Candlestick Charts - Option Trading

option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners, Best Candlestick Charts

Course: [ How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals ]

At the beginning of this chapter, we said that Honma discovered that emotions play a significant part in the supply and demand for stock and therefore were important in determining price.

At the

beginning of this chapter, we said that Honma discovered that emotions play a

significant part in the supply and demand for stock and therefore were important

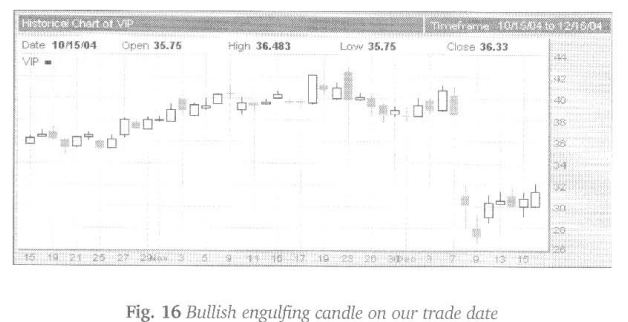

in determining price. In this example, all we know right now is that the market

is bidding volatility to very high levels but that just means the market

expects large price moves in the near future. We need to know if these large

moves are due, for example, to an impending takeover (bullish) or corporate

scandal (bearish) that is about to hit the news. Let’s take a look at a candlestick

chart on VIP and see if we can get a sense of how the supply and demand is

stacking up. Figure 16 shows a two-month candlestick chart right up to the

December 16lh date of our decision:

At the

right side of the chart, you’ll see the last two candles forming a classic “Bullish

Engulfing” pattern. In fact, the second “engulfing” candle never

traded below the opening price, as there is no lower shadow. This shows us that

the traders are stacking up as net buyers and we should expect the stock to continue

higher. There is no way to get the information that quickly from a western style

“open-high-low-close” chart. With one simple glance at a candlestick

chart, we now know the two important pieces of information that are needed to

trade options profitable - direction and speed. We know the market demand is

stacking up to the bullish side and that volatility appeal's to be too high. So,

what type of strategy should we use? Because the market is bullish, we do not

want to be caught holding short calls since that is a bearish bet. If the

market is correct, we could end up with huge losses even though we were correct

in selling theoretically high volatility. In order to create a winning trade,

we need to take into account that we are bullish along with our belief that

volatility is high. Because we’re bullish, we obviously want a bullish bet. But

because volatility is high, we do not want to buy a bullish bet. Instead, we

need to sell the bullish bet. And that means we need to sell puts.

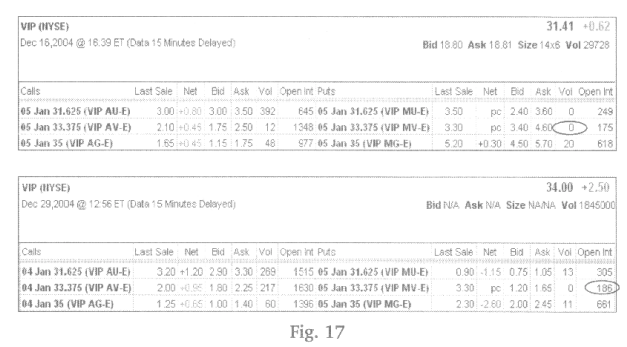

Figure 17

is a reprint of Figure 1 and Figure 2. You can see that selling the $33,375 put

for $3.40 would yield a nice profit after buying it back thirteen days later

for only $1.65.

How would

the other puts have performed? The $31,625 puts could have been sold for $2.40

and repurchased for $1.05 and the $35 puts could have been sold for $4.50 and

repurchased for $2.45. The sale of any put resulted in a significant gain for

the simple fact that this simple strategy properly aligned both the directional

and volatility aspects of options.

As we

stated before, the purchase of any call resulted in a loss. And that’s because

the buyers were correct on direction (the stock did rise) but they were wrong

about volatility (they bought the high volatility). Many traders believe that

if calls are expensive to buy then they must be a great deal to sell. Let’s see

if that’s true. Notice that if you had sold the $33,375 calls, you would have

sold for $1.75 and repurchased for $2.25, which leaves you with a loss. By

selling these calls, you were correct in selling volatility (you sold

volatility when it was high) but you were wrong about the direction of the

stock. In fact, the sale of any of the calls resulted in a loss. It is only

the short put trader that made money since that strategy properly aligned

direction and volatility. Only when both components are properly aligned can

you expect to make money with options.

Once

again, notice that the one-dimensional stock trader would have made money by

purchasing at $31.41 and selling for $34. But in order to make money with

options, you must be correct on direction and speed. And that means you must

take volatility into account.

Your best

source for understanding volatility comes from using the BlackScholes Model and

the best directional indicators come from candlestick charts. It is the trader

who uses both tools that will be able to separate price and value of options.

How To make High Profit In Candlestick Patterns : Chapter 6. Option Trading with Candlestick Signals : Tag: Candlestick Pattern Trading, Option Trading : option trading guidelines, option trading requirements, option trading good for beginners, best option stocks for beginners, Best Candlestick Charts - Candlestick Charts - Option Trading