Why Volatility Matters

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners, Volatility Traders

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

Many option traders choose to ignore volatility and trade options based solely on directional beliefs. However, this approach ignores the value of options in terms of volatility and large losses can occur - even if you are right on the direction - as the following real-life example shows.

Many

option traders choose to ignore volatility and trade options based solely on

directional beliefs. However, this approach ignores the value of options in

terms of volatility and large losses can occur - even if you are right on the

direction - as the following real-life example shows.

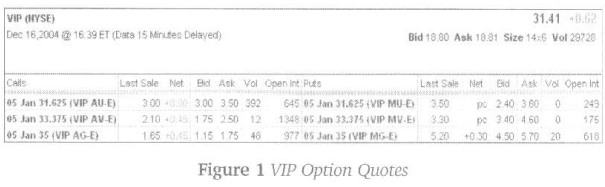

On

December 16,2004, VimpelCom (VIP) was trading for $31.41 as shown by tire

quotes in Figure 1:

Most

option traders who were bullish on the stock might be tempted to buy a call

option to leverage their outlook. Figure 1 shows that the $31,625 calls were

asking $3.50, the $33,375 calls were asking $2.50, and the $35 calls were

asking $1.75.

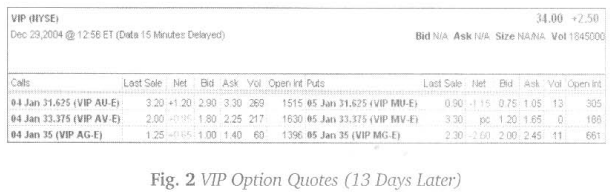

On

December 29, just thirteen days later, the stock rose significantly horn $31.41

to $34, which is a healthy 8% increase (over 200% on an annualized basis). This

certainly sounds like it should leave tire trader with a nice profit on the

leveraged calls but Figure 2 tells a different story. The $31,625 call was

bidding only $2.90 thus leaving the trader with a 17% loss for being correct on

the direction of the stock.

What

would have happened if you purchased either of the other calls? If you had

purchased tire $33,375 calls, you would have a 28% loss (paid $2.50 and sold

for $1.80) and a massive 42% loss (paid $1.75 and sold for $1.00) had you

purchased the $35 calls. No matter which call you may have chosen in Figure 1,

you were left with a substantial loss in Figure 2 even though the stock’s price

rose substantially. This example clearly shows that understanding stock price

direction is not enough to trade options profitably.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners, Volatility Traders - Why Volatility Matters