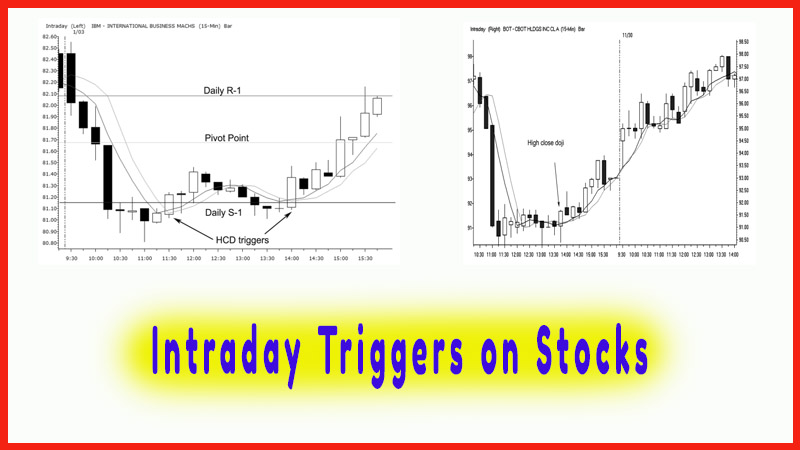

Triggers on Stocks

How to Triggers on Stocks, pivot point analysis, How to trade resistance target levels, How to identify doji pattern

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers ]

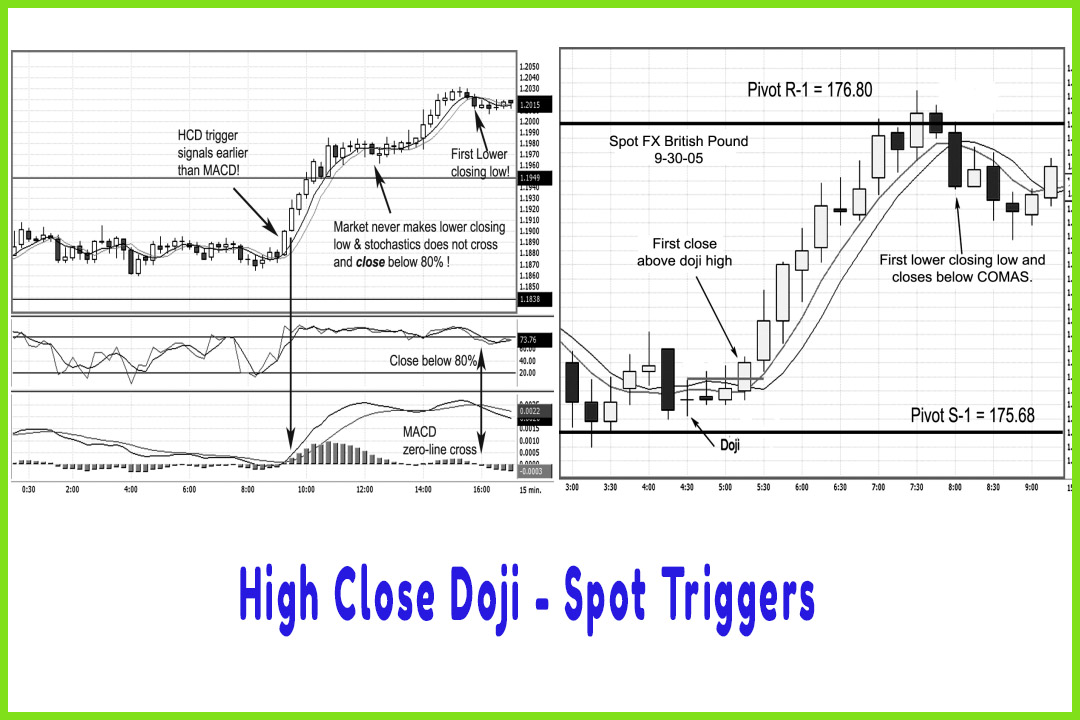

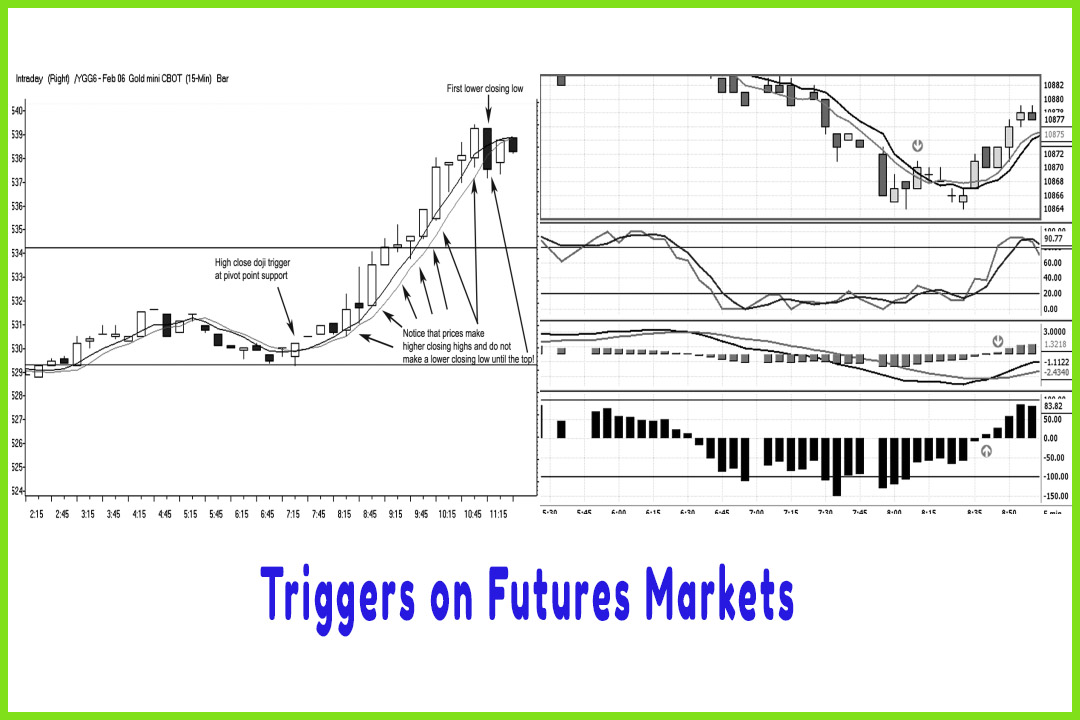

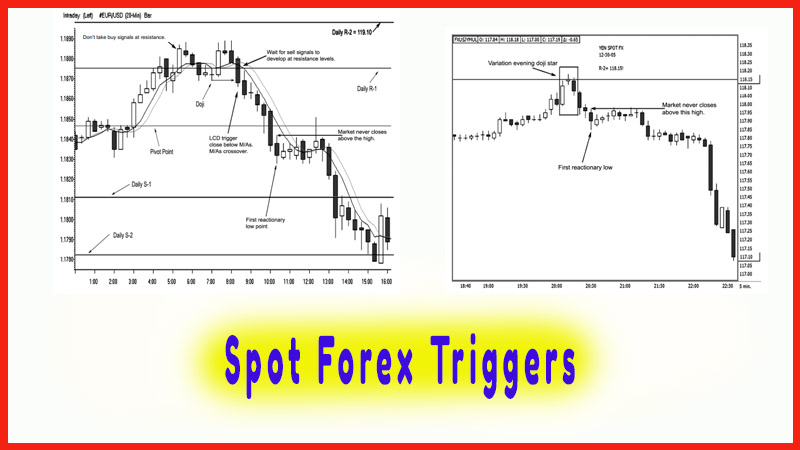

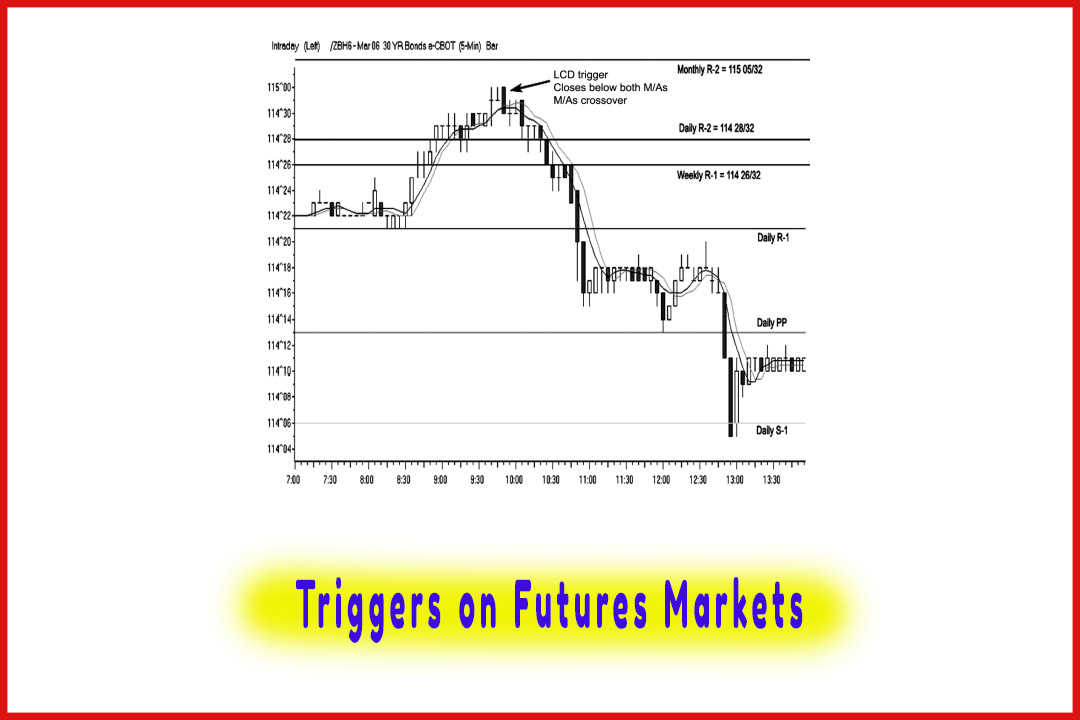

Pivot point calculations are and how the markets react to them. The resistance target levels are “hidden,” meaning you cannot see a projected high because it is not drawn from a past chart pattern; rather, it is derived from a mathematical calculation.

Triggers on Stocks

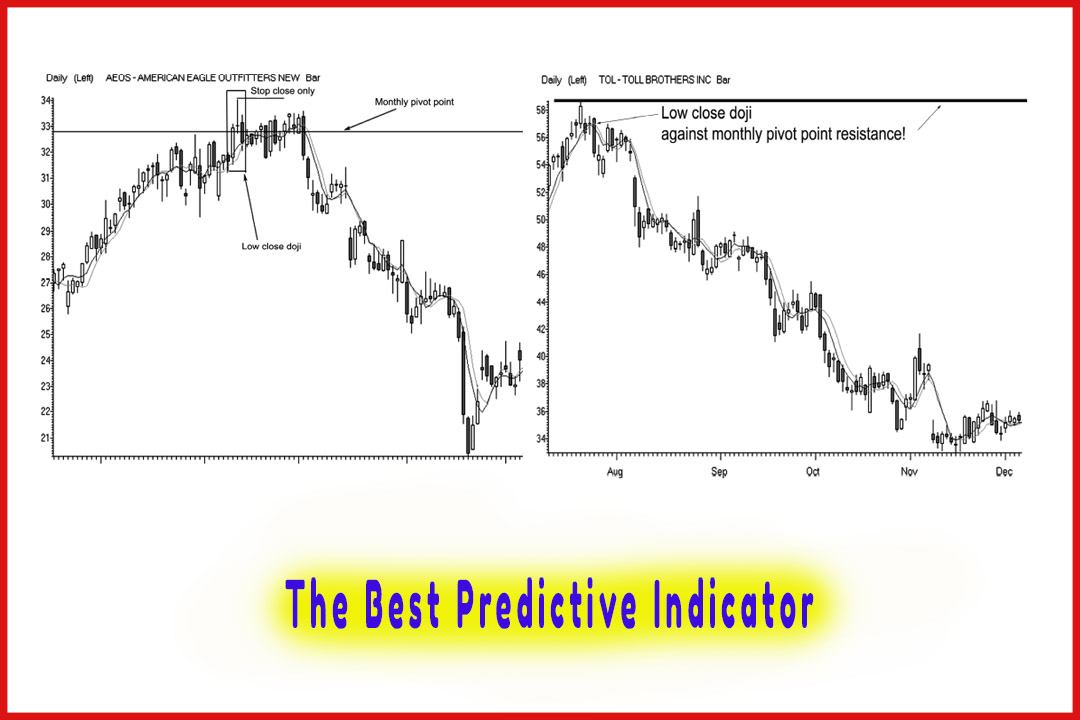

In

Chapter 1, I gave an example of how an exchange traded fund may not react as

much or at all compared to a stock in that group or sector. One such stock I

showed was in Figure 1.15—Toll Brothers. If you broke that monthly chart down

to a weekly and then a daily time frame and used the combination of the

techniques taught so far with pivot point analysis in conjunction with these

specific candle patterns, you would have been alerted to a top in the market in

the summer of 2005.

Why don’t

traders act on these signals? Most traders do not realize what pivot point

calculations are and how the markets react to them. The resistance target

levels are “hidden,” meaning you cannot see a projected high because

it is not drawn from a past chart pattern; rather, it is derived from a

mathematical calculation. This gives a projected price expansion on a

measured-increase based on the previous time period’s range according to the

pivot point formula. Using the monthly pivot point method, taking the trading

data for Toll Brothers from June would have helped predict the high for July.

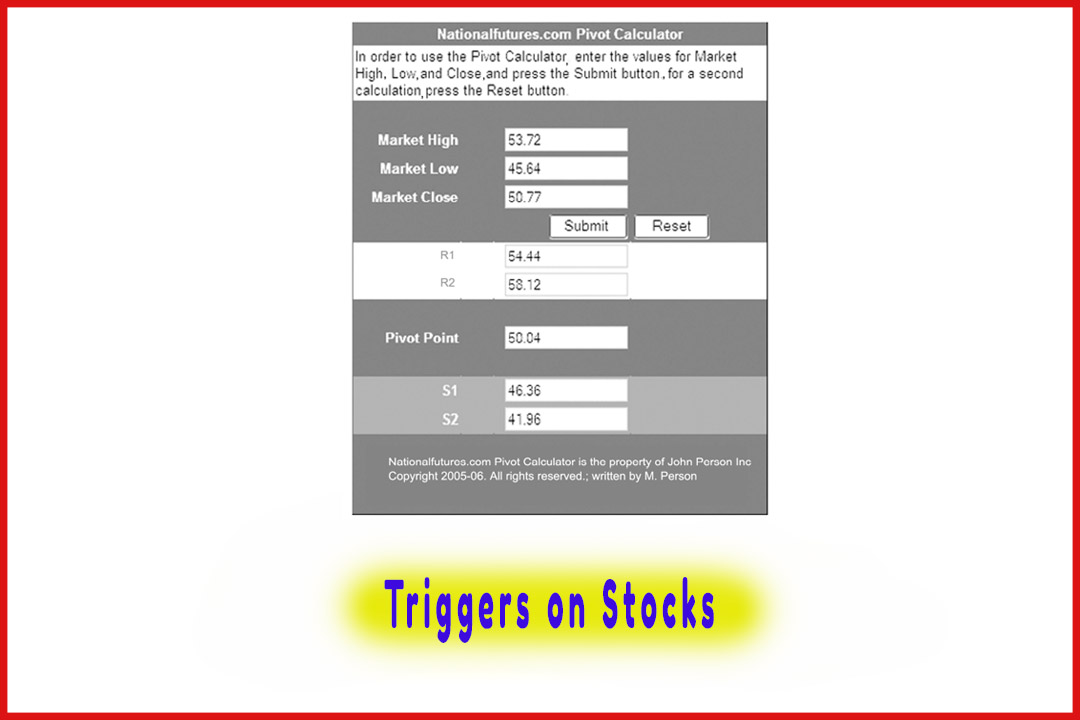

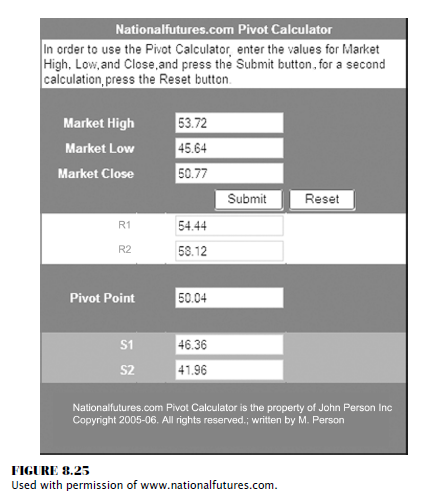

Figure 8.25 shows the Pivot Point Calculator with the high, the low, and the

close from the month of June. Notice that the R-2 target number was 58.12. The

exact high in July was 58.67!

The chart

in Figure 8.26 illustrates the low close doji trigger. In addition, we had the

moving averages cross over, and prices traded beneath both moving averages to

help confirm that the market had lost its bullish momentum.

To some

traders, the tall white candle at the top may have appeared to look like a

buying opportunity, especially as the market made a slight correction. The low

close doji against the longer-term monthly pivot point resistance told a

different story.

Identifying the doji at or near a pivot point

is a great guideline to alert you almost every time that there is a potential

price change or reversal coming. Once the market makes that lower closing low,

that is the trigger to sell. That will hold as a valid statement until the

market closes back above the doji’s high.

The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers : Tag: Candlestick Pattern Trading, Forex, Pivot Point : How to Triggers on Stocks, pivot point analysis, How to trade resistance target levels, How to identify doji pattern - Triggers on Stocks