Volatility Moves Sideways

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

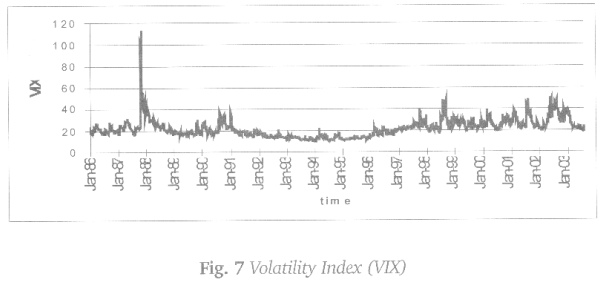

In order to use the Black-Scholes Model to your advantage, you must understand an important characteristic of volatility. That is, volatility tends to move sideways over time.

In order

to use the Black-Scholes Model to your advantage, you must understand an

important characteristic of volatility. That is, volatility tends to move

sideways over time. For example, Figure 7 shows an 18-year history of the

Volatility Index, or VIX, which measures the volatility of the S&P 500

Index. Although the index has risen substantially over this time period, notice

that the volatility did not - it just moved sideways.

This

sideways characteristic of volatility is about the only constant in options

trading and, consequently, is an important observation we can use to our advantage.

When volatility rises significantly above the long-term average, there is a

tendency for it to fall and vice versa. The tendency for volatility to fall

toward the long-term average is called mean reversion. That is, volatility

tends to revert to the mean (average). Anytime an extreme event happens, chances

are that following events will be less extreme, not more. Mean reversion is

easy to understand by looking at a real-world example - one that is often

explained by a jinx.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Volatility Moves Sideways