Inverted Hammer Pattern

Hanging Man signal, inverted hammer candle, inverted hammer candlestick pattern, inverted hammer candlestick pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals ]

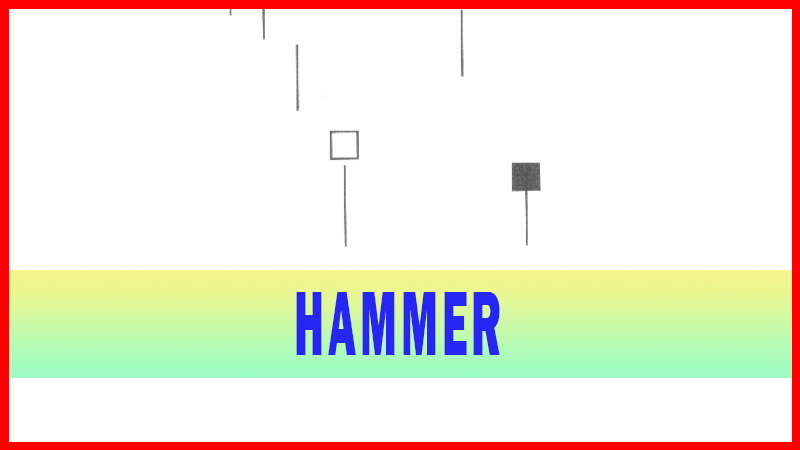

The Inverted Hammer incorporates the reverse interpretation of the Hanging Man signal. Found at the bottom of a downtrend, this shows evidence the Bulls started to step in, but that selling was still going on. After a downtrend has been in effect, the atmosphere is very bearish. The price opens and starts to trade higher.

INVERTED HAMMER (Tohba)

Description

The

Inverted Hammer incorporates the reverse interpretation of the Hanging Man

signal. Found at the bottom of a downtrend, this shows evidence the Bulls

started to step in, but that selling was still going on. After a downtrend has

been in effect, the atmosphere is very bearish. The price opens and starts to

trade higher. The Bulls have stepped in. But they can’t maintain the strength.

The existing sellers knock the price back down to the lower end of the trading

range. The Bears appeal* to still be in control. It has the aspects of being a

bearish signal.

The

mental effect of the Inverted Hammer creates cause for concern for the bears.

Although the price closes back down near the low of the day, the buying that

day had the Bears worried. The next day, if prices open higher, the Bears are

thinking, “darn, the Bulls are still at it.”

If the Bears see that the Bulls are being persistent, they start getting out of

the way. The higher the price moves up before being pushed back down, the more

consternation it will have caused for the Bears.

The

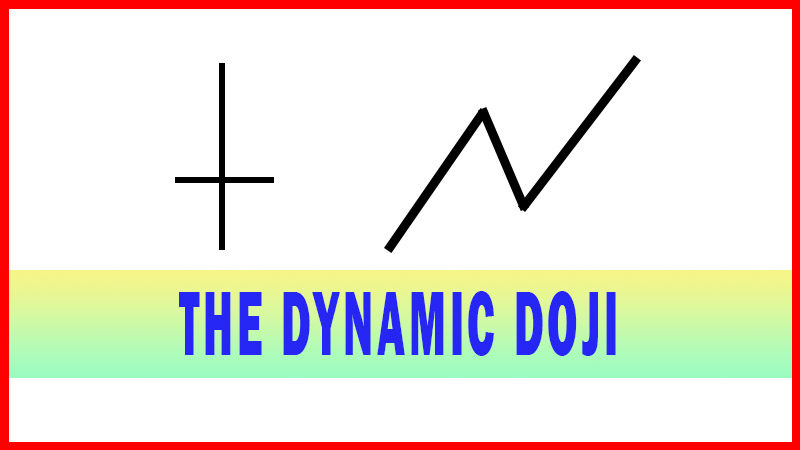

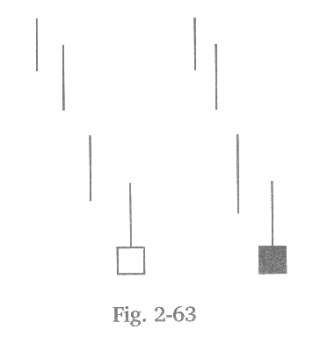

Inverted Hammer is comprised of one candle. It is easily identified by the

presence of a small body with a shadow at least two times greater than the

body. The color of the small body is not important but a white candle has

slighdy more bullish implications than the black body. A bullish candle is required

the following day to confirm this signal.

The

signal is also a very high probability signal. It does not occur as often as

most of the other major signals, but when it does, it will usually produce

positive trade results. It also provides an excellent stop loss format.

Purchasing a position on a positive open on the following day is the correct

entry process. However, if the price would then close below the low point of

the Inverted Hammer, a simple deduction can be made. The Bulls were not in

control. Close it out immediately.

Criteria

1.

The upper shadow should be at

least two times the length of the body.

2.

The real body is at the lower end

of the trading range. The color of the body is not important although a white

body should have slightly more bullish implications

3.

There should be no lower shadow

or a very small lower shadow.

4.

The following day needs to

confirm the Inverted Hammer signal with a strong Bullish day.

Signal Enhancements

1.

The longer the upper shadow, the

higher the potential of a reversal occurring.

2.

A gap down from the previous

day's close sets up for a stronger reversal move provided the day after, the Hammer

signal opens lower.

3.

Large volume on the Inverted Hammer

Day increases the chances that a blow off day has occurred.

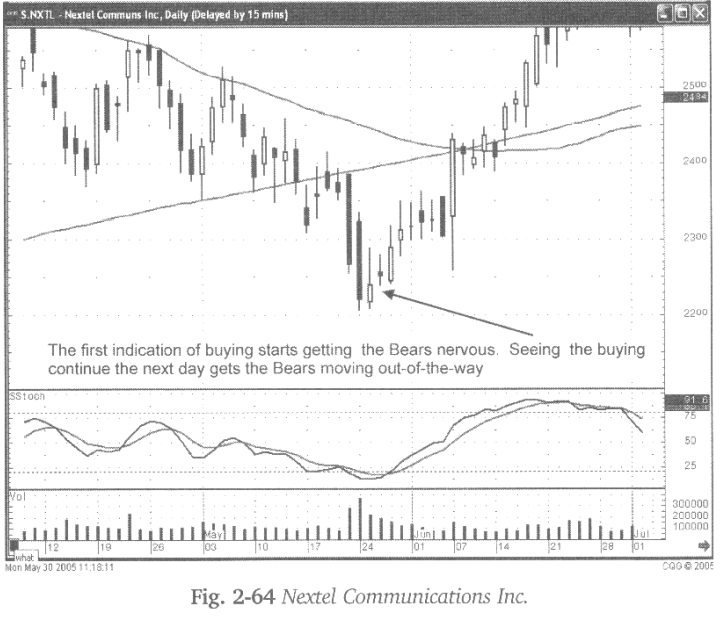

The most

informative factor conveyed in an Inverted Hammer signal is the fact that the

buying started. Although the sellers appeared to have maintained control by

the end of the day, the Bears had noticed that some buyers had gained

confidence in this price area. This may have caused a tinge of doubt to come

into the Bear’s thinking. The bearish sentiment that may have been stronger in

the earlier parts of the downtrend should now create some questions.

A gap up

in price clearly indicates that the bullish sentiment is definitely in control.

The probabilities become extremely high that an uptrend is in process when the

prices gap up following the signal. The definition of a gap up in the case of

the Inverted Hammer would be a price opening above the body of the signal. That

could mean the price opening up in the upper shadow area or above the high of

the Inverted Hammer trading range. Of course, the higher the next day’s open,

the greater the probability that the uptrend will show strength. Fig. 2-64, the

Nextel Communications chart reveals a positive open, although a Doji day, it

still revealed the buyers coming into the price again.

The

candlestick investor, understanding what this signal is doing to the psychology

of the Bears, can now be prepared. If the bearish sentiment is waning, as

indicated by an Inverted Hammer signal, then the bearish sentiment should

become less pronounced upon seeing more buying. A position entry strategy

becomes simple. If the price appears to be opening positive following the Inverted

Hammer, the candlestick investor can start buying immediately.

If the

eye becomes trained to recognize the signals, then it produces a format for

entering trades at the optimal entry areas. The key word in this statement is

areas. Most investors allow ego to dictate an entry strategy. The sense of

pride for entering a trade at the absolute lowest point becomes an overriding

factor. What most investors forget is that investing is for the purpose of

maximizing profits. The challenge of getting into a trade at the lowest possible

entry level diminishes the effectiveness of a good investing program

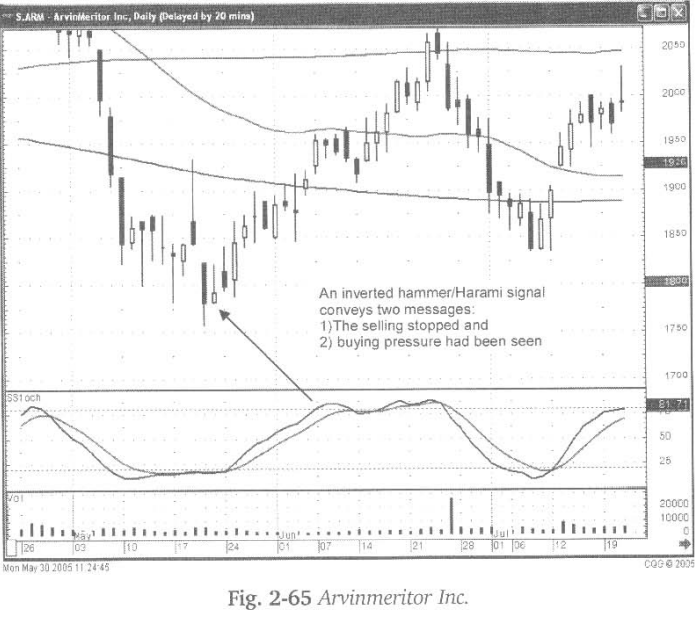

Fig. 2-65

the Arvinmeritor Inc. chart demonstrates an Inverted Hammer acting as a Harami

signal also.

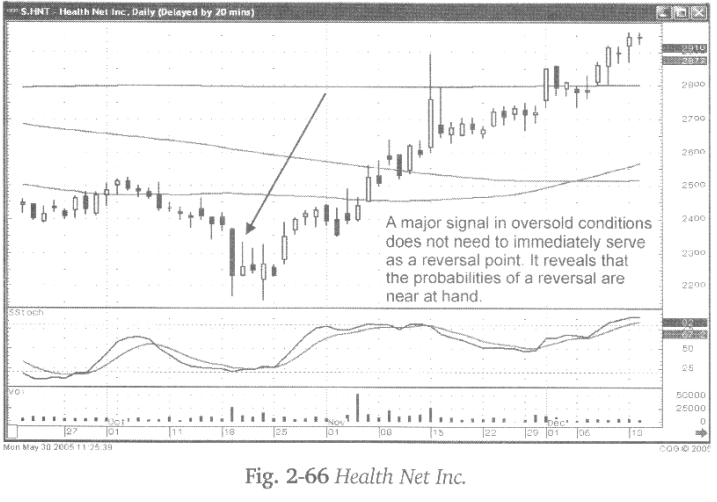

The

candlestick signals are a function of a change in investor sentiment. Not a

function of anticipating where the absolute bottom will be. The Health Net Inc.

chart illustrates what an Inverted Hammer foretells. The appearance of the

signal implies that the buyers have stepped in at what could be perceived as

the bottom. Will that necessarily mean the uptrend will start immediately? Sometimes,

it does, sometimes it doesn’t. But what it does demonstrate is that buying

started, probably putting an end to the downtrend.

The

candlestick investor is anticipating strong buying indications. Even though the

buying may not appear immediately, the fact that the Inverted Hammer appeared

indicates a change in investor sentiment should be experienced soon. Fig. 2-66 the

Health Net chat illustrates that the Inverted Hammer signal was the first signs

of the buyers stepping in. It took a few days for the remaining selling to be

finished.

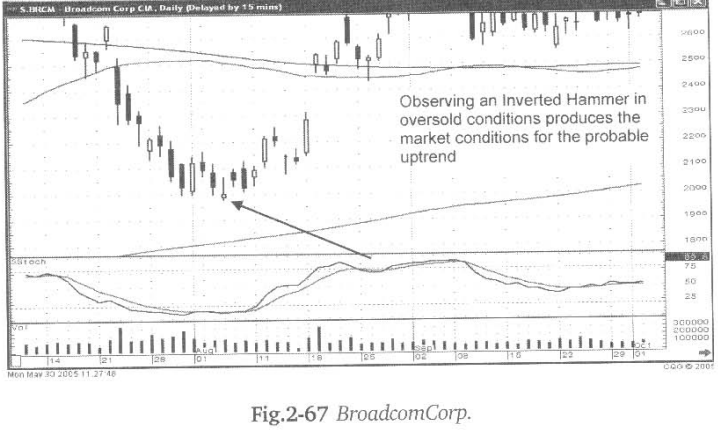

The same

illustration can be seen in Fig. 2-67, the Broadcom Corp. chart. Although the

trading following the Inverted Hammer signal did not reveal dramatic strength

immediately, it eventually acted as the bottom. The shadows to the upside

indicate buying, which needs to be included into the visual analysis. Something

in investor sentiment is changing. That knowledge gives the candlestick

investor an advantage. The Japanese Rice traders viewed this signal for

centuries. Understanding the psychology that creates a signal aid an investor

to understanding what is expected in the trend results.

How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals : Tag: Candlestick Pattern Trading, Forex : Hanging Man signal, inverted hammer candle, inverted hammer candlestick pattern, inverted hammer candlestick pattern - Inverted Hammer Pattern