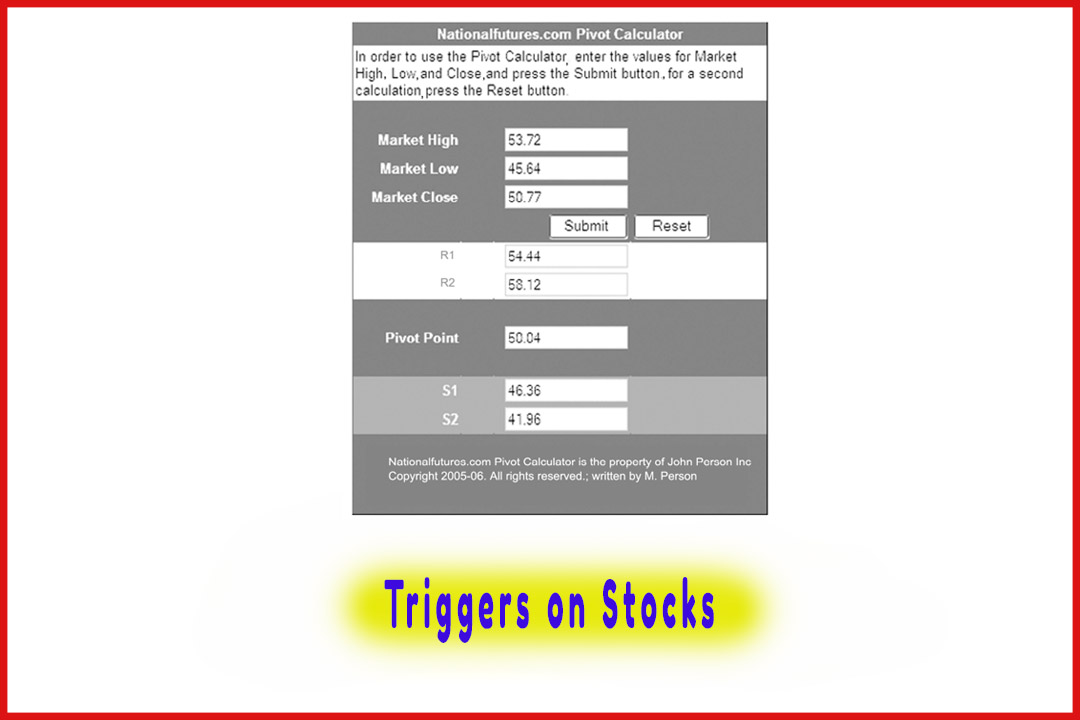

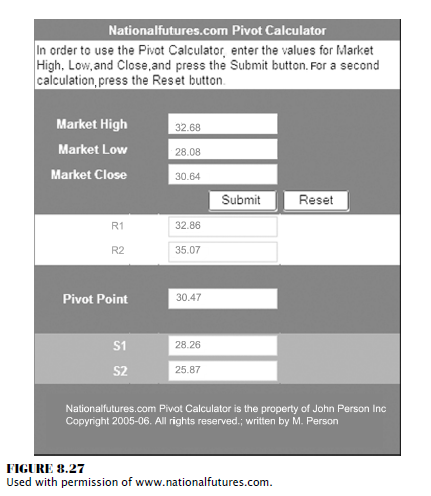

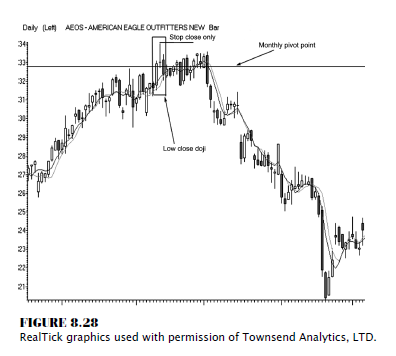

A great example of using this method to help

uncover a potential disaster in the stock of clothing retailer American Eagle

Outfitters was used in mid-July. Taking the trading data from June as shown in

Figure 8.27, the Pivot Point Calculator shows the monthly R-1 was 32.86 and the

R-2 was 35.07. The actual high was 34.04, right in the middle of the target resistance

levels.

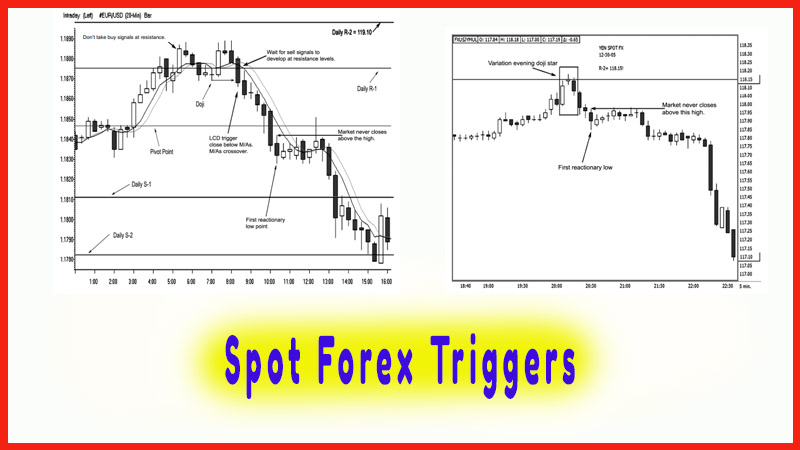

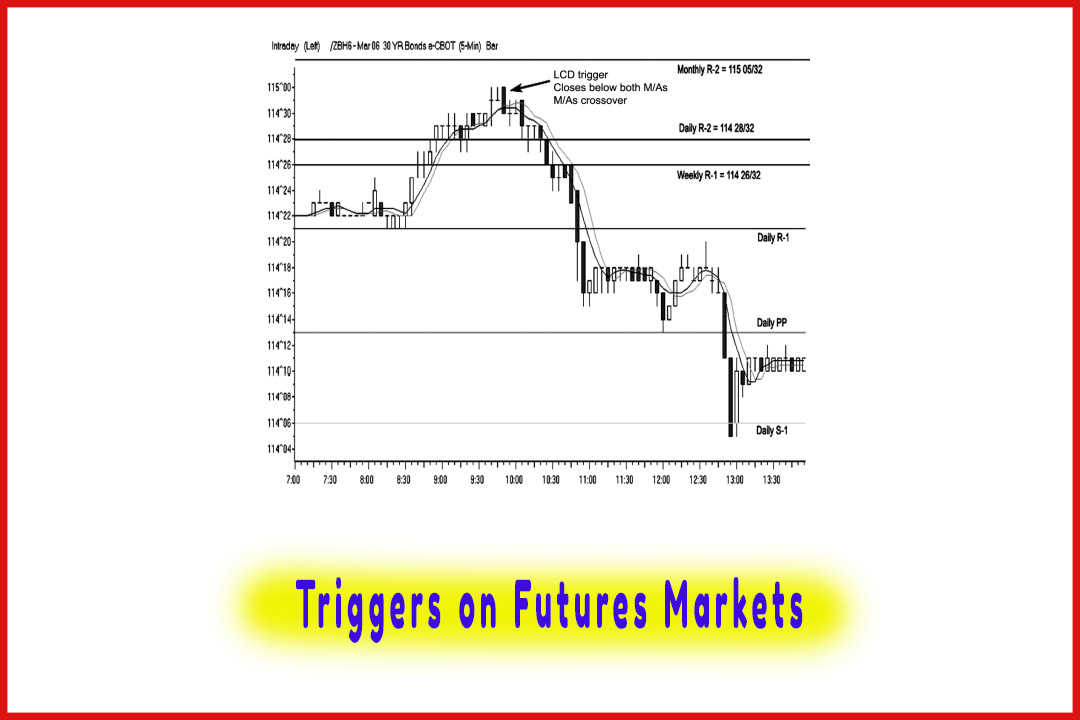

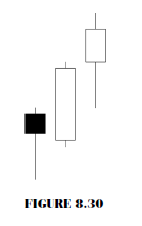

One thing

interesting here is that in Figure 8.28, the variation evening doji star does

create the low close doji setup and indicates that the bullish momentum, or

uptrend, had stopped. However, the market traded in a consolidation range for

two weeks before the trend reversal occurred. The trigger to go short was not

elected because there were two elements missing: (1) The market did not close

below both moving average values; (2) the shorter-term moving average did not

cross below the longer-term moving average. Those variables came later, as you

can see on the chart. But the fact is that the monthly pivot point kept the

market from establishing further gains; and the low close doji trigger was a

significant warning to exit longs, buy put options, or at least tighten stops

or move stop orders up to protect profits from long positions. The initiative

to sell short was also a very viable action. Using a stop-close-only above the

doji’s high, a trader would not have been knocked out of the short position at

any time.

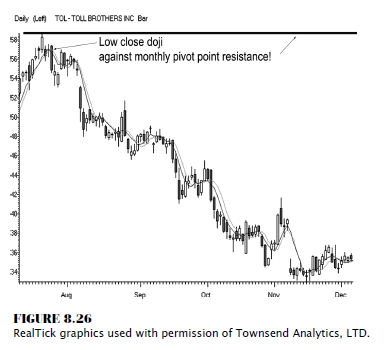

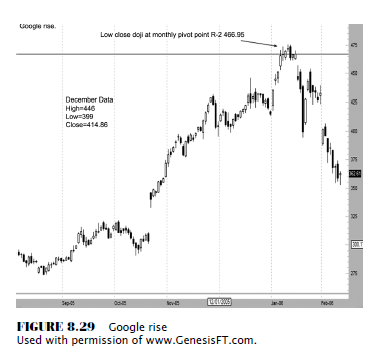

One of

the more popular stocks in 2005, which mystified traders as it made a

stratospheric rise, was Google. Figure 8.29 shows the price move that many

thought would never end. Stock analysts were making upgrades calling for 600

per share in the first week of January 2006, and some were claiming as high as

2000. As you can clearly see, the low close doji pattern foretold of the market

top; more important, it traded near the monthly R-2 resistance level of 466.95.

Once again, here was a high-profile stock that formed a major top with an LCD

trigger at a monthly pivot point target resistance number.

The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Best signal predictive pattern, Best doji pattern, Best trading pattern - The Best Predictive Indicator