Bullish Engulfing Pattern

Major reversal pattern, Engulfing pattern, Engulfing body, Engulfing Trading strategy, Trend reversal Pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals ]

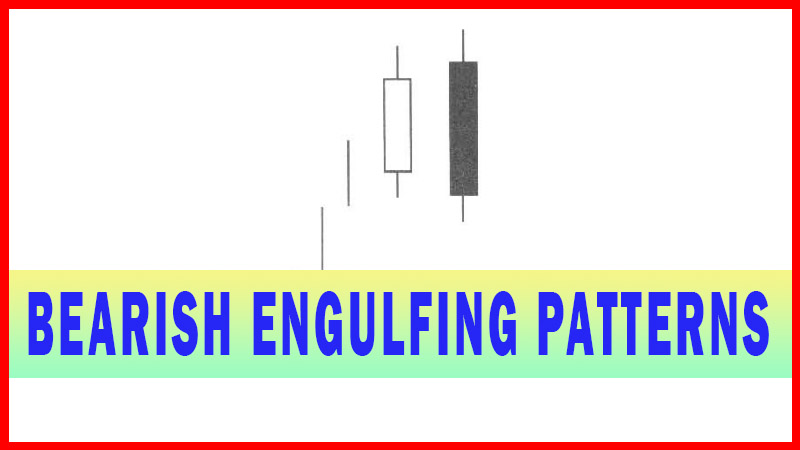

The Bullish Engulfing Pattern Is a very easy signal to identify. At the end of a down trend, it becomes evident that the Bulls are now involved. The Bullish Engulfing pattern is a major reversal pattern comprised of two opposite colored bodies.

ENGULFING PATTERNS

BULLISH ENGULFING

Description

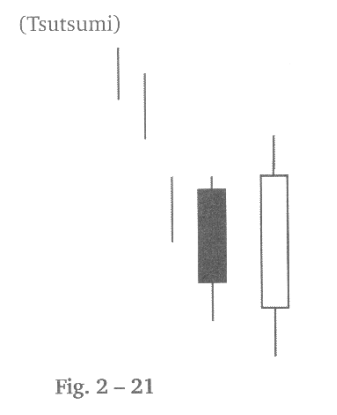

The

Bullish Engulfing Pattern Is a very easy signal to identify. At the end of a

down trend, it becomes evident that the Bulls are now involved. The Bullish

Engulfing pattern is a major reversal pattern comprised of two opposite colored

bodies. It opens lower than the previous day’s close and closes higher than the

previous days open. Thus, the white candle completely engulfs the previous

day’s black candle body. This produces a clear visual graphic that in the early

part of the trading, the Bears were still in control. As the time frame moves

on, the Bulls started stepping in and continue to buy all the way past the open

of the previous day. The graphic itself illustrates that there is now strong

bullish sentiment in the price at these levels. The Engulfing Signal can be

formed with the open and the close of one end of the pattern being equal but

not open and close of both days being equal.

Engulfing

patterns are considered major signals for two reasons. First, they occur often

and second, they produce a high probability that the trend has reversed. Not

only has the trend reversed, but the buyers have come in with enthusiasm. The

most obvious element of the engulfing signal is a candle body color that is

completely opposite of the previous trend.

Criteria

The body

of the second day completely engulfs the body of the first day. Shadows are

not a consideration. Prices have been in a definable down trend, even if only

for a short term. The body of the second candle is the opposite color of the

first candle, and the first candle is the color of the previous trend. The

exception to this rule is when the engulfed body is a Doji or an extremely

small body.

Signal Enhancements

1.

A large body engulfing a small

body. The small body shows the trend is running out of steam. The large body

indicates the new direction has started with good force.

2.

When the engulfing pattern occurs

after a fast move down, there is less supply of stock to slow down the reversal

move. A fast move makes a stock price over-extended and increases the potential

for profit taking. Large volume on the engulfing day increases the chances that

a blow-off day has occurred.

3.

An engulfing body which engulfs

more than one previous body demonstrates power in the reversal. If the

engulfing body engulfs the body and the shadows of the previous day, the

reversal has a greater probability of working.

4.

The greater the open price gaps

down from the previous close, the greater the probability of a strong reversal.

The

appearance of a Bullish Engulfing signal when stochastics is in an oversold

condition produces an extremely high probability that the trend will move to

the upside. Some features of the engulfing body can make it more convincing.

The bigger the engulfing body is compared to the last down trending body, the

more likely the uptrend will move with significant force.

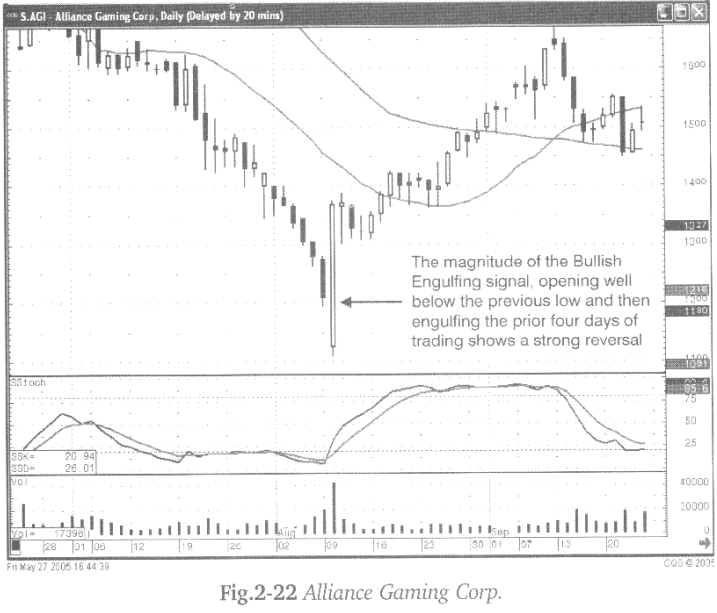

The

Alliance Gaming Corp. Chart Fig. 2-22 (following page), is a prime example of a

reversal signal. A large bullish engulfing signal occurring with oversold

stochastics and an inordinate amount of volume. This clearly represents that

the existing negative sentiment of the trend has been completely altered.

The

further the engulfing body opens below the close and/or the trading range of

the previous day, and then closes above the previous days open, the higher the

probability and the more forceful the uptrend will be. This incorporates the common-sense

aspects that candlestick analysis conveys. Where do most investors sell? Panic

selling at the bottom! That is where the Bullish Engulfing signal starts its

formation. The deeper the selling, starting the Bullish Engulfing formation,

the more convincing that all the weak stock has finally been sold into the

strong hands. The further a Bullish Engulfing signal closes above the previous

day’s candle, engulfing one, two, three or more previous candles, the more

compelling the reversal signal.

Stochastics are Excellent Indicators for Overbought and Oversold Conditions

When are you near a bottom? When your indicators, such as stochastics, tell you the trend is in an oversold condition. Also, when you can identify selling at the bottom. Keep in mind, the oversold condition can last for a long period of time as shown in the Alliance Gaming Corp. chart. A gap down at the bottom, then the formation of a strong bullish engulfing signal bringing the stochastics of the oversold condition becomes a very relevant reversal signal.

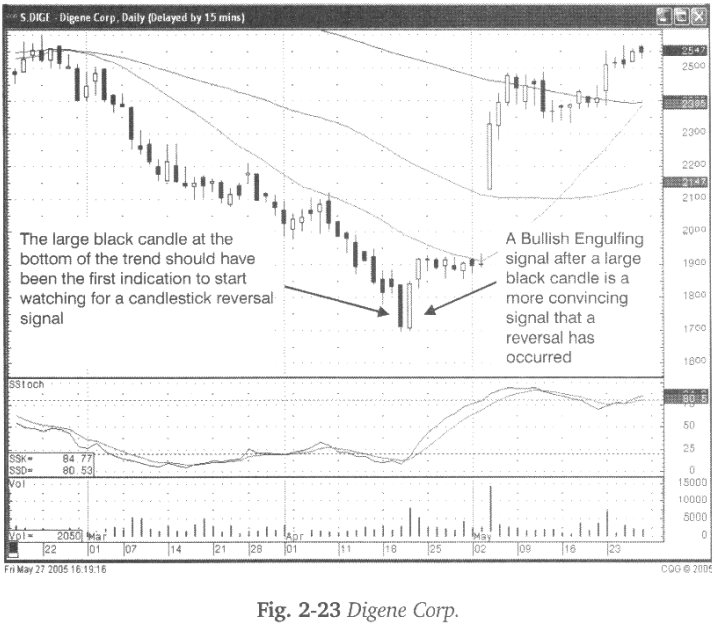

Fig.

2-23, the Digene Corp. chart illustrates the classic reversal signal. The last

day of the downtrend shows aggressive selling. This should be the first alert

for watching for a candlestick “buy” signal. The following day forms a Bullish

Engulfing signal. A Bullish Engulfing signal has more significant ramifications

when both candles have “long days”.

(Long

days are identified when the size of the candle is larger compared to the

majority of the other candles within the immediately preceding area on the

chart. Generally, two or three weeks of previous candle formations are

sufficient to judge the average candle size.) Simply stated, the sellers were

in a hurry to get out of the trade. The next day, the Bulls clearly

demonstrated that they were getting into the trade.

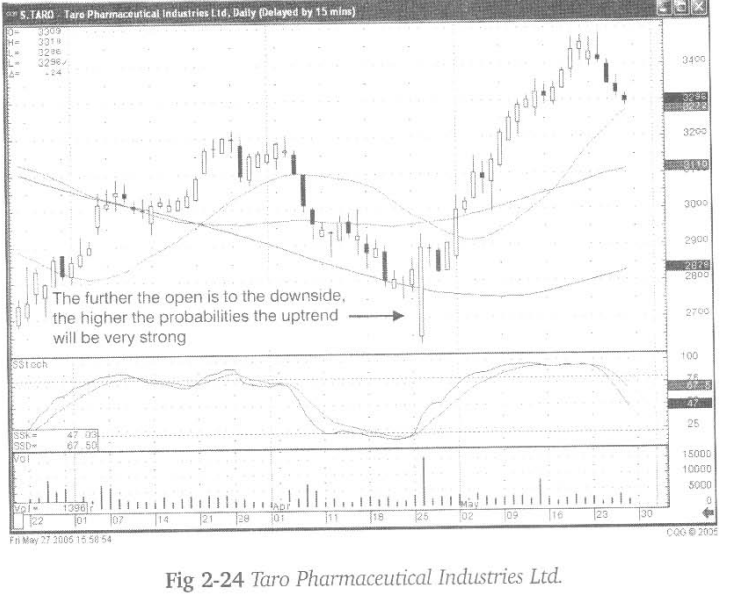

The Taro

Pharmaceutical Industries Ltd. Chart Fig. 2-24, is an example of investors

wanting to get out, no matter what. After nearly a month of selling, the final

gap-down demonstrates the extensive desire for investors to get out of the

position. The fact that once the price opened, started moving up, and finished

above the previous day’s trading, clearly signifies the Bulls had stepped into

this position. The previous day was not a black candle and therefore, technically

not a Bullish Engulfing signal, nonetheless the fact that you had a huge

Bullish Engulfing signal drat actually engulfed the previous four days of

trading provides a significant message. The buyers had stepped in at the

bottom.

Does

identifying a candlestick reversal signal always foretell that a new trend is

starting? Not all the time! But the “probabilities” are extremely high a reversal

will occur. Will that new trend start up immediately? Not necessarily, but the

signal occurring in the correct conditions increases the likelihood a new trend

should be starting. If not immediately, very soon.

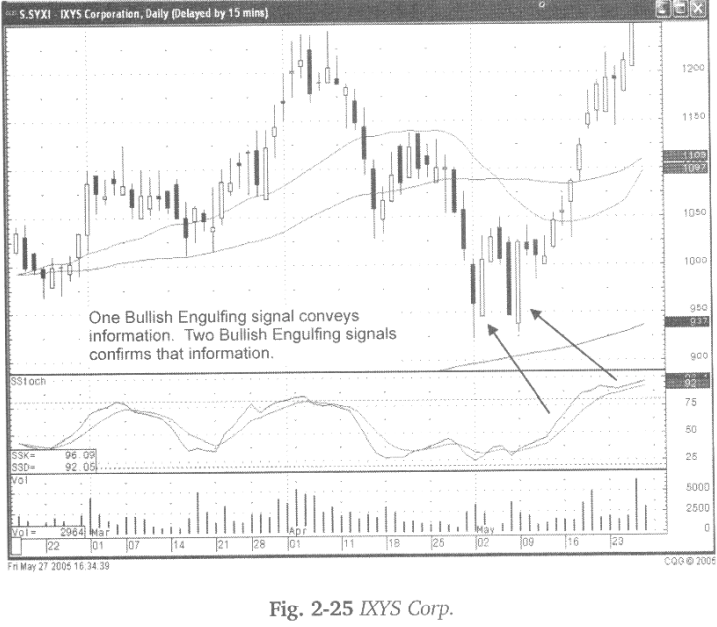

Witnessing

a bullish signal in oversold condition conveys the information an investor

should be looking for. The buyers have started moving into the position. The

uptrend may not start immediately. As witnessed in Fig. 2-25, the IXYS Corp.

chart, the first Bullish Engulfing signal occurred with stochastics in the

oversold condition. The uptrend fizzled. However, that did not negate the fact

that a bullish signal formed in an oversold condition. Even though that uptrend

did not get started, the oversold condition was still in existence.

If the

first Bullish Engulfing signal failed, the second Bullish Engulfing signal will

be more significant. The Bears see the buying from the first bullish signal.

They are relieved when there is no follow-through buying. However, when they see

the second Bullish Engulfing signal, the Bears realize that the Bulls are back

again. They finally step out of the way. If one Bullish Engulfing signal

indicates the buyers are stepping in, then two Bullish Engulfing signals

indicate the buyers are serious.

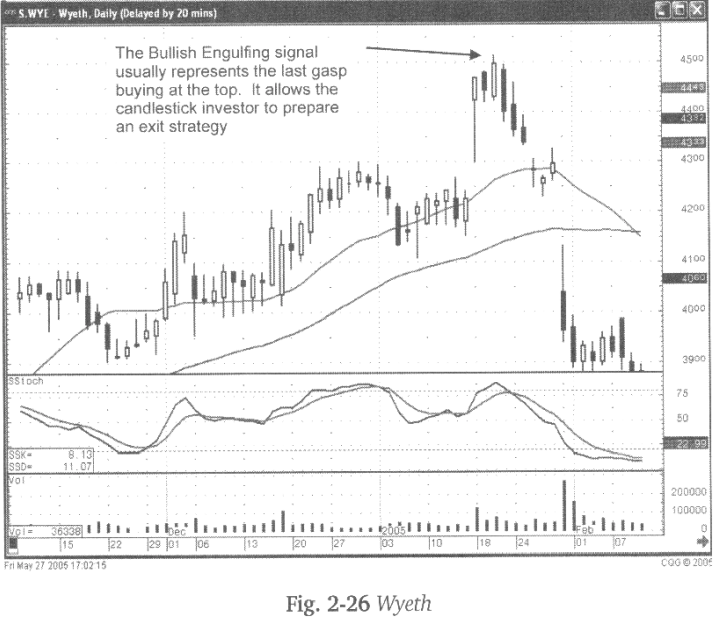

It makes good sense that when a Bullish Engulfing signal is witnessed in an oversold condition, a trend reversal is likely to occur. But what happens if you see a bullish engulfing signal occurring in an overbought condition? As a Bull, that would be a comforting event. However, the Japanese Rice traders used a Bullish Engulfing signal in overbought condition as an ‘alert’ to start watching for candlestick “sell” signals. The rationale is that the Bullish Engulfing signal, at the top of a trend, is usually the last gasp buying.

How can

this information be used to the candlestick investor’s advantage? First, if

long a position and you observe some toppiness with a Bullish Engulfing

signal, be prepared to close out the position. If short a position, based upon

a candlestick sell signal, such as a Bearish Harami, followed by a Bullish Engulfing

signal, you should be less inclined to cover the short position. The trend

would require further buying after the Bullish Engulfing signal to indicate the

uptrend is still in force. Otherwise, be prepared for the price to start

heading down.

Fig.

2-26, The Wyeth chart illustrates the Bullish Engulfing signal occurring in the

overbought condition acting as the last gasp buying. The logical stop loss in

this trade, if long, would have been at the low of the Bullish Engulfing signal

day. The logic being; that if this stock was still in an uptrend, it should not

be coming back down through the low of the last bullish candle.

The

Bullish Engulfing signal has graphic characteristics that make it easily identified.

As a major signal, a Bullish Engulfing signal will be viewed often during

scans. They will appear every single day somewhere. They work very effectively

when stochastics is in oversold conditions. They also work effectively at

important support levels such as a trend lines or major moving averages.

The

information conveyed in a Bullish Engulfing signal is very simple. The Bulls

have come into a position with reasonable force. That buying force more than

negated the previous day’s trading. Use that knowledge to your advantage.

How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals : Tag: Candlestick Pattern Trading, Forex : Major reversal pattern, Engulfing pattern, Engulfing body, Engulfing Trading strategy, Trend reversal Pattern - Bullish Engulfing Pattern