The Dynamic Doji

Doji Star, Doji pattern, Candlestick Pattern, Doji trend, Reversal pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals ]

The Doji it is the most recognized candlestick signal. Its formation, essentially looking like a cross, has relevant implications. It illustrates indecision during a specific time period between the Bulls and the Bears.

THE DYNAMIC DOJI SIGNAL

Doji Star

Description

The Doji it is the most recognized candlestick signal. Its formation, essentially looking like a

cross, has relevant implications. It illustrates indecision during a specific

time period between the Bulls and the Bears. The Doji is also comprised of one

candle. The Japanese say when a Doji occurs, one should always take notice. It

is one of the most important Candlestick signals. The formation is created when

the opening price and closing price are the same or nearly the same. This forms

a horizontal line. It is an important alert at both the top and bottom of

trends. At the top of a trend, the Doji signals a reversal without needing

confirmation. The rule of thumb is that you should close a long or go short

immediately.

However,

the Doji occurring during the downtrend requires a bullish day to confirm the

trend reversal. The Japanese explanation is that the weight of the market can

still force the trend downward. The Doji is an excellent example of the

Candlestick method having superior attributes compared to the Western bar

charting method. The deterioration of a trend is not going to be as apparent

when viewing standard bar charts.

Criteria

1.

The open and the close are the

same or very near the same.

2.

The length of the shadow should

not be excessively long, especially when viewed at the end of a bullish trend.

Signal Enhancements

1.

A gap, away from the previous

days close, sets up for a stronger reversal move.

2.

Large volume on the signal day

increases the chances that a blow-off day has occurred although it is not a

necessity.

3.

It is more effective after a long

candle body, usually an exaggerated daily move compared to the normal daily

trading range seen in the majority of the trend.

A Doji at the Top

Illustrations in the following chapters will

not have explanations of every indicator. The stochastic settings for all the

charts are 12,3,3. The moving averages are the 50 day and 200-day simple moving

averages. If a question of which is which, the 50-day MA will be the more

volatile of the two.

The Doji becomes an extremely significant reversal signal when

viewed at the top of a trend. The definition of a top of a trend is a function

of the stochastic’s in an overbought condition. The Japanese rice trader’s

scenario is easy-to-understand. After an extensive uptrend, the

appearance of a Doji is an illustration the Bulls and the Bears have reached a

point of equilibrium. The price has finally reached a level where the bullish

buying pressure is being equalized by the Bears selling into them. A Doji at the

top becomes an immediate sell signal. The Japanese Rice traders say to start

taking your profits. A Doji in the overbought condition becomes more relevant

following a large white candle or a gap-up. A large white candle or a gap-up

signifies the exuberant buying coming in at the top of a trend. That

exuberance, followed by a Doji, becomes a very strong signal that a reversal is

about to occur.

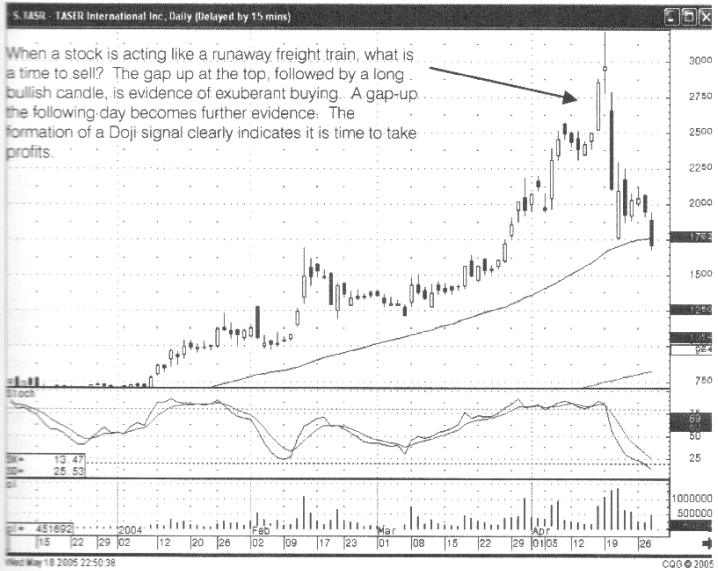

In early

2004, Fig.2-11, TASER International Inc. was the stock that just would not

quit. It moved from the low single-digit price range up to the mid-30s in just

a few months. Of course, it was well-publicized on the financial news stations.

The higher it moved, the more it became debated as to whether it still had huge

upside potential or was way over-priced.

If you

were long, where did you take profits? If you are looking to short the stock,

where did you want to get in? The Doji at the top in mid-April provided a very

clear answer. Notice how the price of TASER stock started moving exuberantly in

the first part of April, 2004. The long bullish

candle, after a small gap-up, with stochastics in the overbought condition,

should have been an alert to start watching for a candlestick ‘sell’ signal.

That signal became clearly apparent the following day with a large Doji signal.

Fig. 2-11

TASER International Inc – early 2004

The Doji

became the sell signal. The evidence of exuberant buying, followed by a Doji

formation, would have allowed an investor to take profits near the very top of

the trend. Could the price have continued higher? Certainly! However, remember

that the Japanese Rice traders have analyzed these circumstances for hundreds

of years. The probabilities of a top reversal signal occurring is a function of

witnessing exuberant buying followed by a gap up Doji signal. The Japanese Rice

traders have recognized that this is time to sell. The gap-down open, the

following day, clearly illustrates that the sellers have stepped into this

trade.

If it is assumed that the signals have significance, then we would not be looking at them today if they did not work. Selling upon the appearance of a Doji is a high-probability profitable result. Exuberant buying followed by a Doji equals ‘sell’!

When the

greed sets in, and the exuberant buying becomes visually apparent, be prepared

to take profits. Viewing big price moves at the top of a trend, followed by a

Doji, especially when that Doji gaps up at the top, take the profits. What is

occurring when these formations occur? Investor sentiment deciding that

everything is apparently so rosy for the future, they want to get in at any

price. The question always needs to be raised “If everything is so great, who

is selling?” The answer is usually the smart money.

The price

of TASER International Inc. Fig.2-12, illustrated again the Doji at the top

creating the reversal at the end of 2004. A long bullish candle, in the

overbought condition, followed by a gap up Doji illustrates that the uptrend

should be over. How do you exit the trade? Investors that have access to computer

screens during the final 30 minutes of trading will be able to witness a Doji

forming near the end of the day. They can close out their position on the close.

Fig.2-12 Taser International Inc. - late 2004

For the

investor that does not have access to the markets during the day, the 'sell

stop’ can be placed for the next days trading. A logical stop loss point would

be at the low of the trading of the previous days Doji signal. If the selling

came back down through that point, that would be a clear indication that the

sellers had now started coming into the trade.

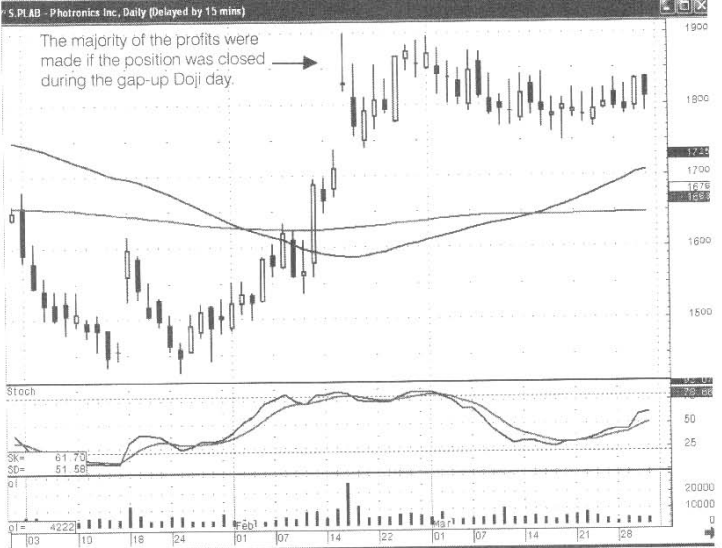

The

gap-up at the top of a trend can have many conclusions. A gap-up followed by a

long bullish candle has different implications than a gap-up that forms a Doji.

As illustrated in the Photonics Inc. chart, Fig. 2-13, a gap-up Doji indicated

the top of the trading. Profits should have been taken at the close of the Doji

day or on the lower open the following day. Could a higher price have been achieved?

Fig. 2-13

Photonics Inc.

As seen

in this chart, a better price could have been obtained approximately a week

later. However, what is the main point of investing? To maximize your returns

and to do so with the least amount of risk! Holding onto this position for

another week would not have produced the percentage returns to make the risk of

holding that position worth while. As can be seen, the majority of the profits

were made when the price gapped up and formed a Doji.

The point

of investing is not to maximize your profits on each individual trade. It is to

maximize your profits for your account. The majority of the profits were

extracted from this made at the gap up Doji. Those funds now should be moved to

a lower risk trade, one that would have the upside potential as was seen at the

beginning of this trade in mid to late January.

The

appearance of a Doji at an important resistance level such as a trend line also

has significance. Notice in Fig.2-14, the Cadence Design Systems Inc. chart,

how a Doji, in the overbought, condition forms right at a trend line. The major advantage of candlestick signals is that they indicate

immediately what the investor sentiment is doing at important levels.

Fig. 2-14 Cadence design Systems

Inc

Witnessing

a Doji, at what everybody else might be anticipating as a resistance level,

provides an immediate confirmation that the buyers and sellers have

participated in indecisive trading. The Doji illustrates that the trend-line

has become resistance once again. It is further confirmed by seeing the selling

the next day when prices gap to the downside.

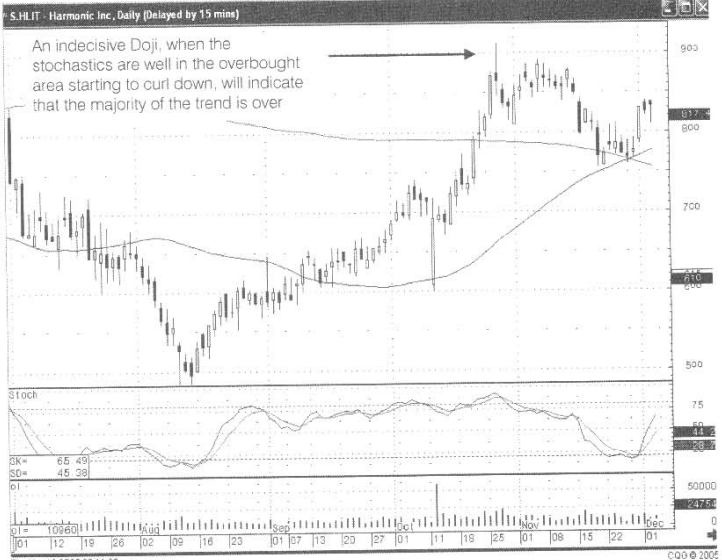

Fig. 2-15 Harmonic Inc

If one

Doji represents indecision, a series of Doji represents a lot of indecision.

Finding a series of Doji is the set up for some powerful trades. Observing a

series of Doji should alert investors that the Bulls and the Bears are having a

hard time deciding which direction the trend should be moving. The more

extensive the series, (the longer the indecision time frame) the more convincing

the trend will be once it breaks out.

A series

of Doji is an excellent warning device. It illustrates that something is about

to happen. Logically, if a series of Doji occur in oversold condition, what

should occur is a move to the upside. Conversely a string of Doji, seen in the

overbought condition, usually indicates the trend is about to turn down. The

caveat to witnessing a large number of Doji forming is analyzing the previous

chart formations. A trading entity that has Doji forming a high percentage of

the time will not be as significantly influenced by more Doji. A series of Doji

becomes more significant when found in a normal trading chart.

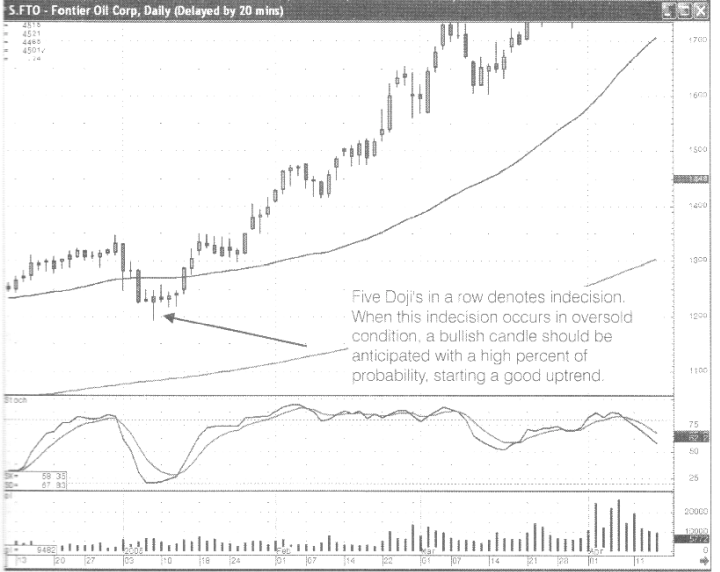

As

illustrated in Fig. 2-16, the Frontier Oil chart, after a mild sell-off the

investors became very indecisive. This indecision occurred as the stochastics

came into the oversold condition. One Doji, in an oversold condition, calls to

the attention of an investor to watch for a reversal. Watching a series of Doji

develop allows an investor to take advantage of a strong trend developing right

from the very start.

Fig. 2-16 Frontier Oil Corp

What does

a series of Doji represent? Indecision! What does the bullish candle illustrate

after the series of Doji? The investors have now made up their mind which

direction to take the trend. With that knowledge, it becomes an easy process to

watch which direction the trading will move from that indecisive period. The

candlestick investor can start putting on the trade as soon as the price

movement has indicated that the indecision is over. A strong move, from an

indecisive trading range, is an extremely high probability indicator. It can be

acted upon immediately. An indecisive trading range can have many configurations.

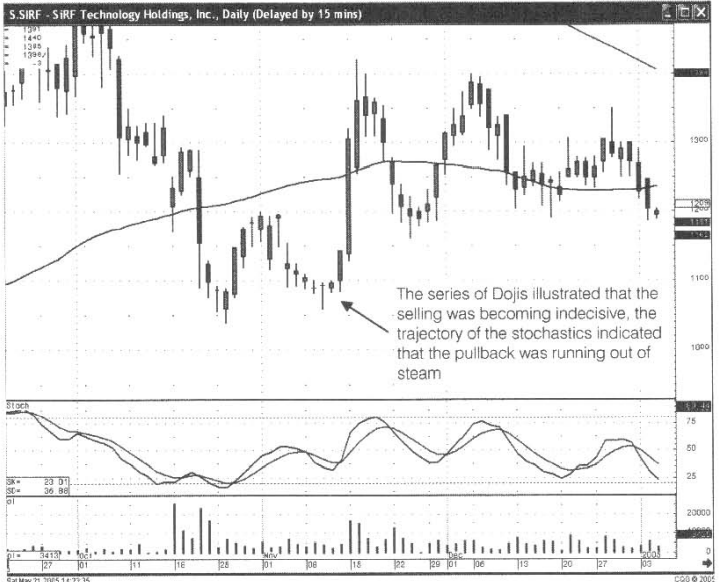

As witnessed in Fig. 2-17, the SIRF Technology Holdings Inc. chart, the

indecision after the slight pullback could be viewed. The Doji illustrated that

the downward trajectory was running into indecisive trading.

Fig. 2-17 SIRF Technology

Holdings Inc

Although

the stochastics were in mid-range, the series of Doji illustrated that the

selling was waning, giving time for the stochastics to start curling to the

upside. When the trading becomes indecisive at important moving averages, the

investor should become aware of a potential trend change.

That

scenario becomes relatively clear in Fig.2-18, the Champion Enterprises Inc.

chart. Doji/Spinning Tops occurring at a major moving average while stochastics

are starting to move up should be watched. The appearance of a Long-legged Doji

at the end of the series creates additional relevance. The indecisiveness is

growing.

Fig.2-18 Champion Enterprises Inc.

Being

prepared for a major consequence to occur allows an investor to make a purchase

decision quickly. What is expected after a series of Doji? A significant move!

If that is the case, a gap-up or a gap-down immediately illustrates what has

been decided.

In the

case of the Champion Enterprises Inc. Chart, Fig. 2-18, a gap up above the 50-day

moving average, followed by the immediate buying, should have activated a

purchase immediately.

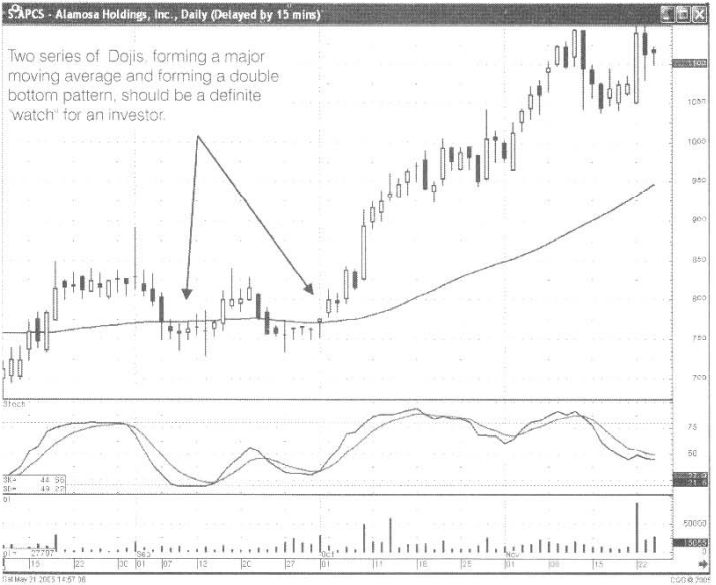

Allow

your eyes to evaluate what the major signals are doing. Keep it simple. As seen

in Fig. 2-19, the Alamosa Holdings Inc. chart, a series of Doji indicated a

bottom in early September. Another series of Doji occurred at the same level at

the end of a month. The Bulls and the Bears were indecisive the first time the

trend pulled back. The Bulls and the Bears were just as indecisive the second

time the trend pulled back to that level.

Fig.

2-19, the Alamosa Holdings Inc.

Both

times the series of Doji were revealing valuable information. Something should

happen from these levels. The first rally failed. Is this not contrary to the

implication that a series of Doji, followed by a strong move out of that

trading range, should produce a strong rally? The key word is “probabilities”. Not all series of Doji

are going to be followed by high profit trend. However, an extremely high

percentage of the trends will be strong.

The fact

that the first trend failed does not negate the probabilities that the second

series of Doji will have any less likelihood of being followed by a strong

trend. Realistically, the second time the series of Doji indicated that there

was great indecision at approximately the $7.50 level. A new buying indicator

appeared. The gap up from the 50-day Ma and the stochastics curling back up.

The sellers recognize the persistency of the Bulls.

A series

of Doji occurring near a major moving average has significant implications. Two

series of Doji at the same level, creating a double bottom formation, creates

stronger implications. Will a series of Doji in the oversold condition always

preclude a bullish trend? Will any series of Doji in the overbought condition

always preclude a bearish trend? No! The Doji indicate a major move is about to

occur. The “probabilities” point to a bullish trend after Doji have formed in

the oversold condition. The “probabilities” point to a bearish trend when Doji

are viewed in an overbought condition. The important factor that the Doji

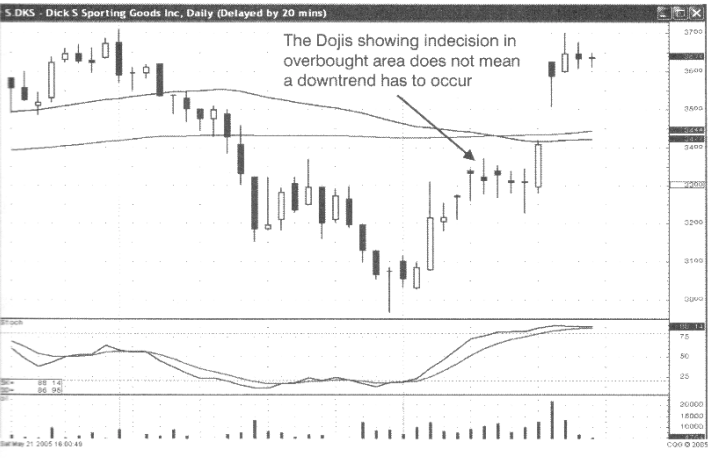

portray is that a major move is likely to occur. As illustrated in Fig. 2-20,

the Dick’s Sporting Goods Inc. chart, the series of Doji was just an indecisive

congestion area in a strong up trend.

Fig. 2-20

Dicks Sporting Goods Inc.

One Doji,

be prepared. Two Doji, be more prepared. Three Doji, definitely start looking

for something major to happen one way or the other. This can be applied to any

trading entity. Whether you are analyzing the long-term trends in the indexes

or trading minute-by-minute in E-mini S&P trades, the appearance of a large

number of Doji becomes an excellent trade entry warning.

Series of Doji Observations

1.

The bigger the series of Doji,

the more powerful the resulting move from that level will be.

2. A series of Doji, forming in an

oversold condition, represents an extremely high probability that a major

uptrend is about to start.

3.

A series of Doji forming in an overbought

condition represents an extremely high probability that a major downtrend is

about to start.

4.

The initiation of the trend will

be illustrated by a strong candle moving away from the indecision area.

How To make High Profit In Candlestick Patterns : Chapter 1. The Major Candlestick Signals : Tag: Candlestick Pattern Trading, Forex : Doji Star, Doji pattern, Candlestick Pattern, Doji trend, Reversal pattern - The Dynamic Doji