Supply and Demand Fresh Zones

Fresh supply zone, Fresh demand Zone, How to find the supply and demand zone, market imbalance

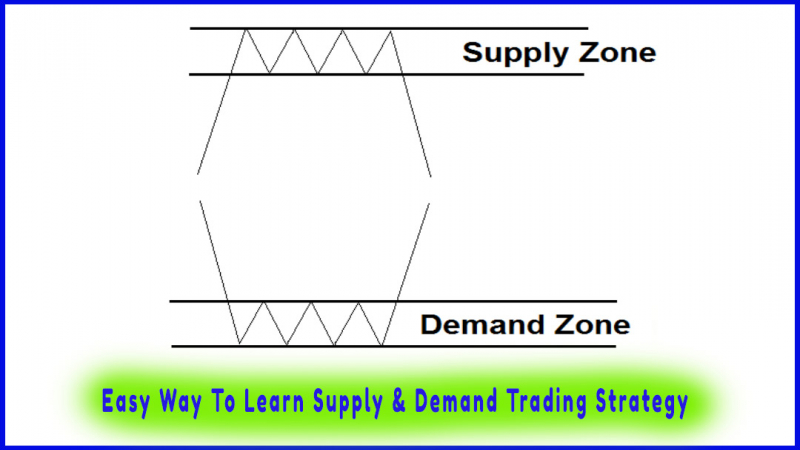

Course: [ Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy ]

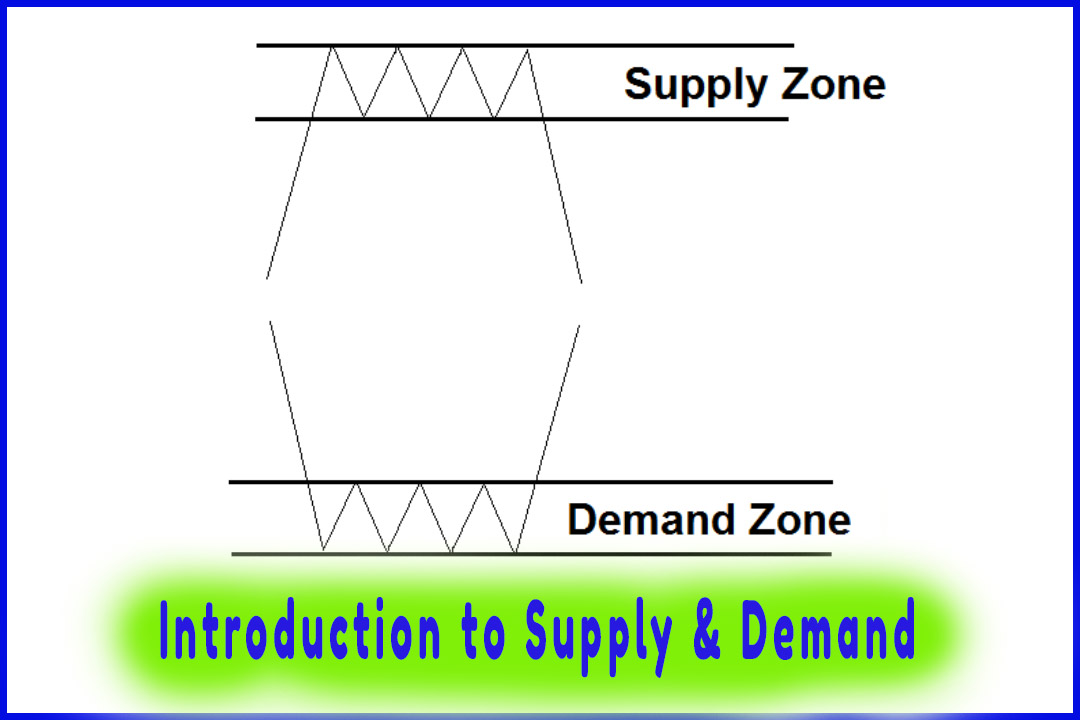

A fresh zone is a supply or demand zone that price has not been tested yet. The first retracement tends to be the strongest and most reliable one to trade. We should always choose fresh untested zones to stack the odds in your favor.

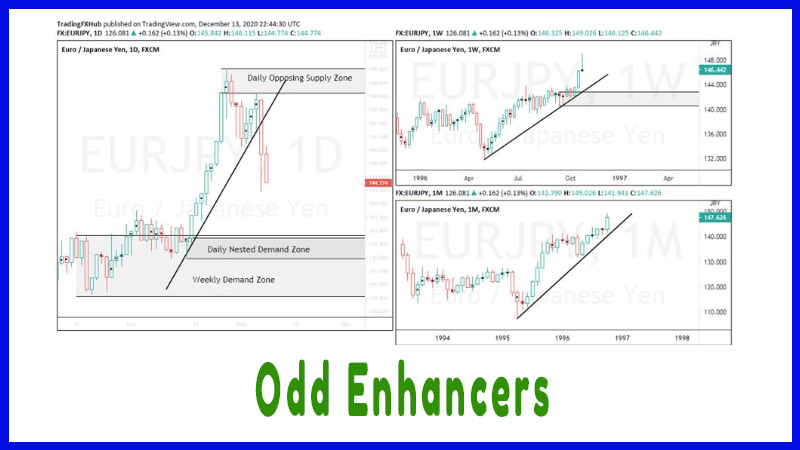

Odd Enhancer 3: Fresh Zones

A fresh

zone is a supply or demand zone the price has not been tested yet. The first

retracement tends to be the strongest and most reliable one to trade. We should

always choose fresh untested zones to stack the odds in your favor.

After a

second retracement to the zone, it is better not to consider it because there

might not be enough supply or demand to move prices.

If the price

revisits a supply or demand zone but barely touches it, this is a very good

zone and we could expect the price to come back to test it again.

As a rule

of thumb, once the price penetrates 50% or more into the zone, you should ignore

the zone and start looking for a new fresh zone to trade.

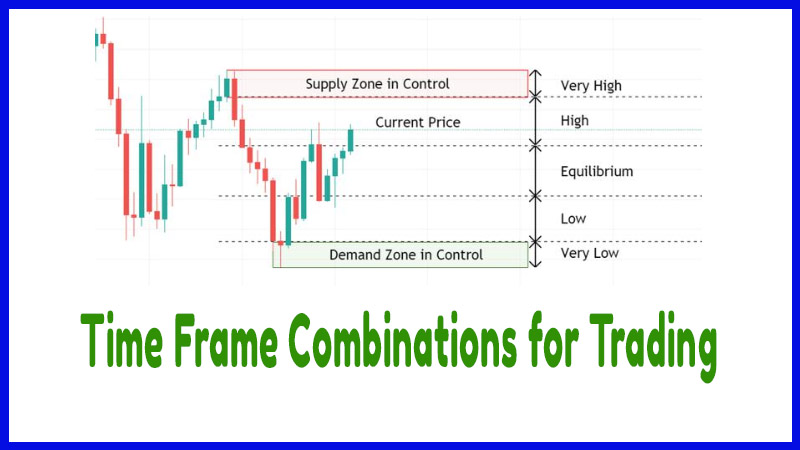

On the

chart below, we have two fresh supply zones that price has not been tested yet.

These are good zones to short once the price retraces back to either one.

The same

thing for the fresh demand zone below, if the price returns to test it we go

long.

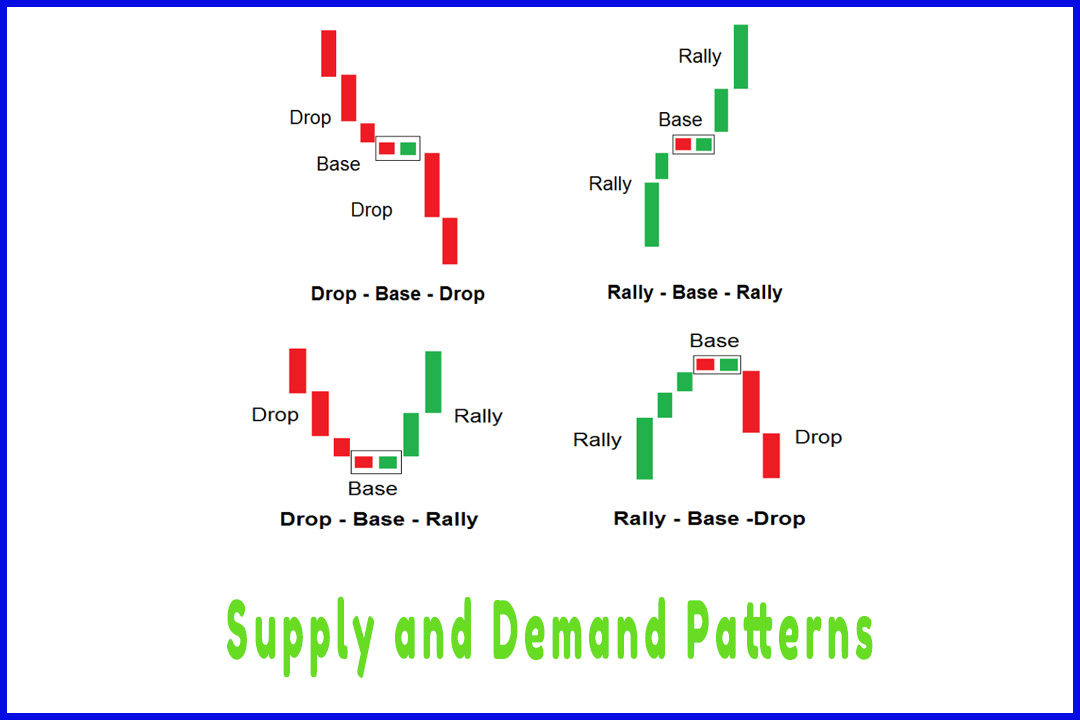

In the

first retracement, the price tested the supply zone and moved down, the same

thing happened in the second and third retracements. After the 3rd retracement,

the price broke above the supply zone as no more supply was found there.

Notice

how the price left the supply zone after the second and the third retracement.

The strength of these last two moves is weakening.

This

signals a potential shift in the market imbalance as more buyers are stepping

in creating a breakout above this supply zone.

In this

example, the price broke the demand zone after the second retracement. Notice

that price penetrates deeper inside the demand zone with each retracement. This

is a good signal that the demand zone is no more valid and a potential

breakthrough is expected.

After the

second retracement, the demand zone is no longer valid as the market imbalance

shifts from demand to supply.

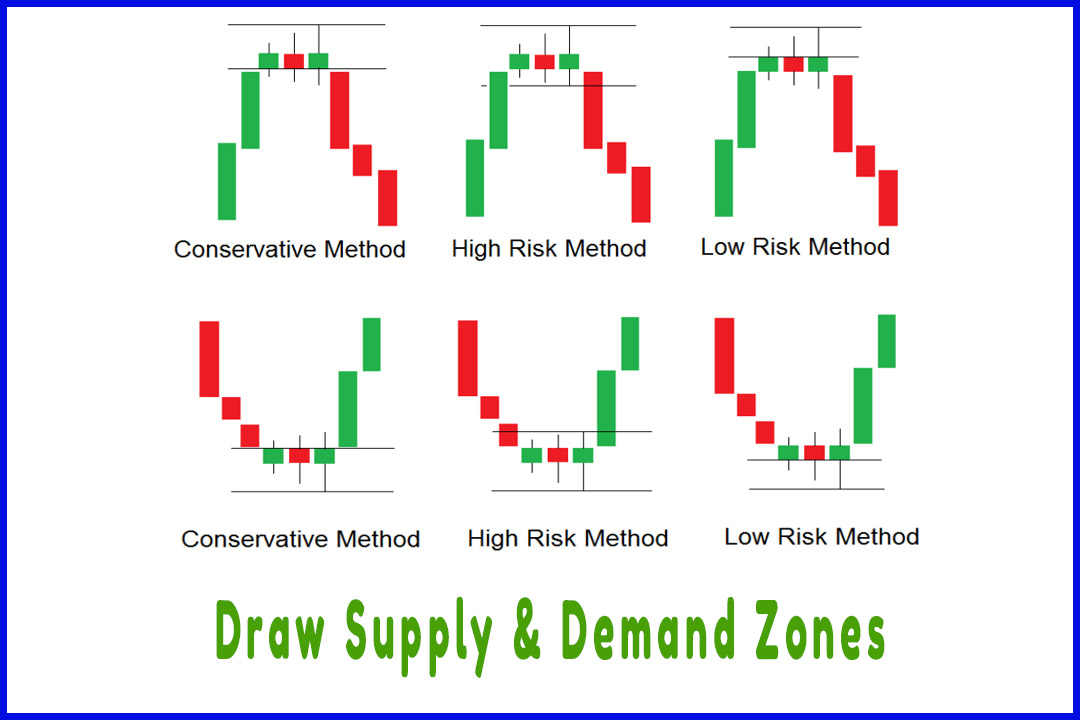

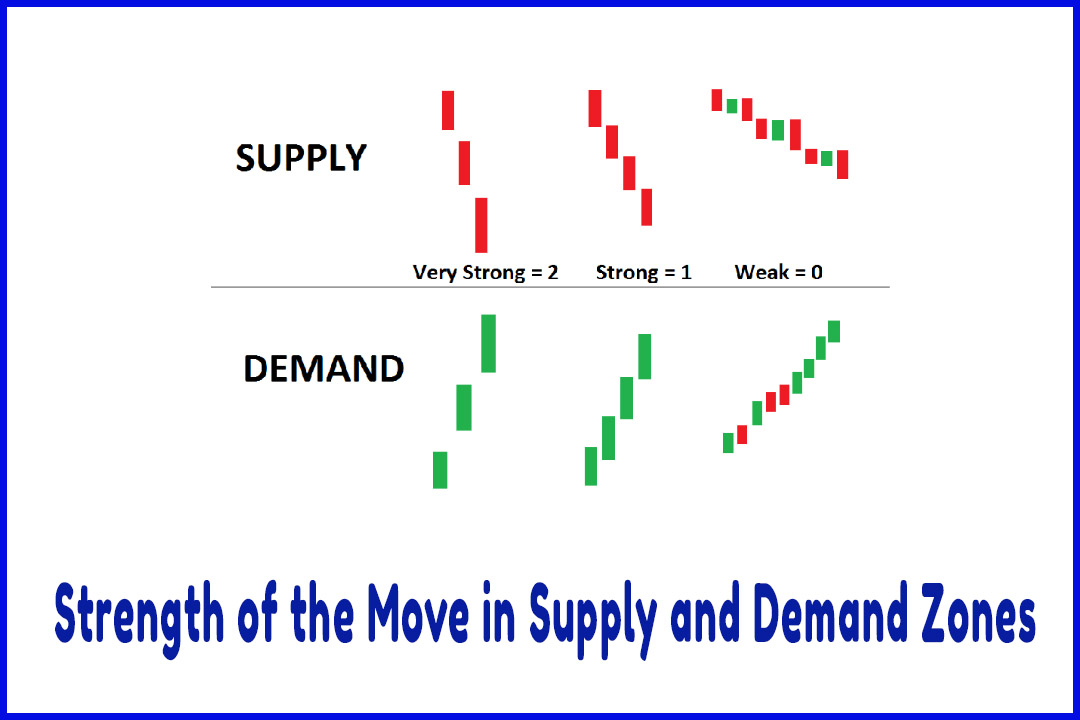

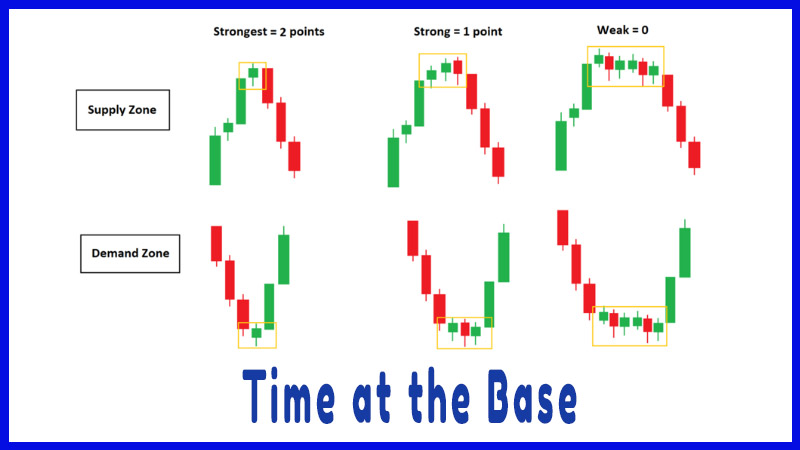

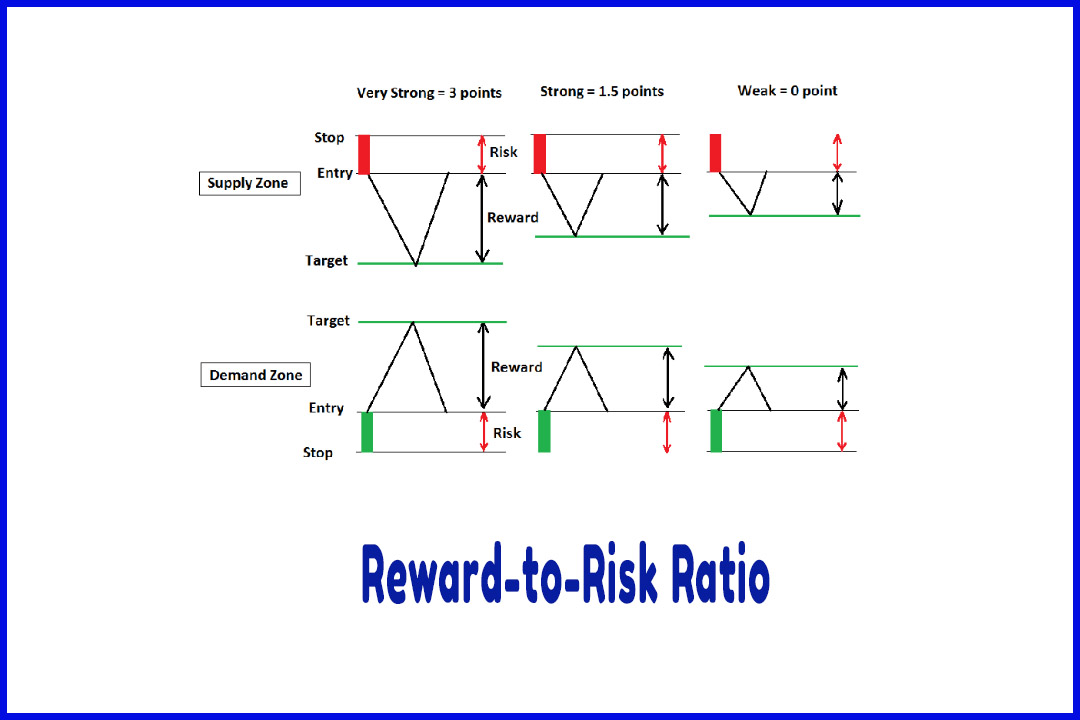

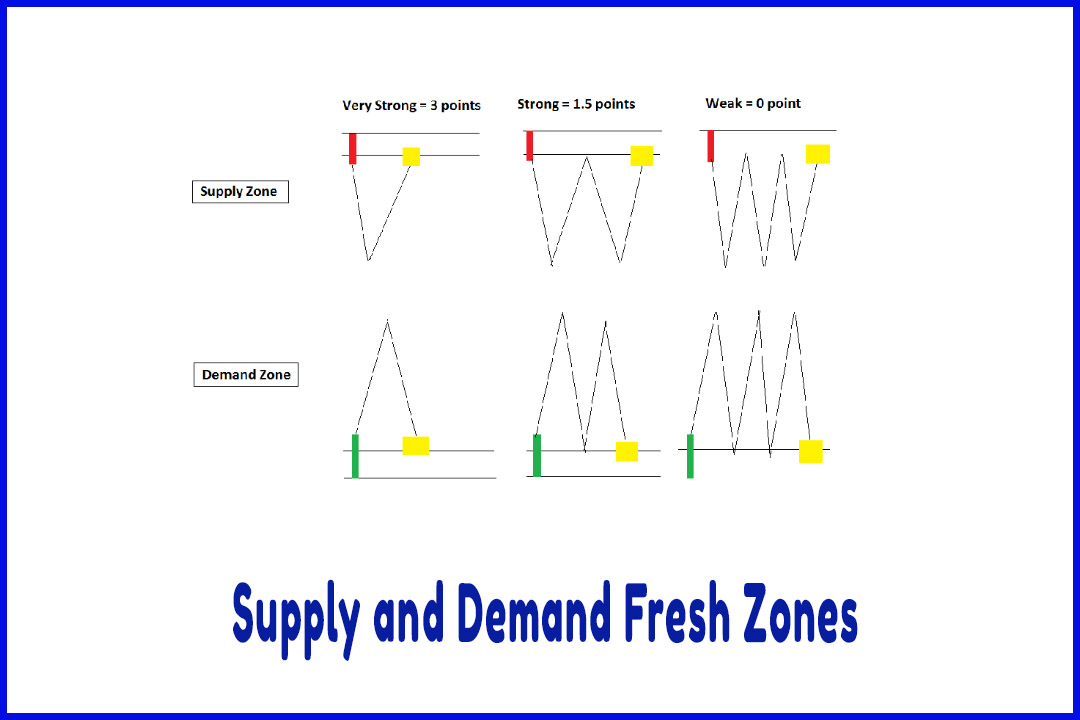

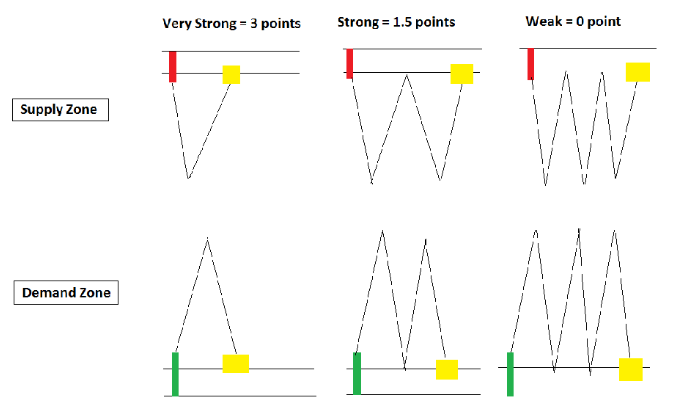

Using

this odd enhancer, we can give a maximum score of 3 points.

A fresh

zone that has not been tested has a score of 3 points. This is the one we need

to focus on when trading supply and demand in the forex. We need to stack the

odds in our favor by choosing fresh untested zones to trade.

If the

price retraces back to our zone for the first time, we give it a score of 1.5

points. We can still consider this zone but again we are looking for high-probability trading zones.

If the

price retraces back again for the second time, we give it a score of zero as it

has less probability of success.

At this

point, most of the unfilled orders are gone and the price might just pierce the

zone and move away to find another supply or demand zone.

Here we

have a price chart with a fresh non-tested demand zone at the bottom of the

chart and two non-fresh demand zones at the top.

The score

for the fresh zone is 3 points, whereas the two top non-fresh zones have a

score of zero because the price retraced twice to the zones.

Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy : Tag: Supply and Demand Trading, Forex : Fresh supply zone, Fresh demand Zone, How to find the supply and demand zone, market imbalance - Supply and Demand Fresh Zones