Types of Forex Trading Orders - Market, Limit, & Stop Orders

Pending orders forex, Types of orders in forex, Types of pending orders in forex trading, Buy stop and sell stop strategy, What is buy stop in forex, Meaning of buy limit in forex

Course: [ Top Trading Strategy ]

A market order is executed immediately when placed. It is priced using the current spot, or market price. A market order immediately becomes an open position and subject to fluctuations in the market. This means that should the price move against you, the value of your position deteriorates – this is an unrealized loss until the order is closed.

Forex - Market, Limit, & Stop Orders

MARKET ORDERS

A market order is

executed immediately when placed. It is priced using the current spot, or

market price. A market order immediately becomes an open position and is

subject to fluctuations in the market. This means that should the price move

against you, the value of your position deteriorates this is an unrealized loss

until the order is closed.

Example: If the

price of EUR/USD is at 1.1900, and you place a market order for a BUY or SELL,

your trade will immediately be placed at the current price of 1.1900 + (spread

& slippage)

What is

Spread?

Spread is one way your

broker makes their money. It is a small difference in price between what the

market price actually is, and what your broker is offering it to you for. For

example, if you place a market order BUY at 1.9000, your broker may actually

place you into the market at 1.8999. The broker will keep the 1 pip difference

earning them a small profit on the trade. Different brokers offer different

spreads, but the average is anywhere from 0.1 pip to 3 pips.

What is

Commission?

Commission is a fixed fee

for placing a trade that is charged by your broker. Some brokers offer no

commission at the expense of a higher spread. Some brokers offer very low

spreads in exchange for a small commission on each trade. It is up to you to

decide what you prefer. I am currently using IC MARKETS as a broker

and their "ZERO Account" for trading. This setup gets me very low

spreads (usually 0.1 to 1 pip) and I pay a commission of about $4 per Standard

Lot traded.

What is

Slippage?

Slippage occurs when the

market activity is high. You may place a market order for a BUY at 1.9000, but

your order take a few seconds to process and the market moved a few pips before

your order was entered. So you actually got in the market at 1.9005. This is

not a fee from the broker, and it usually only occurs during high-impact situations

like news and world events that cause the market to go crazy.

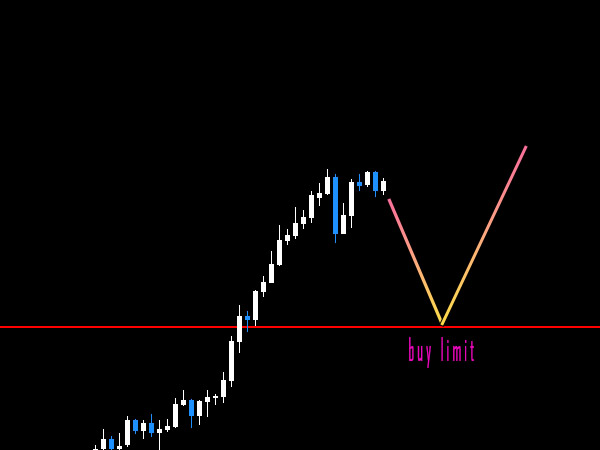

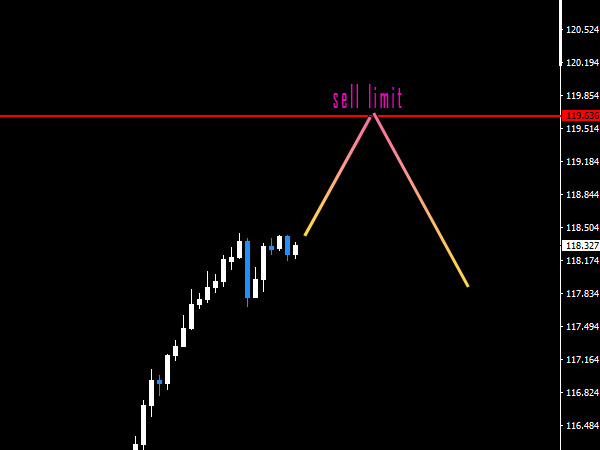

LIMIT ORDERS

A limit order is

an order to buy or sell, but only when certain conditions included in the

original trade instructions are fulfilled. Until these conditions are met it is

a pending order and does not affect your account totals or margin calculation.

The most common use is to create an order that is

executed automatically if the price reaches a certain level. When the

conditions of a limit order to BUY or SELL are met, the order

is automatically executed. Limit orders are usually placed in areas where

you think the price will reach, and then reverse from in the opposite

direction.

Example: If the price of

EUR/USD is at 1.1900, but you only want to SELL if the price gets up to 1.1950,

you can place a SELL LIMIT order at 1.1950. If the price reaches that level,

your trade will automatically be entered at that level with your predetermined

position size and STOP orders.

STOP ORDERS

A stop order is

also an order to buy or sell, but only when certain conditions included in the

original trade instructions are fulfilled. Until these conditions are met it is

a pending order and does not affect your account totals or margin calculation.

The most common use is to

create an order that is executed automatically if the price level reaches a

certain level. When the conditions of a stop order to BUY or SELL are met, the

order is automatically executed. Stop orders are usually placed in areas

where you think the price will reach, and then continue moving in that

direction.

Example: If the price of EUR/USD is

at 1.1900, but you only want to SELL if the price gets up to 1.1950, you can

place a SELL LIMIT order at 1.1950. If the price reaches that level, your trade

will automatically be entered at that level with your predetermined position

size and STOP orders.

STOP-LOSS and

TAKE-PROFIT

A stop-loss order

is a defensive mechanism used to protect against further losses. It

automatically closes an open position when the exchange rate moves AGAINST you

and reaches the level you specified.

For example, if you are

LONG on EUR/USD at 1.1900, you are expecting it to move up. If the price moves

down instead, you will be losing money the further the price moves against your

intended direction. To limit your losses, a stop-loss order can be placed

before or during your trade to restrict your losses to a certain amount. Let's

say you were willing to lose up to 50 pips on this trade. If you entered the

trade at 1.900, you would set your stop-loss to 1.1850. This means that if the

price reached the 1.1850 level, your trade would automatically be exited regardless

if you were at your computer or not. This prevents you from losing more money

on a trade than you intended to risk.

A take-profit order

is similar to a stop-loss order, but for the opposite purpose. A take-profit

order automatically closes an open trade when the price has reached your

intended target. Remember, you haven't actually won or lost any money until you

close the trade. Until then, your profit or loss is just fluctuating as an open

order waiting for you to cash out by closing the trade.

For example, let's imagine

you are again LONG on EUR/USD at 1.1900, and you are expecting it to move up.

If the price moves up as expected, you will be making money the further the

price moves in your intended direction. To lock in your profits, a take-profit

order can be placed before or during your trade to ensure you book a profit if

the price reaches your intended target. Let's say you were aiming to make 100

pips on this trade. If you entered the trade at 1.900, you would set your

take-profit to 1.2000. This means that if the price reached the 1.2000 level,

your trade would automatically be exited regardless if you were at your

computer or not, and you'd be 100 pips richer! A take-profit also helps prevent

you from losing money on a trade that may reach your target, but then turns

around and goes the other direction before you had a chance to close the trade;

remember, you haven't made or lost any money until you actually close the

trade!

Top Trading Strategy : Tag: Top Trading Strategy, Forex : Pending orders forex, Types of orders in forex, Types of pending orders in forex trading, Buy stop and sell stop strategy, What is buy stop in forex, Meaning of buy limit in forex - Types of Forex Trading Orders - Market, Limit, & Stop Orders