Option Trading Criteria

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

Unlike investing in stocks, options have a time element involved. The infusion of a timeframe to an investment creates dramatically different dynamics. The time factor creates three crucial criterion: DIRECTION, TIME, and MAGNITUDE.

Unlike

investing in stocks, options have a time element involved. The infusion of a

timeframe to an investment creates dramatically different dynamics. The time

factor creates three crucial criterion: DIRECTION, TIME, and MAGNITUDE.

As has

been experienced through the centuries, most investors have difficulty in

mastering the direction of a price move. Implementing candlestick analysis

greatly increases the probabilities of analyzing price movement in the proper

direction. Knowing the direction of a trend’s move, with a relatively high

degree of probability, allows an investor to produce high-profit option strategies.

The

direction of a price move is only one key element to a successful option trade.

The amount of time available for that price to move is also an important

factor. The strategy for a trade will have a vast difference when considering a

trade that will expire in one week versus a trade that will expire in two

months.

Evaluating

what the candlestick signals are demonstrating makes establishing a very

short-term option trade much more feasible. Establishing longer-term option

trades can be implemented with more sophisticated risk/ reward strategies when

the direction is visualized with the signals. The fact that the candlestick

signals illustrate what investor sentiment is doing right NOW permits an

investor to incorporate the direction of a move for any time period.

Magnitude

is a third key element. Magnitude or volatility! Just because a price moves in

the correct direction does not guarantee that an option will make money. Bill

Johnson author of “An Investors Guide

to Understanding and Mastering Options Trading,” “The Single-Stock Futures

Revolution,” and “10 Biggest Mistakes in Option Trading”

provides valuable instructions for investors that want to master profitable

option trading strategies.

Option

trading usually implies high risk. Utilizing candlestick analysis can eliminate

a lot of the risk implication. The same analytical approach for putting all the

probabilities in your favor for a stock trade can easily be assembled into a

successful option trade. Stop-loss procedures can easily be incorporated. Evaluating

price movement with candlestick signals at potential targets provide improved

exit strategies.

Bill

Johnson’s 14 years of option trading background has helped with the creation of

many successful trading strategies. Applying that knowledge with candlestick

analysis makes for some high-probability, high-profit trade potentials while

utilizing commonsense risk management procedures.

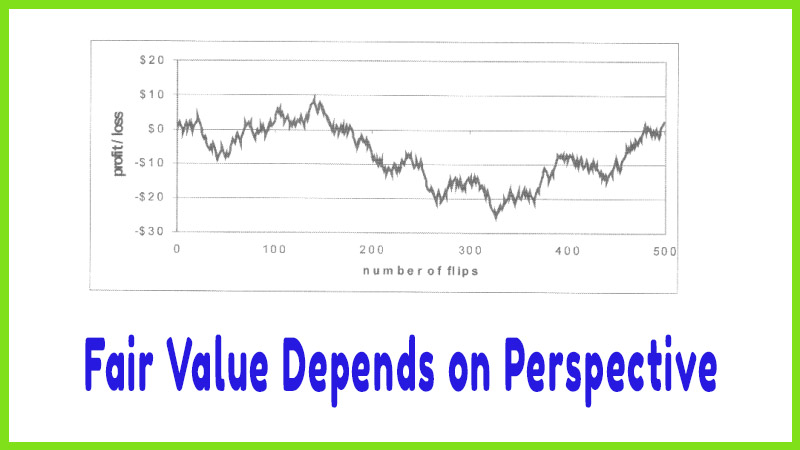

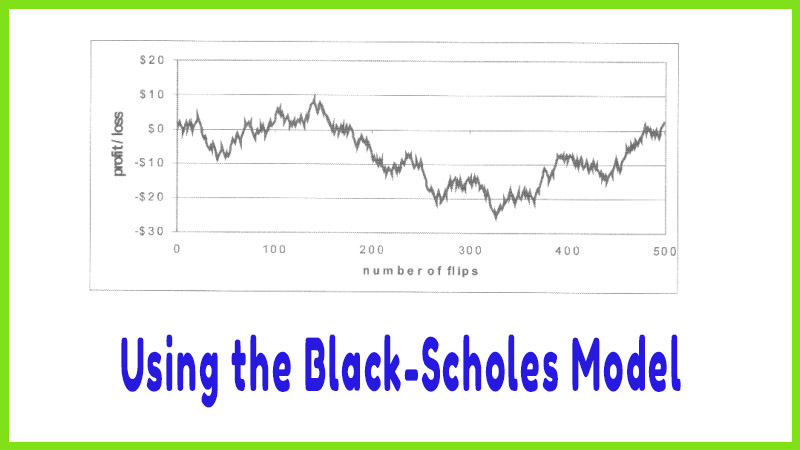

The

following chapter, written by Bill Johnson, not only describes how direction,

time, magnitude/volatility are important factors, but another major criterion

needs to be considered. The value of the option as measured by the remaining

time and past volatility of the underlying trading entity needs to be

evaluated. When putting all the probabilities in one’s favor, evaluating

whether an option price is overvalued or undervalued becomes part of a

successful option trade.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Option Trading Criteria