Supply and Demand Entry & Exit Strategies

Trade Exit Strategies, Confirmation Order, Market Order, Limit Order, Entry Strategies

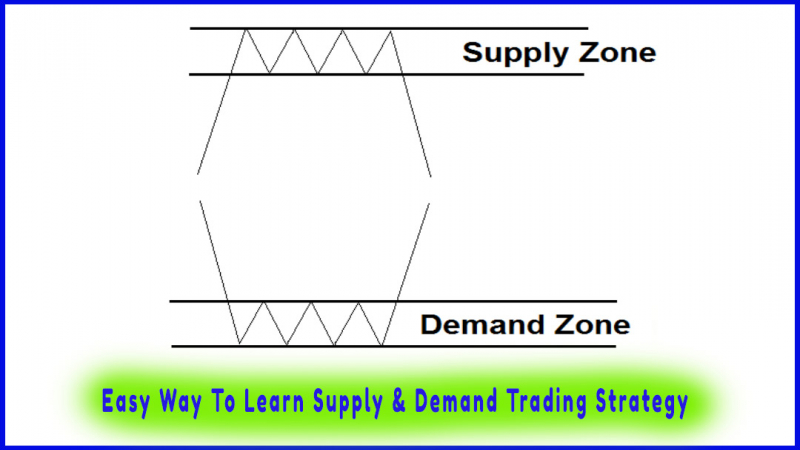

Course: [ Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy ]

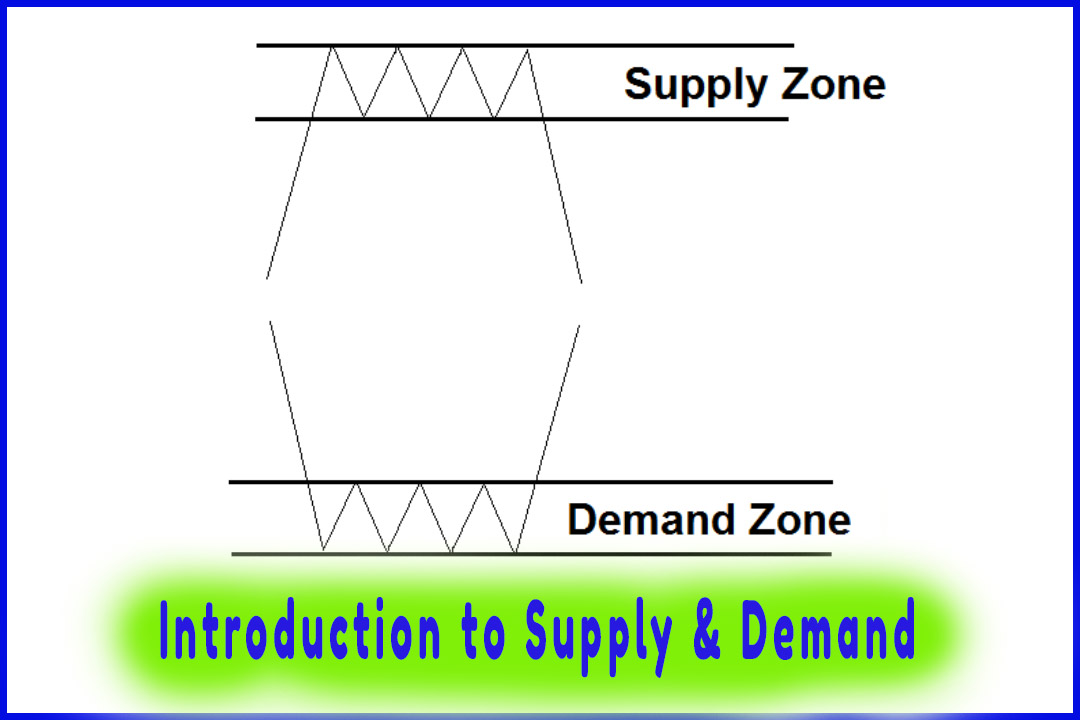

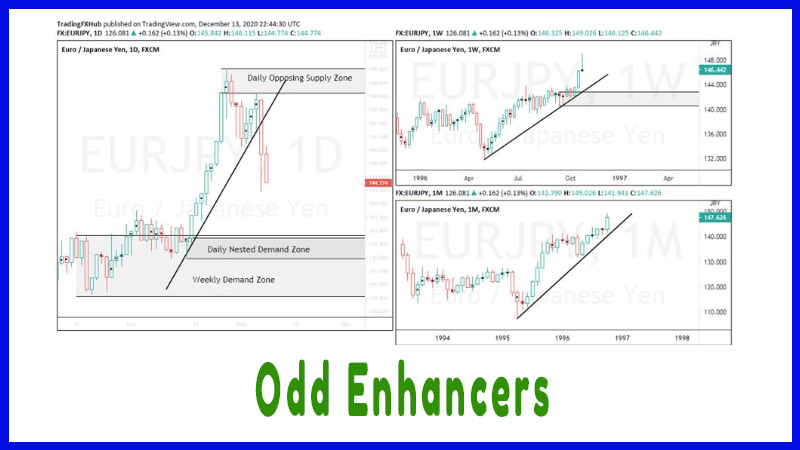

In the previous chapter, we discussed the main odd enhancers that we use to filter out supply and demand zones. Because supply and demand zones don’t work all the time, we need a system to let you filter out the good zones from the bad ones.

Entry & Exit Strategies

In the

previous chapter, we discussed the main odd enhancers that we use to filter out

supply and demand zones. Because supply and demand zones don’t work all the

time, we need a system to let you filter out the good zones from the bad ones.

Remember

that these odd enhancers don’t guarantee the success of the trade. Instead,

they give us a better chance of making the right trades when they show up and

leaving the ones that have a low probability of success.

Ideally,

we are only interested in supply and demand zones with a final score of above 8

points.

Note:

If two

levels or zones have the same score, then the zone which is closest to your

higher time frame is the one that takes priority.

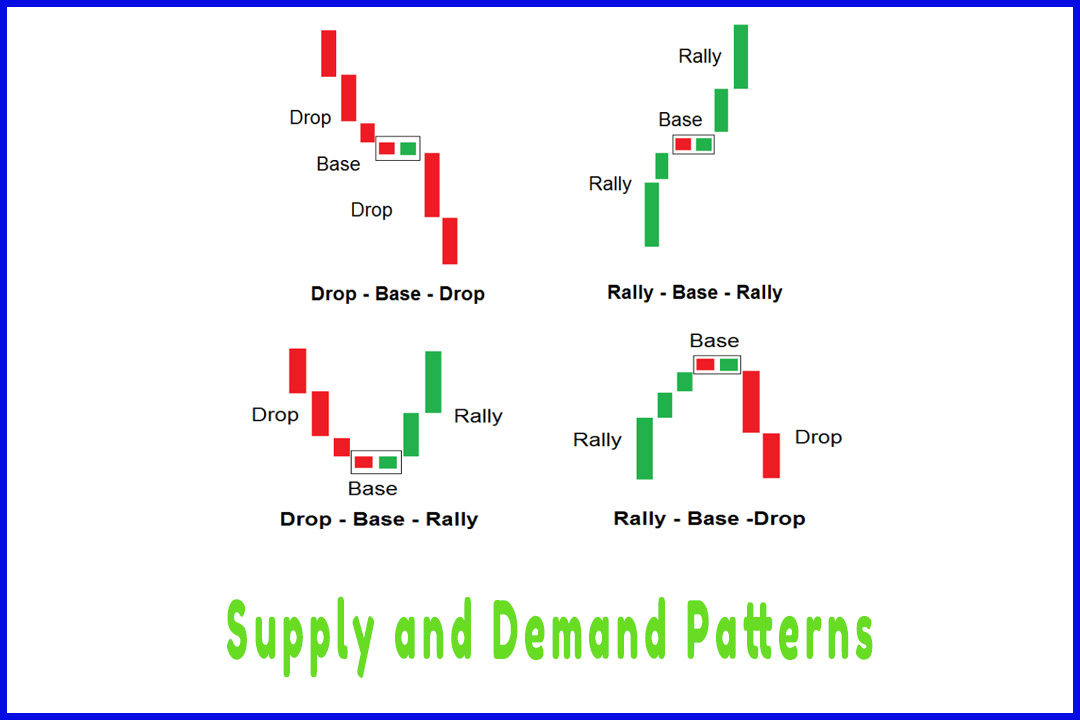

Entry Strategies

There are

three types of entries: limit orders, market orders, and confirmation orders.

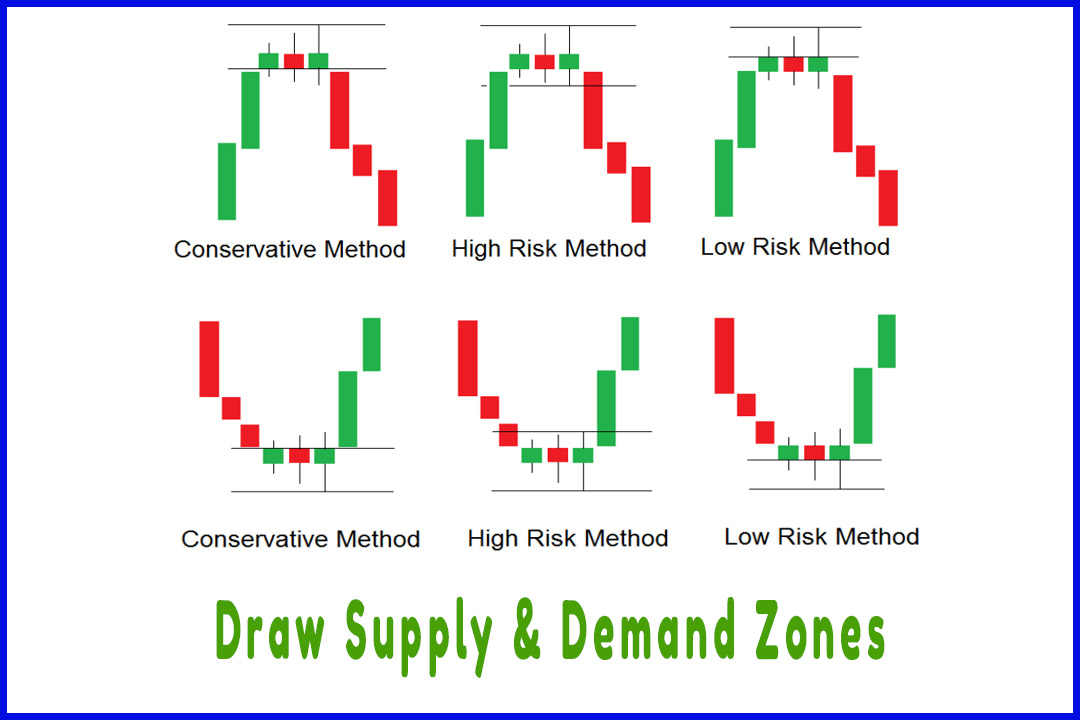

1. Limit Order

A limit

order is used to trade supply and demand zones with a score of 10 points. We

place a limit order at the proximal line with a stop loss a few pips away from

the distal line.

2. Market Order

A market

order is used to trade supply and demand zones with a score between 8 and 9

points. We place a market order when the price is anywhere inside the zone.

3. Confirmation Order

A

confirmation order is used to trade supply and demand zones with a score

between 8 and 9 points.

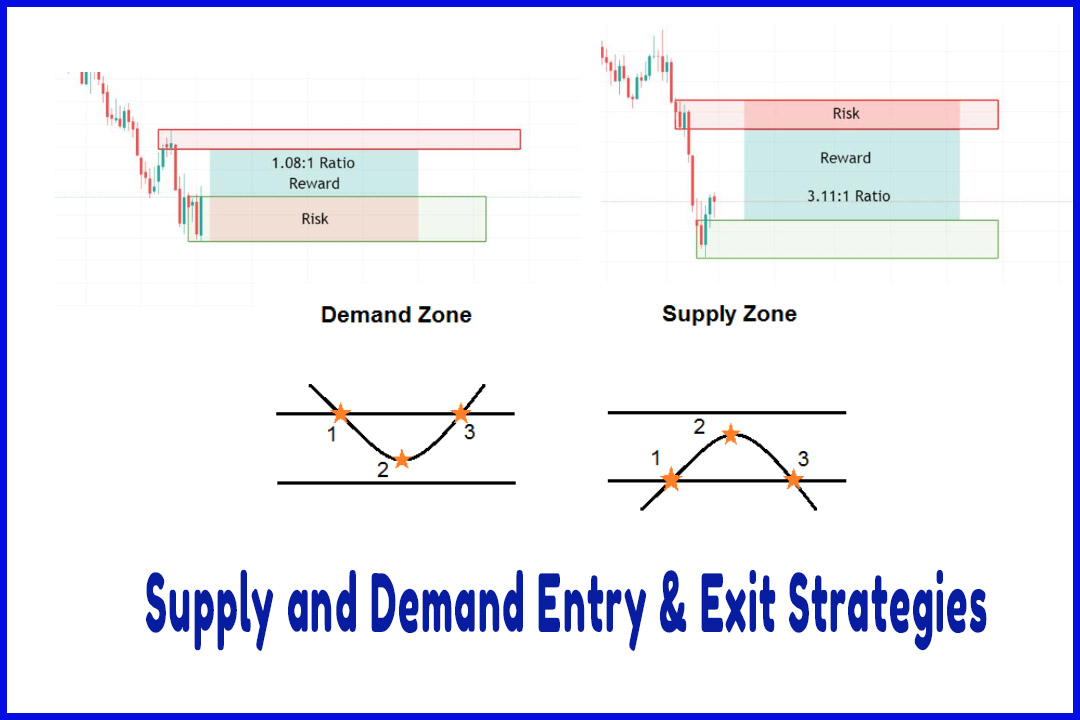

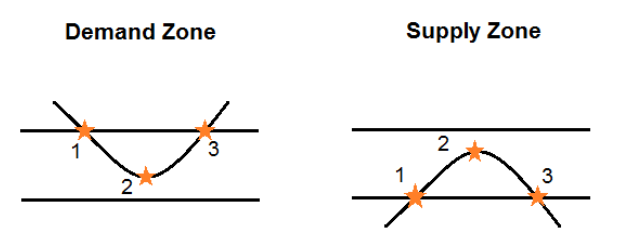

When the

price dips into the zone first (in 1) and crosses above (for demand zone) or

below (for supply zone) the proximal line (in 2). The moment it pierces the

entry line, you open a market order (in 3):

Examples

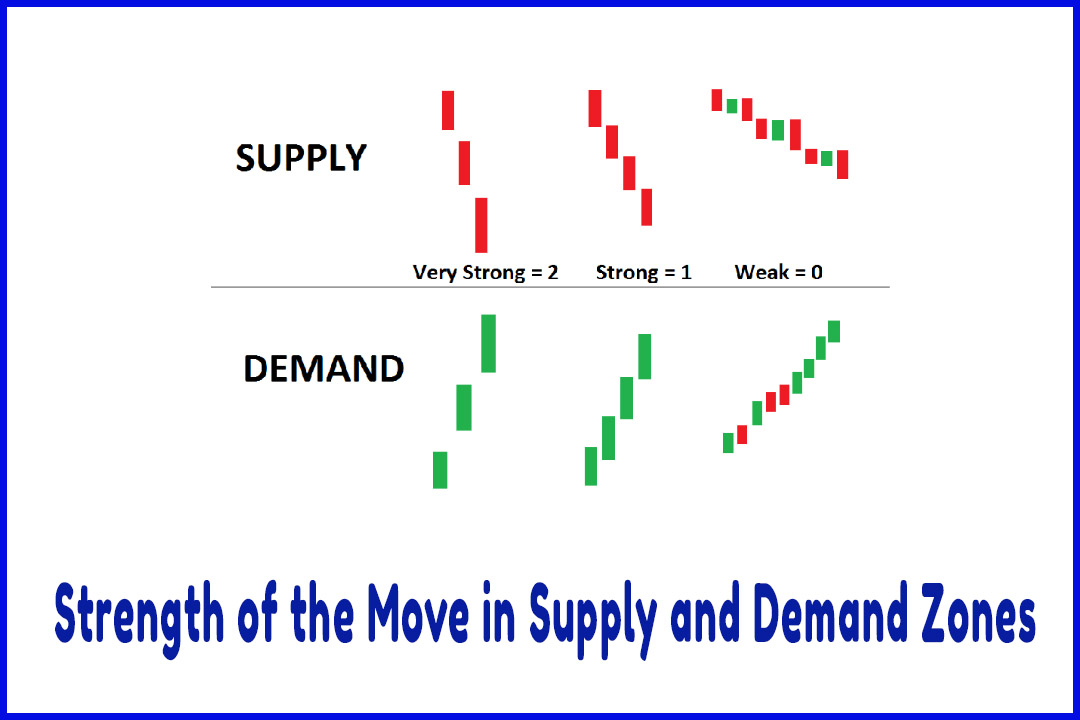

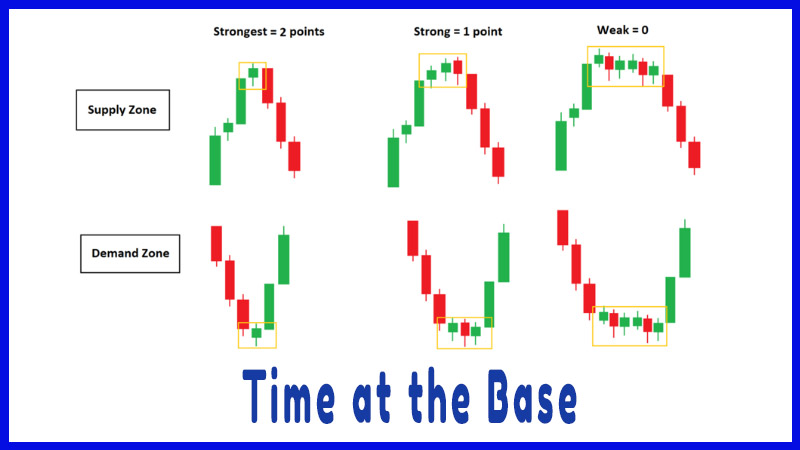

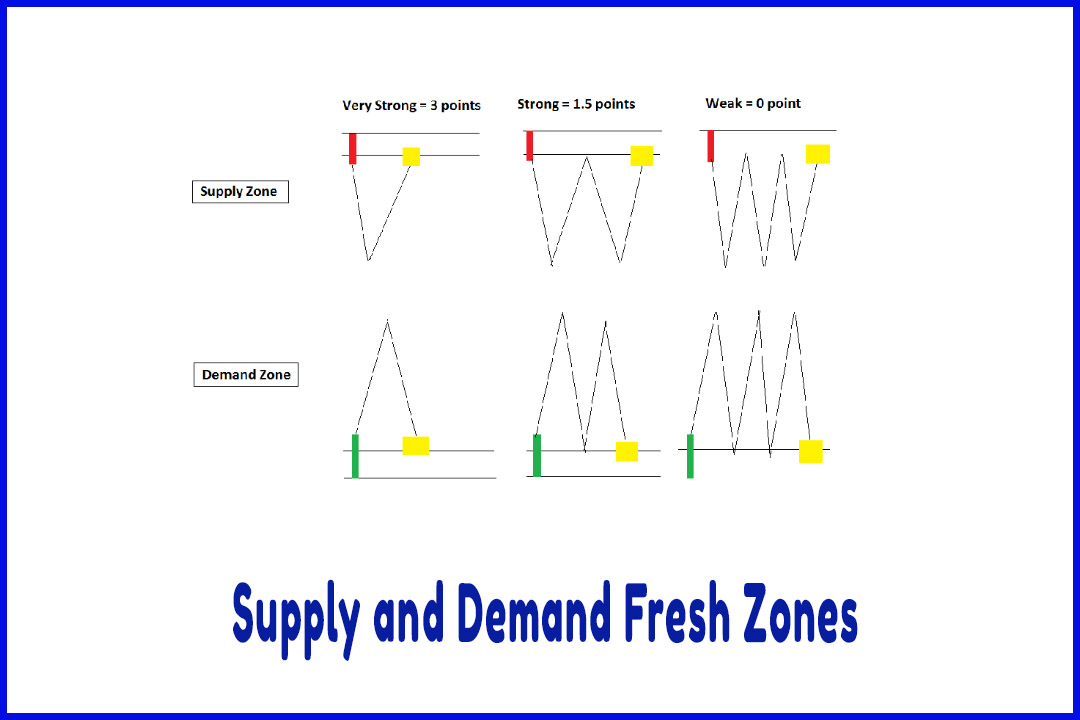

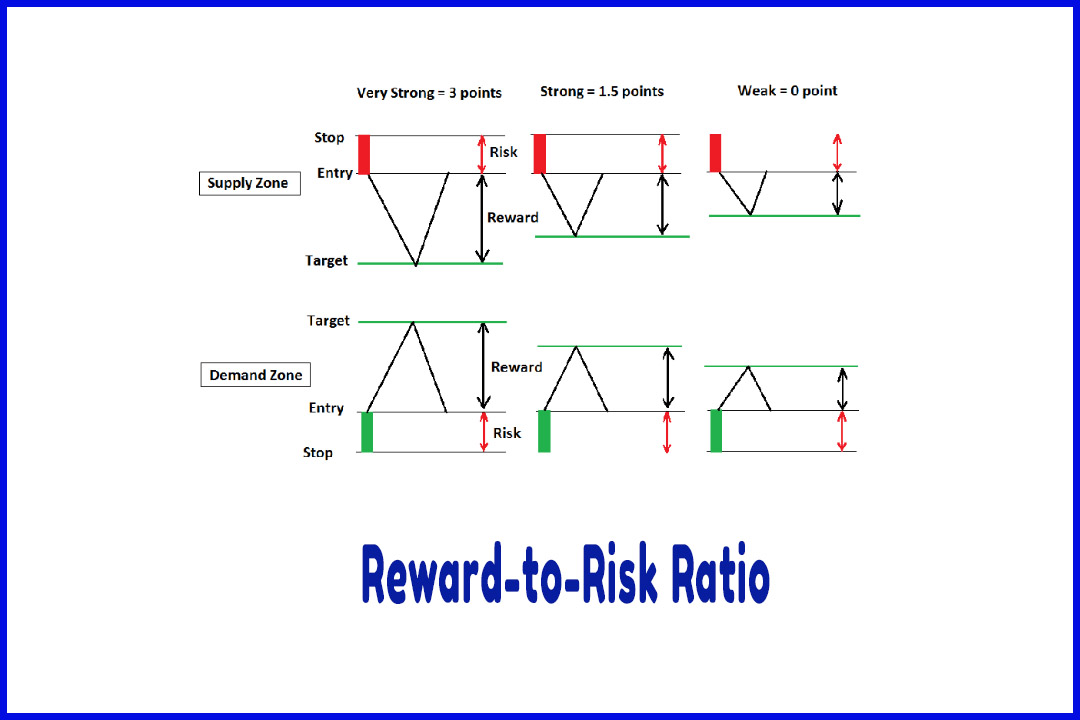

The first

example shows a supply zone with a score of 10 points. The strength of the move

is strong giving us 2 points.

The zone

is fresh, price did not test it (3 points) and price spent as little as one

candle at the base (2 points). Finally, the zone has enough room to give us a

3:1 ratio (3 points).

The final

score is 10 points and with this score, we have to place a limit order at the

proximal line of the supply zone and wait for the price to continue moving

higher to trigger our pending order.

This is a

good example of the perfect trade.

The next

example shows a supply zone with a final score of 5.5 points. In this example,

the supply zone is fresh (3 points) but has 6 candles which makes it a weak

zone to trade (0 point).

Next, we

have a weak move out of the zone because of the two ERCs we give it 1 point.

The reward-to-risk ratio is 2:1 scoring 1.5 points.

The final

score is 5.5 points which is a good example of a bad zone to trade. This supply

zone is considered a low probability zone based on our final score.

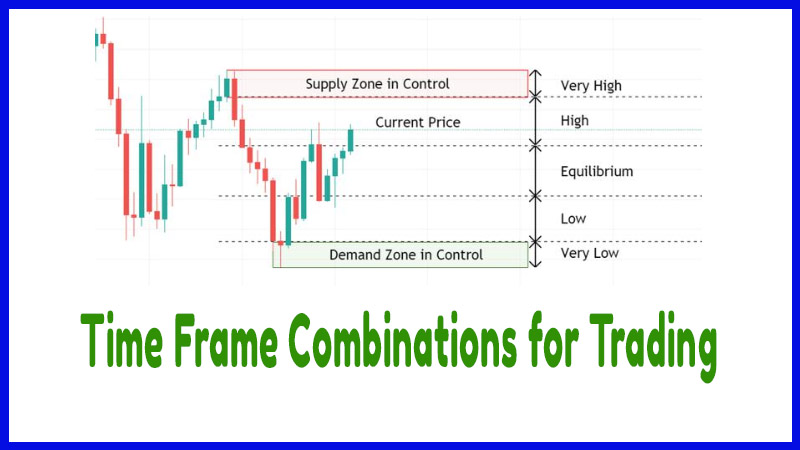

Exit Strategies

To close

open positions, we could either use an opposing zone or a fixed pip ratio.

-

Opposing Zone: we sell at the supply zone and we exit as soon as the price

reaches the first opposing demand zone.

We can

also close half the position size at the first opposing zone and close the

second half when the price reaches the second opposing zone further down.

-

Fixed pip ratio: we use the stop loss to calculate the exit of our trade. For

example, if we use a 3:1 reward-to-risk ratio, we multiple the stop loss by 3

to get our exit.

In this

example, we sell at the supply zone with a 78 pips stop. The exit level is 234

pips away from our entry.

Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy : Tag: Supply and Demand Trading, Forex : Trade Exit Strategies, Confirmation Order, Market Order, Limit Order, Entry Strategies - Supply and Demand Entry & Exit Strategies