Types of Stop Orders

Types of stoploss, Money management, Chart-Based Stop, Volatility-Based Stop, Percentage-Based Stop

Course: [ Top Trading Strategy ]

This is the most common of all stops. The trader must first decide how much percentage of his total equity he is willing to risk on a single trade. As already mentioned in Part 2 of Money Management, if you risk a certain percentage, say 3% on a trade, you work out your stop loss in pips and your lot size according to the 'fixed cost' of risk

Types Of Stop Orders

1. Percentage-Based Stop

This is the most common of all stops. The trader

must first decide how much percentage of his total equity he is willing to risk

on a single trade. As already mentioned in Part 2 of Money Management, if you

risk a certain percentage, say 3% on a trade, you work out your stop loss in

pips and your lot size according to the 'fixed cost' of risk. Do not place an

arbitrary stop on your position. Always make sure that you analyze the charts

for the next significant support or resistance levels to give an idea of where

is safe to leave your stop, and once you have calculated your stop loss in

pips, adjust your lot size accordingly so that the amount at risk does not

exceed your pre-determined percentage risked.

2. Volatility-Based Stop

Although still taking into account not risking

more than 3% on a trade, a volatility-based stop is used, instead of price

action, to set risk parameters. This method of placing stops is based on

adapting your stop to the current market conditions. When the Forex market is

experiencing high volatility, whereby prices traverse a larger range, the

trader must adapt to this high volatility, and give more allowance for the stop

so as to avoid being stopped out by intra-day market noise. The opposite holds

true for a less volatile Forex market, whereby you can compress your risk

parameters accordingly.

Bollinger Bands

Bollinger Bands are a type of envelope that are

plotted at standard deviation levels above and below a moving average. This

results in a widening of bands during periods of higher volatility, and a

contraction of bands during less volatile periods. Bollinger bands allow for an

understanding of changes in supply and demand for the underlying security as a

quick view. Often there is a cluster of stop orders outside of the current

trading range to protect against a breakout of the current trading range.

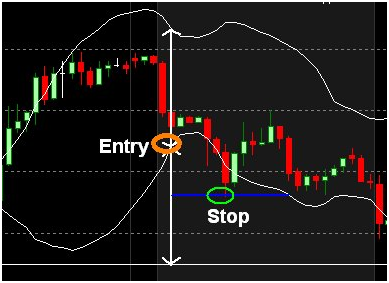

One way to place a stop using Bollinger bands

during a period of high volatility is to measure the bandwidth of the Bollinger

bands around the time of entry, and project half of that bandwidth from your

entry price. You can then place your stop at that projected point. Figure 1

shows a 60 min chart of GBP/USD, with a bandwidth measuring around 95 pips from

one end of the band to the other. So the estimated stop is half of that amount

projected from your entry point, as indicated by the green circle.

Figure

1

Figure

1

If the currency pair has low volatility at the

point of entry, project the entire bandwidth of the Bollinger bands from your

entry point to place your stop there. Figure 2 shows a 15 min chart of USD/JPY,

with a bandwidth measuring around 15 pips (low volatility). The green circle

indicates the point of stop as projected by the bandwidth from the point of

entry (circled orange).

Figure

2

Figure

2

Parabolic SAR

Developed by Welles Wilder, the Parabolic SAR

("stop and reverse") sets trailing price stops for long or short

positions, which are indicated by small dots on the currency chart. The

"stop and reverse" indicates when the trader should close his

position or open an opposing position when this switch takes place. These price

stops are dynamic, meaning they move incrementally along with changes in

currency price.

In an uptrend, a long position should be

established with a trailing stop that will move up every bar/candle (whatever

the time period you are monitoring) until activated by the price falling to the

stop level. In a downtrend, a short position can be established with a trailing

stop that will move down every bar/candle (whatever the time period you are

monitoring) until activated by the price rising to the stop level. Refer to

Figure 3.

Figure

3

Figure

3

3. Chart-Based Stop

This often relies on a break in a trendline,

moving average, or another key measure of support or resistance like Swing Low or

Swing High. For example, if you trade a breakout of a Double Top chart pattern,

a chart-based stop would be placed slightly above the neckline of the Double

Top, since previous support should most likely act as future resistance.

Another example of a chart-based stop is

illustrated in Figure 4, whereby if you trade the bounce of an up trendline

for a currency pair, a chart-based stop would be placed slightly below the

trendline support, and be periodically adjusted as the trendline slopes higher.

Figure

4

Figure

4

4. Indicator-Based Stops

If you have entered your trades based on

indicator signals, your stop could also be based on signals from the indicator

that you are using.

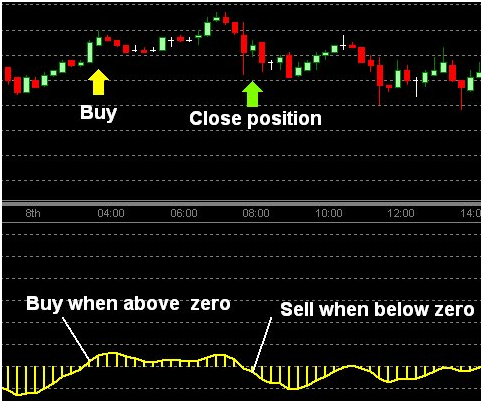

For example, you may have a buy signal for a

currency pair when the MACD crosses up above its zero signal line, so a

MACD-based stop, in this case, would be activated by the MACD reversing its

previous signal by crossing back below the zero signal line (Refer to Figure

5).

Figure

5

Figure

5

The problem with using trend-following

indicators (such as MACD) as stops is that they are lagging, meaning that the

currency pair may have reversed its direction suddenly, and you will still have

to wait for the lagging indicator, like MACD, to catch up before you can cut

your losses.

Likewise, for any other indicators or

oscillators that you may use for entering trades, you can also activate your

stops based on the opposing signals. For example, if you have a buy signal for

a currency pair when the Slow Stochastics crosses up above its oversold line,

your stop could be activated when the oscillator moves back down into the

oversold area.

Trading Tips

- Some

people also use time-based stops in their trading whereby they time how

long they want to be in the market for, and if the time is up, they close

their positions accordingly.

- My

personal preference is to use a percentage-based stop as I find it the

most suitable for my trading style. Find one that suits your own trading style.

- No

matter what type of stops you use, always make sure that you do not risk

more than the pre-determined percentage of your total equity on a single

trade.

Top Trading Strategy : Tag: Top Trading Strategy, Forex : Types of stoploss, Money management, Chart-Based Stop, Volatility-Based Stop, Percentage-Based Stop - Types of Stop Orders