Bearish Harami

Profitable Candlestick Trading, Harami signal , bearish candle, Reversal Pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals ]

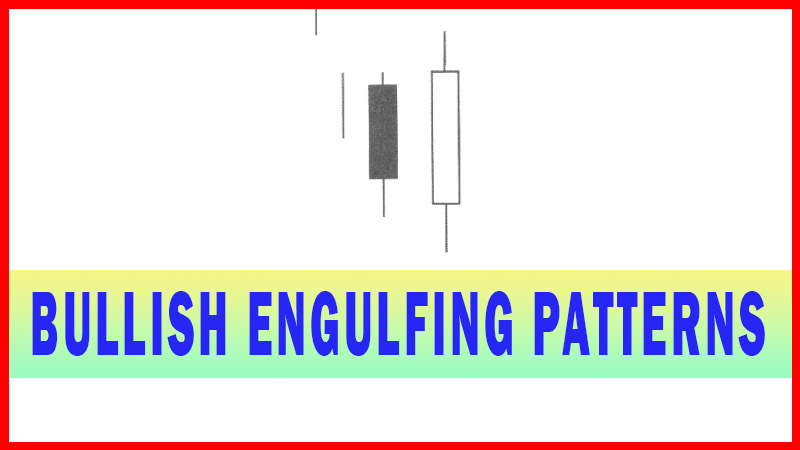

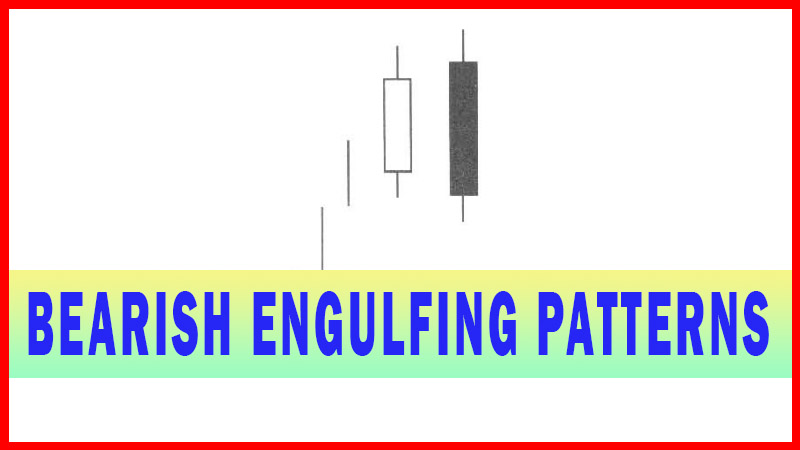

The Bearish Harami is the exact opposite of the Bullish Harami. The pattern is composed of a two-candle formation. The body of the first candle is the same color as the current trend. The first body of the pattern is a long body, the second body is smaller.

HARAMI

BEARISH HARAMI

Description

The

Bearish Harami is the exact opposite of the Bullish Harami. The pattern is

composed of a two-candle formation. The body of the first candle is the same

color as the current trend. The first body of the pattern is a long body, the

second body is smaller. The open and the close of the second body occurs inside

the open and the close of the previous day. The appearance of a Bearish Harami

indicates that the uptrend has stopped. The uptrend can be extensive or a one-

or two-day trend. The Bearish Harami becomes more significant if it occurs at

important resistance levels. After a strong up trend has been in effect and

after a long white candle day the appearance of a Harami is more significant.

Bears open the price lower than the previous close. The longs get concerned and

start profit taking. The price finishes lower for the day. The Bulls are now

concerned as the price closes lower. It is becoming evident that the trend has

been violated. A weak day after that would convince everybody that the trend

was reversing. Volume increases due to the profit taking and the addition of

short sales.

Criteria

1.

The body of the first candle is

white, the body of the second candle is black.

2.

The up trend has been apparent. A

long white candle occurs at the end of the trend.

3.

The second day opens lower than

the close of the previous day and closes higher than the open of the prior day.

4.

For a reversal signal,

confirmation is needed. The next day should show weakness.

Signal Enhancements

1.

The longer the white candle and

the black candle, the more forceful the reversal.

2.

The lower the black candle closes

down on the white candle, the more convincing that a reversal has occurred,

despite the size of the black candle.

If you

break down the aspects of the Bearish Harami, it makes understanding why the

signal works much easier. Consider what occurs in the formation of a Bearish

Harami. After an uptrend has been in progress, the formation of a Harami is

inconsistent with the expectations of the uptrend. The first day of the two-day

Harami signal is a bullish candle. The bullish candle coincides with the

expectations of the price move in an upward trend. The price opens and continues

to move higher. The following day, the price opens lower than the previous

day’s close. That in itself does not stifle an uptrend.

The

factor, not congruent with an up-trending price, is that no further strength is

seen in the price move. The lower open may or may not see additional buying

during the day. The prices moving lower by the end of the day become the

relevant indicator. It becomes obvious that the buying has started waning,

especially when stochastics are in an overbought condition. This should be an

indication that investor sentiment has taken an obvious turn. Prices opening

lower than the previous days close and then continuing to close below the

opening price reveals selling pressure.

Fig.2-55,

The Cross-Country Healthcare chart illustrates a Harami signal. The

probabilities become extremely high that the uptrend is over. Will the Harami

signal identify the absolute top in all trends? Definitely not! However, the

signal will suggest that the majority of the move is over.

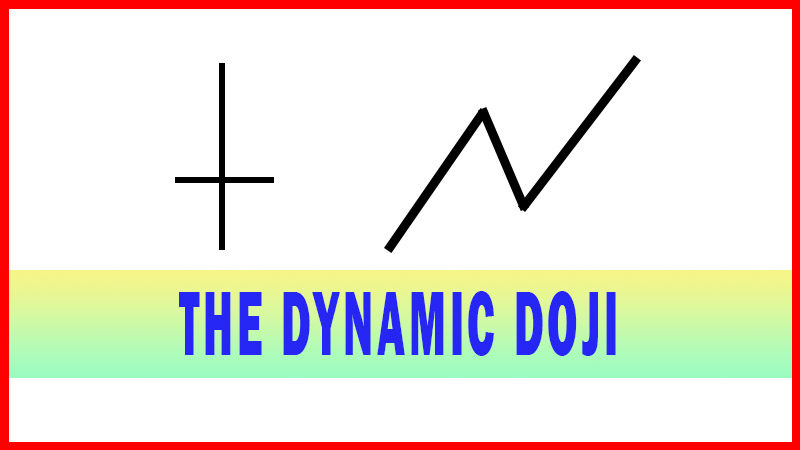

A common

Bearish Harami signal involves a Doji. An upward price move followed by a

Doji/Harami signal is easy to interpret, especially when the trading has moved

into the overbought condition. A Doji represents indecision. A Harami indicates

the buying has stopped.

What is

expected after a Doji/Harami? A high likelihood that the sellers may be coming

in, as indicated in Fig. 2-56, the Aspen Corporation chart. A lower open

following a Doji/Harami confirms the signal. The probabilities are now

extremely high that the uptrend has stopped and a downtrend may be starting.

The Bearish Harami followed by additional candlestick ‘sell’ signals, such as a

Shooting Star and/or Doji should be analyzed as a group scenario. The Bearish Harami

provides the initial information. The buying has stopped. The following

candlestick signals produce additional confirmation to what the Harami is

revealing.

Fig.

2-57, The Fuel Cell Energy Corporation chart provides a clear Harami indicator.

The uptrend, now shown to be stopped, is experiencing more indications of

indecision at these levels. When the stochastics start turning down, it further

confirms the buying forces have disappeared.

If one

Bearish Harami signal reveals a potential reversal of a trend, then witnessing

two Bearish Harami’s in close proximity should be clearer confirmation. The

M-Systems Flash Disk Pioneers Ltd. chart reveals simple logic in viewing two

Bearish Harami’s at the top.

The first

signal illustrates that the buying stopped. After pulling back, the Bulls make

another attempt to move the price up, followed by another Bearish Harami. This

should become obvious that the Bears knock the prices back down when the bulls

try to advance.

Bearish

signals were occurring right near a major moving average. The stochastics were

starting to roll over, making for an easy analysis. The sellers are starting to

take control. This is illustrated in Fig. 2-58, the M-Systems Flash Disk

Pioneers Ltd. Chart.

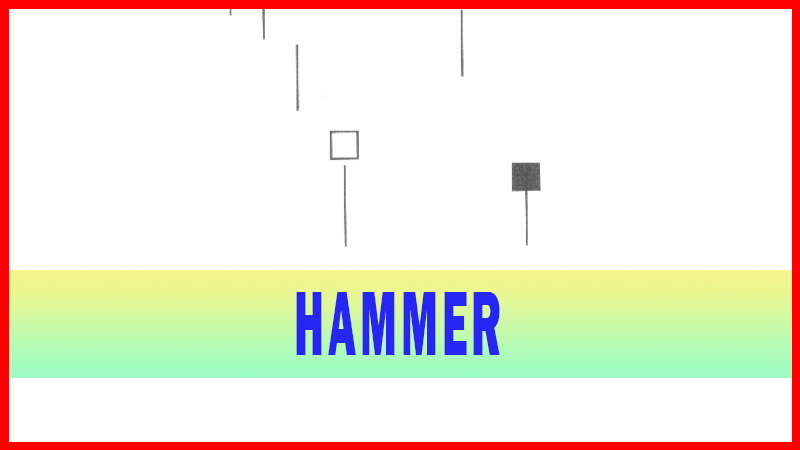

As

illustrated in Fig. 2-59, the Landrys Seafood Rest, chart, like the Doji acting

as a combination signal with the Bearish Harami, the same can be seen with the

Hanging Man signal. The analysis should be the same. The Harami indicates that

the selling has stopped. The bearish implication the Hanging Man signal

conveys, added to the implication a Bearish Harami conveys, produces a strong

argument that any further weakness should start a downtrend.

The

Bearish Harami has one basic informative fact. The uptrend has ended. Observing

the Bearish Harami signal at major technical levels, and appearing when the

stochastics indicate an overbought situation, produces a high probability

factor. The uptrend has stopped. Now start watching for further selling to

confirm that a downtrend is starting.

How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals : Tag: Candlestick Pattern Trading, Forex : Profitable Candlestick Trading, Harami signal , bearish candle, Reversal Pattern - Bearish Harami