Creating a Winning Trade

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

We’ve just demonstrated with a real-life example that option trading requires more than a directional belief about the underlying stock. In other words, just because you may be bullish does not mean that buying calls is the right strategy to capitalize on that outlook.

We’ve

just demonstrated with a real-life example that option trading requires more

than a directional belief about the underlying stock. In other words, just

because you may be bullish does not mean that buying calls is the right

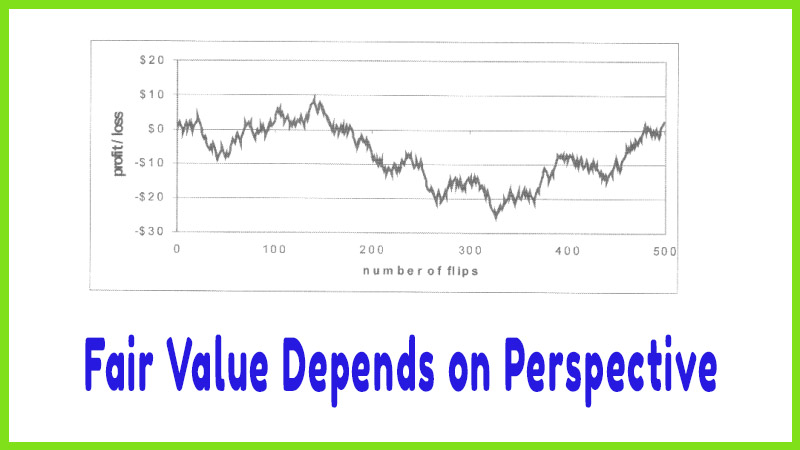

strategy to capitalize on that outlook. The reason is that long positions have

a “point spread” built into them in the form of a time premium. If that

time premium is too high, we can lose on the option even though the stock may

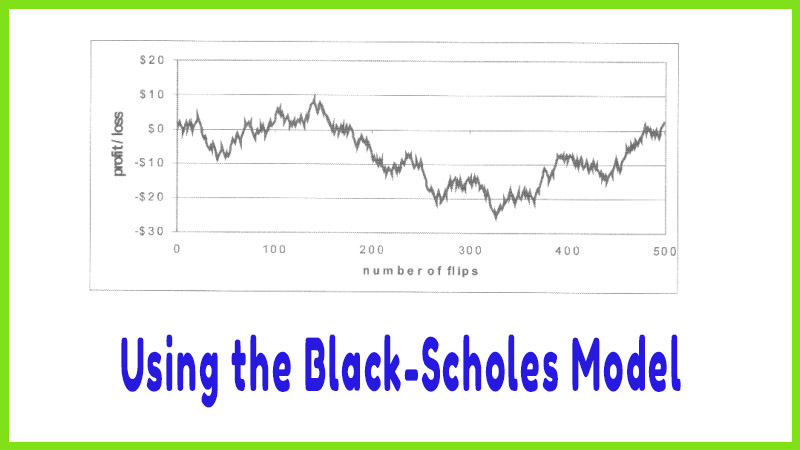

rise. By using the Black-Scholes model, we could guess that it’s probably not

wise to buy the $33,375 call when it’s priced at 80% volatility. Does this mean

we should sell the call?

On the

surface, many traders erroneously think that if the volatility appears to be

too high then we should simply be the sellers of the calls but that is not

necessarily true. There are two main reasons. First, in this example, VIP

appears to be priced at high volatility levels but it’s possible there is a

good reason. If we sell the call and the stock price jumps much higher, we

could end up with sizeable losses. So, we do not necessarily want to sell calls

“just because” volatility is high. Second, a high volatility does not equate

to a bullish bias. It’s certainly possible that the market is equally negative

on the stock. Remember, high volatility just means that the market is expecting

large price swings in the future; volatility measurements do not take direction

into account but, instead, only the size of the price swings. So if the VIP

$33,375 call appears to be priced high, it could be due to traders bidding up

the price of the puts (as the price of puts rise so does the price of calls)[1].

Since we determined that volatility is exceptionally high, all we can really do

at this point is decide to avoid the trade. We have tremendous insights into

the price swings (volatility) that the market is expecting but nothing has been

said about the direction. And it is this point that makes candlestick charting

so important for option traders. If we can gain some insights into the direction

of the stock, we can then determine whether we wish to buy or sell the bet.

Let’s see if we can use candlesticks to gain this critical additional

information.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Creating a Winning Trade