Price can Gap UP or Gap DOWN

gap trading strategy pdf, gap trading forex, gap trading crypto, gap forex strategy, Professional Gaps, Novice Gaps

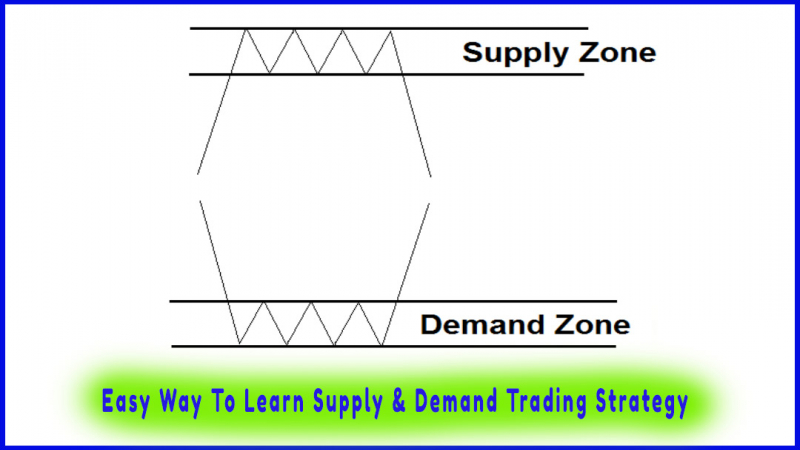

Course: [ Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy ]

A gap is an empty space between two candlesticks where the price either rises or falls from the previous candle's close with no trading occurring in between.

Gaps

A gap is

an empty space between two candlesticks where the price either rises or falls

from the previous candle close with no trading occurring in between.

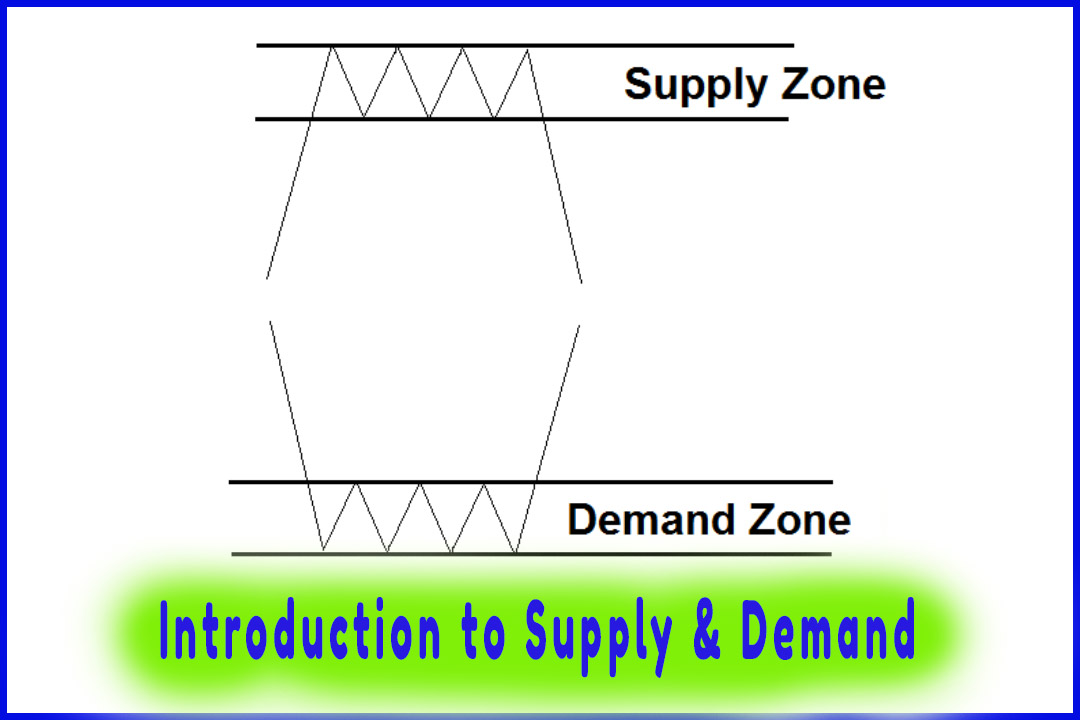

They also

represent big supply and demand imbalances where either supply exceeds demand

or demand exceeds supply.

When

trading supply and demand, gaps are great indicators of market imbalance. In

general, levels with gaps are considered to be the strongest levels to trade

because they are high probability zones.

Price can gap up or gap down:

A gap up

is a gap that occurs when the lowest price of a candle is above the highest

level of the previous candle.

A gap

down occurs when the highest price of a candle is below the lowest price of the

previous candle.

Gaps are

common when a major economic event causes market fundamentals to change during

the weekends when the market is closed. They are usually found at the open of

the market on Sundays.

A gap is

considered closed or filled when the price comes back and fills the entire

range of the gap. Once price fills the gap, it reverts to the direction of the

prevailing trend.

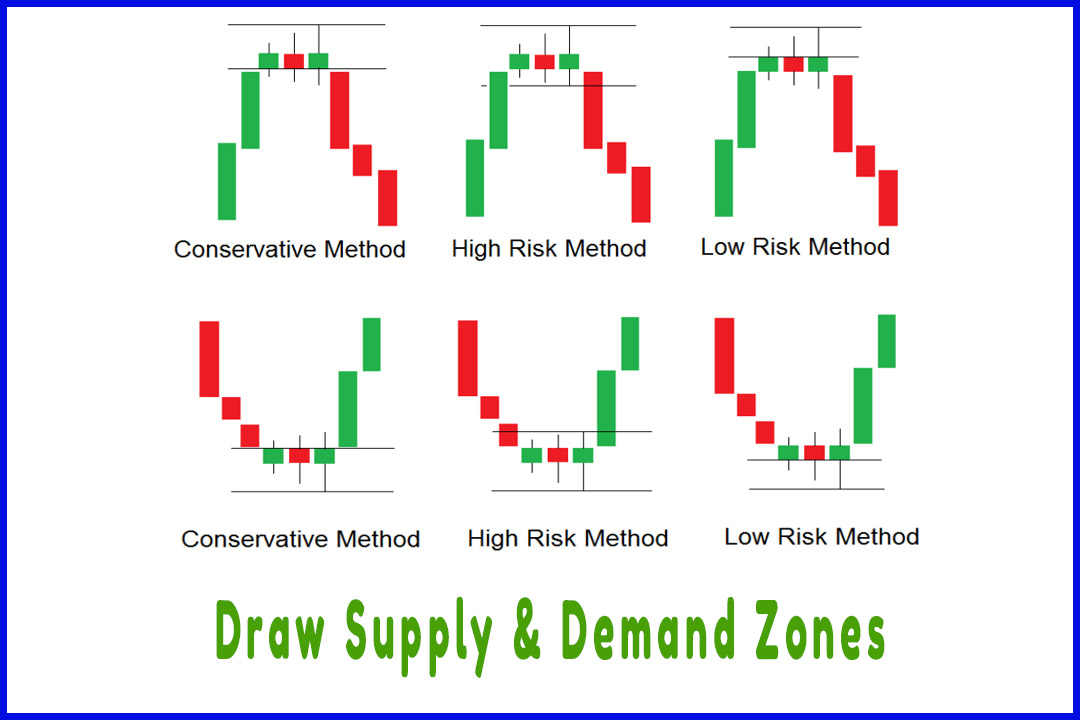

To draw

your supply and demand zones with gaps, we always draw the proximal and the

distal lines at the origin of the gap and not after it.

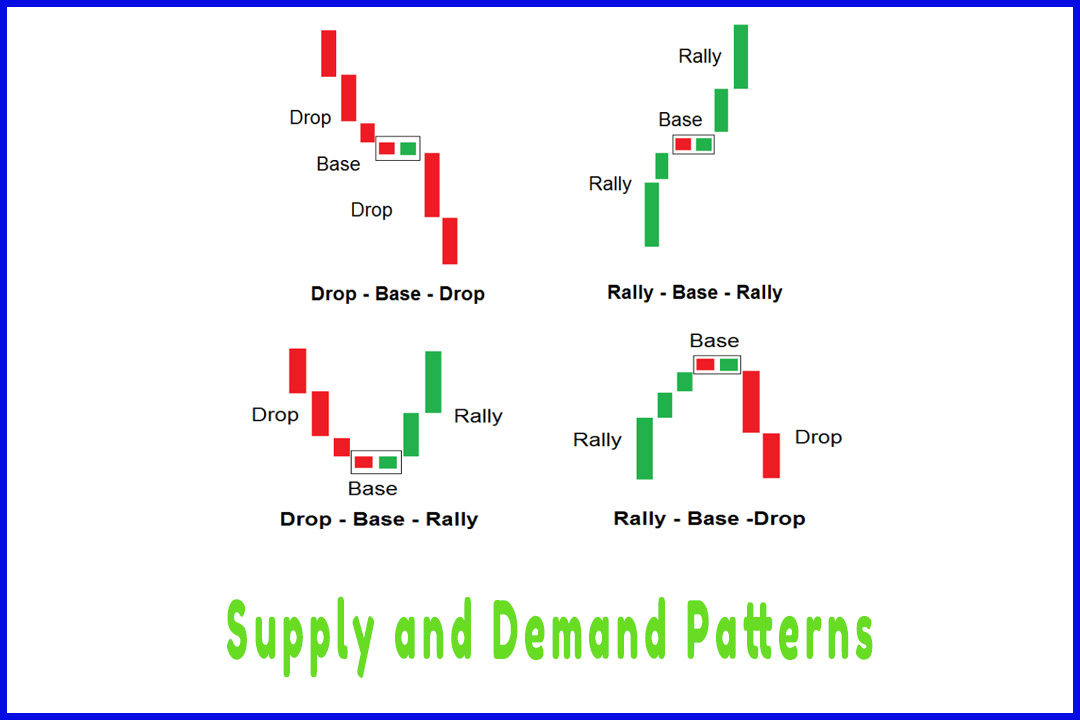

Professional Gaps

A

professional gap is a gap that occurs in the opposite direction of the previous

trend. The professional gaps are formed at the beginning of the moves and

extended it.

On this

chart, we have a professional gap formed in the opposite direction of the

prevailing trend (uptrend). Price retraces back up to test the supply zone and

fills the gap to continue moving down.

This kind

of gap signals a continuation in the direction of the gap created by

professional traders.

Novice Gaps

A novice

gap is a gap that occurs in the direction of the prevailing trend. A novice gap

tends to form at the end of a move signaling a potential trend reversal.

The chart

below shows an example of a novice gap created at the end of an uptrend. Novice

traders use conventional technical analysis to trade breakouts using support

and resistance.

On this

chart, the gap happened right after the breakout of the resistance line. This

gives a bullish signal to buy at the breakout.

They are

buying high instead of buying low and they do it right at the supply zone where

professional traders are selling. Price tests the supply zone and the trend

reverses to the downside taking all their stops out.

As a rule

of thumb, when we have a novice gap, we trade against the novice traders.

It is

important to understand these two types of gaps when trading supply and demand

because when they happen, they give us an important piece of information as to

where the market is willing to go next.

Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy : Tag: Supply and Demand Trading, Forex : gap trading strategy pdf, gap trading forex, gap trading crypto, gap forex strategy, Professional Gaps, Novice Gaps - Price can Gap UP or Gap DOWN