Valuing an Option

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

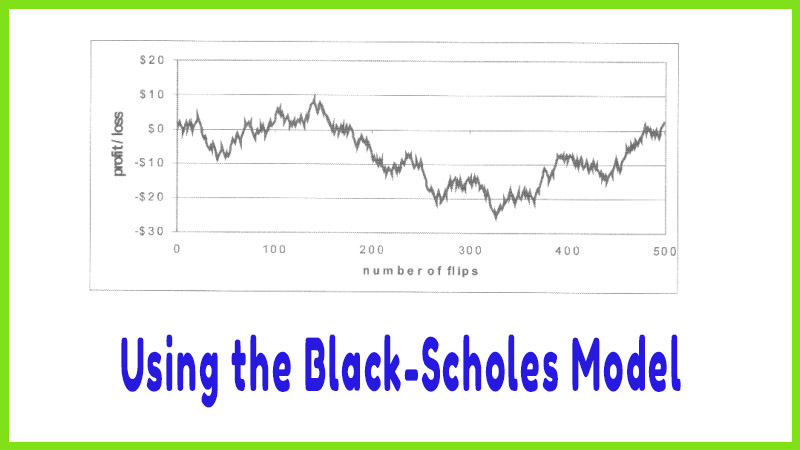

According to the Black-Scholes Model, the key ingredient in valuing an option is the future volatility - the volatility of the stock’s prices that will occur over the life of the option.

According

to the Black-Scholes Model, the key ingredient in valuing an option is the

future volatility - the volatility of the stock’s prices that will occur over

the life of the option. We do not need to know anything about the direction of

the stock (notice that the model does not ask you for a prediction on the direction

of the stock). The reason for this is that stock price changes follow a bellshaped

curve. Once we have the volatility (the standard deviation) we can determine

many probabilities since we know the following properties must hold for bell

curves:

1.

68% of the data fall within one

standard deviation

2.

95% of the data fall within two

standard deviations

3.

Essentially all of the data fall

within three standard deviations

As an

example, if we have a $100 stock with 30% volatility, we know that in one year:

1.

There is a 68% chance tire

stock’s price will fall between $70 and $130 (one standard deviation, or 30% on

either side of the current $100 price).

2.

There is a 95% chance the stock’s

price will fall between $40 and $160 (two standard deviations, or 2* 30% on

either side of $100)

3.

There is virtually a 100% chance

that the stock’s price would lay between $10 and $190 after one year (three

standard deviations, or 3 * 30% on either side of $100).

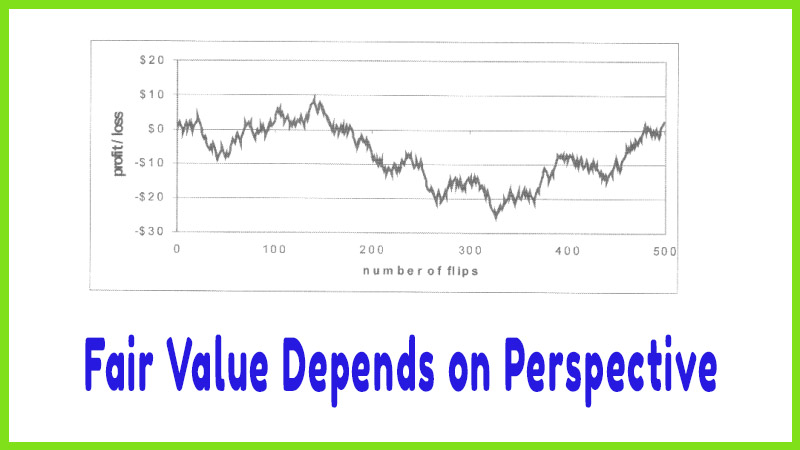

Once we

have a standard deviation (volatility), the Black-Scholes Model can then find the

probabilities and payoffs of the option and that means we can find the fair

value of the bet. If we are faced with low volatility, then there are only a

few possible stock prices that can occur and the option has only a few possible

small payoffs. Consequently, the option has a low price. But if there is a lot

of volatility then there are a lot of possible stock prices underneath that

bell curve and the bet become more valuable (the option has a much higher

price). For option trading it is important to remember the following: High volatility

equals high-priced options (true for both calls and puts). Low volatility

equals low-priced options.

Of

course, we will never know what the true volatility number is until after the

fact but we can get an idea based on past volatilities. There is one more

concept that we need to grasp before putting all of this information together.

That is, volatility tends to move sideways over time. Let’s take a closer look

at why this statement is true.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Valuing an Option