The Need for Speed with Option Trading

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

What causes an option to have a speed component to its price? The quick answer is that it has to do with the fact that options have a time premium. The bigger tire time premium, the further the stock must move to recoup the cost.

What

causes an option to have a speed component to its price? The quick answer is

that it has to do with the fact that options have a time premium. The bigger

tire time premium, the further the stock must move to recoup the cost. But that

begs the question why do options have a time premium? In order to understand

why options, have a time premium, consider the following similarity of a

football bet.

Imagine

that you are betting on this year’s Superbowl between the New England Patriots

and Philadelphia Eagles. You do your homework and find that all of the analysts

are predicting that New England will win. To the unwary, this high probability

outlook sounds like it is too easy to make money; all you have to do is bet big

on New England and you’ll walk away richer. But if you attempt this, you’ll

quickly find it is not that easy. The reason is that everybody is reading and

acting on the same information and the crowd will want to bet on New England

too. That means you now have a problem since you cannot find anybody to take

the other side of the bet.

How can

you entice someone to take the other side; that is, to bet on the Eagles? One

of the easiest is to offer a point spread. While nobody is willing to bet on

the Eagles in actual points (or “even up”), people will take the bet if you

create a point spread. For instance, if you offer someone a 7-point spread that

means you must subtract seven points from the Patriots score before comparing

it to the Eagles score (or, equivalently, anybody betting on the Eagles gets to

add seven points to their score). This acts as a handicapping system thus

making it more difficult for the Patriot bettors to win. If the Patriots win

21-14, there is exactly a 7-point spread (the difference in scores) and no

money is won or lost. A bigger difference in scores results in a win for the

person betting on the Patriots while a smaller spread results in a win for the

one betting on the Eagles.

How is

tine spread determined? It is determined by the market. If a bookie posts too

low of a point spread then nobody will be swayed to betting on the Eagles. If

the point spread is too large, then everybody will wish to bet on the Eagles.

It’s only when the point spread is just right - the market price - that bookies

will find an equal number of buyers and sellers and all bets can be placed.

Only when you have a balanced number of buyers and sellers can the bet be

viewed as fair; the crowd is indifferent between betting on one side or the

other.

Now, if

you just think of an option as a directional bet on the stock, let’s see how

this football analogy relates to the options market. If everybody thinks that

VIP stock’s price will rise, then everybody would want to buy call options. In

other words, nobody would be willing to sell those calls. That is, nobody will

sell the calls unless you offer a point spread on the bet. The spread on an

option is somewhat hidden but it is easy to show that it is there. Figure 1

shows that the $31,625 call was asking $3.50. Any trader who buys this option

and exercises it will have a cost basis of $31,625 + $3.50 = $35,125 on the

stock. However, the trader could have elected to buy the stock at the current

price, which gives him a cost basis of $31.41. So the trader who buys the call

needs the stock price to move to $35,125 just to break even at expiration.

In

essence, anybody buying this call is really betting on something more than that

the stock will rise. The buyer of this call is really betting that the stock’s

price will be above $35,125 by expiration since that is the breakeven point on

the option. The stock buyer is really betting that the stock’s price will be

above its current price of $31.41 whereas the call buyer is betting that the

stock’s price will be above $35,125. And those are two very different bets.

Since the

current stock price is $31.41, there is effectively a $35,125 - $31.41 = $3.71

spread on the “bet” at this time. This spread acts in the same way a point

spread does for our earlier football example bet. It is only because of this

$3.71 point spread that a market between buyers and sellers could be created.

If the time premium was higher than $3.50 on that call then we would have too

many people wanting to sell the bet and the price would fall. If the premium

were less than $3.50 then we have too many people wanting to buy the bet and

the price would rise. At a price of exactly $3.50, the number of buyers and

sellers is balanced at that point in time and the bet can be viewed as fair.

Notice

that, at expiration, if the stock rises to $35,125 or less, any trader who paid

$3.50 for the $31,625 call loses the bet - even though the stock’s price rose.

Using the football analogy, you would lose the bet if the Patriots win by less

than the spread. Even though you picked the correct team to win, you still lost

the bet since they did not win by a big enough spread. And this is exactly what

happened to the traders who bought any of the VIP calls in Figure 1 and tried

to sell thirteen days later. Although traders buying the call were correct on

the stock price direction, they accepted too big of a point spread on the bet.

Hopefully,

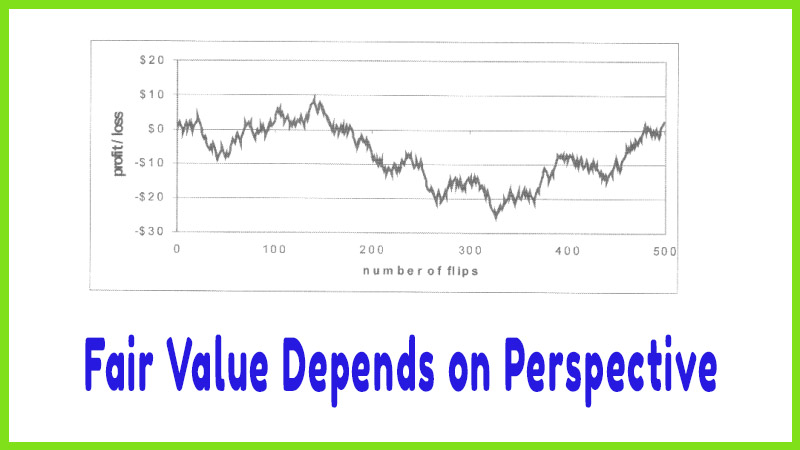

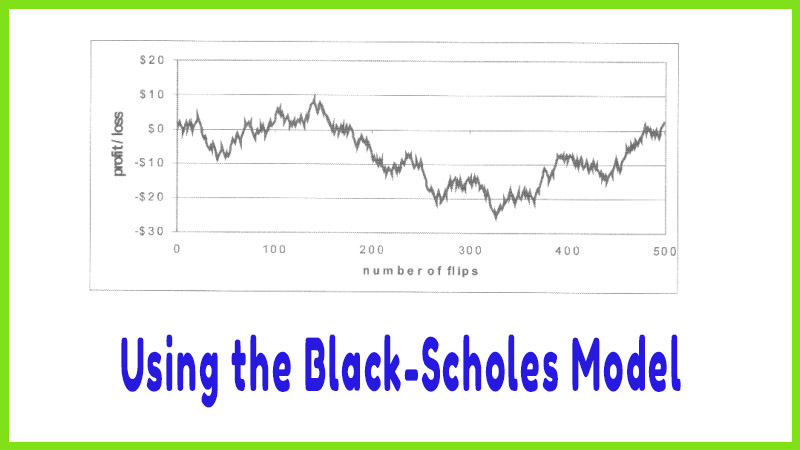

you are now convinced that volatility matters. Yet most option traders do not

take it into account when assessing the value of a trade. So how does a trader

account for the volatility? That is where the Black-Scholes Model comes into

play.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - The Need for Speed with Option Trading