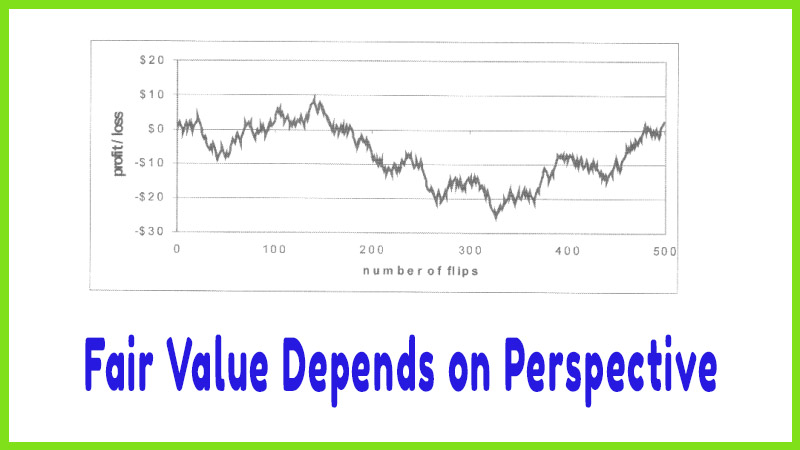

Fair Value Depends on Perspective

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

In the coin toss gamble, we calculated drat $1.00 was the fair value of the bet. However, that result is due to our assumption that the chance of winning (and losing) is 50%. Obviously, if we used different probabilities, we would get different results.

Fair Value Depends on

Perspective

In the

coin toss gamble, we calculated drat $1.00 was the fair value of the bet.

However, that result is due to our assumption that the chance of winning (and

losing) is 50%. Obviously, if we used different probabilities, we would get different

results. This means that the fair value of any bet depends on our perspective;

it depends on our views of the future probability of winning.

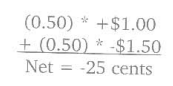

For

example, let’s assume that somebody offered to pay $1.50 for this coin toss

game. There are two ways we could look at it. First, we could assume there is a

50% chance of winning and losing and say that it is too high of a price since

that results in an expected loss of 25 cents per flip:

However,

we could also look at this bet another way. We could assume that the $1.50

price is a fair price since nobody should intentionally pay more than what they

think is fair. If we could assume that it is a fairly valued bet, we would need

to adjust the probabilities so that they balance to zero. It works out that if

there is a 60% chance of winning the dollar (and therefore a 40% chance of

losing your wager) then $1.50 is a fair price to pay for the game. If somebody

were willing to pay $1.50 to play this game, we would say that the gambler is

implying that his chances of winning are 60% (and the chances of losing are

40%) since those probabilities result in a fairly valued bet:

Although

the gambler may not specifically state that he believes the probability of

winning is 60%, the mere fact that he is willing to pay $1.50 for such a bet

implies a 60% probability of winning if we assume the bet is fair.

This

shows that there are two ways of looking at any bet. First, if we believe there

is only a 50% chance of winning then paying $1.50 is too high of a price.

Second, we can assume the $1.50 is a fair price and adjust the probabilities

to make the bet fair. So is $1.50 a fair price to pay for this game? It all depends

on how we view the future probability of winning.

Now, as

the gambler, it is up to you to decide which viewpoint is more realistic.

Should you assume the future chances of winning are 50% and only be willing to

pay $1.00? Or is a 60% chance of winning more realistic? Notice that if you

assume that 50% is the correct probability that you will be outbid by another

gambler if he feels 60% is the more realistic probability. You would only be

willing to bid up to $1 for the bet while he would be willing to pay up to

$1.50. It is critical that we are confident in our assessments. If 60% sounds

like too high of a probability, we’re probably better off not taking the bet.

It’s better to miss out on some reward rather than to lose some or all of our

money.

You can

see from this example that your probability assessment of 50% or 60% (or

something else) to value this coin flip game is an important assumption if you

are to make money. It is even more important when valuing options. However, as

we said before, very few option traders ever check to see how the price of the

option compares to their assessment of value. In order to do that, option

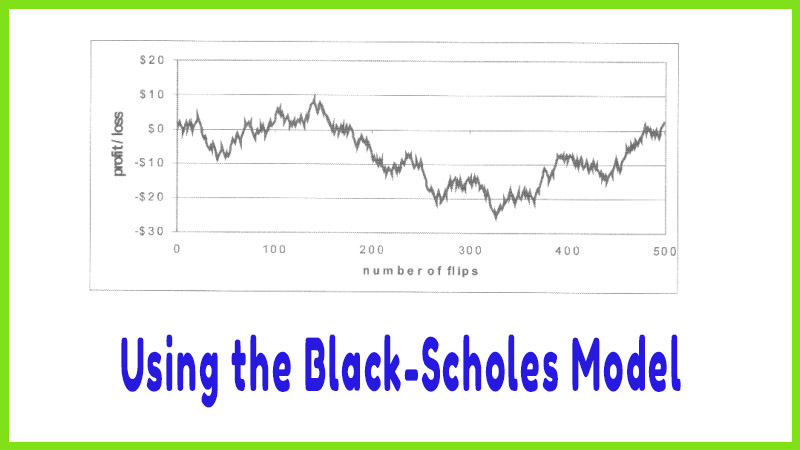

traders need to use the Black-Scholes Model before stepping into any trade.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Fair Value Depends on Perspective