Bearish Engulfing Pattern

Major reversal pattern, Engulfing pattern, Engulfing body, Engulfing Trading strategy, Trend reversal Pattern, Bearish Pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals ]

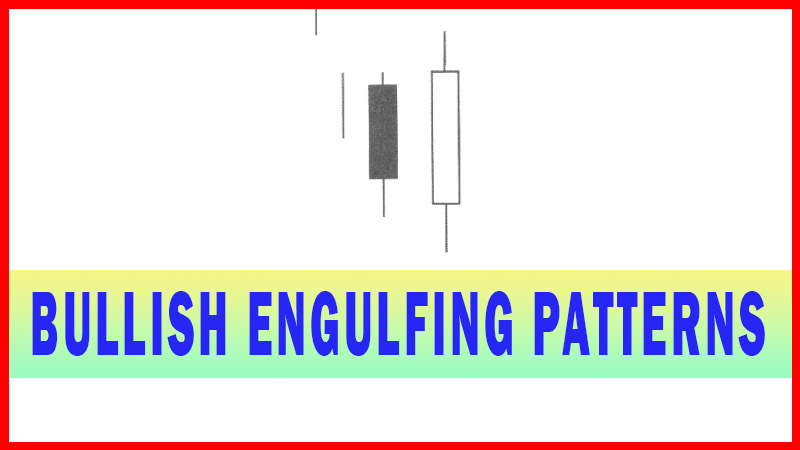

The Bearish Engulfing signal is exactly opposite the Bullish Engulfing signal. The Bearish Engulfing pattern is a major reversal pattern comprised of two opposite-colored bodies. The Bearish Engulfing Pattern (Figure 2-23) is formed after an uptrend.

ENGULFING PATTERNS

BEARISH ENGULFING

Description

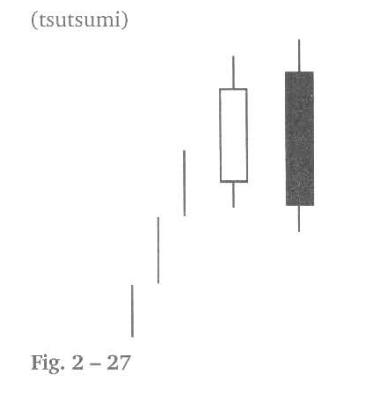

The

Bearish Engulfing signal is exactly opposite the Bullish Engulfing signal. The

Bearish Engulfing pattern is a major reversal pattern comprised of two opposite-colored

bodies. The Bearish Engulfing Pattern (Figure 2-23) is formed after an uptrend.

It opens higher than the previous day's close and closes lower than the

previous days open. Thus, the black candle completely engulfs the previous

day's white candle. Engulfing can include either the open or the close being

equal to the open or close of the previous day but not both.

Criteria

1.

The body of the second day

completely engulfs the body of the first day. Shadows are not a consideration.

2.

Prices have been in a definable

uptrend, even if it has been short term.

3.

The body of the second candle is

opposite color of the first candle, the first candle being the color of the

previous trend. The exception to this rule is when the engulfed body is a Doji

or an extremely small body.

Signal Enhancements

1.

A large body engulfing a small

bod); The previous day was showing the trend was running out of steam. The

large body 2. shows that the new direction has started with good force.

2.

When the engulfing pattern occurs

after a fast spike up, there will less supply of stock to slow down the

reversal move. A fast move makes a stock price over-extended and increases the

potential for profit taking and a meaningful pullback.

3.

Large volume on the engulfing day

increases the chances that a blow-off day has occurred.

4.

The engulfing body engulfing more

than one previous body demonstrates power in the reversal.

5.

If the engulfing body engulfs the

body and the shadows of the previous day, the reversal has a greater

probability of working.

6.

The greater the open price gaps

up from the previous close, the greater the probability of a strong reversal.

The

Bearish Engulfing signal is created with the same investor psychology as the

Bullish Engulfing signal. After an uptrend, the open of the Bearish Engulfing

signal is above the close of the previous day’s bullish body. Once again, the

investor psychology that illustrates exuberance, began the formation. A Bearish

Engulfing signal requires only to have an open above the previous days close.

The demonstration of exuberant buying, an open price much higher than the

previous day’s close and/or above the previous day’s trading range is more

significant. Where do most investors buy? Exuberantly at the top!

The

further to the upside that the Bearish Engulfing signal opens, the more

convincing the Bearish Engulfing signal becomes. It clearly illustrates that

the Bears have now taken over control of the trend. As with the Bullish Engulfing

signal, the Bearish Engulfing signal is visually clear to identify. It is a

dark candle after an uptrend of bullish candles.

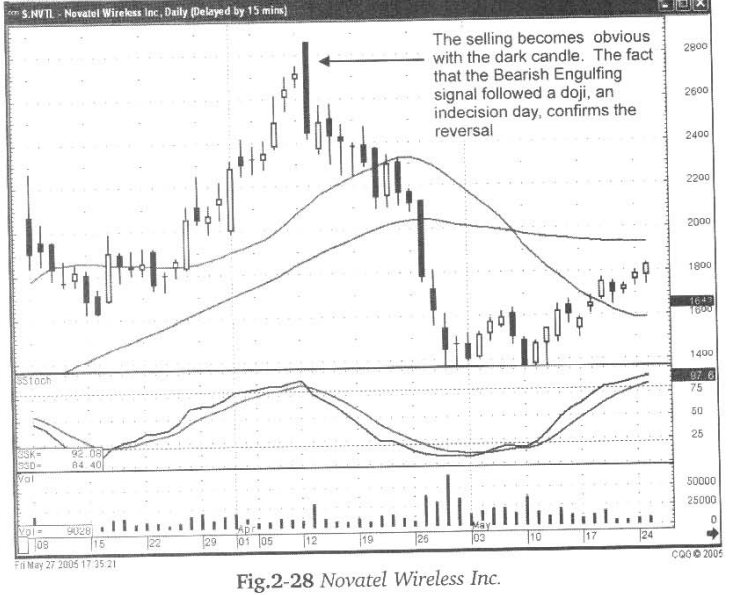

A Bearish

Engulfing signal following another candlestick sell signal adds more conviction

to a downside move. As illustrated in Fig. 2-28 the Novatel Wireless Inc.

chart, the Bearish Engulfing signal is initially created with a gap- up in overbought

conditions.

A gap-up

in price, followed the Doji/Spinning Top formation of the previous day. The

bearish trading of that day confirms the indecision that was developing in the

previous day’s signal. As with all the major signals, the signal itself is the

most important factor. Confirming indicators, such as stochastics, are just

that, confirming indicators.

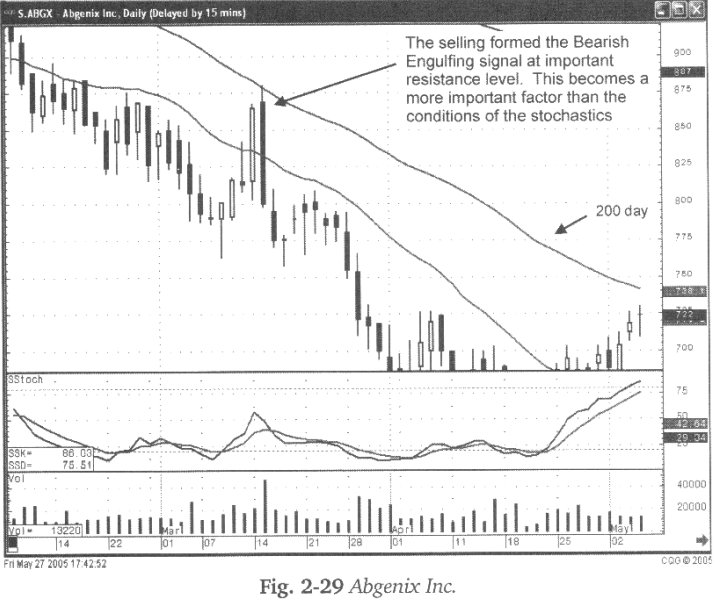

The

Bearish Engulfing signal witnessed in Fig. 2-29 (following page), the Abgenix

chart, occurred at a significant level. Although the stochastics were not near

an overbought condition, a Bearish Engulfing signal occurring exactly at the 200-day

moving average is meaningful.

It

clearly illustrated that the sellers made their presence known once an important

resistance level had been touched

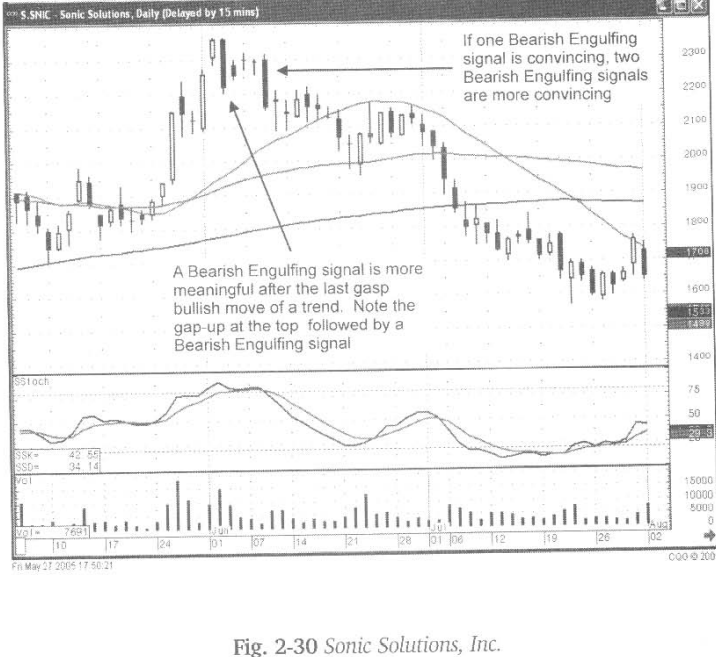

A Bearish

Engulfing signal gains more credibility after witnessing the obvious topping

signals of a trend. Notice in fig. 2-30, the Sonic Solutions chart (following

page), the uptrend shows topping signals with a gap up in the overbought condition.

This would be the area to start looking for a candlestick sell signal. The

formation of the Bearish Engulfing signal, the following day, is more relevant

after the gap-up. The second Bearish Engulfing signal four days later reaffirms

that the sellers have come into this price. Both long dark candles provide more

evidence that the sellers are now in control.

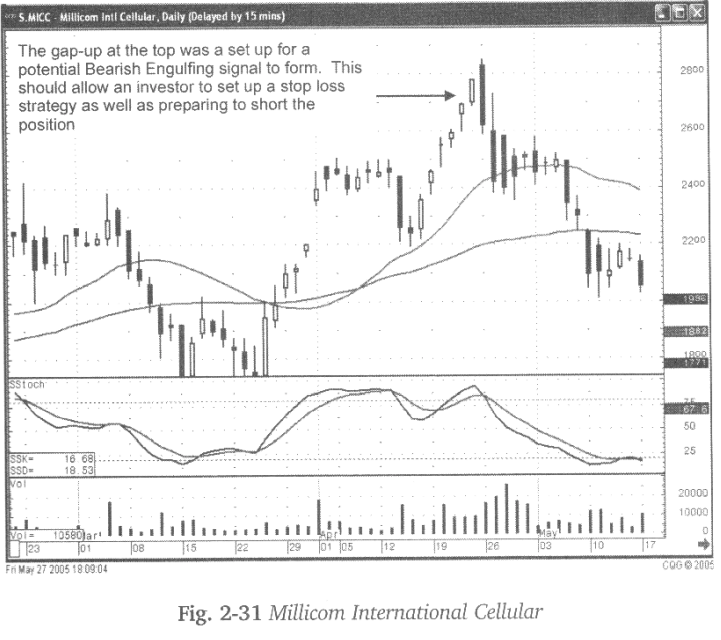

The

Bearish Engulfing signal can be created by opening higher than the previous

day’s close. If the open is higher than the previous day’s trading range, stop-

loss procedures can easily be implemented. Stop-loss procedures will be further

discussed in the Entry and Exit Strategy chapter. The completion of a Bearish

Engulfing signal, in an overbought condition, allows investors to prepare for

short trade potentials.

Notice in

Fig. 2-31, the Millicom International Cellular chart, the gap up in the

overbought condition was the first indication of a bearish signal being formed.

A ‘close’ below the previous days open, as well as the open on the candle two

days prior, made for a strong Bearish Engulfing signal. Not only should this

have closed out any long positions, it should have set the stage for shorting

the stock.

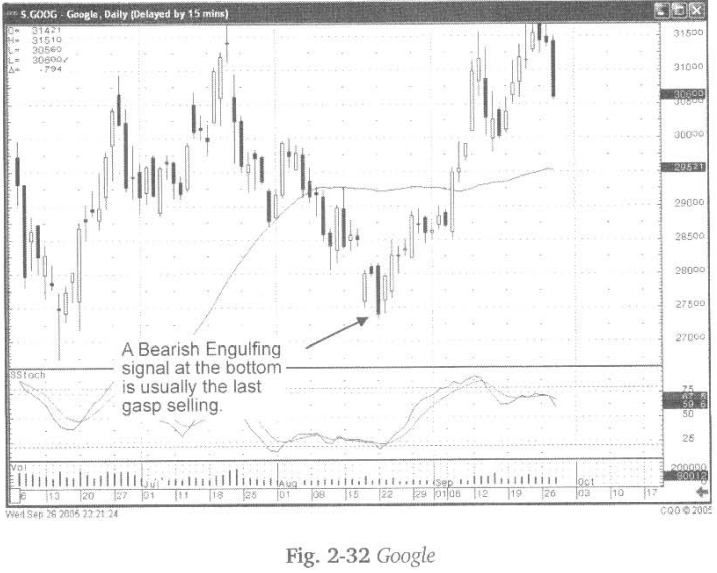

The

Bearish Engulfing signal portrays the same characteristics as found in the

Bullish Engulfing signal. A Bearish Engulfing signal viewed in an overbought

condition projects an extremely high probability of the trend turning down.

What happens when a Bearish Engulfing signal is seen in an oversold condition?

As with the Bullish Engulfing signal viewed in the overbought condition,

representing last gasp buying, a Bearish Engulfing signal provides the same

alert. A Bearish Engulfing signal in an oversold condition demonstrates the

final selling.

When viewing

a Bearish Engulfing signal in oversold condition, an investor should be

prepared for a bullish signal to occur very soon. As an alert for the bull to

start watching for a buy signal, it should also forewarn the investor with a

short position to be prepared to cover as seen in Fig. 2-32, the Google chart

The

Bullish and the Bearish Engulfing signals are both highly effective candlestick

signals.

They can

easily be recognized visually on a chart. Incorporating investor psychology

that is built into those signals allows the candlestick investor to take

advantage of tread reversals at the most opportune rimes. The signals,

occurring in overbought or oversold conditions, make their effectiveness that

much greater. The engulfing patterns reveal a significant change in investor

sentiment. They should always be addressed. The Bullish and the Bearish Engulfing

signal, occurring at other major technical levels, provide a significant

meaning. Do not ignore these signals.

How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals : Tag: Candlestick Pattern Trading, Forex : Major reversal pattern, Engulfing pattern, Engulfing body, Engulfing Trading strategy, Trend reversal Pattern, Bearish Pattern - Bearish Engulfing Pattern