Time Decay - Option Trading

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

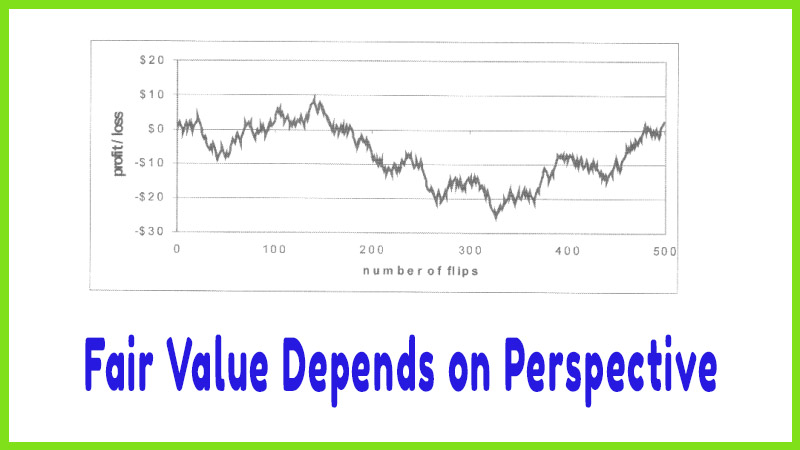

Many traders believe that the VIP calls lost money simply because of time decay. Time decay means that time has been subtracted from the life of the option and that the option must therefore be worth less money.

Many

traders believe that the VIP calls lost money simply because of time decay.

Time decay means that time has been subtracted from the life of the option and

that the option must therefore be worth less money. However, that assumes that

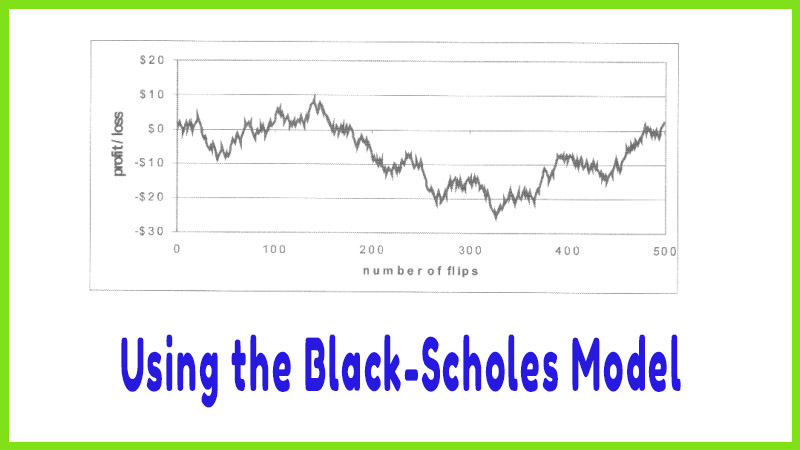

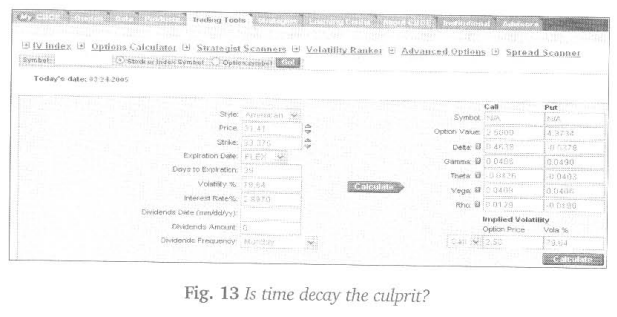

all other factors stay the same. We can use the Black-Scholes Model to see if

time decay was the culprit. Figure 13 shows that if we use a volatility of

79.64% then the price of the call is $2.50, which was the market price at the

time we considered buying the $33,375 call:

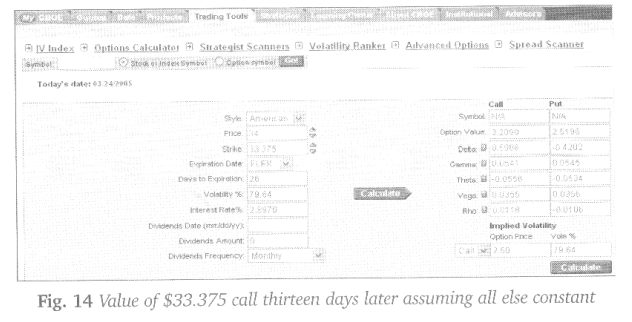

Thirteen

days later, the stock rose to $34. Figure 14 shows the value of the $33,375

call thirteen days later (26 days to expiration instead of 39) would be $3.20

assuming that volatility remained constant at 79.64%:

So, the

fact that time decayed by thirteen days was not the culprit of the loss on the

VIP $33,375 call[1].

Had thirteen days passed and volatility remained constant, we would have been

able to sell the call for $3.20 and gained a nice profit. Instead, we faced a

loss with the call bidding only $1.80. Which volatility is necessary to create

a $1.80 bid price?

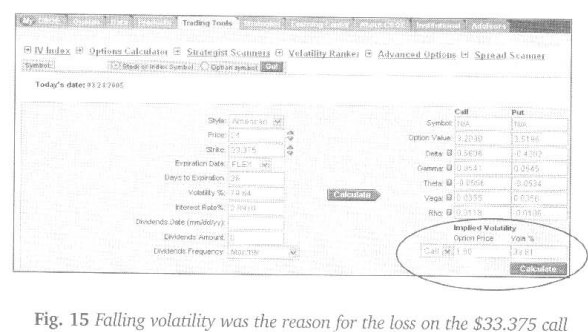

Figure 15

shows that an implied volatility of about 40% (39.81%) equates to a $1.80 call

price. This shows that the reason the $33,375 call lost money was not because

of time decay but rather that the implied volatility was cut in half; it fell

from 80% to 40% in thirteen days.

The

Black-Scholes Model allowed us to see the volatilities that the market was

using to price the $33,375 call. Had we not used the model, all we would see is

the $2.50 call price and have to make our decision based on our belief of the

direction of the stock. But as we’ve seen, knowing the direction is not enough

to profit on options. We must also know something about the volatility that the

market is using to price the options. Because the market’s assessment of

volatility was so high, we were faced with a very large premium ($2.50 market

price versus our estimate of $1.30). In order to overcome this large premium,

the call option had a high-speed component. Had VIP moved from $31.41 to $34

the next day, we would expect the call to be profitable. But it took thirteen

days to get there and that’s a different story.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Time Decay - Option Trading