Bullish and Bearish Divergence in Forex Trading Strategies

What is divergence in forex trading, What is divergence trading strategy, What is divergence day trading, What is divergence in stock

Course: [ Top Trading Strategy ]

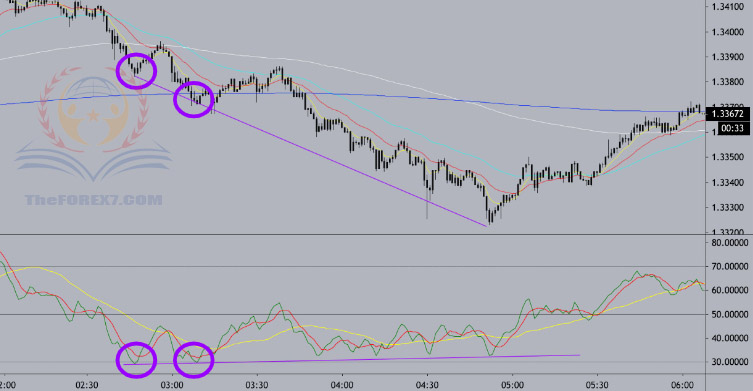

A disagreement between price action and the indicator (RSI). Divergence is telling us that the market is changing.

WHAT

IS DIVERGENCE?

· A disagreement between price action

and the indicator (RSI)

· Price will lie, the indicator will

not.

· You can use this to spot the end of a

pullback or at the point of a possible reversal.

· Divergence is telling us that the

market is changing.

WHAT ARE THE MOST IMPORTANT LEVELS?

· Asian session high/low

· Yesterday’s high/low

· 50, 200, 800EMAs (pullbacks move off

these levels)

· ADR Max (reversal point)

WHAT DOES IT TELL US?

· If in a trade, and divergence

presents against us we may need to consider an exit.

· If we are looking to enter a trade

into divergence we have to note that it will be a less probable trade because

divergence is present.

· Don’t assume reversal just because

divergence is present, use it as a warning flag.

· You can find it in trend and counter-trend

HOW DO WE USE DIVERGENCE?

Two ways

In Trend (D1)

We find divergence at significant levels that tell

us when the pullback is complete and the trend is ready to continue

Counter Trend (D2)

We see the divergence at the extremes, telling us

that a potential change is about to occur - either a chop or a reversal of some

degree

BULLISH DIVERGENCE

BEARISH DIVERGENCE

WHERE DO WE DRAW IT IN AN UPTREND?

(L50 in the buy zone & EMAs long

biased)

·

Bullish

divergence would present off an EMA or significant level, in direction of the

trend

·

Drawn on the

bottom of price action and the RSI

·

D1 Entry in

direction of the overall trend

·

Bearish

divergence would present at a significant level (OB/OS or Maxed ADR) going

counter-trend

·

Drawn on top

of price action and the RSI

·

D2 entry

signaling reversal off the top

WHERE DO WE DRAW IT IN A DOWNTREND?

(L50 in the sell zone & EMAs

short biased)

·

Bearish

divergence would present off an EMA or significant level in direction of the

trend

·

Drawn on the

top of the RSI and price action

·

D1 entry -

used to get into a trade-in direction of the overall trend

·

Bullish

divergence would present at an extreme and off a key level

·

Drawn on the

bottom of price action and the RSI

·

D2 entry -

used to find a bottom signaling reversal

HOW DO YOU DRAW DIVERGENCE?

·

Find the RSI

high or low (reaction point 1)

· Find the price action high or low (reaction

point 2)

2 REACTION POINTS

IDENTIFYING THE TWO

POINTS

IT CAN HOLD DIVERGENCE

FOR HOURS

PRACTICE IDENTIFYING

DIVERGENCE

HOW DO YOU TURN THIS INTO AN ENTRY SIGNAL?

NAMING THE SIGNALS

In trend: D1

Countertrend: D2

WHAT’S THE DIFFERENCE?

In trend:

The signal will be of a significant level like the 50ema, 200ema, or

Asia high, yesterday's high, etc...

The higher time frames agree with the direction, multiple reasons to be

in this trade

WHAT’S THE DIFFERENCE?

Countertrend:

These will present at the extremes — OB and OS — looking for a full

reset back to the 800ema

These should also use the higher time frames to confirm or deny the

direction you're trading in the reversal

Top Trading Strategy : Tag: Top Trading Strategy, Forex : What is divergence in forex trading, What is divergence trading strategy, What is divergence day trading, What is divergence in stock - Bullish and Bearish Divergence in Forex Trading Strategies