Kicker Signal Pattern

Bear Kicker, Bull Kicker, Kicker signal, bearish signals, kicker signal candlestick patterns, bullish kicker signal, Bearish kicker signal

Course: [ How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals ]

he Kicker signal is the strongest signal of all the major signals. It demonstrates a dramatic change in investor sentiment. Some occurrence caused a violent change in the direction of price.

KICKER SIGNAL (Keri Ashi)

Description

The Kicker signal is the strongest signal of all the major

signals. It

demonstrates a dramatic change in investor sentiment. Some occurrence caused a

violent change in the direction of price. Usually, a surprise news item or a

major world/ sector event is the cause of this type of move. The signal

illustrates such a dramatic change in the current direction that the new

direction will persist with strength for a good while. On a daily chart, that

time frame is usually two to three weeks.

While the

entry strategy after most bullish or bearish signals requires confirmed buying

or selling, the Kicker signal does not require confirmation. The magnitude of

the reversal resulting from a Kicker signal does not preclude some immediate

profit taking. Even on a pullback, after a Kicker signal has altered the trend,

it is usually safe to buy after a Bull Kicker or to sell into buying strength

after a Bear Kicker. The Kicker Signal works equally well in both directions.

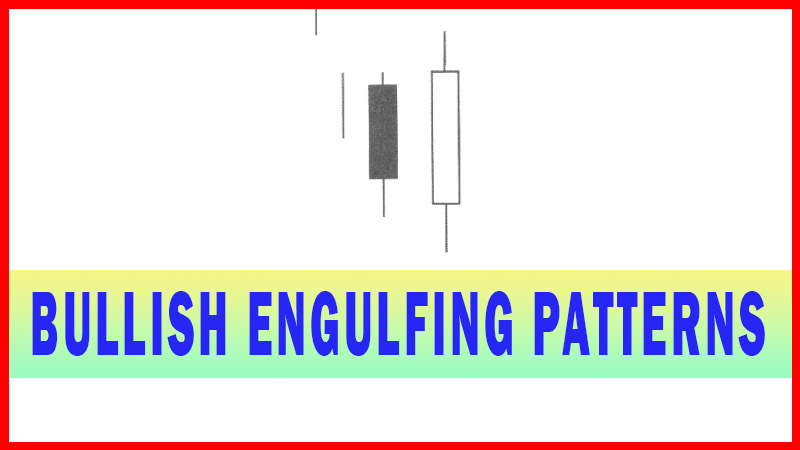

The occurrence of a Kicker Signal in an overbought or oversold condition

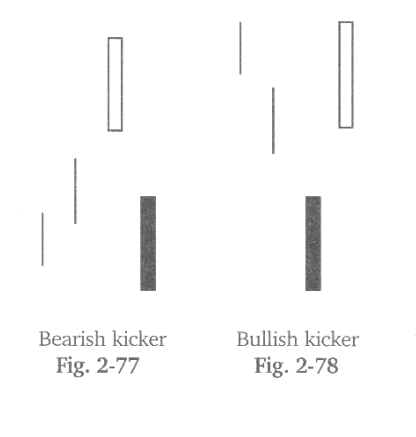

magnifies its relevance. It is formed by two candles. The first candle opens

and moves in the direction of the current trend. The second candle opens at the

same open of the previous day, a gap open, and continues in the opposite

direction of the previous day’s candle. The bodies of the candles are opposite

colors. This formation is indicative of a dramatic change in investor

sentiment. The candlesticks visually depict the magnitude of the change.

There is

one caveat to this signal. If the next day prices gap back the other way,

liquidate the trade immediately This does not happen very often, but when it

does, get out immediately. This usually means the event, which caused the

Kicker signal, has been corrected.

A Kicker

signal can also be created by a change of recommendation by a major brokerage

firm. Although the announcement has created the signal, usually the strength

in that scenario may not be as relevant. Be more diligent in watching for

selling indicators to occur. The uptrend may not possess as much strength as a

signal created by announcements or events that would change the fundamental outlook.

Criteria

1.

The first day’s open and the

second day’s open are the same or gaps beyond the previous open.. The price

movement is in opposite directions from the opening price.

2.

The trend has no relevance in a

kicker situation.

3.

The signal is usually formed by

surprise news before or after market hours.

4.

The price never retraces into the

previous day’s trading range.

Signal Enhancements

1.

The longer the candles, the more

dramatic the price reversal.

2.

Opening from yesterdays close to

yesterday’s open already is a gap. Additionally, gapping away from the

previous day’s open further enhances the reversal.

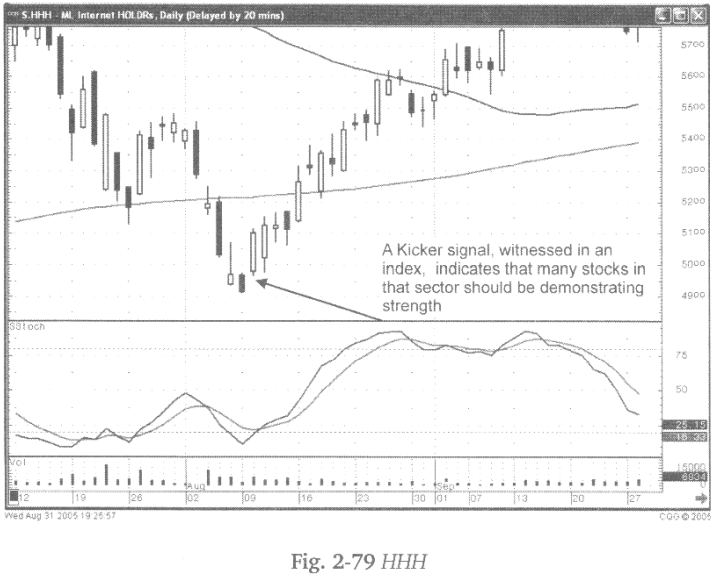

Witnessing

a Kicker signal in an index provides valuable information. Something has

happened in an industry/sector that is going to affect a number of stocks

participating in that index. Whatever news or event causing the Kicker signal

will make bullish signals in individual stocks in that sector that much more

effective. As viewed in Fig. 2-79, the Merrill Lynch Internet Holdings index

(HHH), a Kicker signal in oversold condition indicated the entire sector had

information that will affect a number of stocks.

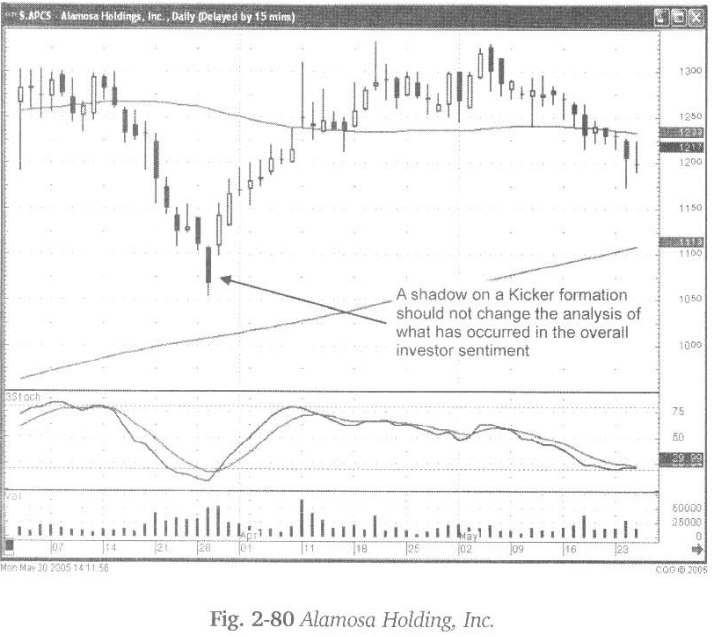

The true

Kicker signal does not have shadows on the body. The gap in price, going in the

opposite direction, should open and immediately move away from the previous

candle. However, the presence of a shadow should not negate the overall

analysis of the signal.

Even when

a shadow appears on the new candle, such as in Fig. 2-80, the Alamosa Holdings

Inc. chart, the result should still be obvious. The investor sentiment has

changed dramatically. The shadow at the bottom of the bullish candle should not

deter from the analysis that an uptrend should be starting with force.

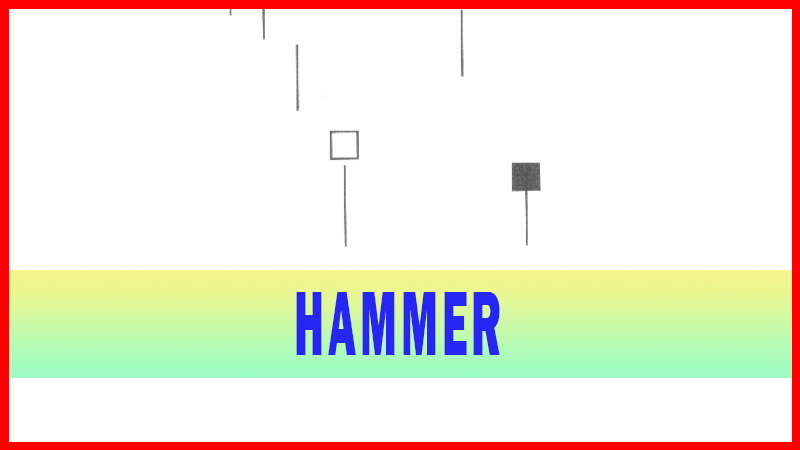

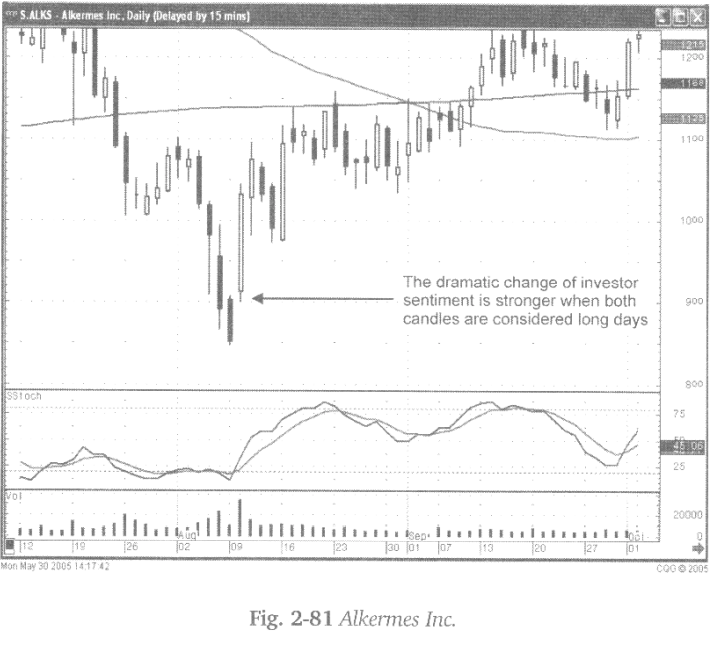

The

signal is considered more effective when the bodies are both long bodies. A

long body formation to the downside illustrates strong investor sentiment in

the bearish direction. A long body bullish candle now has double connotation.

First, the price had to gap up the full length of the black body candle.

Secondly, once that gap up occurred, the buying force was shown to have continued

with strength.

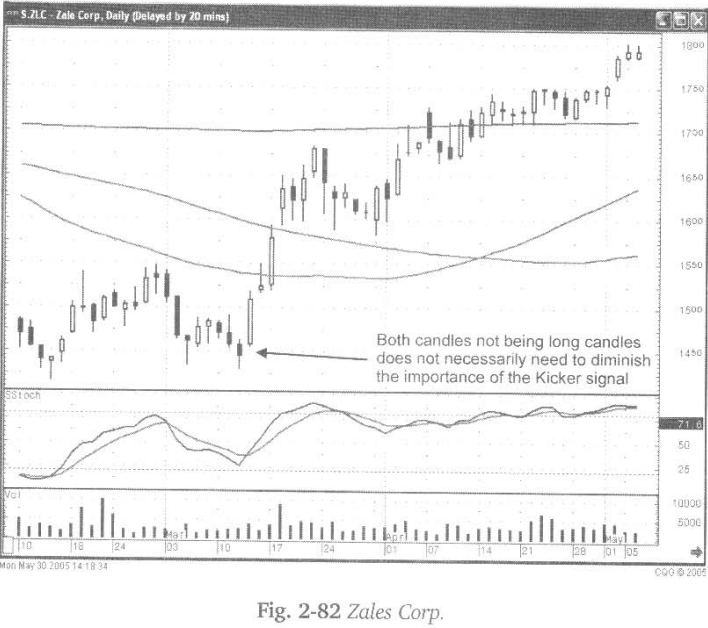

The effect

of a Kicker signal should not be disregarded if one of the two bodies forming a

signal is smaller than the other. The result remains the same.

The

investor sentiment made the price gap in the other direction and proceeded in

that opposite direction.

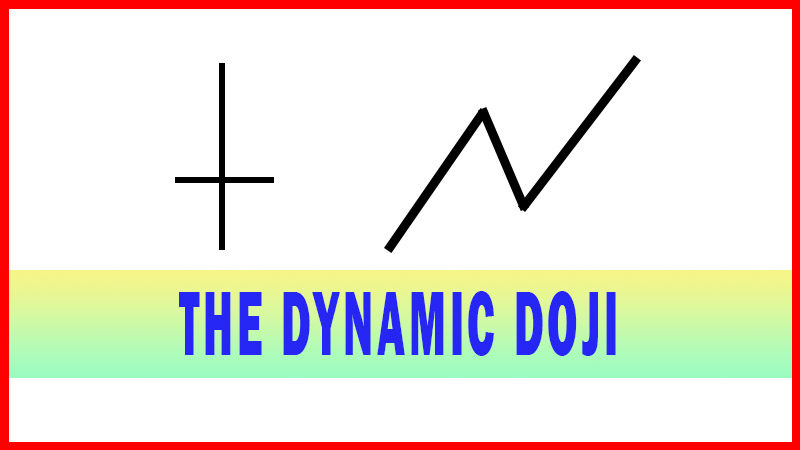

Technically,

a Spinning Top or a Doji with black bodies, followed by a gap- up long bullish

body could be considered a Kicker signal. While that pattern is just as

effective for identifying a strong reversal it would not necessarily fit into

the description of a Kicker signal. The long bodies better define the Kicker

signal.

Fig.

2-81, The Alkermes Inc. chart shows the downtrend was progressing with

reasonable strength. Whatever news announcement or event that occurred made the

new sentiment very bullish.

Fig.

2-82, the Zales Corp. chart demonstrates that both candles do not have to be

large candles, the kicker signal still reveals a definite change of the trend.

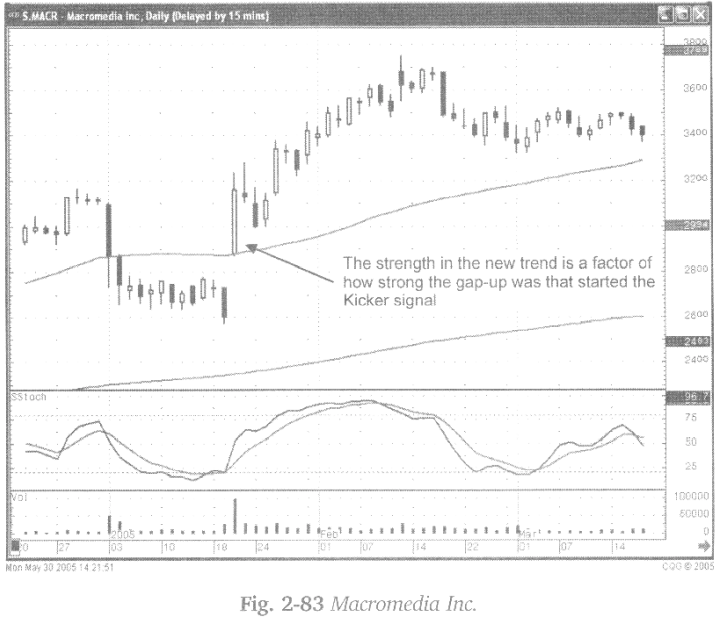

The

magnitude of the gap, above the previous days open, in a bullish candle has

great relevance. The gap up in price, followed immediately by added buying,

clearly reveals the strength in which buyers wanted to get into a position.

Illustrated

in Fig. 2-83, the Macromedia Inc. chart, is a price trend that clearly- had no

upward bias until the gap up Kicker signal occurred. As mentioned previously,

buying at any price during the next few days should be profitable. Some profit

taking is likely to occur after a big move to the upside. However, the signal

itself illustrates a dramatic change in investor sentiment. That change will

not disappear very soon. It can be anticipated that there will be a few weeks

to the uptrend.

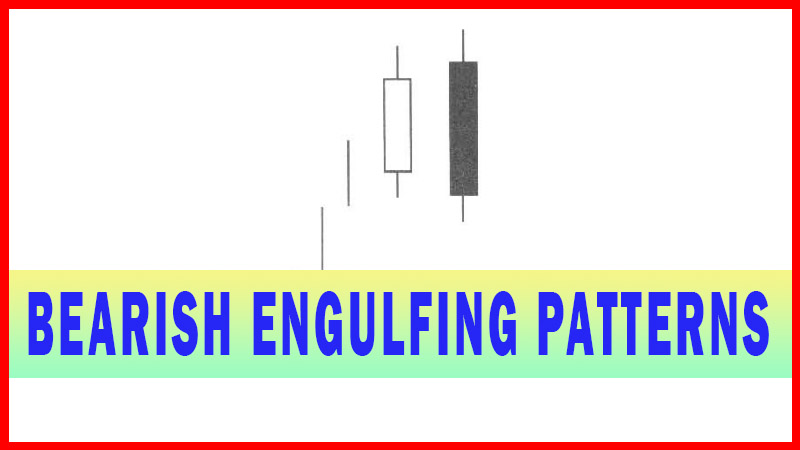

The

Kicker signal works equally as well to the downside as it does to the upside.

As illustrated in Fig. 2-84, the Motorola Inc. chart, the uptrend was immediately

terminated with a gap down in price below the previous days open. The

continuation of the selling revealed that the downtrend was going to persist.

Understanding the elements forming a Kicker signal allows the candlestick

investor to make immediate decisions. An investor that may have been long

Motorola Inc., seeing the gap-down open well below the previous days open

should have the insight to close the long position immediately. Rarely will a

news announcement produce a dramatic gap down open, then see the resuming of

the current trend. The results of that dramatic gap-down will usually be a

continuation of selling.

Kicker

signals produce powerful moves as well as high probability moves. They do not

occur very often. When they do occur, they should be analyzed immediately and

exploited. They will produce a high percentage of not only correct trades but

also very profitable trades.

How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals : Tag: Candlestick Pattern Trading, Forex : Bear Kicker, Bull Kicker, Kicker signal, bearish signals, kicker signal candlestick patterns, bullish kicker signal, Bearish kicker signal - Kicker Signal Pattern