Triggers on Futures Markets with Pivot Points

pivot point analysis, support and resistance levels, pivot point support, pivot point resistance, Spot Forex Triggers, bullish momentum

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers ]

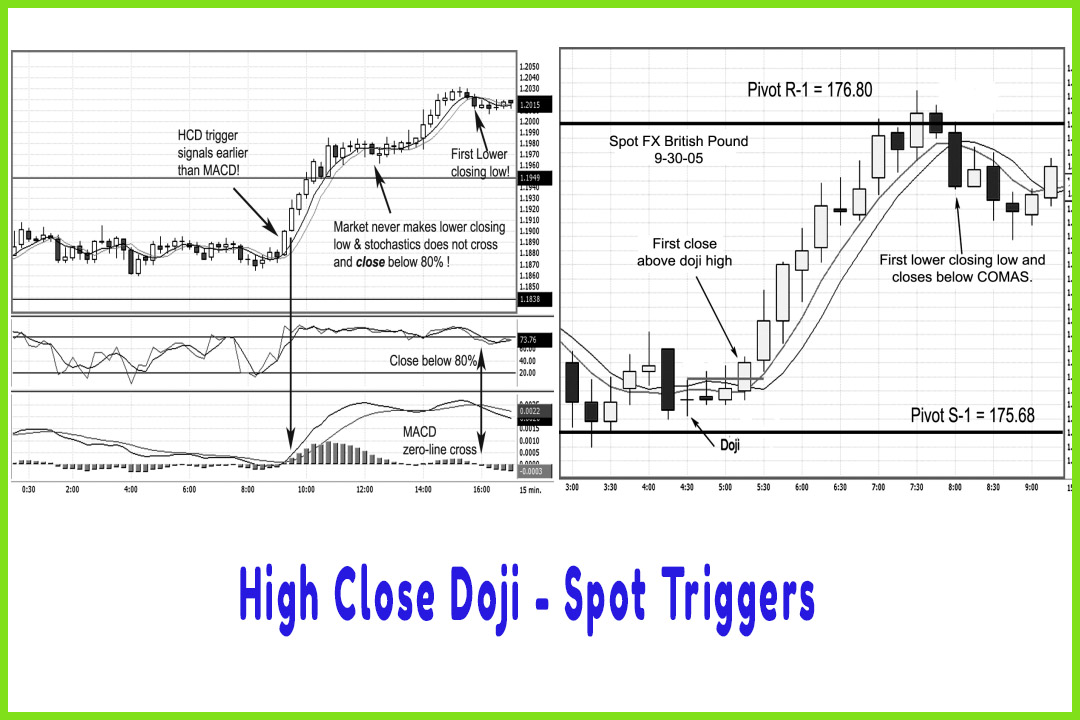

The trigger to go long is on the close of that time period or the next time frame’s open. If the market is to go into trend mode, which in this example it did, we should see the sequence of events unfold, such as higher highs, higher lows, and higher closing highs.

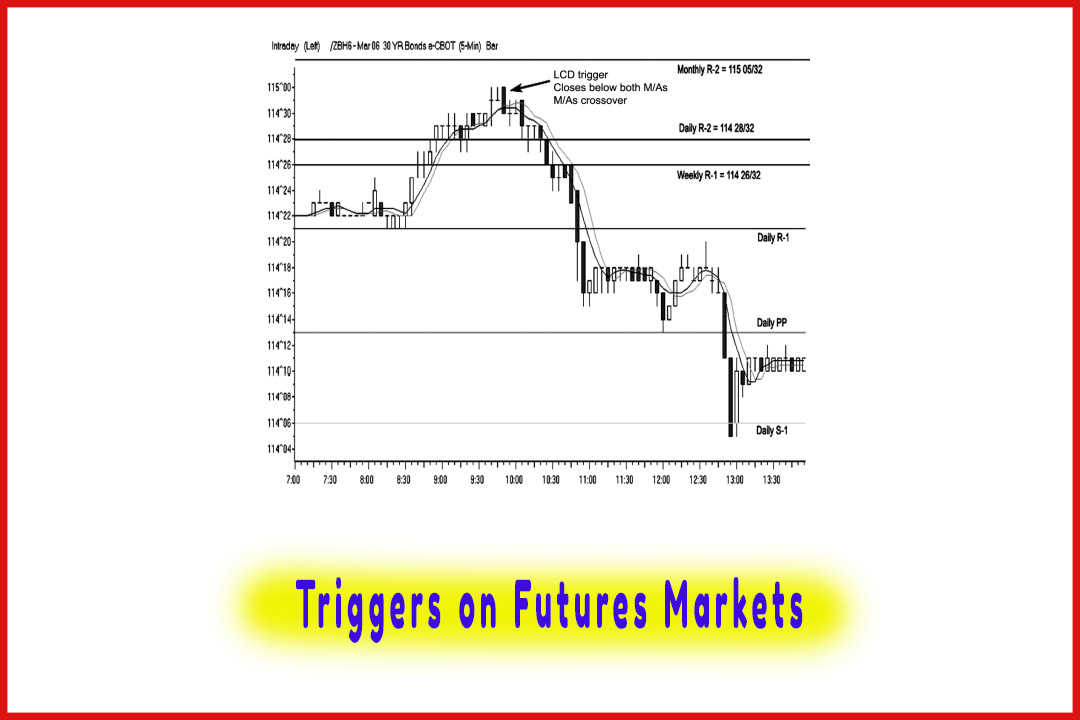

Triggers on Futures Markets

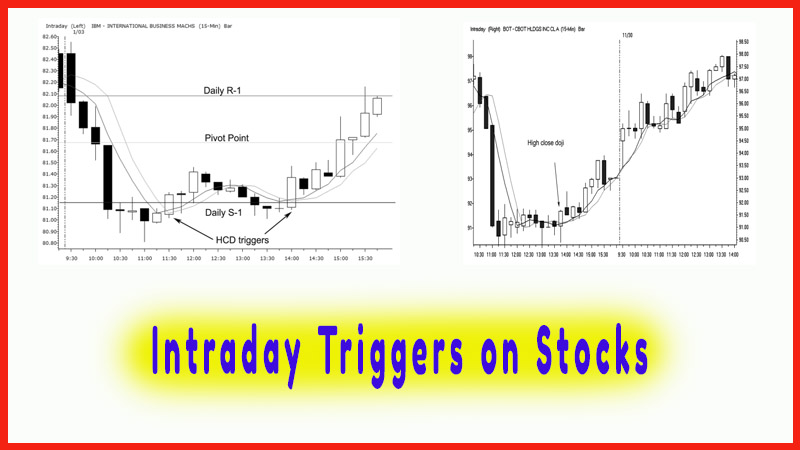

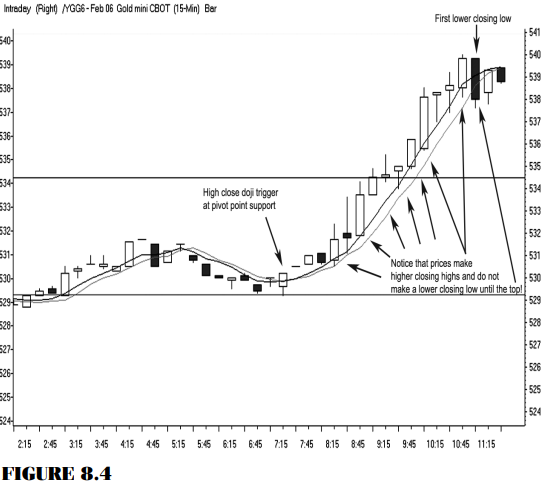

Let’s

tune our focus to the futures markets. Figure 8.4 shows a 15-minute chart on

the Chicago Board of Trade (CBOT) mini-gold contract. Notice the HCD trigger

and the small hammer like pattern that forms on the pivot point support. The

trigger to go long is on the close of that time period or the next time frame’s

open. If the market is to go into trend mode, which in this example it did, we

should see the sequence of events unfold, such as higher highs, higher lows,

and higher closing highs. As a day trader, your exit is at the least to be

calculated by the end of the day; but until the market makes the first lower

closing low near a key resistance level, you stay with the position or at least

scale out of partial positions at the first sign of a pause in the trending

condition.

The long

would be entered at 530.50, and the offset was triggered at 538. That would be

a $7.50 move per contract and would equate to $250 per contract.

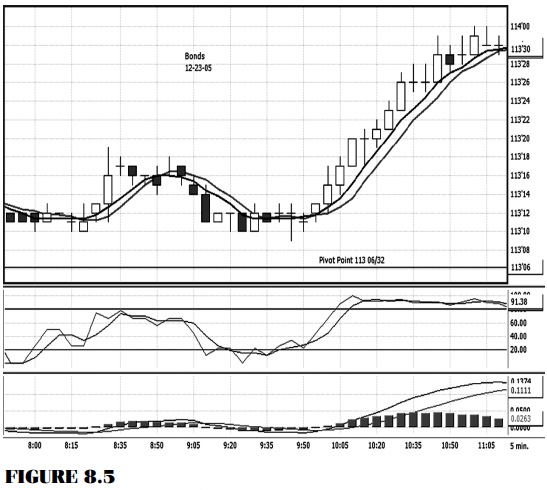

The

example in Figure 8.5 is on a five-minute chart. We see confirmation of an HCD

trigger with the fast stochastics closing back above the 20 percent line. Here

we have the same feature with higher highs, higher lows, and higher closing

highs. The trigger to go long here is 113%, and the trade was still going

strong until we see a series of dojis at the top.

In this

case, especially as a day trader, you may do several things: Liquidate your

longs at the last price, 1133032, which equates to a juicy profit per contract

of $468.75 (each tick in bonds is $31.25). You would look to get out because

you know, based on the research covered in Chapter 7, that dojis form the day’s

highs or lows in bonds a fair amount of the time; and that is what occurred in

this example. Then when you see a doji form after a nice trend run or near a

pivot, getting flat is good common sense. If you had multiple positions on, the

scaling out of half to two-thirds of them would be another alternative (Figure

8.6).

The trade

example in Figure 8.7 shows a 5-minute chart on the CBOT mini-Dow contract. The

daily pivot point support lines up at 10836. A doji forms; and the confirming

HCD trigger, which was initiated at 10846, develops. I have three identical

studies under the chart: (1) the fast stochastics, (2) the MACD study, and (3)

a commodity channel index (CCI) using a 14- period parameter setting. The

stochastics closes above the 20 percent line at the same time as the entry on

the HCD trigger; the MACD has not yet triggered a signal to go long, even as

the market soars to 10861. The CCI makes a zero-line cross signal, triggering

to buy or at least confirming that your long position is valid, but also late.

What is

important is studying how the indicators work and under-standing that if most

traders follow lagging indicators, by the time they see a bonafide buy signal,

you are already well on your way to profits.

This signal gets you 15 points ahead of the

crowd, or $75 per contract. That might be not much money; but on a day trade

margin of $500, that is a 15 percent return and gives you a leading edge over

the competition.

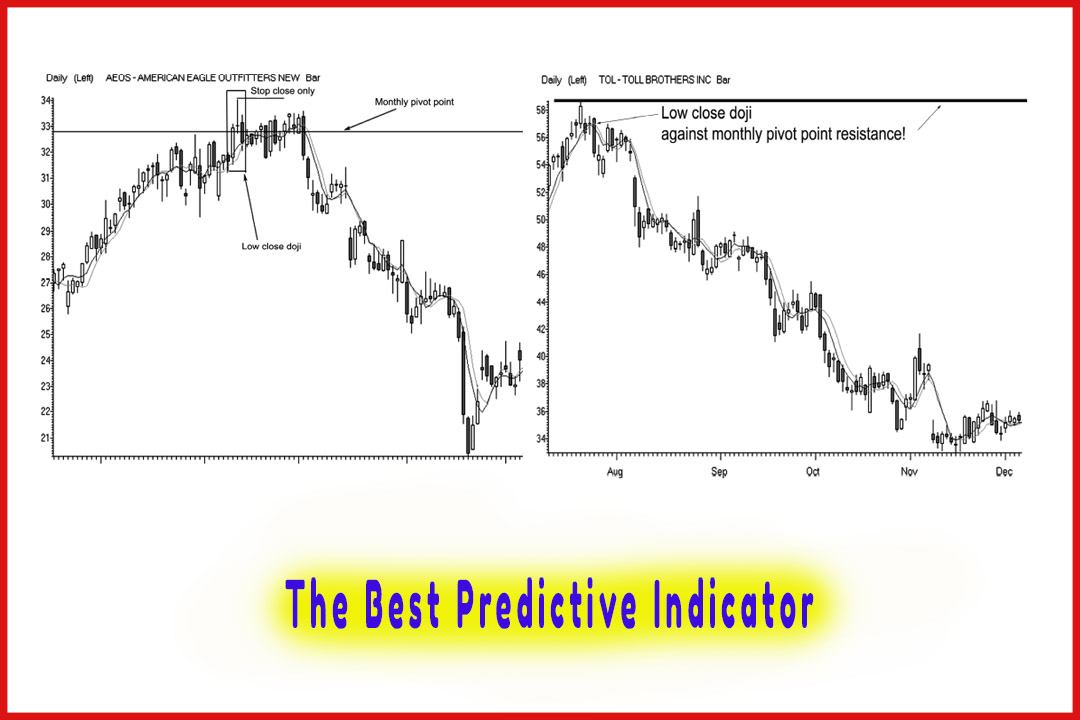

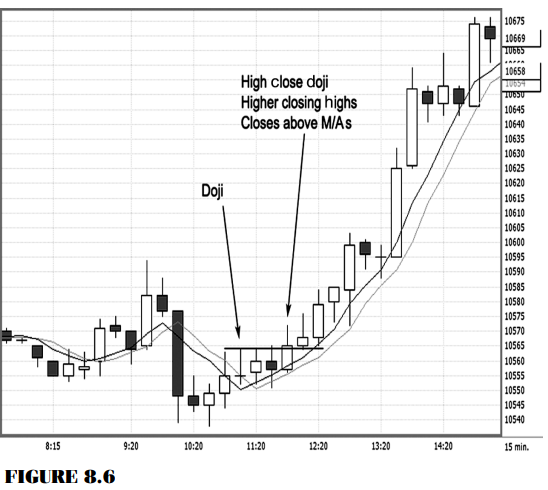

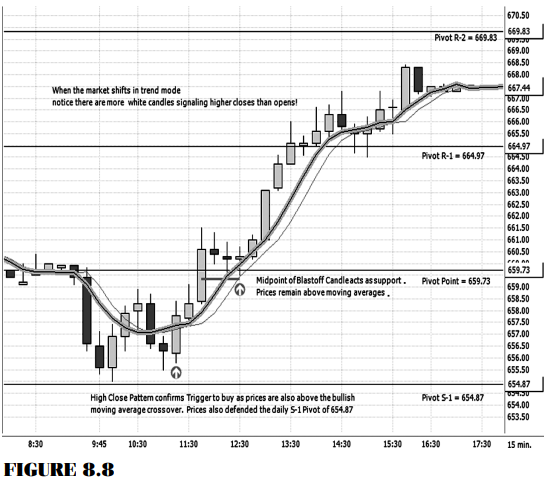

Besides

the mini-Dow, Standard & Poor’s (S&P), and the Nasdaq, there is the

Russell 2000 contract, which had a tremendous run in 2005 and early 2006. This

stock index contract responds well with the high close doji triggers combined

with the COMAS method. Remember that we do not see a bona fide doji appear all

the time; for example, when the close is not at the exact same price as the

open. A doji can assume the shape of a spinning top pattern as well, which is

why I use my judgment to determine if the close is less than 8 percent or so of

the overall range. I do consider the psychological aspect of the creation of

the doji candle pattern. After all, even a spinning top after a downtrend

indicates indecision; so a higher assigned value or a higher closing high takes

on the same meaning as a high close doji. Also confirming a trigger to go long,

as the example in Figure 8.8 shows, is seeing the HCD form at or come near to

the pivot point support level and then look for a close above both moving

average components. In addition, the shorter-term moving average crosses above

the pivot point average, confirming a conditional bullish change in the market.

A trigger

to enter a long was established on the close above the spinning top pattern or

the open of the next period, which was at 658.00; and as you can see, higher

highs, higher lows, and higher closing highs developed. Examine the market’s

behavior at the R-1 target resistance level: The market simply paused, but yet

still closed above the R-1 price resistance level. After it penetrated the R-1

level, the market consolidated but still maintained a bullish bias be-cause the

market did not confirm an exit signal by simultaneously establishing three

criteria:

- A close below a prior low.

- The moving averages that did not cross and close below each other.

- A price that did not close below both moving average values.

Fractal Relationships

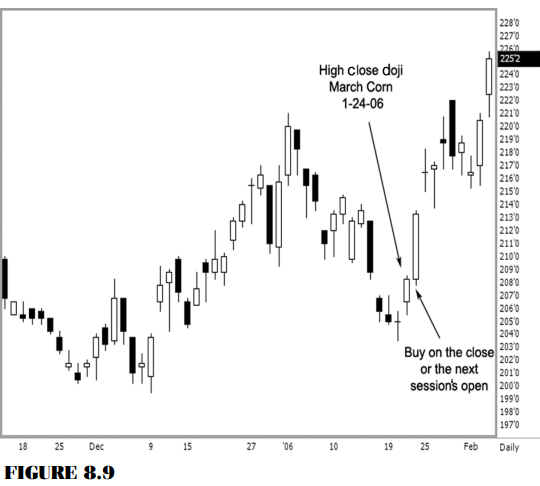

In Figure

8.9, I want to dissect a daily chart to see what the intraday pattern looked

like, as the daily chart formed a textbook high close doji trigger. The trigger

to go long was at 208.25, on the close of business on January 24 or on the open

on January 25. This example really highlights a fractal relationship as one

time period interacts with another.

My

favorite time period for intraday trading is the 15-minute time period because

it is divisible by 3, a relatively important number in the field of technical

analysis. More important, it is an extremely relevant time period to the grain

complex: Since the market opens at 9:30 a.m. (CT) and closes at 1:15 p.m. (CT)

there are 15 complete 15-minute time periods to trade.

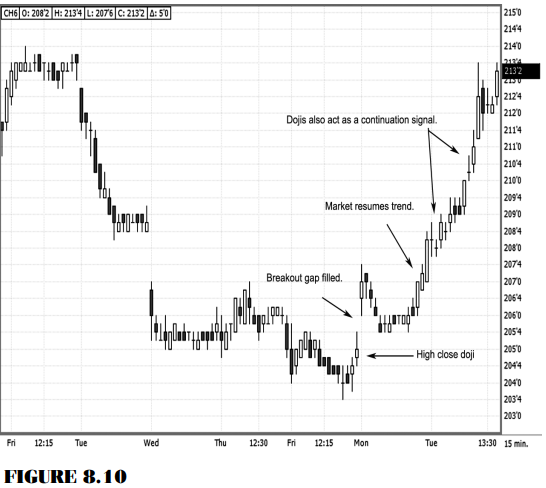

Coincidentally,

the day the doji formed on an end-of-day chart as shown in Figure 8.9, we see

that a high close doji pattern formed on the intraday chart on a 15-minute time

period as well. Therefore, we sometimes see this pattern develop on smaller

time periods, such as the 15-minute period for end-of-day patterns for added

confirmation. Figure 8.10 shows the 15-minute chart for corn on January 24, the

day the doji formed. This is a great example of what a fractal relationship is

with trading signals.

As you

look at the 15-minute chart, we see a nice bullish run, complete with the

sequence of events we like when in a long position: higher highs, higher lows,

and higher closing highs. Quite a sweet setup—no pressure— no hassle—the way

trading should be all the time!

The Candlestick and Pivot Point Trading Triggers : Chapter 8. Setups and Triggers : Tag: Candlestick Pattern Trading, Forex, Pivot Point : pivot point analysis, support and resistance levels, pivot point support, pivot point resistance, Spot Forex Triggers, bullish momentum - Triggers on Futures Markets with Pivot Points