Trade Reversals & Continuation Patterns

Continuation Patterns, Reversal Patterns, Direction of the trend, supply and demand patterns, Very strong patterns to trade

Course: [ Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy ]

Reversal patterns are located at the extreme highs and lows where the trend changes direction in the opposite way. These extremes are known as peaks and valleys. They are very strong patterns to trade.

How to Trade Reversals & Continuation Patterns

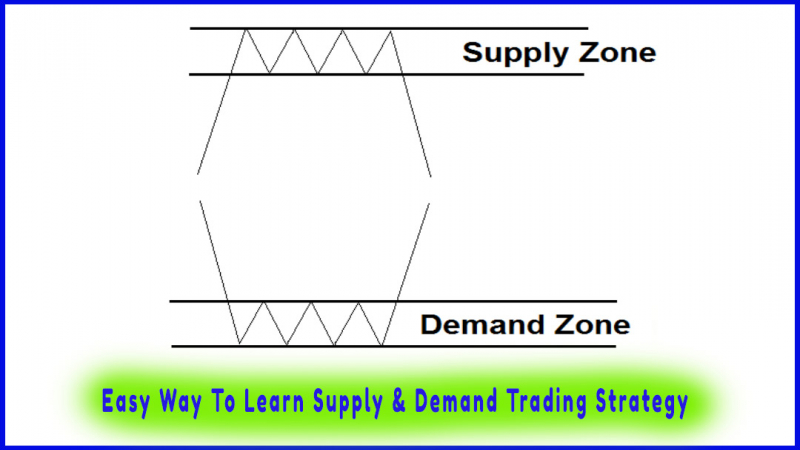

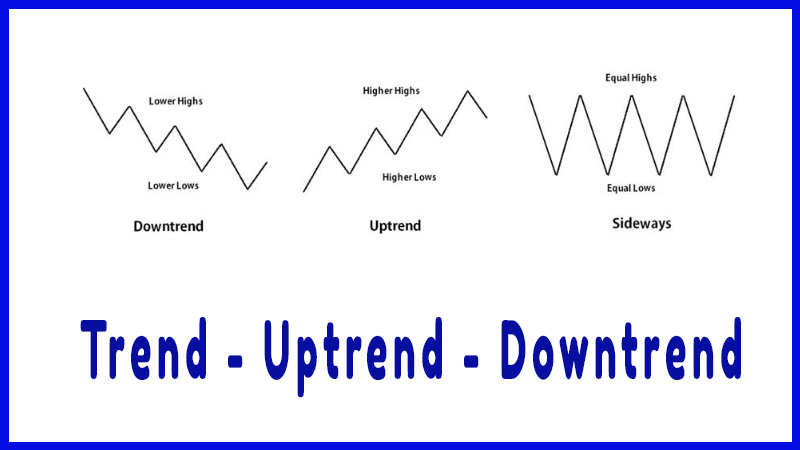

There are

two types of patterns in supply and demand: reversal patterns and continuation

patterns.

Reversal

patterns are located at the extreme highs and lows where the trend changes

direction in the opposite way. These extremes are known as peaks and valleys.

They are very strong patterns to trade.

Continuation

patterns are formed within the trend. These patterns are usually weak and

better trade them near the reversals.

In this

chapter, we will learn how to trade these supply and demand patterns and how we

can position ourselves to trade in the direction of the trend.

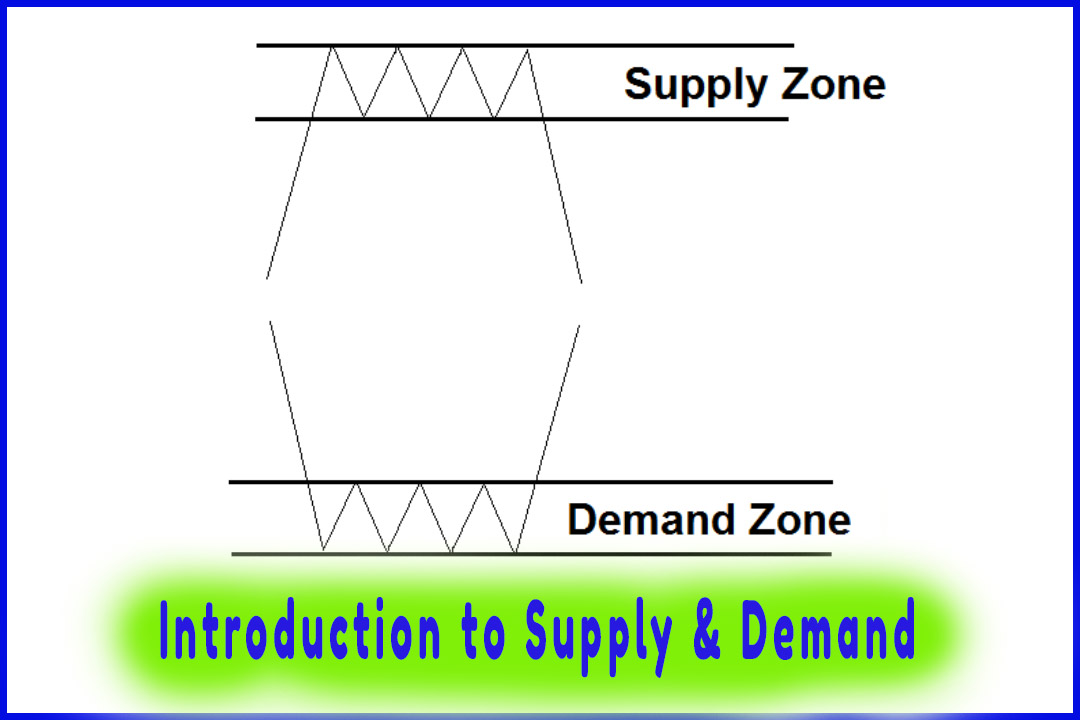

Reversal Patterns

Reversal

patterns tend to form at the peaks and valleys of price charts. When the price

is over-extended (price running out of steam) with more than 3 consecutive CPs,

we could expect a potential trend reversal.

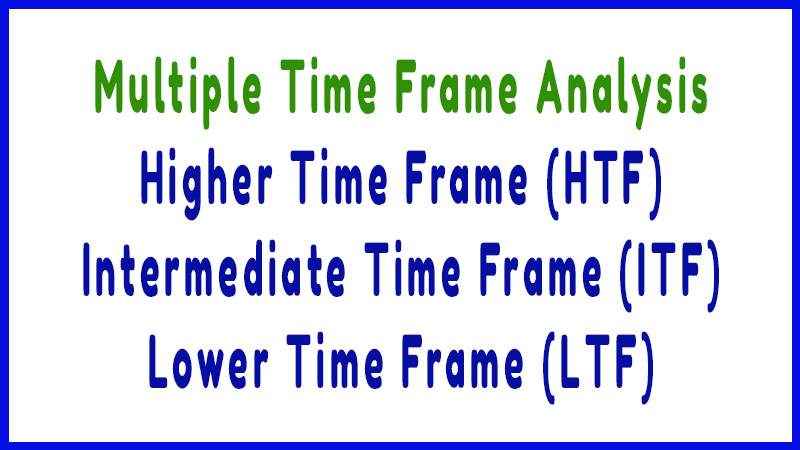

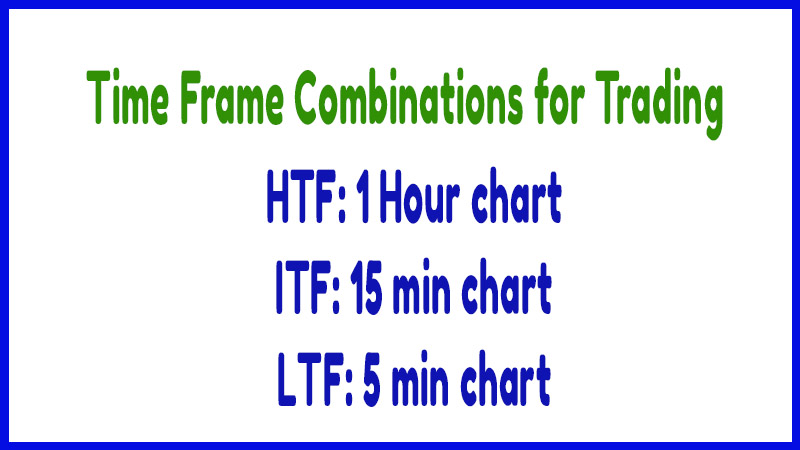

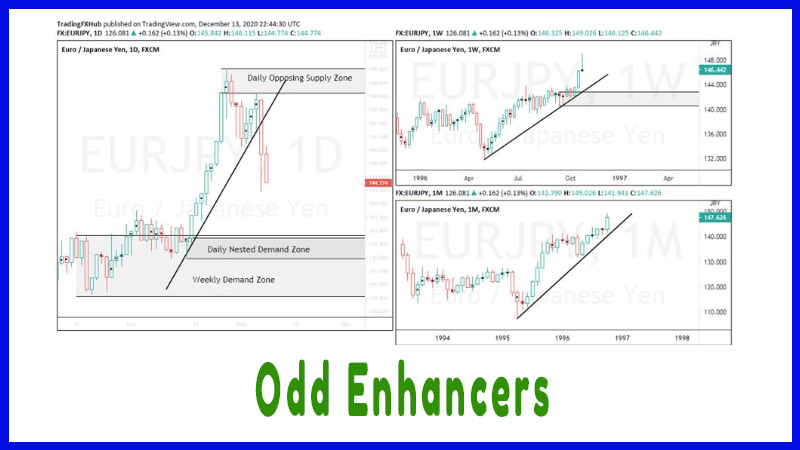

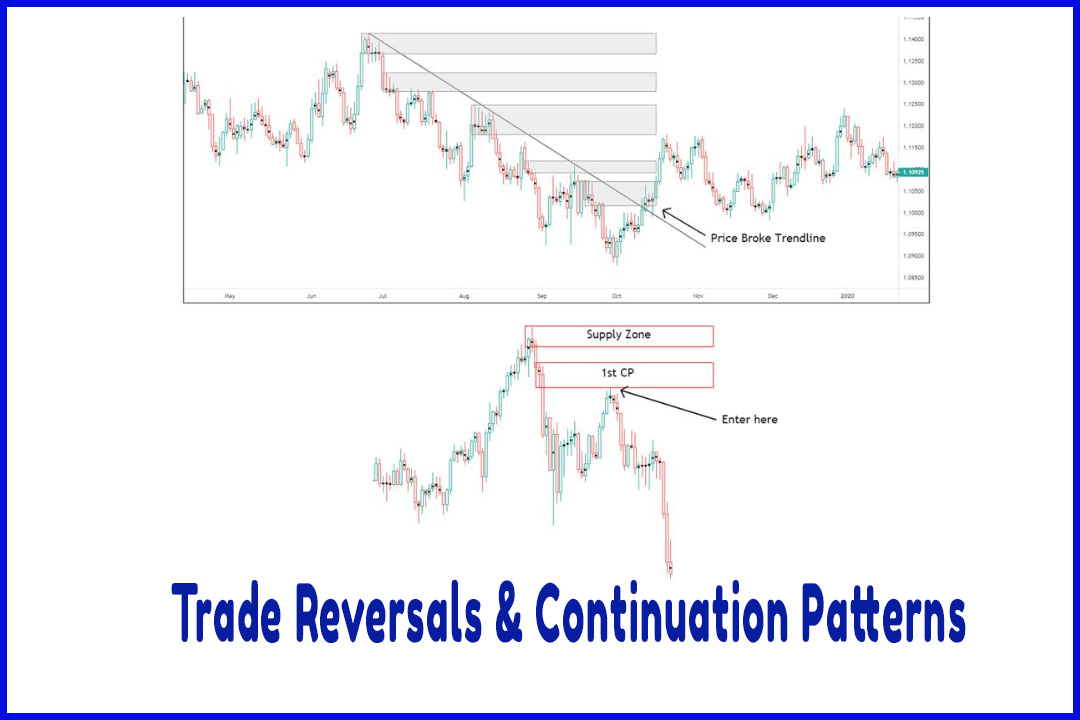

The next

example shows a monthly chart with an over-extended price to the upside. The

price creates a new higher high on the higher time frame and starts losing

strength to keep moving higher.

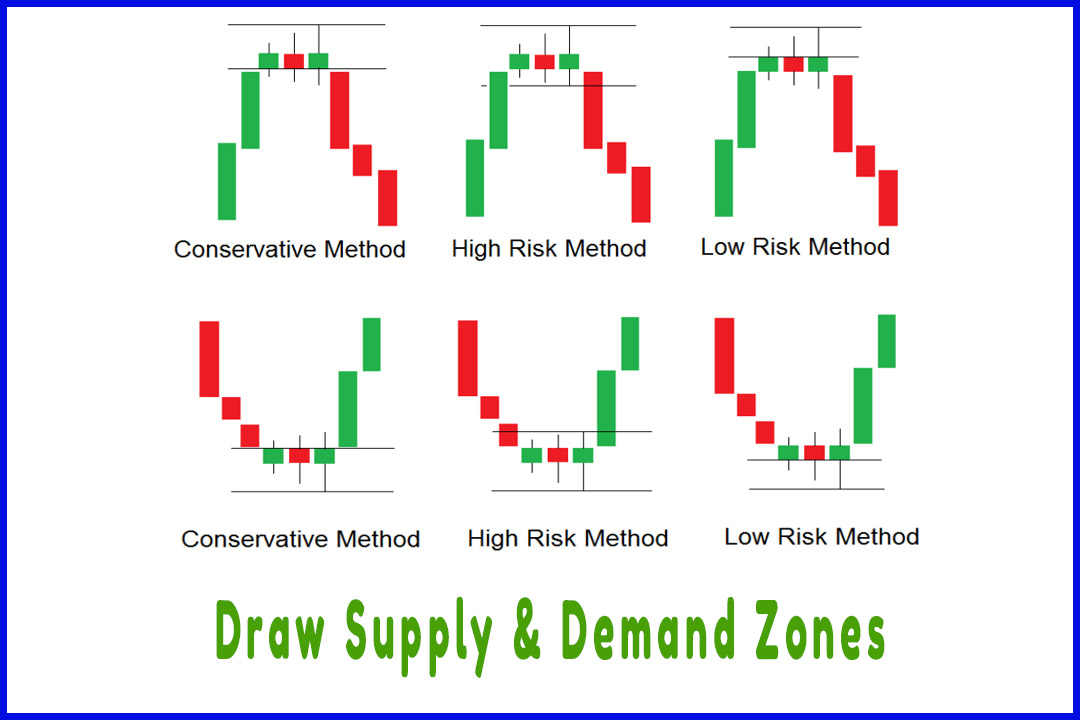

On the

intermediate time frame (weekly chart), price broke the trendline and we wait

for the price to create a new fully formed candle below the trendline.

On the

lower time frame (daily chart), we wait for the price to create the first

continuation pattern to short the market.

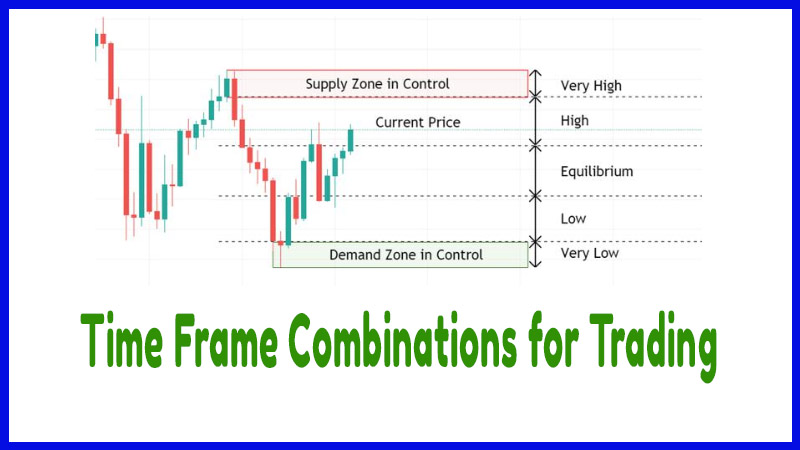

We do the

same thing for a demand zone, we wait for the price to retrace back up and test

the first continuation pattern to go long.

In case

the price did not create a CP, we simply trade the extreme peak or valley.

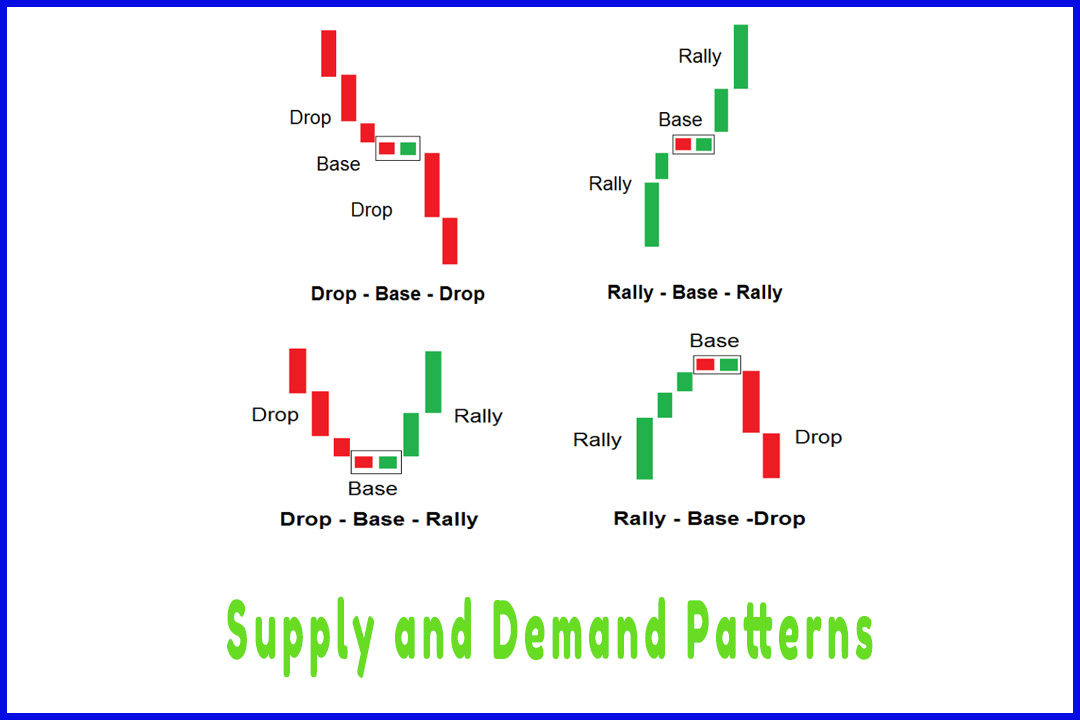

Continuation Patterns

Continuation

patterns are good at the beginning of the reversal. After the third CP, we stop

trading them because the price is over-extended.

On this

chart, the price created a reversal setup, broke the trendline, and created the

first continuation pattern. After the third CP is formed, the price started

going sideways and reversed back down.

We also

don’t trade CPs when price breaks the trendline. If price breaks the trendline,

we simply move to the higher time frame to find a fresh zone and wait for the

trend to align in all three frames.

Easy Way To Learn Supply & Demand Trading Strategy : Supply and Demand Trading Strategy : Tag: Supply and Demand Trading, Forex : Continuation Patterns, Reversal Patterns, Direction of the trend, supply and demand patterns, Very strong patterns to trade - Trade Reversals & Continuation Patterns