Dark Cloud Cover

Piercing pattern, Bearish Engulfing signal, Candlestick sell signal, Dark Cloud signal, Reversal signal

Course: [ How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals ]

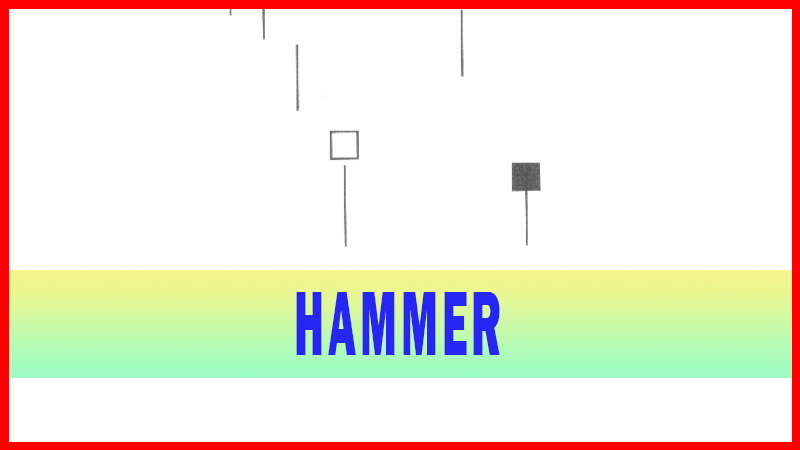

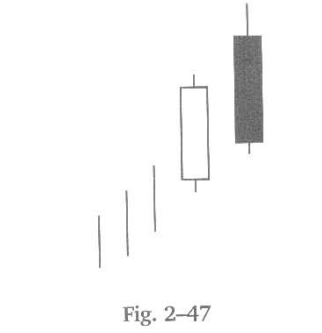

The Dark Cloud Cover is the bearish counterpart to the Piercing pattern. It gets its name from the ominous dark candle that is formed after a nice bright uptrend. The first day of the pattern is a long white candle at the top end of a trend.

DARK CLOUD COVER(Kabuse)

Description

The Dark

Cloud Cover is the bearish counterpart to the Piercing pattern. It gets its

name from the ominous dark candle that is formed after a nice bright uptrend.

The first day of the pattern is a long white candle at the top end of a trend.

The second day’s open price is higher than the high of the previous day. It

closes at least one-half the way down the previous day’s candle. The further

down the white candle, the more convincing the reversal. ‘Kabuse’ means to get

covered or to hang over.

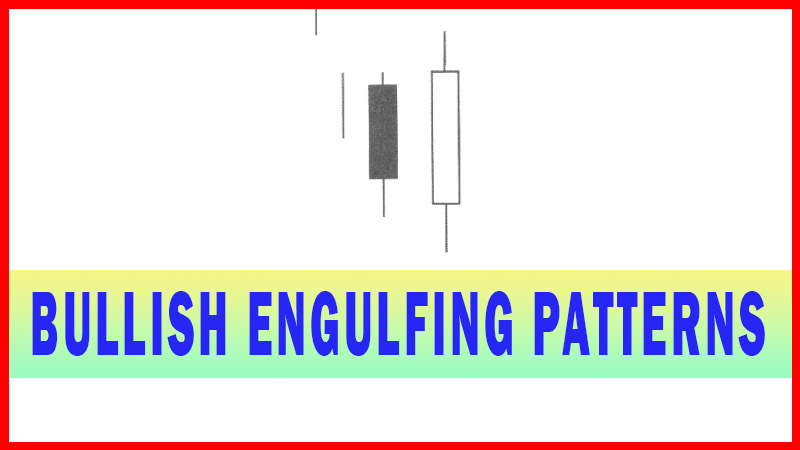

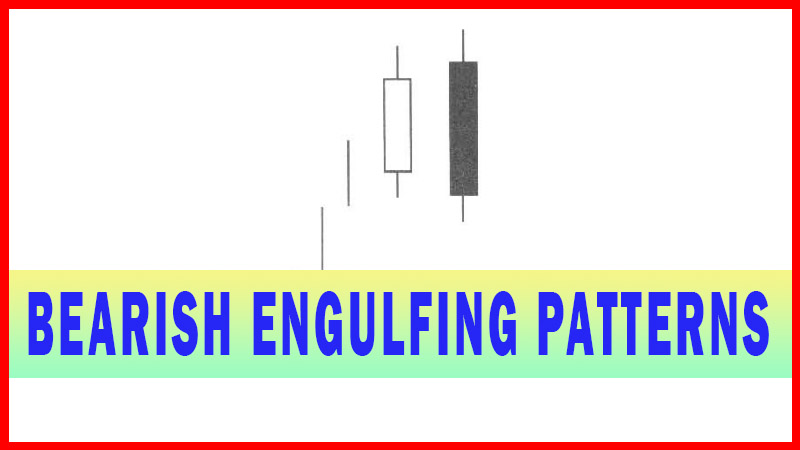

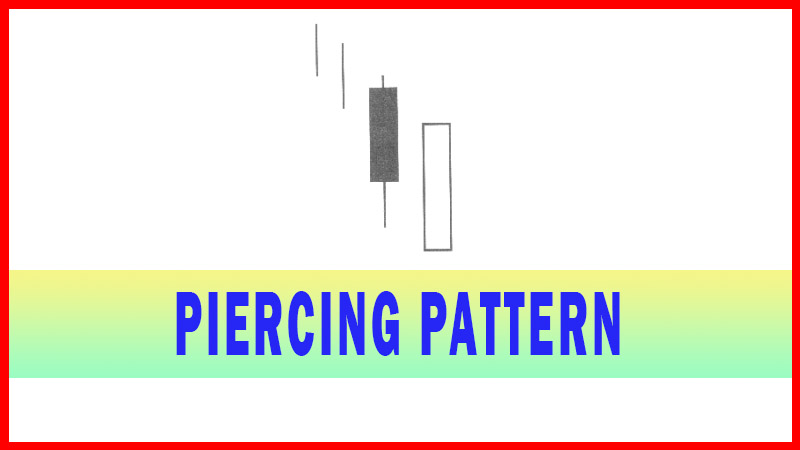

The

Piercing Pattern has almost the same characteristics as a bullish engulfing

signal. Likewise, the Dark Cloud signal has almost the same characteristics as

the Bearish Engulfing signal. The difference is that a Dark Cloud is formed as

it opens higher than not only the previous day’s close of the white candle, but

it gaps up above any of the previous day’s trading range.

The gap

up becomes the first alert indicating that a candlestick sell signal is in the

making. The exuberant buying at the top should be viewed with suspicion. Once the

selling has occurred, it continues into the close. As the Piercing Signal

requires a close more than halfway up into the previous day’s black candle, a

Dark Cloud signal requires a close below the halfway point of the last white

candle. The same parameters enhance the credibility of a Dark Cloud as seen in

the Piercing signal. The higher the gap-up open, the higher the probability a

downtrend is in progress and the greater the potential force of the downtrend.

The further the close comes below the midway point of the previous day’s

candle, the stronger the downward trend should be. Once again, like the

Piercing Signal parameter, a Dark Cloud signal requires a close below more than

the midway point of the previous bullish candle.

Criteria

1.

The body of the first candle is

white; the body of the second candle is black.

2.

The up-trend has been evident for

a good period. A long white candle occurs at the top of the trend.

3.

The second day opens higher than

the trading of the prior day.

4.

The black candle closes more than

half-way down the white candle.

Signal Enhancements

1.

The longer the white candle and

the black candle, the more forceful the reversal.

2.

The higher the gap up from the

previous day’s close, the more pronounced the reversal.

3.

The lower the black candle closes

into the white candle, the stronger the reversal.

4.

Increased volume during these two

trading days is a significant confirmation.

A Dark

Cloud signal is not difficult to spot. Keep in mind the very simple rules that

established a Dark Cloud signal. A gap up above the previous day’s trading and

closing well into the last bullish candle forms a signal that clearly indicates

an uptrend is over.

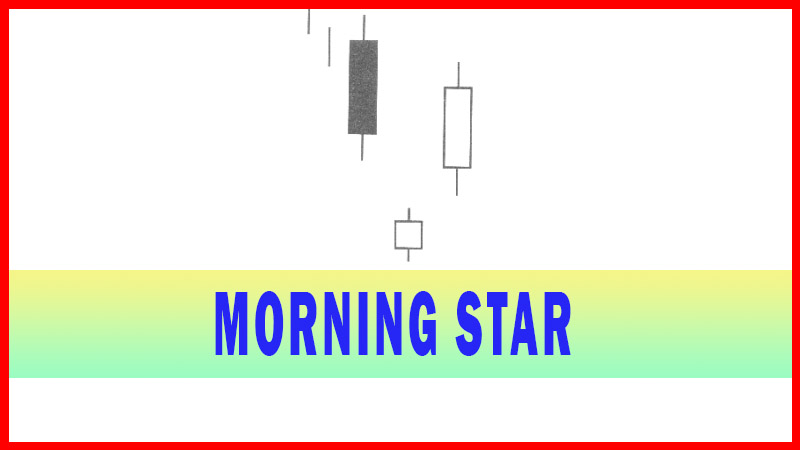

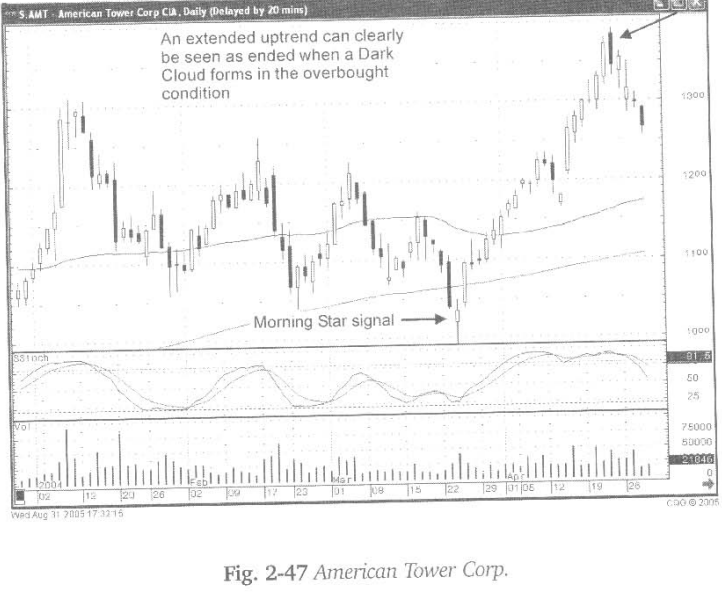

Fig.

2-47, The American Tower Corp. chart has a nice uptrend in progress for a month

and a half. It started at a major moving average with a Morning Star signal.

The top was clearly illustrated with a dark candle that showed a change of

investor sentiment.

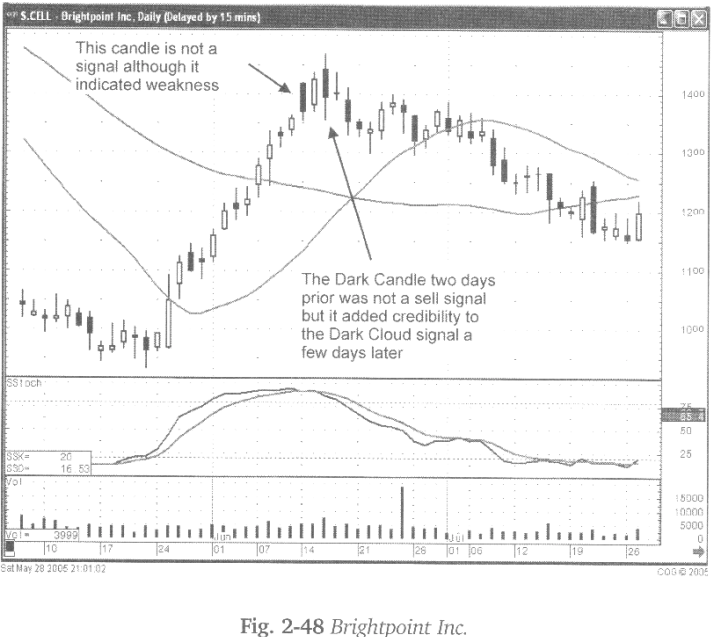

The trends

in Fig. 2-48, the Brightpoint Inc. chart showed signs of weakness in mid-June

with a bearish candle. However, that bearish candle was not a reversal signal.

When the Dark Cloud signal was formed a couple days later, the fact that some

weakness had occurred a few days prior made the Dark Cloud signal that much

more significant. Although all candle formations are not signals, the

interpretation of surrounding candles in overbought or oversold conditions can

add credibility to the actual candlestick signal when it is formed.

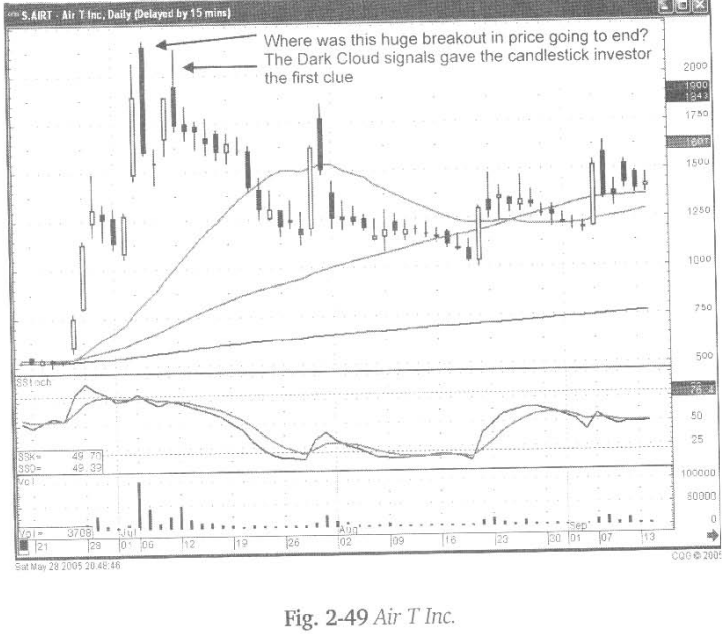

Notice

how the Dark Cloud formed twice in Fig. 2-49, the AirT Inc. chart. The first

Dark Cloud signal produced a very good indication that the breakout in price

was now over. A few days later the second attempt to take the price of the

stock back up was also stifled by the appearance of a second Dark Cloud. Simple

visual observation, observing two Dark Cloud signals, in close proximity of

each other, should have made it apparent that the sellers had stopped the

uptrend.

Use the

dark candle signal to prepare to take profits or be ready to establish short

positions. The Dark Cloud signal lives up to its name. It does cast a dark

cloud over nice up-trends. What other investors are ‘hoping’ for, a continued

upward move in prices, the candlestick investor can visually evaluate. The

probabilities an uptrend is over when a Dark Cloud signal forms, takes the

emotion out of an investment decision.

How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals : Tag: Candlestick Pattern Trading, Forex : Piercing pattern, Bearish Engulfing signal, Candlestick sell signal, Dark Cloud signal, Reversal signal - Dark Cloud Cover