Using the Black-Scholes Model

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

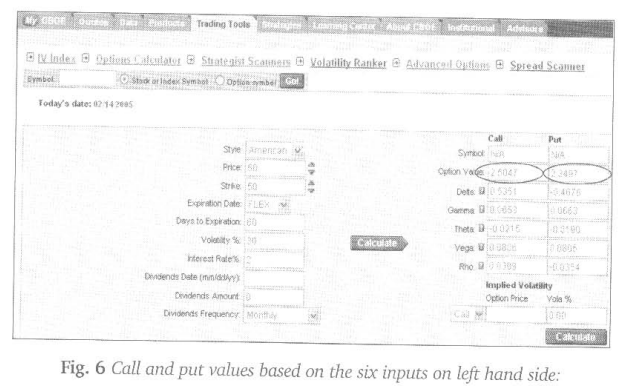

Those circled values are not just some ambiguous values. They are the fair values of the option “bets” based on the six inputs given on the left hand side. In this example, if you pay more than $2.50 for the call option (or $2.35 for the put), you are expected to just break even in the long run.

Using the Black-Scholes Model

The Black-Scholes

Model is an option pricing model that takes six inputs and calculates what the

call and put prices should be. The six factors are:

·

Stock price

·

Exercise price (strike price)

·

Risk-free rate of interest

·

Time to expiration

·

Dividends

·

Volatility

Let’s run

through an example of how to use it. Assume that the underlying stock is $50,

the strike price is $50, there are 60 days to expiration, volatility is 30%,

the risk-free interest rate is 2%, and no dividends are paid during the life of

the option. If we put these values into the calculator (as shown in Figure 6,

following page) and hit the “calculate” bar, we find that the call should be

priced at $2.50 and the put at about $2.35 as shown by the circles in Figure 6:

Those

circled values are not just some ambiguous values. They are the fair values of

the option “bets” based on the six inputs given on the left hand side. In this

example, if you pay more than $2.50 for the call option (or $2.35 for the put),

you are expected to just break even in the long run. If you pay less, you’ll

end up on the winning side and if you pay more you’ll end up on the losing

side. This assumes that you are able to make this exact bet hundreds of times,

which is an unrealistic assumption. In the real world, you are probably only

going to get one shot at any given option scenario. Still, understanding the

fair value of such a bet over hundreds of trials gives us a benchmark for what

we should be willing to pay for only one shot.

Black-Scholes Input Explanations

Style

The

“style” pull down menu asks you to select either ‘American” or “European”

style options. An American style option is one that can be exercised at any

time prior to expiration while the European counterpart may only be exercised

at expiration. All equity (stock) options are American style while most index

options are European (the OEX is about the only major exception - it is an

American style option). If you are valuing stock options, make sure you select

the “American” style.

Interest Rate

The

interest rate is always the annualized risk-free rate over the time period of

the option. In this example, we need the risk-free rate for a sixty-day

investment (expressed as an annual rate). However, the CBOEs calculator

automatically looks this up for you based on the “days to expiration” field you

provide. So the risk-free rate is not an input that you need to worry about

finding if you are using this calculator.

Volatility

This is

the most important number in determining an option’s value. We used 30% for

this example but, in the real world of trading, that number could be anything

from a low of about 10% to a high of 300% or more. The volatility number is

simply the standard deviation of stock price returns, which we will talk about shortly.

The volatility number gives us an idea of how large we expect the future price

swings to be.

Dividends

The

“dividends” field requires us to type in the amount of any dividend that will

be paid during the life of the option.

Of the

six factors, volatility is the most critical since it is not directly

observable in the market. In other words, if you asked 100 traders to fill in

the six fields in the Black-Scholes Model for a particular option, they would

all use the same current stock price, the same exercise price, the same

risk-free interest rate (or at least very close), the same dividend amount, and

the same time to expiration. Those five factors are fixed at each moment in

time. However, it is possible dial no two traders would use the same volatility

since there is no way to say for sure what the correct answer is. This is why

volatility is so important to understand.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Using the Black-Scholes Model