How to use Bollinger Bands

How to use Bollinger Bands | High profit trading strategy | Bitcoin trading Startegy | Cryptocurrency trading strategy

Course: [ Top Trading Strategy ]

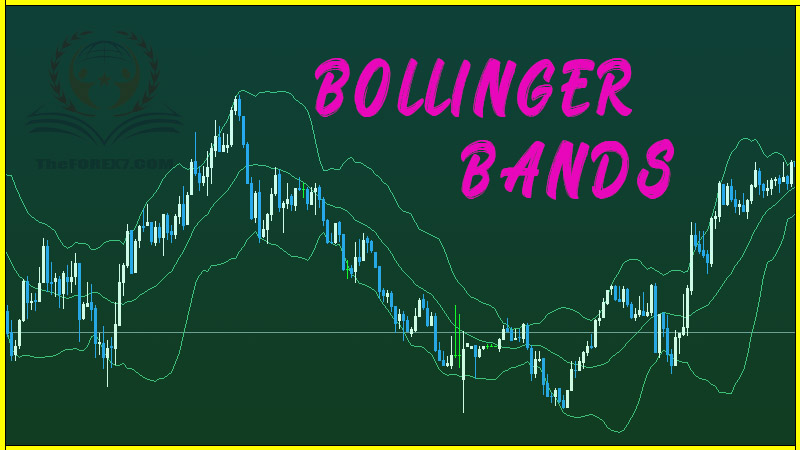

Bollinger bands are envelopes that surround the currency prices on a chart. Envelopes are simply symmetrical lines parallel to a moving average, where the moving average is the centre of the trend, and the envelope consists of the points of maximum and minimum divergence from it. Bollinger bands is a popular method of interpreting the moving average concept.

Bollinger Bands

A Form of Envelopes

Bollinger

Bands are envelopes that surround the currency prices on a chart. Envelopes are

simply symmetrical lines parallel to a moving average, where the moving average

is the centre of the trend, and the envelope consists of the points of maximum

and minimum divergence from it. Bollinger band is a popular method of

interpreting the moving average concept.

The Gist of Bollinger Bands

Bollinger

bands are calculated as standard deviations above and below a moving average,

commonly set to 20. Since the standard deviation is a measure of volatility.

the Bollinger bands adjust themselves to market conditions. The banks widen as

the price trend becomes more volatile, and narrow during less volatile periods.

Figure

1 shows an hourly chart of USD/JPY, with the green band as the upper Bollinger

band, the yellow band as the lower Bollinger band, and the middle purple line

as the 20-moving average.

Figure 1

Figure 1

When

the bands contract, it signals a period of low volatility, whereby demand and

supply are in a fine state of balance, and neither bulls nor bears are in

charge. Narrowing signals a tendency for sharp price movements to follow. If

the price breaks out of a band, the trend is expected to continue.

When

the price exceeds the upper band, it means the upside momentum is strong enough

to support higher prices, and the same is true for a price breakout of the

lower band. Very often, the currency price will cross back into the envelope,

and this crossover signals short-term exhaustion before the trend continues

again. Sometimes, the price will crossover for the last time before the trend

reverses.

One

way of spotting a possible trend reversal is when the currency pair tries

several times in attempting to break out of the upper or lower band but fails,

and in the process, forms a reversal chart pattern, such as a Double Top or

Bottom. The added weight of evidence seeks to alert the trader of a potential

reversal ahead.

How to Use Bollinger Bands in Currency Charts

Bollinger

bands do not generate buy and sell signals alone. They should be combined with

other technical indicators such as MACD or price patterns to give a better

overall technical picture of the currency pair.

Bollinger

bands do not work well during trending phrases, just like momentum indicators.

If you look at Figure 2, you see that when the trend moves persistently in one

direction, which in this case is a downtrend, touching the lower band does not

offer a timely signal because the band progressively turns lower together with

the price declines.

Figure 2

If

you have other technical indications of a currency price trend, it is possible

to use the bands as areas to enter the trend. For example, if technical indicators

and market sentiment favor a downtrend, you may enter a short position when the

price moves to the upper Bollinger band, as shown in the hourly chart of

USD/JPY in Figure 3. Note that the sloping down of MACD at the bottom of Figure

3 indicates that a downtrend is in place.

Figure 3

As

mentioned earlier, after the currency price has broken out of a band, it will

soon cross back into the envelope, and this crossover very often signals a

short-term pause in the trend, as opposed to a trend reversal. As such, it may

be a good idea to take profits when the price moves back into the band after

breaking out earlier on.

Figure

4 shows the price has broken out of the upper Bollinger band in an hourly chart

of USD/JPY, and MACD is sloping upward at the same time. It may be a good place

to take a profit when the price falls back into the band again, as indicated by

the arrow.

Figure 4

Trading Tips

·

It is not

advisable to use Bollinger Bands on their own; that is, for generating sell

signals when the currency price approaches the upper band, and buy signals when

the price approaches the lower bands.

·

The bands may

be used as areas to enter a trend based on trend-following indicators.

·

Combine

Bollinger bands together with other chart patterns like Double Top or Bottom or

divergence signals from momentum indicators if you want to use them for

reversal entry levels.

Top Trading Strategy : Tag: Top Trading Strategy, Forex : How to use Bollinger Bands | High profit trading strategy | Bitcoin trading Startegy | Cryptocurrency trading strategy - How to use Bollinger Bands