Options are Two-Dimensional

Option traders, direction and speed, option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners, Volatility Traders

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

Options have two main factors that affect their price: direction and speed. Because of this, we say that options are two-dimensional. In order to be profitable, you must correctly guess the direction of the underlying stock along with the speed at which the stock’s price will move.

What

happened? How did these VIP call options lose money even though the stock’s

price went up? The reason the VIP options lost money is because options have

two main factors that affect their price: direction and speed. Because of this,

we say that options are two-dimensional. In order to be profitable, you must

correctly guess the direction of the underlying stock along with the speed at

which the stock’s price will move. Option traders must correctly guess the

direction (up or down) of the underlying stock as well as how quickly it will

move (will it move today or next week?). Stock traders, on the other hand, only

trade in one dimension. They only need to correctly guess whether the stock’s

price will rise or fall. They do not need to account for the speed.

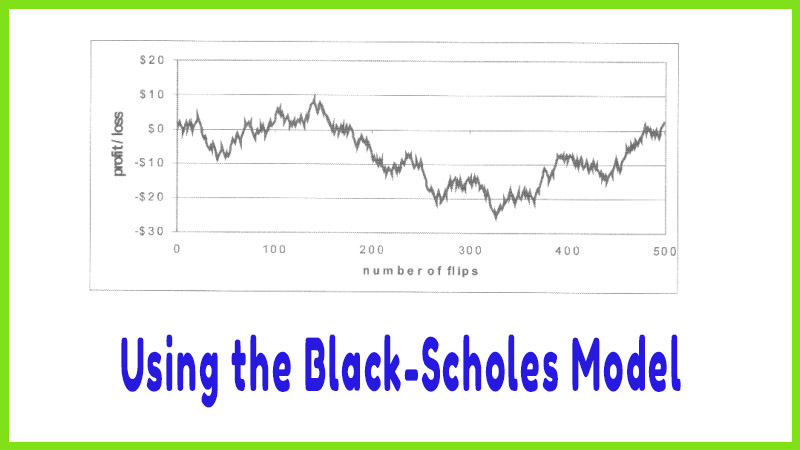

It is the

volatility of the underlying stock that determines the speed component. If you

are trading options on a highly volatile stock then that stock’s price must

move quickly in order for that option to become profitable. The reason has to

do with the fact that there is a direct relationship between volatility and

option prices. If volatility rises, so do call and put prices. But if

volatility falls, then call and put prices fall in response. Volatility,

however, is a hidden component to option prices. It is easy to see if the

stock’s price goes up or down but it is not so easy to get the same information

about volatility. It is certainly possible for the stock’s price to rise but

for volatility to fall enough so that there is an overall decrease in the call

option’s value. This is exactly what happened with the VIP calls in Figures 1

and 2. In this example, the option trader got the stock direction right but not

the speed; it took too long for the stock to rise. If the stock had moved to

$34 in a shorter time, say a day or two (rather than thirteen), the calls would

certainly have made money. It is this second dimension of speed that makes

options trading so much more difficult than stock trading. Notice that a

one-dimensional stock trader would have made money by purchasing at $31.41 and

selling for $34. The speed at which the stock rises does not matter. Therefore,

while a stock and option trader may both have guessed that VIP was moving

higher, only the stock trader made money since he does not need to account for

speed at which the stock gets to a certain price.

This

example shows that call options are not necessarily a direct substitute for

stock. If you think a stock is moving higher, you cannot just buy a call in

place of the stock and expect to make money if you are correct. (Similarly, put

options are not a direct substitute for shorting stock.) Yet most option

traders mistakenly apply this one-dimensional stock trading technique to

options and, consequently, end up losing money.

Understanding

candlestick charts will take care of the directional aspect. Understanding

volatility will take care of the speed aspect. Only when we have correctly

identified both direction and speed can we expect to make money with options.

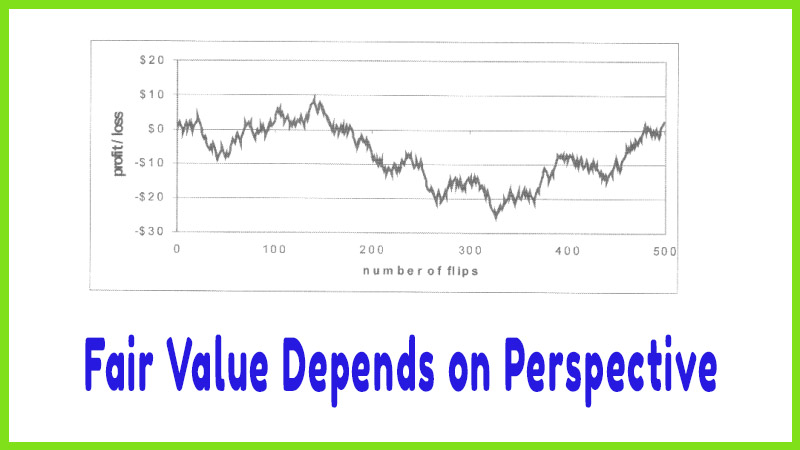

You must

be convinced that the speed of movement in the stock’s price matters. So before

we get into the details of how to identify both direction and speed, let’s look

at a quick analogy to convince you that speed matters.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : Option traders, direction and speed, option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners, Volatility Traders - Options are Two-Dimensional