The Black-Scholes Model - A Scientific way to Value an Option

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

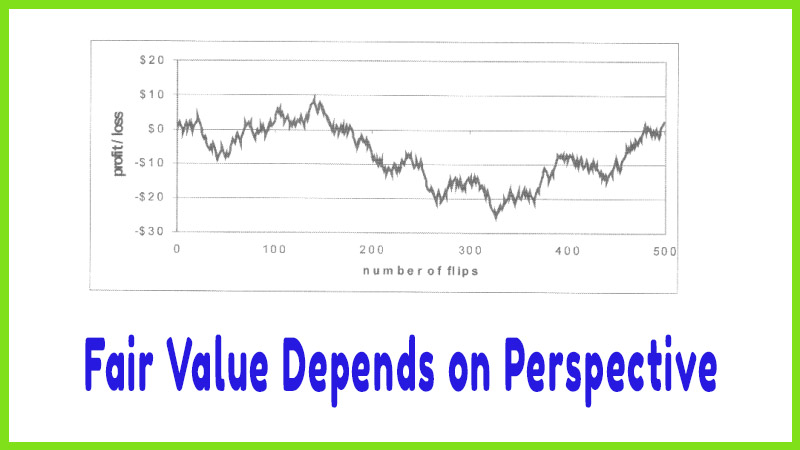

The spread we end up with is a result of broadcasting different point spreads until all bets have been made. Prior to 1973, this is exactly how the options market worked. Traders had to throw out bids and offers based on what they felt a trade was worth.

The Black-Scholes Model - A Scientific way to

Value an Option

When we

value a football bet, there is no way to say for certain if it is valued other

than by the fact that the crowd seems to think so. The spread we end up with is

a result of broadcasting different point spreads until all bets have been made.

Prior to 1973, this is exactly how the options market worked. Traders had to

throw out bids and offers based on what they felt a trade was worth. Because

nobody really had a means to quantify the numbers, traders tended to bid low

and offer high, which creates very large bid-ask spreads. Large spreads mean

low volume so the market became very inefficient and never quite got off the

ground.

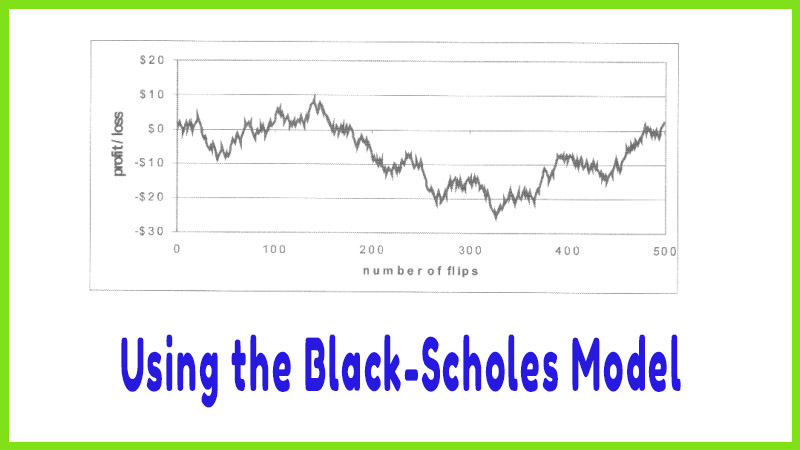

Fortunately,

that all changed in 1973 when Fisher Black and Myron Scholes created the

Black-Scholes Option Pricing Model, which allowed traders to get a more

scientific idea of what an option’s price should be. It is no surprise that

this was the very year that the Chicago Board Options Exchange (CBOE) was

created since there was now an objective way to readily determine the fair price

of an option. And with this knowledge, traders were willing to bid higher and

sell for less.

Despite

the importance of the model, most option traders do not use it. They pick all

their option trades based on directional beliefs. They feel the model is only a

theoretical tool that has no place in the real world of option trading.

Unfortunately, that is far from true. The Black-Scholes Model allows traders to

gain access to one of the most important pieces of information before jumping

into a trade - it allows traders to judge whether the price of an option

reflects a good value.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - The Black-Scholes Model - A Scientific way to Value an Option