Using Candlesticks with Options

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

Option trading cannot be reduced to this same simplistic approach. The reason is, while an option’s price is sensitive to the direction of the stock’s price, it is also sensitive to the volatility of the underlying stock.

Using Candlesticks with Options

In the

mid-1700s, a man named Munehisa Honma had a prominent rice farming estate and,

consequently, had considerable influence over the rice market. Through years of

trading the rice markers, Honma discovered that, while supply and demand

played a role in determining price, the markets were also strongly influenced

by the emotions of traders. In other words, traders emotions could cause

significant changes in supply and demand. Honma found that traders could

benefit from understanding emotions. Through his analysis, Honma brought to us

one of the most important insights to trading: There can be a vast difference

between the price of rice and the value. Hundreds of years later,

the legendary investor Warren Buffett came to the same realization when he

said, “Price is what you pay. Value is

what you get.”

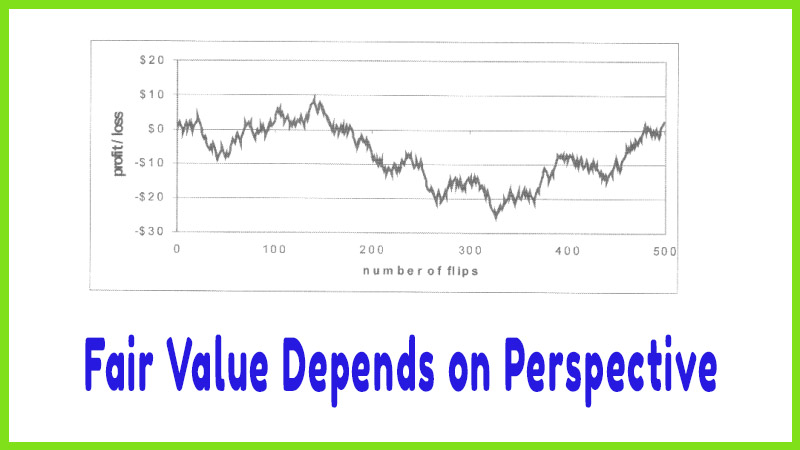

While the

words “price” and “value” are often used interchangeably in

everyday communication, there is a big difference between them when it comes to

investing or trading - as Honma and Buffett have figured out. The price of a

financial asset can be found by looking at the current market quote but the

value is a subjective measure. Value is something that exists in the trader’s

mind and is an assessment of whether the price reflects a good deal.

Here is

an example that demonstrates the difference between price and value. Assume you

are a currency trader and think the yen will rise against the dollar and you

wish to buy one million yen to capitalize on your outlook. Another trader

offers you one million yen in exchange for 7,000 British pounds. Should you

take the trade? Note that 7,000 pounds is the price for one million yen - it is

what you have to give up in order to buy the yen. However, it should be evident

from this example that it may not be a good deal since the value between the

two currencies could be vastly different. In order to check, we can convert the

two currencies into dollars and then make comparisons. At the time of this

writing, 7,000 pounds were equal to $13,440 and one million yen were equal to

$9,615. Now it is easy to compare the two currencies and we can see that it is

not a good deal to give up something worth $13,440 in exchange for something

worth $9,615. In other words, 7,000 pounds is too high of a price to pay for

one million yen since there is not an equal amount of value between the two

currencies.

But there

is something more troubling about the trade than the fact that price is higher

than the value. Notice that if you pay 7,000 pounds for one million yen you

could still end up losing money - even if your outlook is correct and the yen

rises against the dollar. You could lose on this trade because the rise in the

yen may not be enough to offset the high price paid to acquire the yen.

When it

comes to trading stocks, there is only one thing that a trader needs to know to

determine if a particular stock is a good value; that is, the future direction

of the stock’s price. That is exactly what candlestick charting helps a trader

identify. Unfortunately, most option traders take this same approach when it

comes to trading options. They see an option as nothing more than a leverage

substitute for stock. If they think the stock will rise, they buy calls; if

they think it will fall, they buy puts.

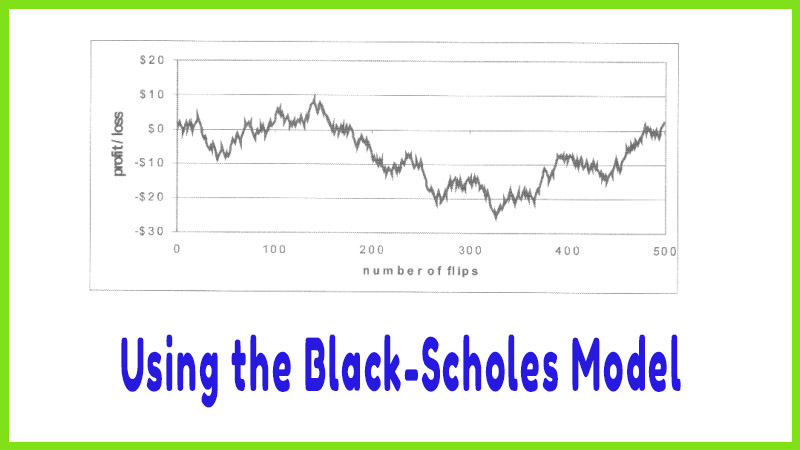

But

option trading cannot be reduced to this same simplistic approach. The reason

is, while an option’s price is sensitive to the direction of the stock’s price,

it is also sensitive to the volatility of the underlying stock. Volatility is

simply a mathematical measure of the price swings exhibited by the closing

prices. In mathematical terms, volatility is the standard deviation of stock

price returns. If there are large price changes from day to day, we say that is

a volatile stock. If the price changes are relatively small then the stock is

not volatile. It is not important to understand the mathematics involved in

measuring the volatility of a stock but the ability to interpret those numbers

is of utmost importance for an options trader.

As odd as

it may sound, knowledge that a stock is moving higher is of little use to an

options trader. In order for that information to become useful, we must also

know how quickly the stock will move.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Using Candlesticks with Options