Utilizing Option Information

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

The use of candlestick signals, in their proper positioning for identifying tread reversals and applying a few minutes of option analysis to a trade, can produce high profits that everybody always promises.

The use

of candlestick signals, in their proper positioning for identifying tread

reversals and applying a few minutes of option analysis to a trade, can produce

high profits that everybody always promises. Utilizing the same principles for

evaluating high profit stock trades will make structuring successful option

trades relatively easy.

Learning

the candlestick signals enhances the ability to identify direction. Being able

to identify price movement enhancements signals, such as gaps or bounces close

off major technical levels, in conjunction with the candlestick signals,

increases the probabilities of establishing a profitable option trade.

Applying

that information to various option expirations provide profitable strategies.

Able to recognize profitable trading patterns might allow an option investor to

sell the near term calls while buying the calls of the next month strike price.

Options strategies become measurably more fined tuned when having the ability

to evaluate short-term direction based upon candlestick signals during a

longer-term price pattern.

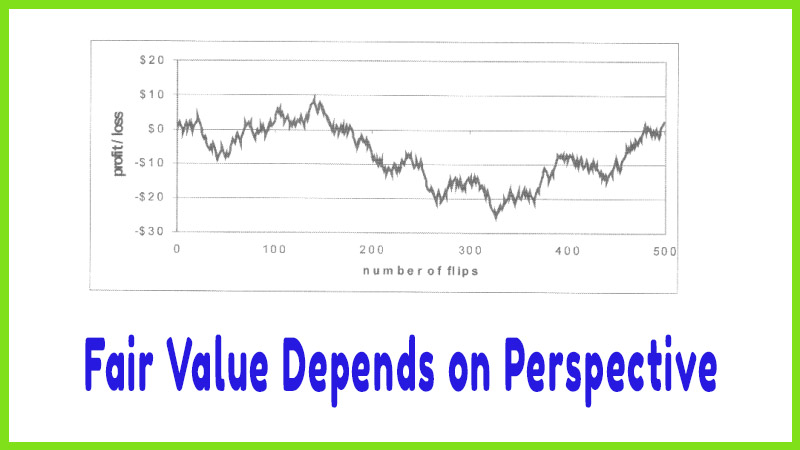

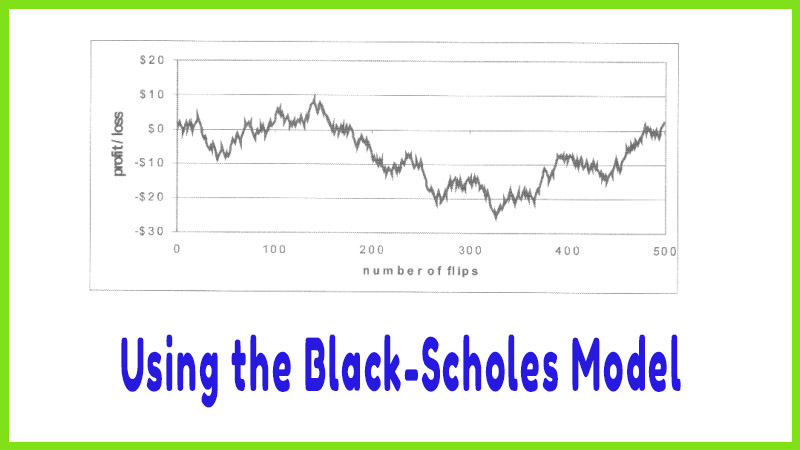

The

Black-Scholes option pricing model adds an additional element for exploiting

specific options that are over or under-priced based upon historic market

conditions. As an example, if a bullish candlestick signal indicates a $53

stock as a strong buy, the Black-Scholes model creates an additional profit

opportunity. In preparation of executing a call, the $50 strike price and the

$55 strike price might be evaluated. If the model indicates the $55 strike

price options are priced correctly and the $50 strike price options are

undervalued, logic dictates purchasing the undervalued options. Or at least

overweighting the $50 options if a combination of both options were being

purchased.

The same

rationale would be applied to selling calls or puts. When an option strategy

was being implemented which involved selling calls are puts, selling the

overvalued options becomes a better probability trade.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners - Utilizing Option Information